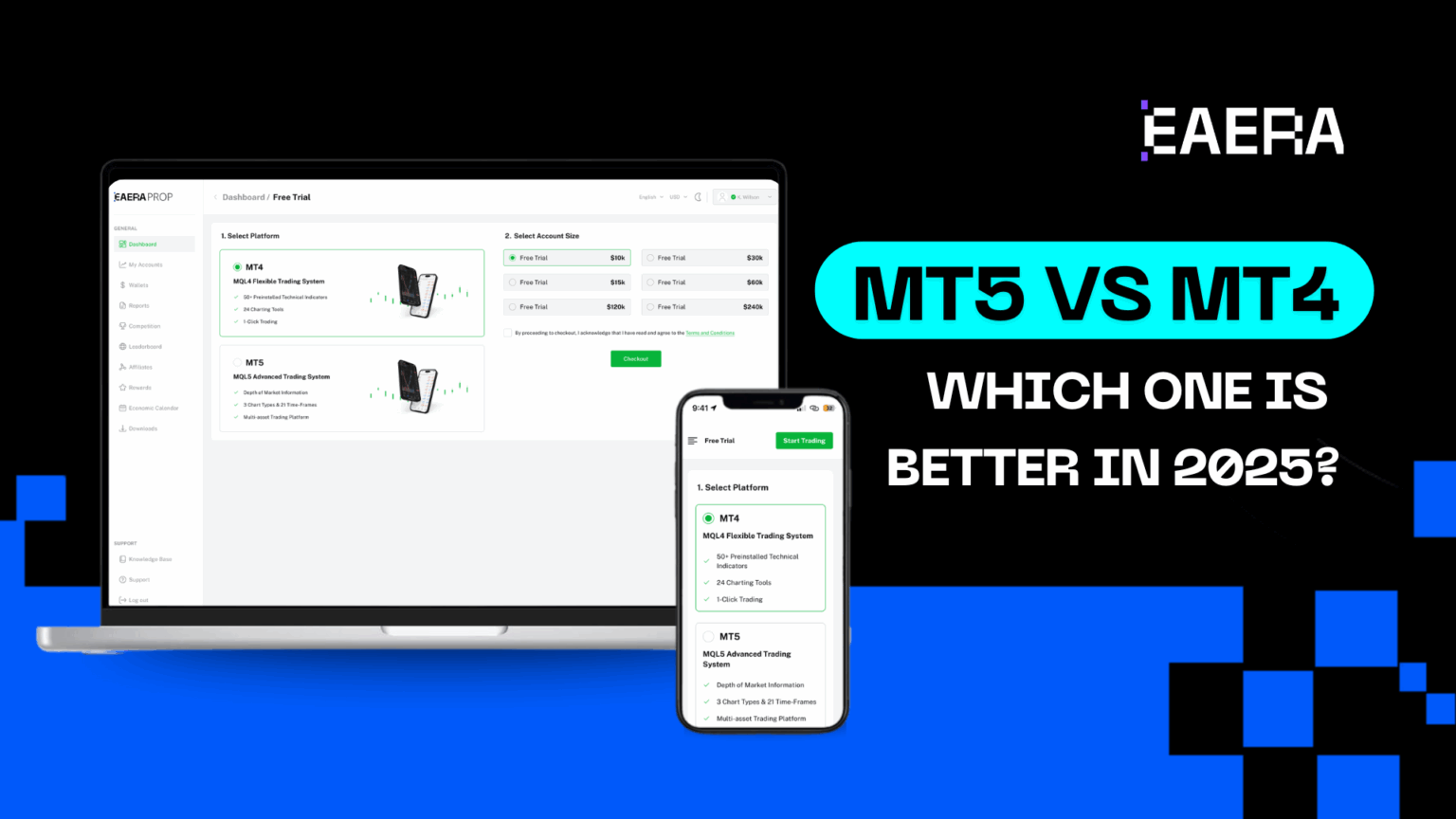

In 2025, the debate between MetaTrader 5 (MT5) and MetaTrader 4 (MT4) continues to shape decisions for forex traders and brokers. Each platform offers unique features tailored to different trading needs, but is it time to transition to MT5 fully? This article explores the evolution, core features, and key differences of both platforms.

Whether you’re managing trades or exploring advanced analytics, understanding the benefits of MT5 could revolutionize your trading experience. Read on to find out how EAERA’s MT5 Reporting System can support your success.

Related articles:

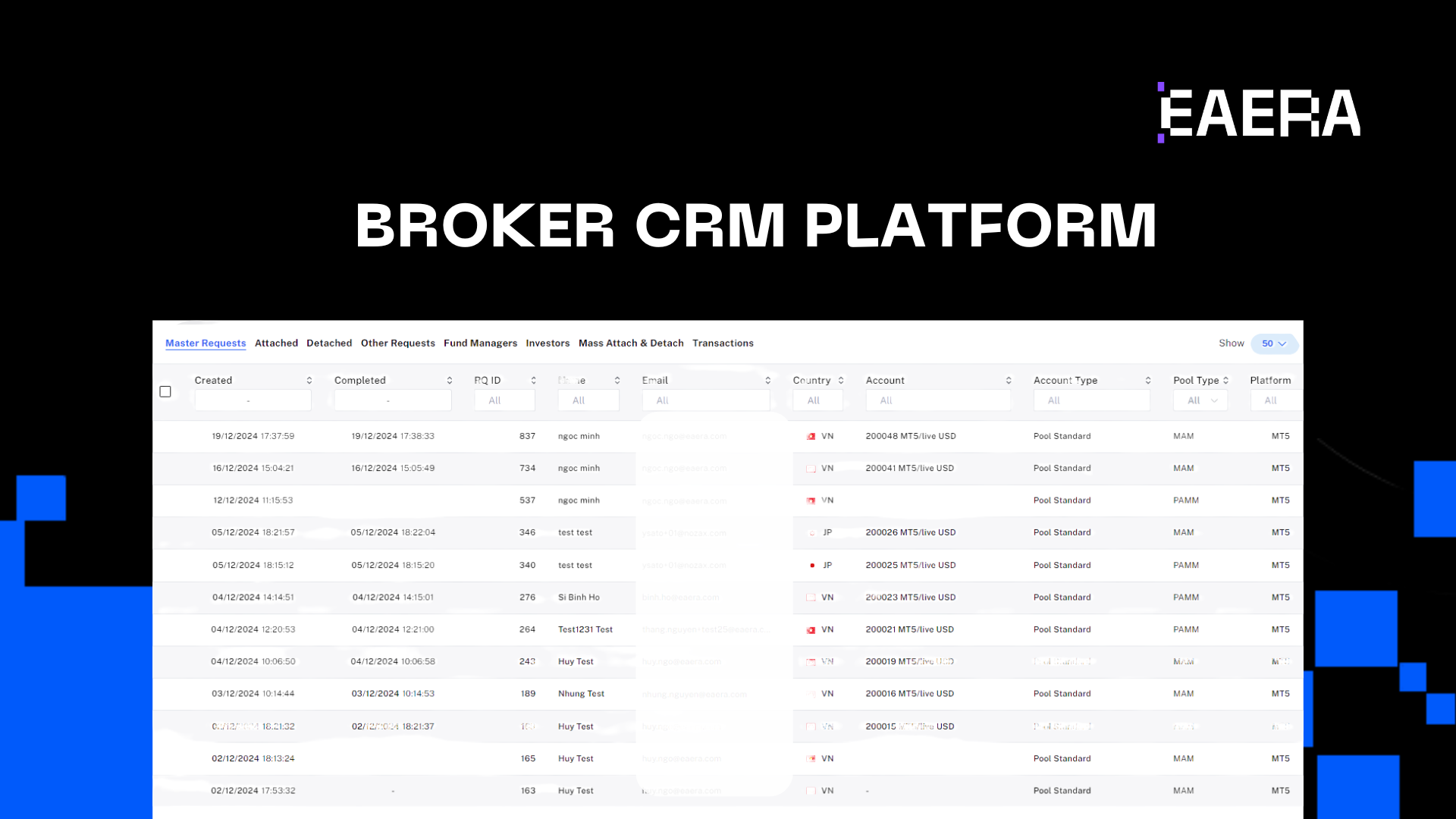

- Unlock Your Brokerage Potential: Top Forex CRM Solutions Revealed!

- The Future of CRM in Forex Brokerage: Trends and Technologies

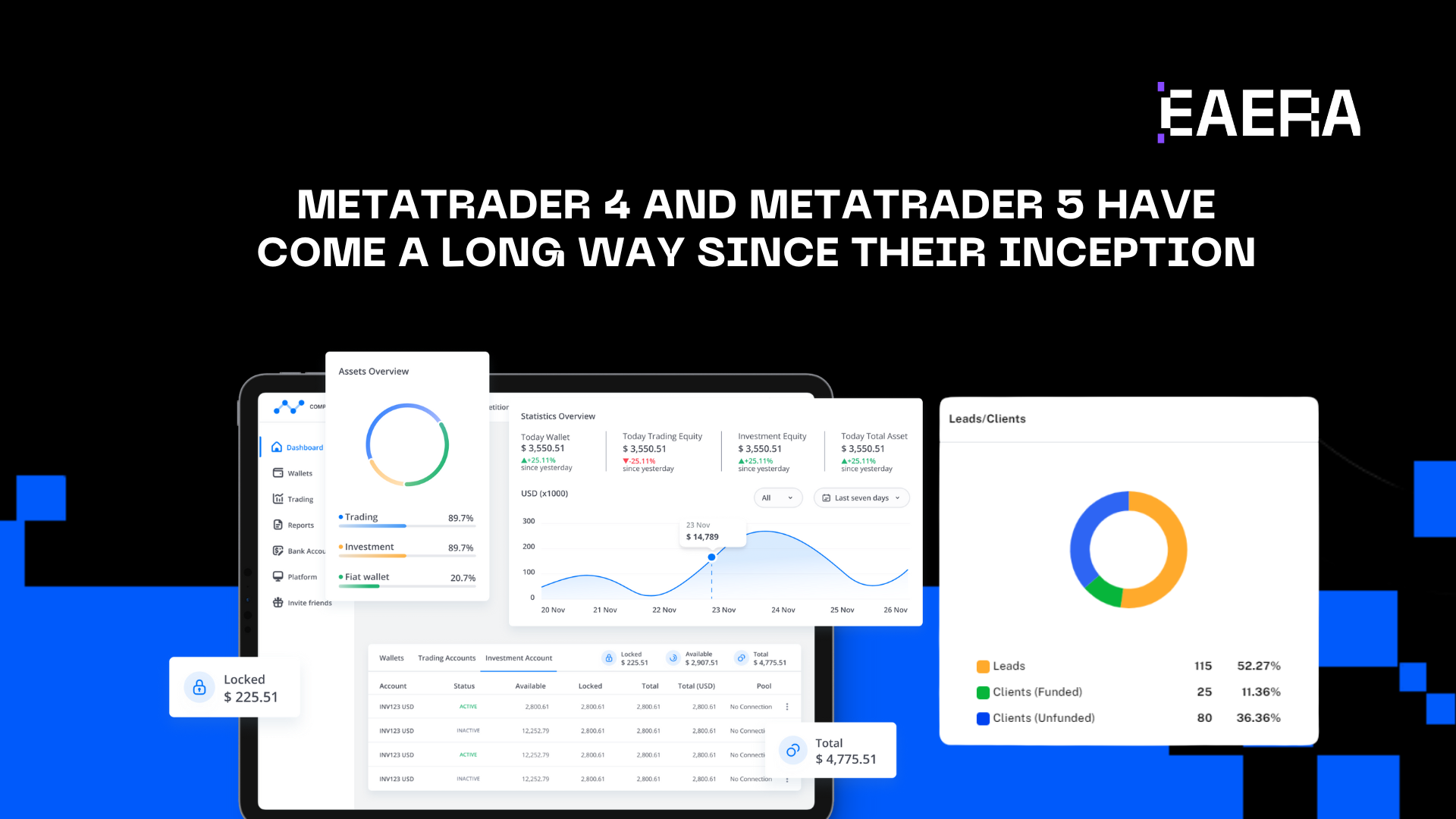

1. Evolution of MetaTrader Platforms

MetaTrader 4 was launched in 2005 as a powerful tool for forex trading, quickly becoming the industry standard. Its simplicity and robust functionality earned it immense popularity. However, as trading demands evolved, MetaTrader 5 (MT5) emerged in 2010, catering to broader markets like stocks and commodities alongside forex.

Key Milestones Leading to 2025:

- MT4 became synonymous with forex trading until brokers sought advanced solutions.

- MT5 introduced Depth of Market (DOM), multi-asset support, and enhanced analytics.

- In 2025, MT5 is widely seen as the future of trading platforms, though MT4 remains supported by some brokers.

MetaTrader 4 and MetaTrader 5 have come a long way since their inception

2. MT5 vs. MT4: Core Features Comparison

User Interface and Experience

The user interface is a key distinction between MT5 and MT4, catering to different trader profiles. MT4 is known for its simplicity, making it an excellent choice for beginners. Its clean design and intuitive navigation allow new traders to focus on learning the basics of forex trading without being overwhelmed. Meanwhile, MT5 provides a more advanced interface tailored to experienced traders. With customizable layouts, enhanced charting options, and integrated tools, MT5 delivers a seamless experience for those managing complex trades or diverse portfolios.

Technical Analysis Tools

Both MT5 and MT4 offer robust technical analysis capabilities, but MT5 outshines its predecessor with more extensive tools. MT4 provides traders with 30 built-in indicators and 9 timeframes, sufficient for standard trading strategies. However, MT5 elevates this by offering 38 indicators, 21 timeframes, and a broader range of drawing tools for in-depth market analysis. Additionally, MT5 supports unlimited charting, enabling traders to analyze multiple assets simultaneously, a feature that sets it apart for professionals seeking greater insight.

Order Types and Execution

Order execution is another area where MT5 brings significant advancements over MT4. While MT4 supports four basic pending order types, MT5 introduces two additional types, offering traders greater flexibility in managing trades. One of the standout features of MT5 is the Depth of Market (DOM), which provides real-time insight into market liquidity and order flow—essential for informed decision-making in volatile markets. Although MT4 remains efficient for straightforward trading, MT5’s enhanced execution modes and faster processing times make it the preferred choice for advanced traders.

3. Other Differences between Metatrader 5 and Metatrader 4

Market Coverage

One of the standout differences between MetaTrader 5 and MetaTrader 4 is market coverage. While MetaTrader 4 is primarily designed for forex trading, MetaTrader 5 supports a wider range of asset classes, including stocks, commodities, and futures. This broader market access makes MetaTrader 5 an ideal choice for traders seeking diversification in 2025.

Algorithmic Trading and Expert Advisors (EAs)

Both platforms support algorithmic trading, but MetaTrader 5 takes it further with its MQL5 programming language, allowing for more sophisticated Expert Advisors (EAs). Compared to the MQL4 language in MetaTrader 4, MQL5 enables faster backtesting and multi-threaded processing, giving traders a competitive edge in automation.

Performance and Speed

In terms of performance, MetaTrader 5 is built on 64-bit architecture, ensuring faster execution and more efficient handling of large datasets. By contrast, MetaTrader 4 operates on older 32-bit systems, which can limit its speed and scalability, especially for high-frequency trading.

Community Support and Resources

While MetaTrader 4 benefits from a large, established community, MetaTrader 5 is quickly catching up. The growing base of traders on MetaTrader 5 means more resources, forums, and expert tools are becoming available, making it increasingly appealing to modern traders.

Broker Adoption and Availability

Although MetaTrader 4 remains widely adopted by brokers, many are transitioning to MetaTrader 5 due to its advanced features and multi-asset capabilities. In 2025, MetaTrader 5 is expected to dominate new broker offerings, while support for MetaTrader 4 gradually diminishes.

Mobile and Web Trading

Both platforms offer mobile and web versions, but MetaTrader 5 delivers a more advanced experience. Its mobile app includes enhanced charting tools and order management options, surpassing the basic functionality available in the MetaTrader 4 app. This makes MetaTrader 5 more suitable for traders who prioritize on-the-go trading.

Security and Reliability

When it comes to security, MetaTrader 5 incorporates advanced encryption protocols and supports centralized exchanges, providing greater reliability for institutional and retail traders alike. While MetaTrader 4 is still secure, its older architecture may present vulnerabilities over time, especially as technology evolves.

MT5 outshines MT4 in market coverage and performance

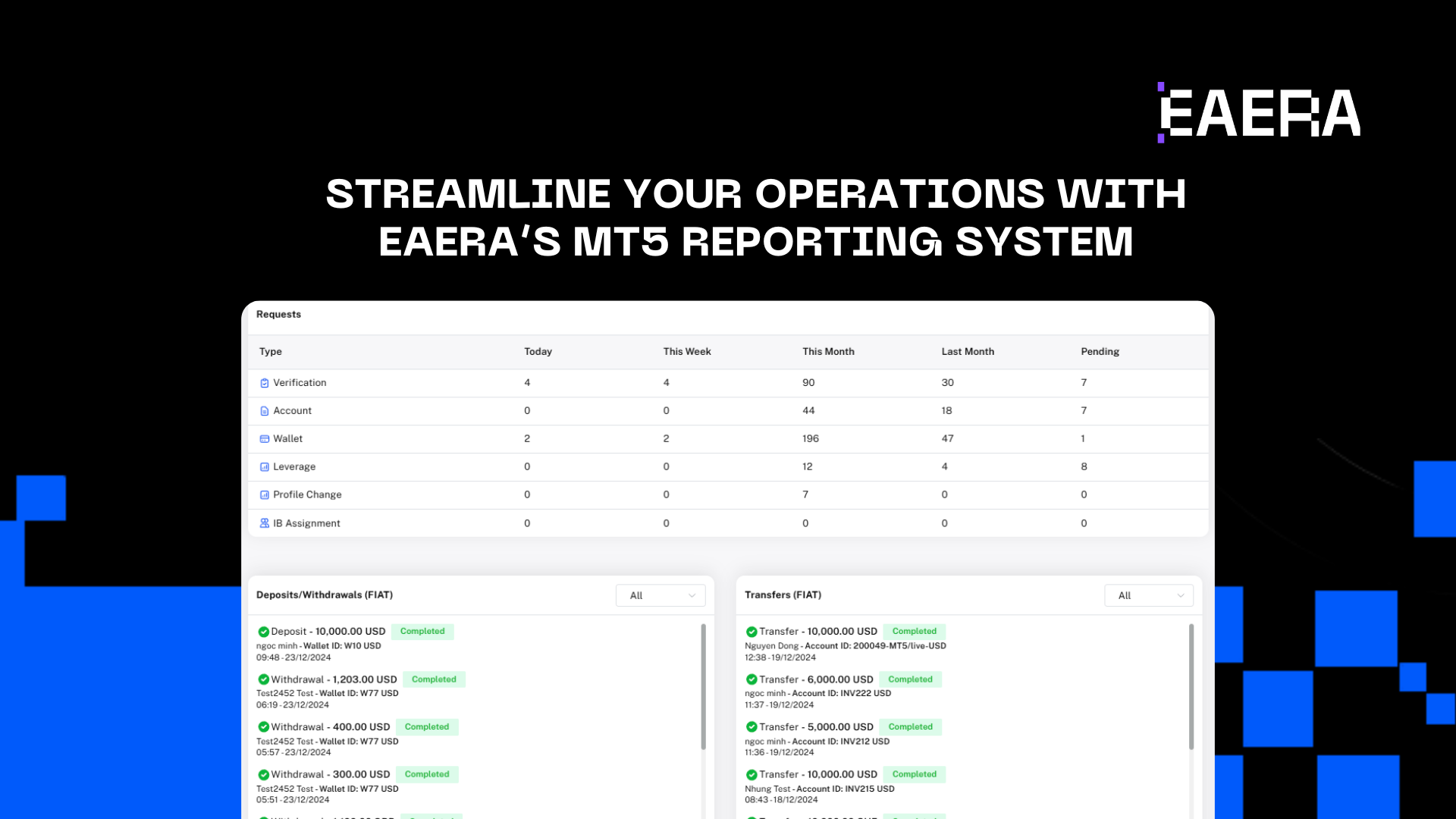

4. Trying EAERA’s MT5 Reporting System

If you’re looking to maximize the potential of MetaTrader 5 in your trading operations, EAERA’s MT5 Reporting System is the perfect solution. Designed to simplify complex tasks, this system offers seamless integration with MetaTrader 5, providing brokers and traders with cutting-edge tools to streamline performance tracking and decision-making.

Key features of the EAERA MT5 Reporting System include:

- Detailed analytics and performance insights to guide better trading decisions.

- Multi-language and multi-currency support for global operations.

- Real-time data synchronization with your MT5 platform.

- Automated compliance tracking, ensuring adherence to regulations like GDPR and AML.

- Scalable and secure architecture, perfect for brokers in fast-paced trading environments.

With its intuitive interface and advanced capabilities, EAERA’s system empowers traders to focus on strategies rather than operational complexities. Experience how it transforms your trading operations today!

Streamline your operations with EAERA’s MT5 Reporting System

5. FAQs

Is MT4 being phased out?

–> MT4 remains operational, but many brokers are shifting focus to MT5 due to its advanced capabilities.

Can I run both MT4 and MT5 simultaneously?

–> Yes, both platforms can be installed and used on the same device without conflicts.

Which platform is better for algorithmic trading?

–> MT5 is better, as it supports more complex algorithms and faster backtesting with MQL5.

How do I transition from MT4 to MT5?

–> Transitioning requires migrating your account and possibly reprogramming custom indicators or EAs to fit MT5’s MQL5 language.

Are there significant cost differences between the two platforms?

–> Costs vary by broker, but MT5 may have slightly higher licensing fees due to its advanced features.

Choosing between MT5 and MT4 in 2025 depends on your trading needs. While MT4 remains reliable, MT5’s advanced tools, market coverage, and performance make it the better choice for most traders. Enhance your trading efficiency with EAERA’s MT5 Reporting System, designed to provide actionable insights and seamless integration. Ready to optimize your trading experience? Request a demo today!