Proprietary trading firms operate in a high-stakes environment where managing risk is paramount to success. With volatile markets and hundreds of traders to oversee, ensuring compliance with drawdown limits both daily and maximum can be a daunting task. Manual monitoring often leads to delays, errors, and missed opportunities, putting firms at risk of significant financial losses.

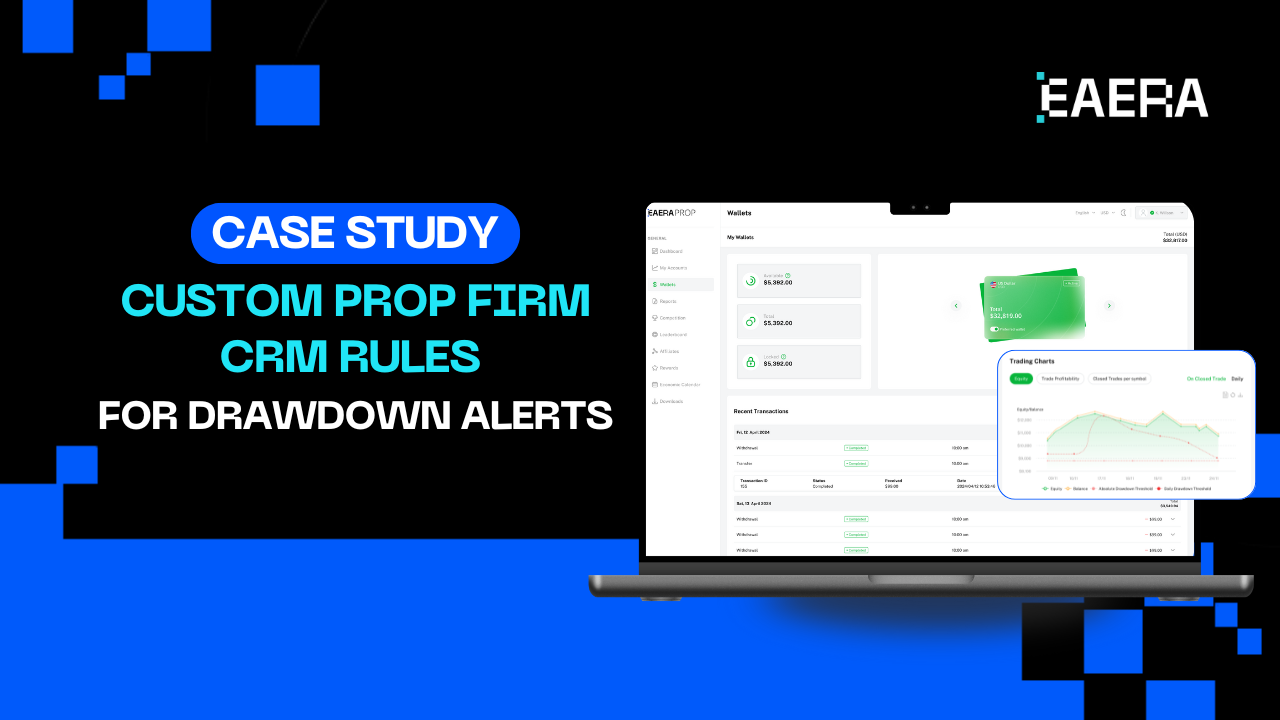

At EAERA, we specialize in delivering innovative tech solutions tailored for financial institutions, including prop firms. Our prop firm CRM empowers these firms to automate critical processes like drawdown alerts, ensuring real time risk management and operational efficiency. This case study explores how EAERA’s custom prop firm CRM rules transformed risk management for a mid-sized prop trading firm, streamlining their operations and enhancing trader compliance.

Related articles:

- Top 10 Forex CRM Features Every FX Broker Needs to Succeed

- The Role of Quality Forex CRM Software in Managing Broker Operations

The Challenge: Manual Drawdown Monitoring in Prop Trading

Proprietary trading firms rely on strict drawdown rules to protect capital and maintain disciplined trading practices. Drawdowns, which measure the decline in account balance from its peak, are typically categorized as daily (e.g., 4% loss limit per day) or maximum (e.g., 10% overall loss limit). Exceeding these limits can result in trader account deactivation or significant capital losses.

However, many prop firms still rely on manual processes or fragmented systems to monitor drawdowns, leading to inefficiencies. For example, a mid-sized prop firm managing 500 traders across forex and futures markets faced significant challenges:

- Delayed Alerts: Manual checks meant administrators were often notified of drawdown breaches hours after they occurred, delaying interventions.

- Human Error: Spreadsheets and manual data entry led to inconsistent rule enforcement and occasional oversights.

- Scalability Issues: As the firm grew, monitoring trader activity across multiple platforms became increasingly time-consuming.

- Trader Trust: Inconsistent communication about drawdown limits eroded trader confidence and satisfaction.

These challenges underscored the need for a robust prop firm CRM to automate drawdown monitoring and ensure compliance in real time. EAERA’s solution was designed to address these pain points with precision and scalability.

EAERA’s Solution: Custom Prop Firm CRM Rules for Automation

EAERA’s prop firm CRM is a powerful platform built specifically for the unique needs of proprietary trading firms. Our customizable rules engine allows firms to define and automate drawdown alerts tailored to their risk management policies. Key features of our prop firm CRM include:

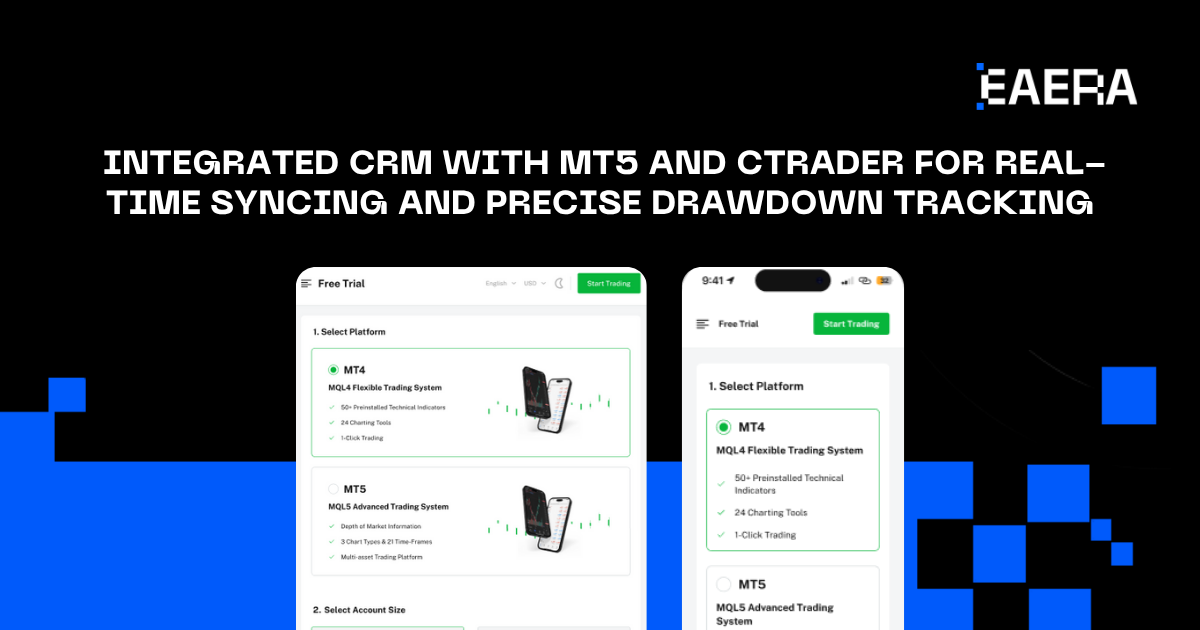

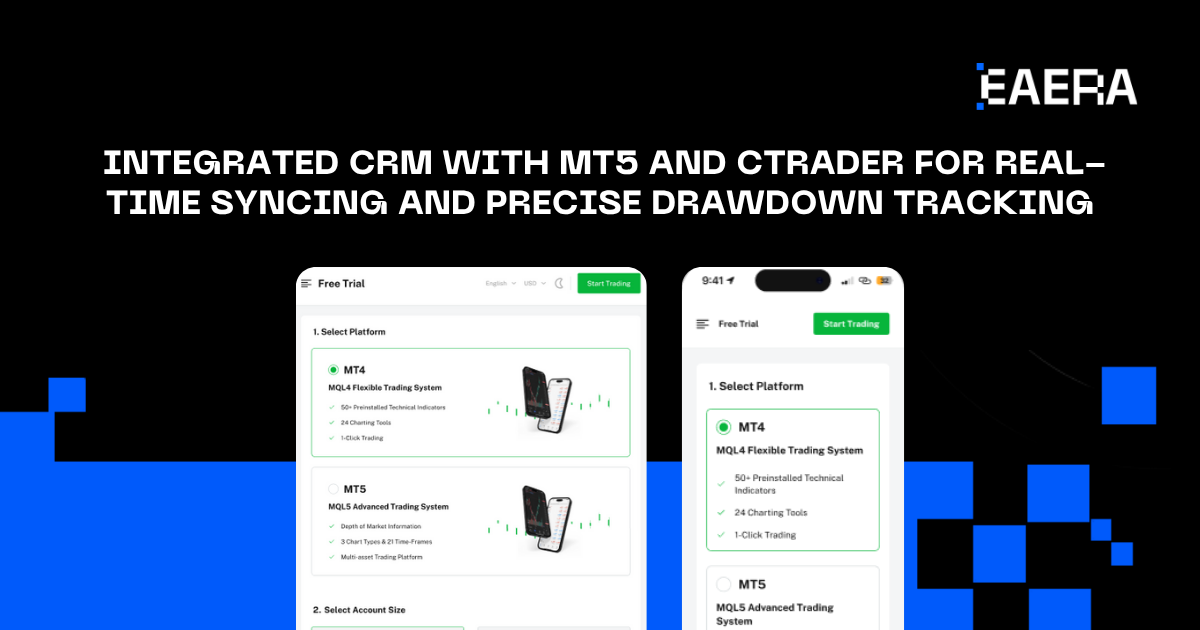

- Real-Time Monitoring: Seamless integration with trading platforms like MetaTrader and cTrader for live data syncing.

- Customizable Alerts: Set specific thresholds for daily and maximum drawdowns, with automated notifications to admins and traders.

- Role-Based Access: Administrators can monitor and act on alerts, while traders receive transparent updates on their account status.

- Scalable Infrastructure: Handles growing trader volumes without compromising performance or reliability.

- Compliance Tools: Ensures adherence to firm-specific rules and regulatory requirements through automated tracking and reporting.

For the prop firm in this case study, EAERA implemented a tailored prop firm CRM solution to automate drawdown alerts. We configured rules to flag accounts approaching a 3% daily drawdown or 10% maximum drawdown, with instant notifications sent via email, Slack, or the CRM dashboard. This eliminated the need for manual oversight and ensured timely interventions, protecting the firm’s capital and reputation.

Case Study: Transforming Risk Management for a Prop Firm

Client Profile

The client, a mid-sized prop trading firm based in London, managed over 500 traders across forex, futures, and CFD markets. With a growing trader base and increasing transaction volumes, the firm struggled to maintain consistent risk management practices. Their legacy system relied on spreadsheets and manual checks, which couldn’t keep pace with the firm’s scale or the fast-moving nature of financial markets.

The Problem

The firm’s manual drawdown monitoring process led to significant inefficiencies:

- Alerts for drawdown breaches were often delayed by hours, risking capital exposure.

- Inconsistent enforcement of drawdown rules led to occasional violations, impacting trader accounts and firm profitability.

- Administrators spent hours daily reviewing trader performance, diverting resources from strategic growth initiatives.

- Traders expressed frustration over unclear communication about their account status, affecting retention. The firm needed a prop firm CRM that could automate drawdown alerts, integrate with their trading platforms, and provide a centralized hub for risk management.

EAERA’s Implementation

EAERA partnered with the firm to deploy a customized prop firm CRM solution over a four-week period. The implementation process included:

- Needs Assessment: Collaborated with the firm’s risk management team to define drawdown thresholds and notification preferences.

- Platform Integration: Connected the prop firm CRM with MetaTrader 5 and cTrader for real-time data syncing, ensuring accurate drawdown calculations.

- Custom Rule Configuration: Set up automated alerts for accounts nearing or breaching drawdown limits, with notifications sent to admins via Slack and email, and to traders via the CRM dashboard

- Training and Onboarding: Provided comprehensive training for administrators and traders to ensure seamless adoption of the prop firm CRM.

- Testing and Rollout: Conducted rigorous testing to verify alert accuracy and system reliability before full deployment.

Our prop firm CRM was designed to be intuitive, with a user-friendly interface that minimized training time and maximized adoption across the firm’s team.

Results: A New Standard in Risk Management

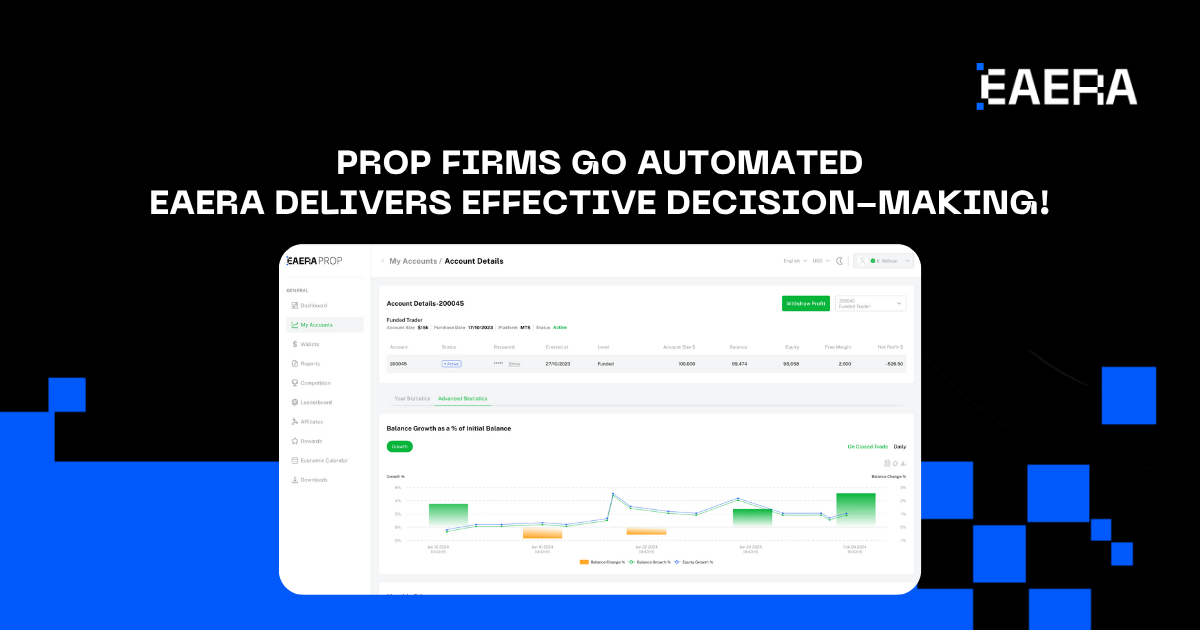

The implementation of EAERA’s prop firm CRM delivered transformative results for the client:

- 80% Reduction in Monitoring Time: Automated alerts eliminated the need for manual checks, freeing administrators to focus on strategic priorities.

- 95% Faster Response Times: Drawdown breaches were flagged in real time, reducing response times from hours to minutes.

- Zero Compliance Violations: Since implementation, the firm reported no drawdown-related compliance issues, thanks to precise rule enforcement.

- Improved Trader Satisfaction: Transparent, real-time alerts via the prop firm CRM dashboard enhanced trader trust and engagement.

- Scalability Achieved: The firm onboarded 200 additional traders without increasing administrative overhead, thanks to the scalable prop firm CRM infrastructure.

A senior risk manager at the firm shared, “EAERA’s prop firm CRM has been a game-changer. We’ve gone from reactive to proactive risk management, and our traders appreciate the clarity and speed of our alerts. It’s allowed us to scale confidently while protecting our capital.”

Why Automation Matters for Prop Firms in 2025

The proprietary trading industry is evolving rapidly, with firms facing increasing pressure to scale operations, comply with regulations, and maintain trader trust. Manual processes are no longer viable in a landscape where real-time decision-making is critical. A modern prop firm CRM, like EAERA’s, offers several advantages:

- Scalability: Supports growing trader volumes and complex trading strategies without compromising performance.

- Compliance: Automates adherence to firm-specific rules and regulatory standards, reducing the risk of penalties.

- Data-Driven Insights: Provides analytics to optimize risk management strategies and trader performance.

- Efficiency: Frees up resources by automating repetitive tasks, allowing firms to focus on growth and innovation.

Industry trends highlight the growing adoption of automation in prop trading, with firms leveraging prop firm CRM solutions to stay competitive. EAERA’s platform integrates AI-driven analytics and seamless platform connectivity, ensuring prop firms are equipped for the challenges of 2025 and beyond.

Conclusion: Partner with EAERA for Smarter Risk Management

This case study demonstrates the power of EAERA’s prop firm CRM in transforming risk management for proprietary trading firms. By automating drawdown alerts with custom rules, we helped a mid-sized prop firm achieve unparalleled efficiency, compliance, and trader satisfaction. At EAERA, we are committed to empowering financial institutions with cutting-edge technology tailored to their unique needs.

Our prop firm CRM is designed to scale with your business, streamline operations, and protect your capital in today’s fast-paced markets. Ready to revolutionize your risk management? Contact EAERA today at eaera.com to schedule a demo and discover how our prop firm CRM can drive your firm’s success.