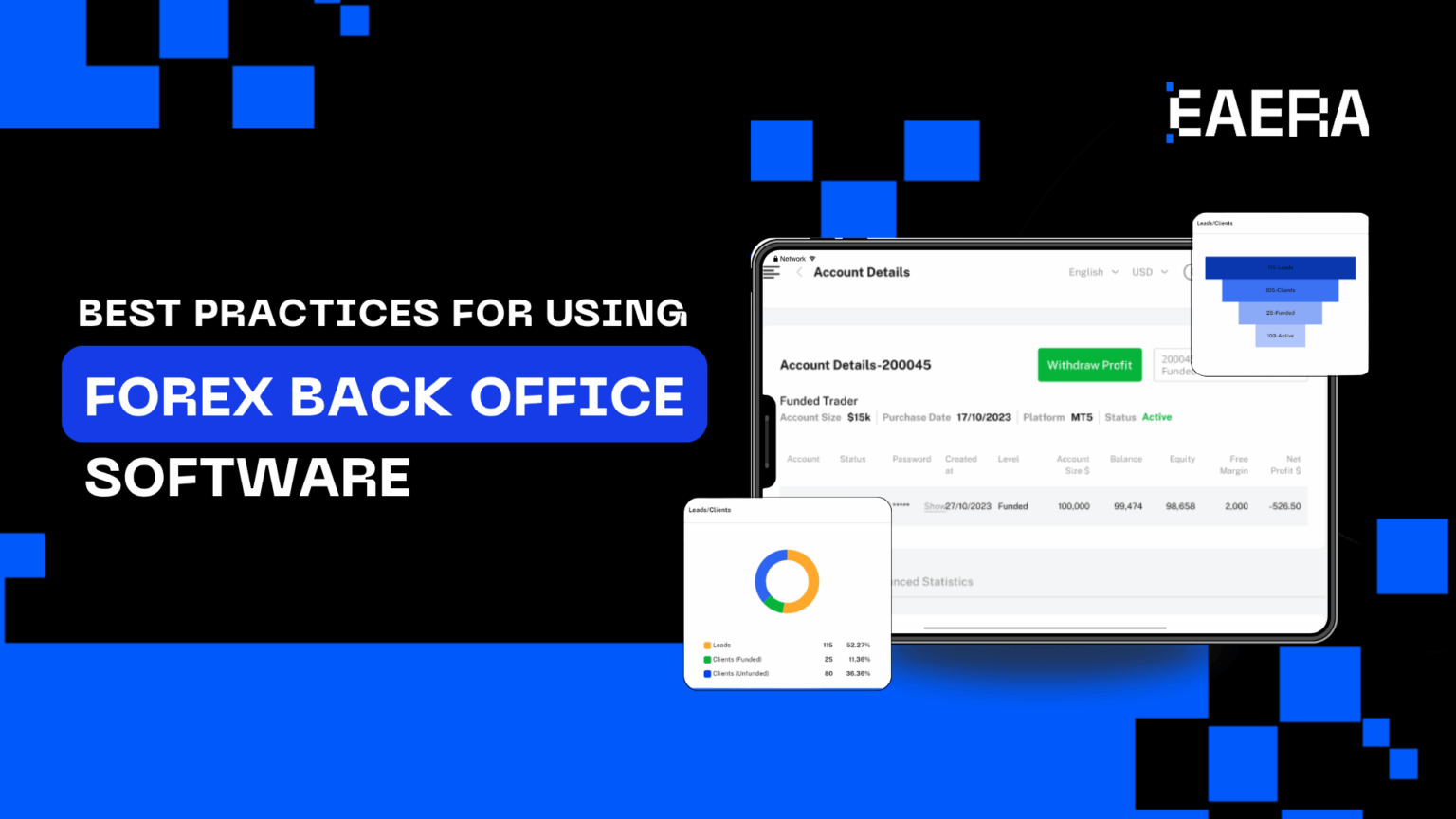

In today’s fast-paced Forex market, FX brokers are under constant pressure to streamline operations, enhance compliance, and deliver better client service. A key enabler in achieving these goals is reliable forex back office software. When used strategically, this software allows FX brokers to automate tasks, optimize customer relationships, and remain compliant in a dynamic regulatory landscape.

Below are five essential best practices for FX brokers to maximize the value of their forex back office software and ensure long-term success, with insights into how EAERA’s solutions can drive growth.

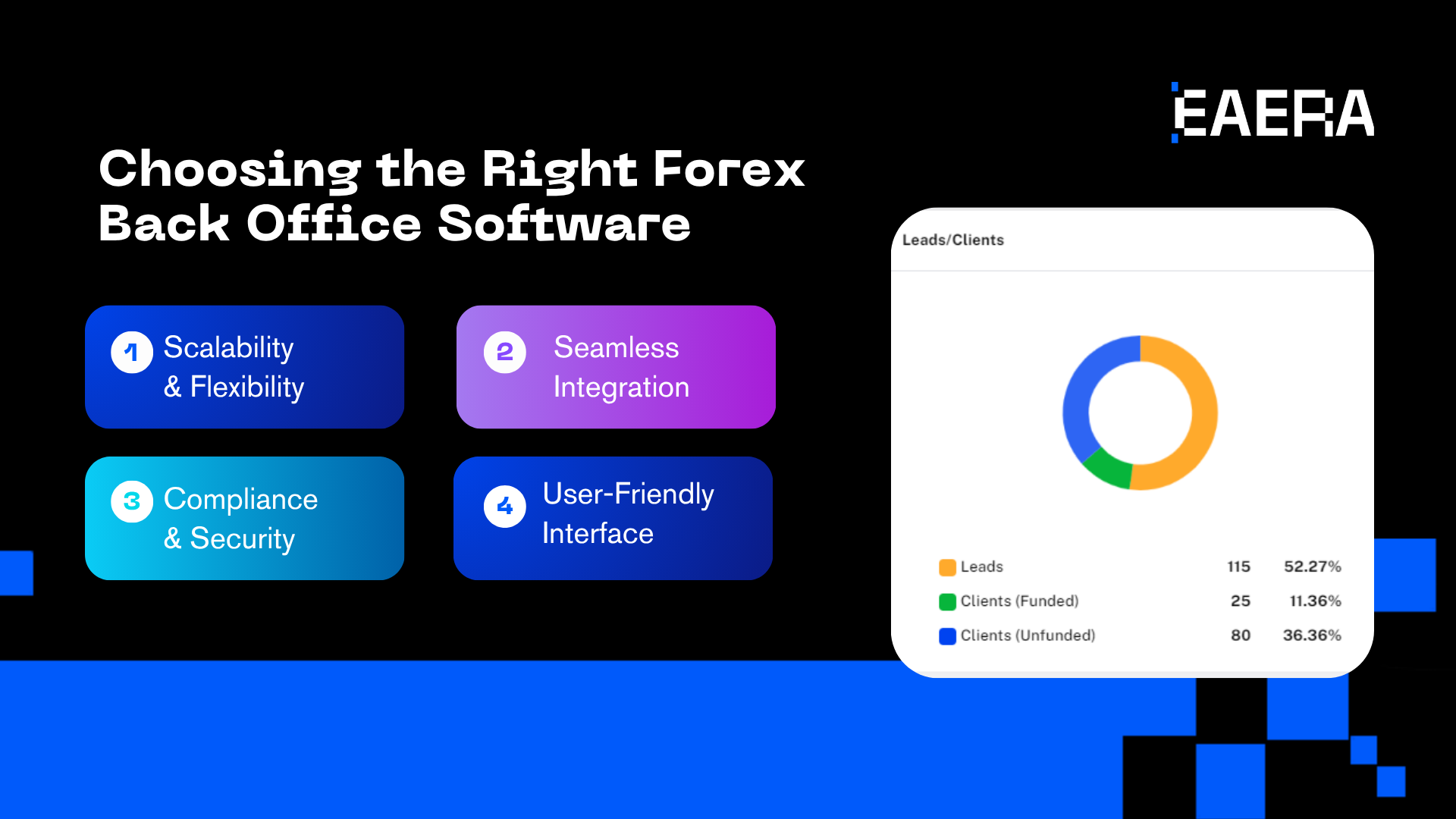

1. Best Practice #1: Choosing the Right Forex Back Office Software

Here are the top features FX brSelecting the right forex back office software is essential for building a strong operational foundation. For FX brokers, this software plays a key role in scaling the business, managing compliance, and improving client service. The right choice should align with both short-term needs and long-term growth.

okers should prioritize:

- Scalability & Flexibility: The system must support your brokerage as it grows. FX brokers should ensure the software can handle more clients, trades, and transaction volume without performance issues.

- Seamless Platform Integration: Compatibility with MT4, MT5, and cTrader is crucial. This allows real-time data syncing, automated reporting, and smooth trade execution—all critical for FX brokers to maintain service quality.

- Compliance & Security Tools: Built-in KYC and AML features help automate identity verification and ensure regulatory compliance. This protects FX brokers from legal risks and operational delays.

- User-Friendly Interface: A clean dashboard makes it easy to manage accounts, view transactions, and generate reports without technical complexity.

- Custom Reports & Analytics: Access to real-time performance metrics allows FX brokers to track revenue, trading volume, and client behavior—supporting smarter business decisions.

EAERA’s forex back office software includes all these features, giving FX brokers a centralized, reliable, and scalable solution to grow with confidence.

2. Best Practice #2: Automating Key Brokerage Processes

Automation is a game-changer for FX brokers. With robust forex back office software, many time-consuming tasks can be automated, leading to better accuracy and reduced manual errors.

- Account Verification (KYC & AML Compliance) – Automating identity verification speeds up onboarding and ensures compliance.

- Deposit & Withdrawal Processing – Automated payment processing improves transaction speed and reduces errors.

- Commission Calculations for IBs – FX brokers can set up automated commission structures for Introducing Brokers (IBs), ensuring timely and accurate payouts.

Brokers who adopt automation experience dramatic improvements—up to 30% faster onboarding and a 40% decrease in transaction errors. FX brokers benefit from greater control and more time to focus on growth.

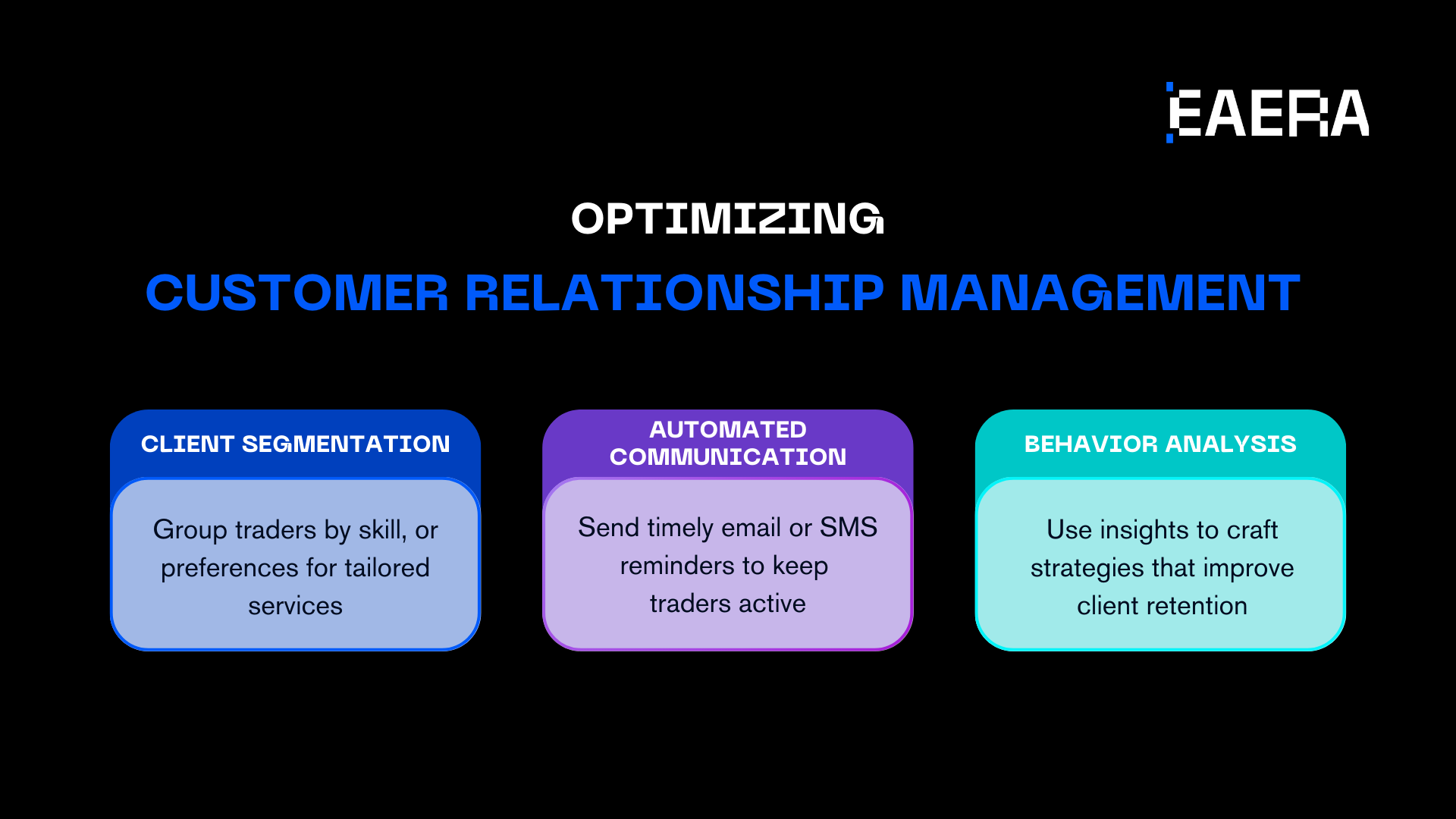

3. Best Practice #3: Optimize Forex CRM for Client Engagement

An effective Forex CRM is a powerful tool for FX brokers aiming to strengthen client relationships, boost retention, and personalize communication. When integrated with forex back office software, it enables smarter decision-making and more efficient operations.

Here’s how FX brokers can maximize the benefits of a high-performing Forex CRM:

- Client Segmentation: Group traders by behavior, trading style, or engagement level. This allows FX brokers to tailor services and promotions to specific client types.

- Automated Communication: Schedule targeted messages, such as trade alerts or funding reminders, via email or SMS. Automation keeps clients engaged without added manual effort.

- Behavior Tracking & Analysis: Analyze trading frequency, deposit habits, and inactivity patterns. FX brokers can use this data to refine marketing strategies and reduce churn.

- Integrated CRM & Back Office Insights: Combining Forex CRM with forex back office software allows FX brokers to align client engagement efforts with operational metrics like trading volume, revenue, and lifetime value.

- Improved Retention and Support: A well-optimized CRM helps FX brokers deliver timely support, personalized offers, and follow-ups—creating a seamless experience that drives loyalty.

By leveraging both a Forex CRM and forex back office software, FX brokers can unify client management and business intelligence, resulting in more targeted strategies and stronger overall performance.

4. Best Practice #4: Maintain Compliance and Data Security

Regulatory compliance is non-negotiable for FX brokers, especially those operating across multiple regions such as the EU, US, and Asia. Strict oversight and evolving standards make it essential for FX brokers to adopt systems that help them stay compliant, avoid penalties, and protect their reputation.

Forex back office software plays a central role in helping FX brokers meet these obligations efficiently and accurately. The right tools reduce manual work, prevent errors, and ensure timely reporting.

Key compliance features FX brokers should look for include:

- AML & KYC Automation: Automated verification tools help FX brokers check client identities, screen for risk, and meet regulatory requirements with minimal effort.

- Secure Payment Processing: Encrypted payment gateways and secure transaction logs protect FX brokers and clients from fraud and unauthorized access.

- Instant Regulatory Reporting: Real-time data collection and automated reports make it easier for FX brokers to submit documentation to financial authorities on time.

Pairing your forex back office software with a strong Forex CRM further enhances compliance. Client data is stored securely, communication logs are maintained, and reporting becomes even more streamlined. Together, these systems help FX brokers remain audit-ready and transparent.

EAERA’s forex back office software is built with compliance in mind, giving FX brokers an all-in-one solution to manage risk, meet global standards, and maintain trust with both clients and regulators.

By prioritizing security and regulatory technology, FX brokers can focus on growth while confidently meeting their legal obligations.

5. Best Practice #5: Use Analytics for Smarter Decisions

Data is one of the most powerful assets FX brokers can leverage. Forex back office software provides actionable insights into trading behavior, revenue patterns, and operational efficiency.

- Trader Activity Insights – Spot client trading patterns to improve service offerings.

- Revenue Monitoring – Track profits and tweak IB commission plans for better results.

- Risk & Liquidity Control – Catch risks early and adjust strategies as needed.

FX brokers who rely on data insights from both their CRM and back office system make more informed decisions, driving profitability and sustainable growth.

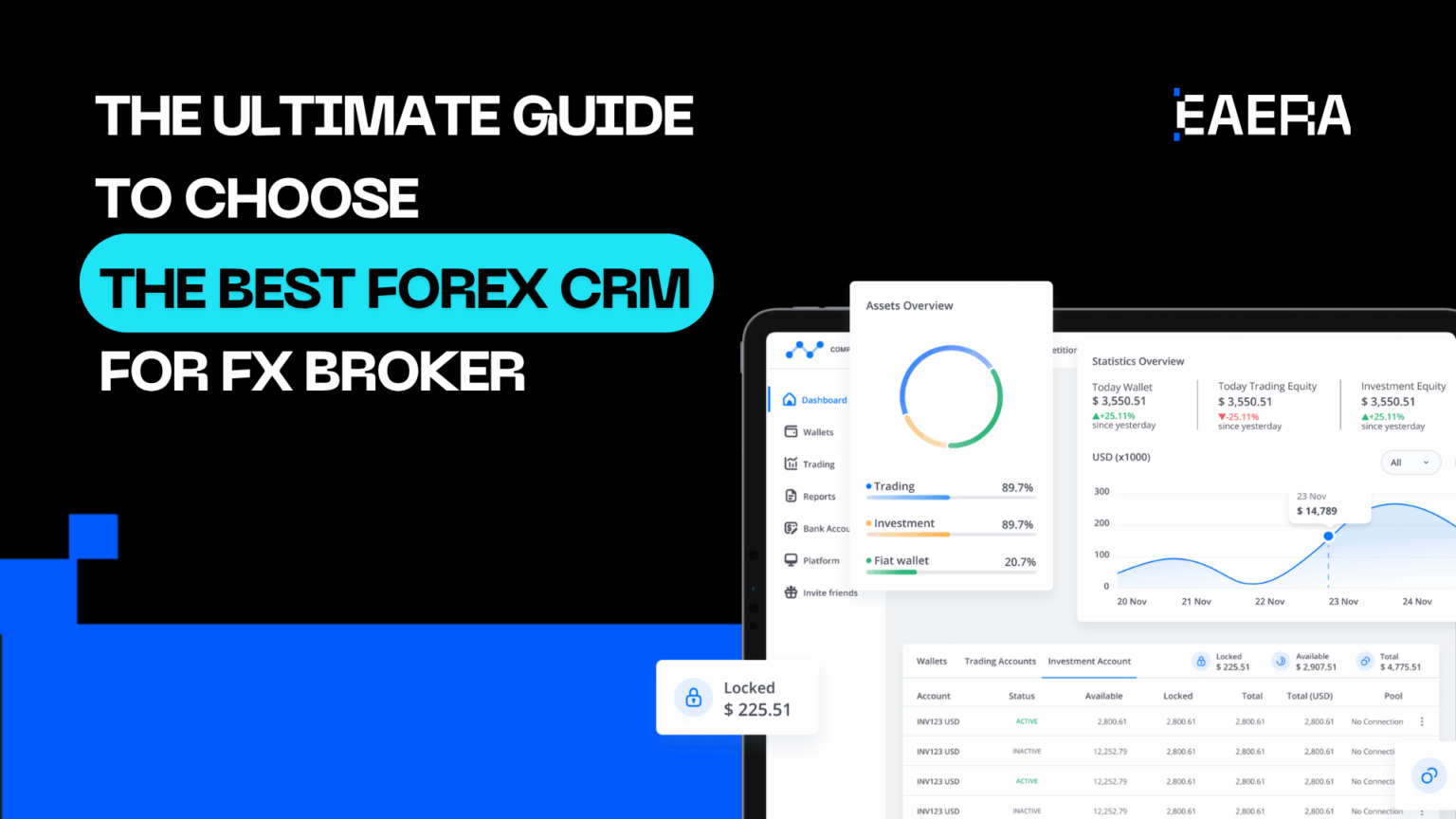

Mastering these five best practices—choosing the right system, automating operations, optimizing CRM, ensuring compliance, and analyzing data—empowers FX brokers to operate more efficiently and competitively.

Forex back office software isn’t just a support tool; it’s a core business enabler. Paired with a powerful Forex CRM, it can transform how FX brokers run their operations. EAERA offers tailored solutions built for growth, security, and success. Explore EAERA’s forex back office software today and elevate your brokerage!