In today’s competitive trading environment, more firms are embracing proprietary trading for its high-profit potential. A prop firm uses its own capital and relies on skilled traders to generate returns instead of traditional clients. Managing these traders efficiently requires more than a generic CRM. While standard systems focus on customer relationships, they lack the tools needed for a prop firm to thrive.

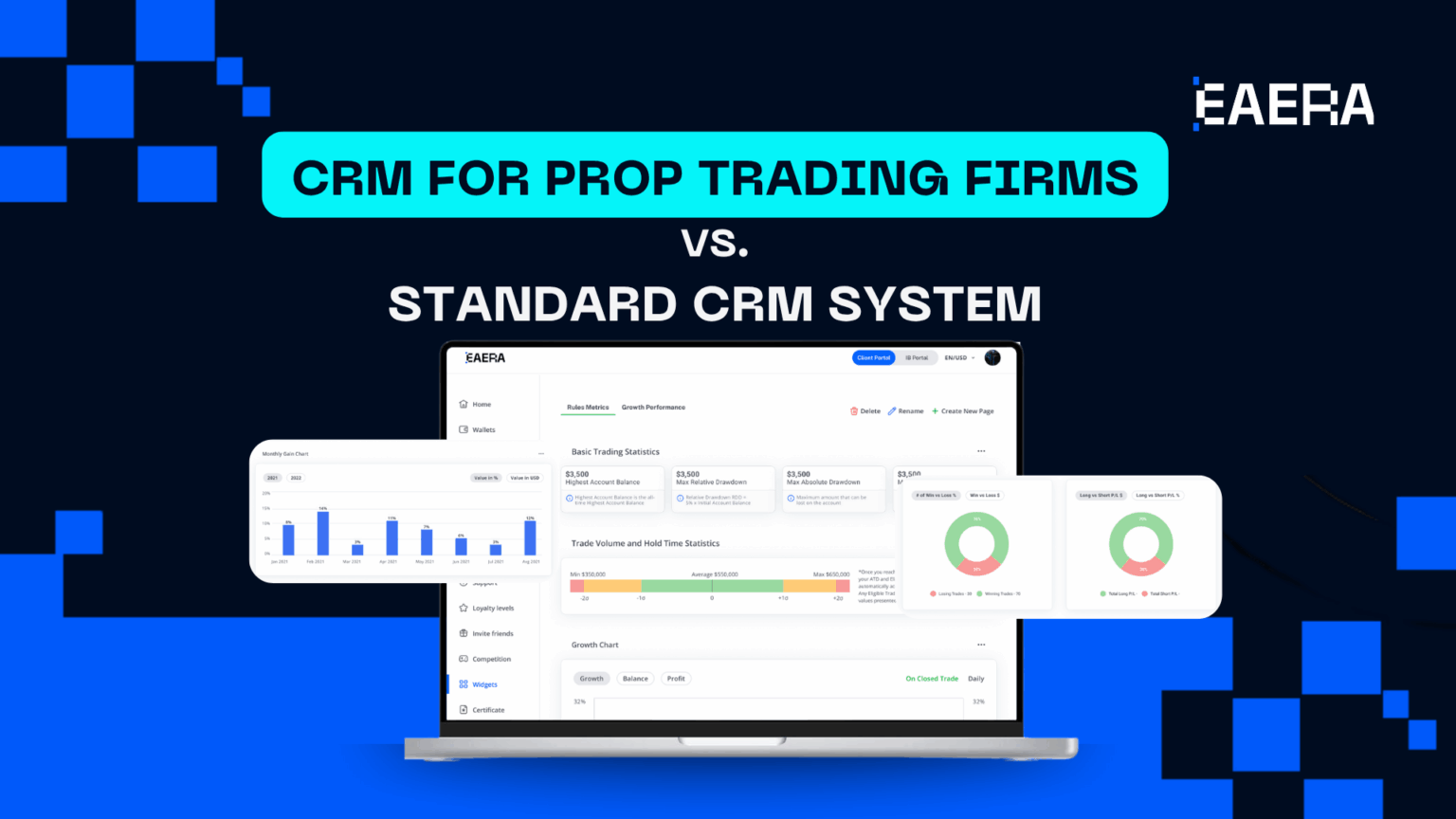

Specialized CRMs are designed for prop trading—handling performance tracking, risk management, and funding. This article from EAERA explores the key differences between a prop firm CRM and a traditional CRM system.

Related articles:

1. Understanding CRM Systems

1.1 What is a CRM System?

A CRM system is designed to centralize client data, automate repetitive tasks, and track interactions across a sales pipeline. For businesses like forex brokers, it simplifies lead management and boosts customer engagement. But when it comes to a prop firm, a general-purpose CRM lacks critical functionalities required for high-performance trader operations.

1.2 The Role of CRM in Financial Services

In financial services, especially forex and crypto trading, CRM systems play a vital role in client onboarding, compliance, and communication. For a prop firm, however, the role extends beyond client care to include risk analysis, regulatory compliance, and trader evaluation.

Financial firms face unique pressures: volatile markets, tight margins, and regulatory oversight. A CRM tailored to these challenges can automate reporting, flag risks, and improve client trust. That’s where specialized solutions from providers like EAERA shine, offering tools that align with the fintech world’s demands.

2. What Makes a Prop Firm Different?

2.1 What is a Prop Firm?

A prop firm uses its own capital to trade markets like forex, stocks, and crypto. Rather than earning through client commissions, these firms profit from traders’ success. This setup requires recruitment, evaluation, and funding of skilled traders, with a strong focus on performance and compliance.

2.2 Unique Needs of Prop Trading Firms

A prop firm doesn’t manage client portfolios—it funds and supports traders to trade using the firm’s capital.

This model creates specific operational needs that a standard CRM can’t fulfill. To succeed, a prop firm requires tools built for its unique environment.

- Managing Traders, Not Clients: A prop firm prioritizes recruiting, evaluating, and supporting traders over handling traditional customers.

- Performance Tracking: Every prop firm must monitor trader performance, risk exposure, and profitability in real time.

- Profit Sharing & Funding: A CRM should help the prop firm automate payouts, profit splits, and funding stage transitions.

- High-Frequency Trading Automation: A prop firm operates in fast markets—requiring real-time data and automated workflows.

- Compliance Requirements: Strict KYC, AML, and contractual oversight are vital for any prop firm to stay fully compliant.

3. Key Differences Between a CRM for a Prop Firm and a Standard CRM

3.1 Trader-Focused vs. Client-Focused Approach

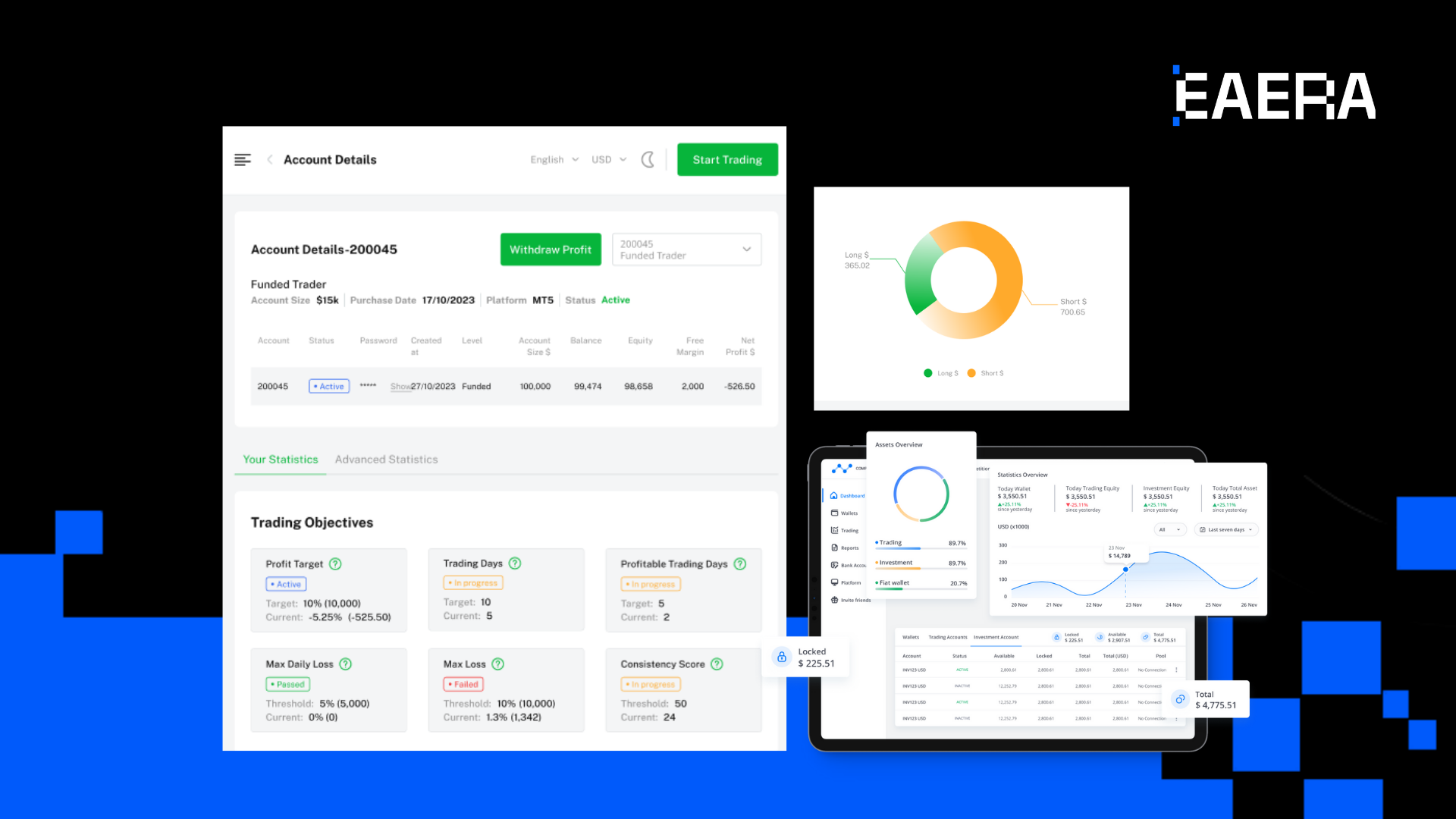

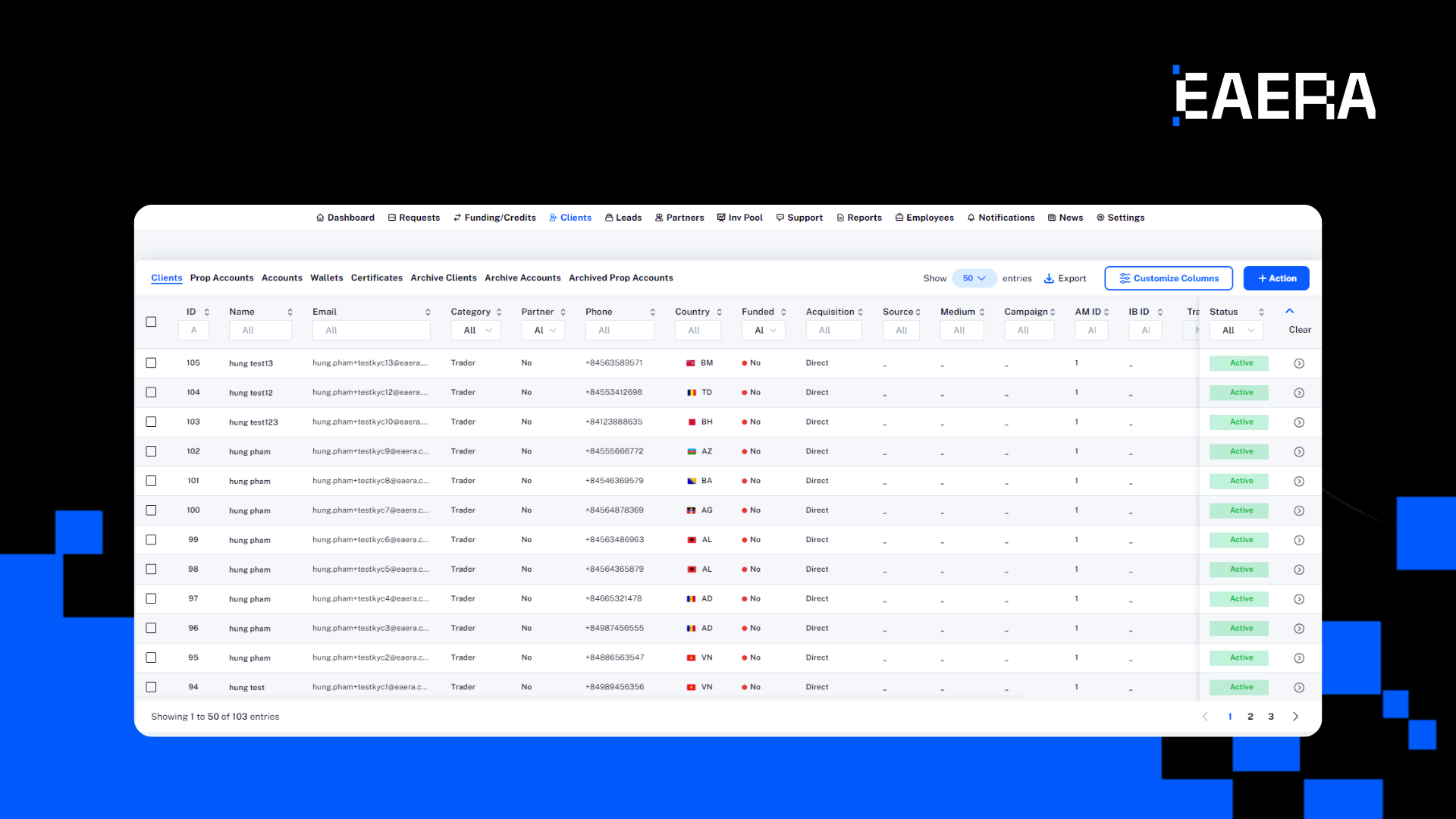

Standard CRMs are designed for lead generation and client management. A prop firm, however, needs a trader-first approach—tracking evaluations, funding stages, and payout processes. A specialized CRM enables seamless trader lifecycle management, from application to funded status.

3.2 Integrated Risk & Performance Management

Unlike traditional CRMs, a CRM for a prop firm connects directly to trading platforms like MT4, MT5, or cTrader. This integration allows real-time performance tracking, flagging risky behavior before it impacts firm capital.

3.3 Profit Split & Funding Milestone Management

Where standard CRMs manage invoices, a prop firm CRM automates profit splits, trader payouts, and funding upgrades. These systems track progression through evaluation phases and automate reward distribution.

3.4 Regulatory Compliance Tools

Standard CRMs lack built-in KYC or AML protocols. A CRM for a prop firm includes tools for automated document verification, trader agreements, and audit-ready reporting—key for maintaining legal standing.

3.5 Custom Evaluation & Challenge Features

A prop firm often uses trading challenges for recruitment. Specialized CRMs let firms design, deploy, and manage these programs, tracking trader success rates and progress in real time.

3.6 Trader-Centric Communication

Prop trading CRMs support real-time notifications, alerts, and dashboard updates—not just customer support emails. Keeping traders informed and engaged is vital for performance.

3.7 Multi-Account Management

A single client in a prop firm may operate several accounts—demo, evaluation, and funded. Unlike basic CRMs, specialized solutions connect all these under one trader profile, simplifying management and oversight.

4. Benefits of Using a Specialized CRM for Prop Firms

A specialized CRM is a powerful tool that redefines how a prop firm operates—making daily processes faster, safer, and more scalable. Unlike generic systems, a CRM built for a prop firm addresses trader-specific needs like onboarding, funding, and compliance.

Key benefits of using a CRM tailored to a prop firm include:

- Efficiency: Automates trader evaluations, cutting manual work and speeding up onboarding

- Real-Time Risk Control: Helps a prop firm monitor trading behavior and flag high-risk activity instantly

- Regulatory Readiness: Offers built-in tools for KYC, AML, and audit reporting to keep your prop firm compliant

- Improved Trader Retention: Custom alerts, dashboards, and timely feedback keep traders engaged and loyal

Whether you’re launching or scaling, a CRM designed for a prop firm gives you the operational edge to grow with confidence.

5. How to Choose the Right CRM for Your Prop Firm

Choosing the right CRM isn’t just about features—it’s about compatibility with the unique needs of your prop firm. Key factors include:

- Trading Platform Integration: Must connect with MT4, MT5, cTrader, etc.

- Automation Capabilities: Handles trader evaluations, payouts, and milestones

- Compliance Tools: Provides robust KYC, AML, and reporting functionality

- Scalability: Accommodates growing trader bases without performance drops

Standard CRMs may offer basic client tracking, but only a specialized CRM empowers a prop firm to thrive. It ensures traders are supported, regulations are met, and growth is sustainable. Companies like EAERA provide tailored CRM solutions that meet these demands head-on. Evaluate your firm’s needs and invest in a CRM that matches the pace and complexity of modern prop trading.

Investing in a dedicated CRM isn’t just smart – it’s essential. It streamlines operations, mitigates risks, and keeps traders engaged. Companies like EAERA lead the way, offering tools that empower prop firmsuccess. Evaluate your needs, weigh the benefits, and choose a system that fuels your growth. In the fast-paced world of prop trading, the right CRM is your ticket to staying ahead.