Running a forex brokerage isn’t just about exciting trades and market opportunities—it’s also about keeping the back end organized. Picture the back office as the brain of your operation, processing every trade, commission, and partner payment. As forex trading grows more competitive, brokers need smarter systems to handle multi-tier IB (Introducing Broker) and affiliate payouts.

Related articles:

- 5 Best Practices FX Brokers Must Know for Back Office Software

- Case Study: How Forex CRM Software Helped a Brokerage Enter New Global Markets

What is a Forex Back Office?

A forex back office is the operational backbone of every brokerage firm. While traders see the excitement of price charts and instant executions, a massive amount of invisible work happens behind the scenes. This back-end system reconciles every trade, calculates commissions, handles client data, and ensures compliance with financial regulations. Without a robust forex back office, even a small brokerage can quickly get buried in errors, delayed payments, and frustrated partners.

Core Functions of a Modern Back Office

A modern forex back-office system is much more than a digital filing cabinet—it’s an all-in-one command center. Its primary mission is to reconcile trades, track multi-tier commissions, and generate accurate financial statements. At the same time, it manages thousands of client accounts, monitors real-time trading volumes, and creates audit-ready compliance reports.

For example, when a client closes a position, the back office immediately matches it with the right trade record, updates the client’s balance, and calculates any profit, loss, or commission owed to IBs (Introducing Brokers) or affiliates. It also handles deposits, withdrawals, and KYC/AML checks automatically. By bringing together trade reconciliation, partner payouts, and compliance, the back office prevents human error and keeps operations fully transparent.

Whether you run a boutique brokerage or a global forex operation, these functions ensure that every cent is accounted for and every transaction is verifiable, building credibility and trust with both clients and regulators.

How It Fits into Brokerage Operations?

Think of the forex back office as the heart pumping life through your brokerage. Traders and investors interact with the front-end platforms—MT4, MT5, cTrader, DXtrade, or proprietary systems—but the back office silently powers each trade and settlement. The moment a client places an order, the system starts recording market data, updating ledgers, and allocating commissions.

It also plays a strategic role in business growth. Managers can pull real-time reports on trading volumes, client activity, and partner performance to make fast, data-driven decisions. Compliance teams rely on the back office to prepare for audits and meet strict forex regulations like MiFID II, FCA, or CySEC requirements. Moreover, seamless integration with CRMs and payment gateways means clients experience smoother deposits, withdrawals, and onboarding.

Why Automation is a Game Changer?

In today’s high-speed forex market, automation is the key to scaling operations without sacrificing accuracy. An automated forex back office eliminates the bottlenecks of manual data entry, complex spreadsheets, and late-night reconciliations.

From Manual Chaos to Streamlined Systems

Before automation, brokerage teams spent countless hours cross-checking trades and calculating commissions. Human fatigue led to inevitable mistakes, which triggered disputes with IBs and affiliates. An automated forex back office changes the game. By connecting directly to trading servers and payment systems, it calculates commissions in real time, instantly updates client balances, and generates detailed statements without manual intervention.

This level of efficiency isn’t just convenient; it’s essential for compliance. Automatic audit trails mean every action is logged and easy to present during inspections. Automation also supports multi-currency operations and multiple asset classes, so your brokerage can expand into new markets without increasing administrative overhead. In short, it transforms a reactive process into a proactive, streamlined workflow where every trade and payout is tracked with machine-level precision.

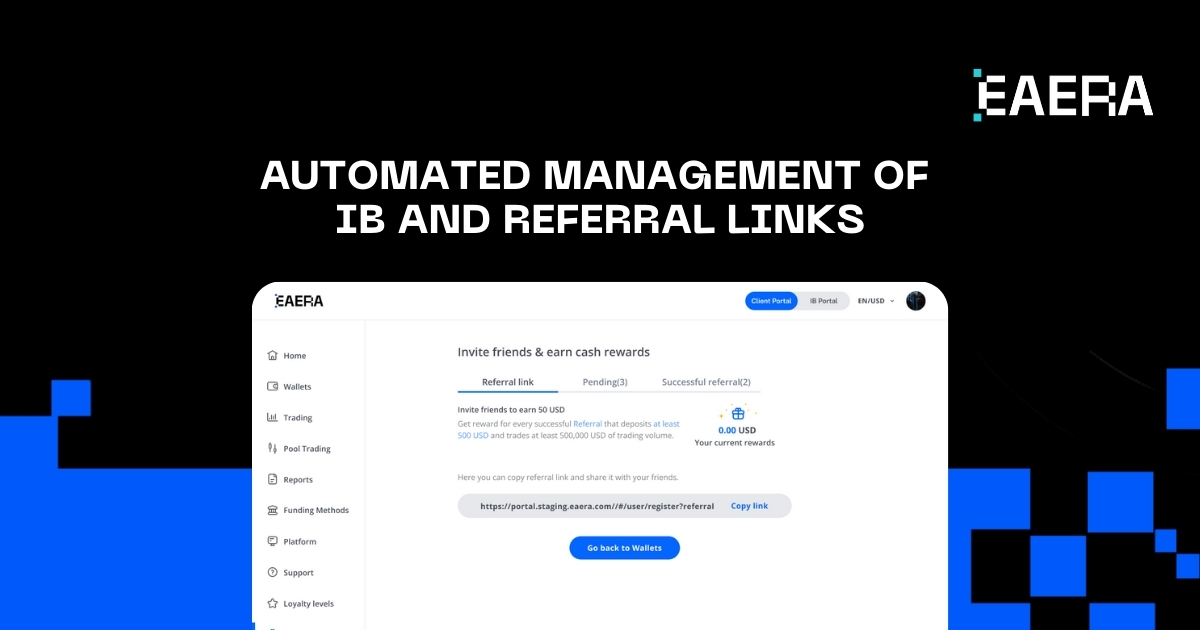

Benefits of Automated IB and Affiliate Payouts

One of the most critical advantages of automation is accurate and timely IB and affiliate payouts. Introducing brokers and affiliates is the lifeblood of forex growth—they bring in new traders and expand your market reach. But if their commissions are delayed or miscalculated, relationships can sour fast.

An automated forex back-office software calculates payouts according to predefined multi-tier rules, checks them against live trade data, and executes payments on schedule. This transparency builds trust and keeps partners motivated to refer more clients. For the broker, it means fewer payment disputes and less time wasted on manual reconciliation.

Moreover, clear, real-time statements give partners complete visibility into how their commissions are earned. By automating IB and affiliate payouts, brokers not only protect their reputation but also create a solid foundation for long-term, scalable growth in the competitive forex market.

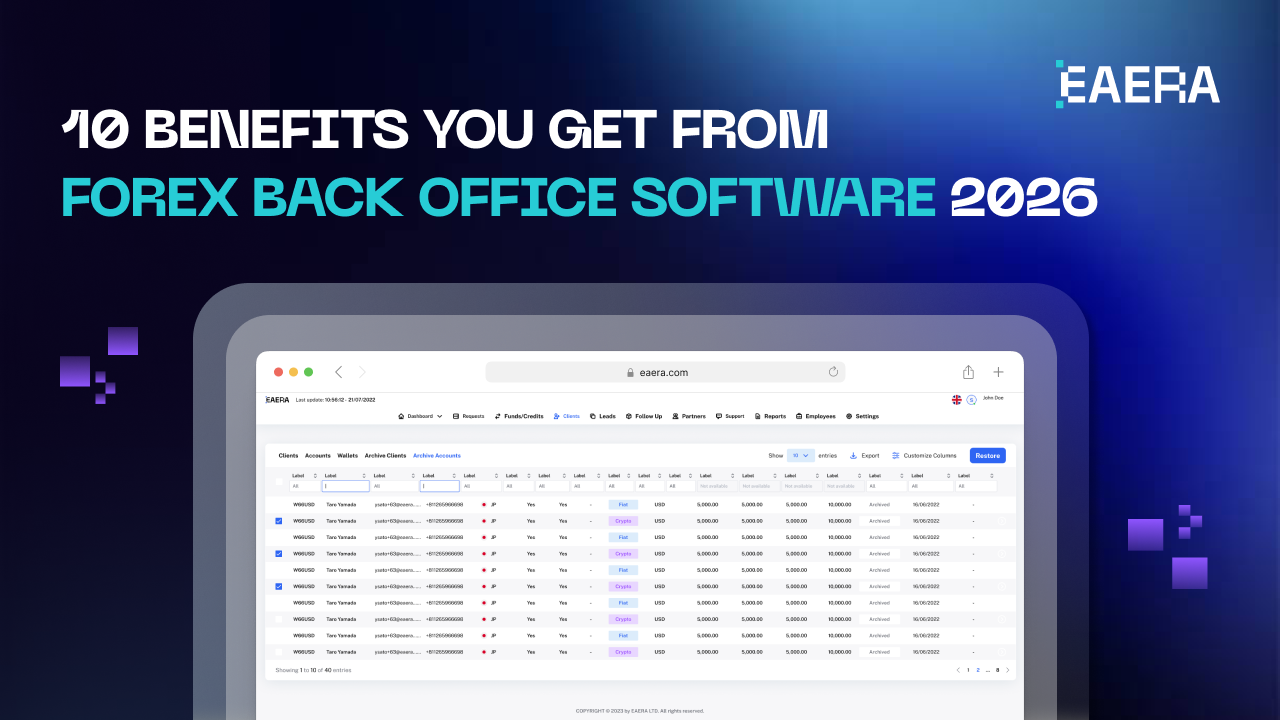

Key Features of a Forex Back Office Software

Not all forex back-office solutions are built the same. The best platforms go beyond basic trade settlement to give brokers automation, visibility, and scalability. Below are the most important capabilities every brokerage should look for.

Multi-Tier IB and Affiliate Management

In forex, partner networks often resemble a family tree—with top-level Introducing Brokers (IBs), sub-IBs, and affiliate marketers. A powerful forex back-office system must manage this complexity. It should let you create unlimited partner levels, define individual commission structures, and track each partner’s performance in real time.

Flexible multi-tier management means you can reward top-performing IBs with special rates while maintaining fair payouts across the network. Brokers also benefit from built-in analytics to identify which tiers drive the most revenue. With accurate, automated IB and affiliate payouts, you keep relationships transparent and motivating, reducing disputes and strengthening partner loyalty.

Real-Time Trade Reconciliation

In a 24/5 trading world, waiting for end-of-day reports isn’t an option. Real-time trade reconciliation ensures every transaction—from a single lot to high-frequency trades—is instantly matched and recorded. A forex back office that delivers live reconciliation eliminates discrepancies, prevents profit-loss miscalculations, and makes regulatory reporting effortless.

By monitoring open positions, margin requirements, and swaps as they happen, brokers can react quickly to market changes and client needs. This feature also provides immediate insights into trading volumes and revenue, allowing management to make proactive decisions rather than waiting on delayed reports.

Transparent Commission Tracking

Commission disputes can damage broker-partner relationships and consume valuable time. Modern forex back-office software provides transparent, audit-ready commission tracking. Every trade’s commission logic—whether based on spread, markup, or hybrid formulas—is visible to both brokers and IBs.

Detailed statements, downloadable reports, and customizable dashboards give partners full clarity on how each payout is calculated. This openness not only builds trust but also satisfies compliance audits, which increasingly demand traceable commission data. Transparent tracking means no hidden fees and no surprises, enhancing your brokerage’s credibility.

API and CRM Integrations

A forex back office doesn’t operate in isolation—it must seamlessly connect with your trading platforms (MT4/MT5, cTrader, DXtrade), client relationship management (CRM) systems, and payment gateways. API-driven integration allows data to flow smoothly across departments: when a client opens an account in the CRM, the back office instantly updates; when a trade closes, commissions are calculated automatically.

This eliminates double data entry, reduces human error, and speeds up client onboarding. It also means that marketing, compliance, and finance teams work from a single source of truth, improving efficiency across your entire brokerage.

Managing Multi-Tier IB and Affiliate Networks

As your forex brokerage grows, so does the complexity of your partner ecosystem. Managing multiple levels of IBs and affiliates manually is nearly impossible. A robust forex back office keeps everything organized.

Flexible Hierarchical Structures

With flexible hierarchical management, brokers can create as many partner levels as needed. You can group affiliates by region, product type, or performance, and assign unique commission rules to each group. This flexibility lets you launch regional campaigns, reward high performers, and experiment with incentive models without overhauling your entire system. A dynamic hierarchy also supports quick restructuring as market conditions change, ensuring your brokerage can adapt and stay competitive.

Custom Payout Rules and Real-Time Statements

Every partner’s relationship is different. A powerful forex back-office system lets you define custom payout formulas—whether fixed per lot, percentage-based, or tiered by trading volume. Real-time statements give IBs and affiliates instant visibility into their earnings, reducing support queries and disputes. By automating these complex calculations and presenting them clearly, brokers enhance partner satisfaction and free internal teams from tedious manual tasks.

Automating Payouts and Commission Calculations

Timely, accurate payments are the heartbeat of broker-partner trust. Automation transforms this critical process.

Reducing Errors and Building Trust

Manual commission calculations are slow and prone to mistakes. An automated forex back office pulls live trading data, applies predefined rules, and calculates exact payouts—error-free and on schedule. This accuracy protects your brokerage from costly disputes and penalties while giving IBs confidence that every dollar is correctly allocated.

Keeping Partners Happy and Loyal

Happy partners bring more clients. With automated, on-time payouts, IBs and affiliates receive earnings without chasing emails or tickets. As a result, your brokerage can build stronger relationships, gain more referrals and experience a steady growth.

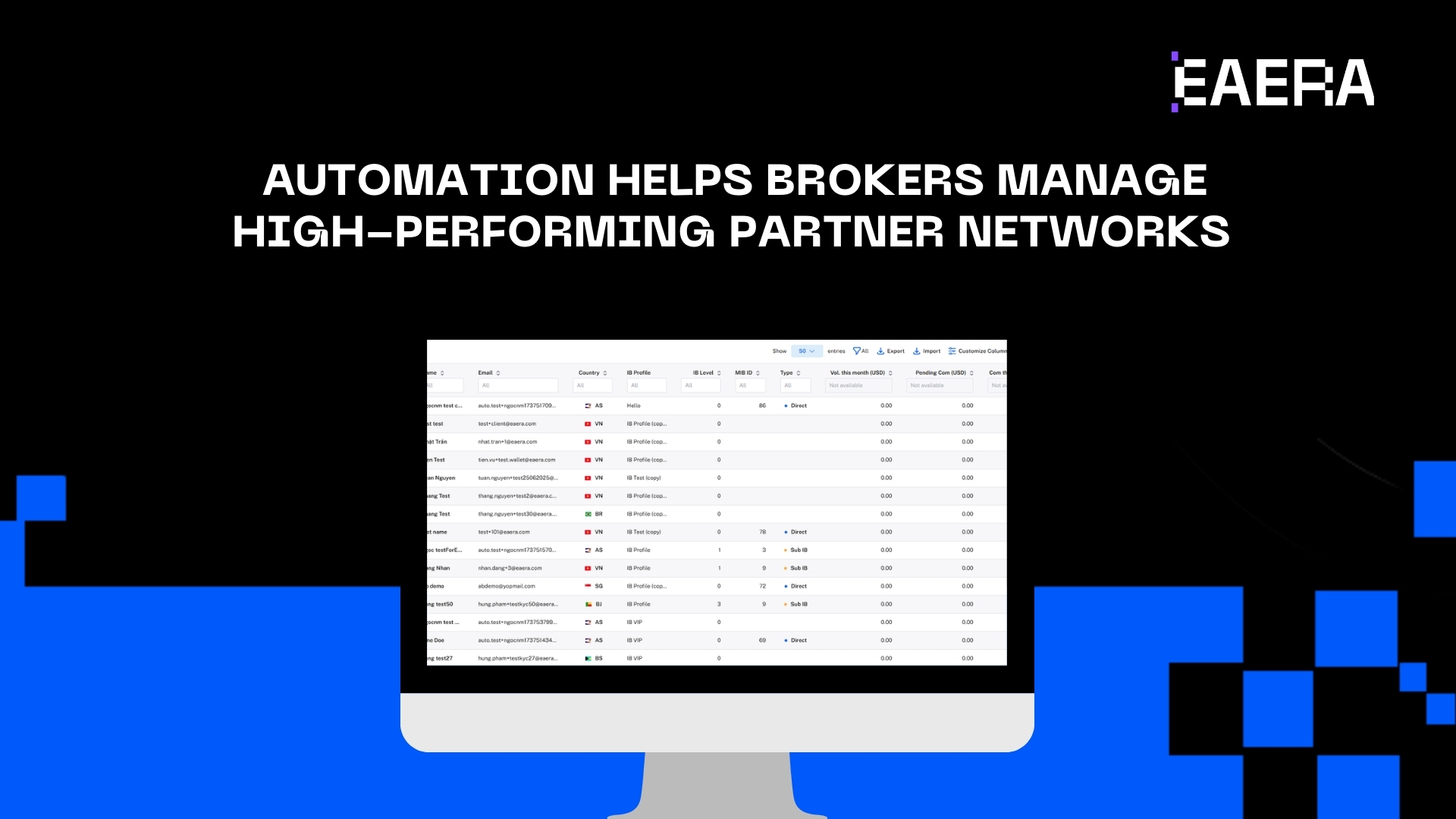

EAERA IB System: Building and Managing High-Performing Partner Networks

Comprehensive Multi-Level IB Management

The EAERA forex back office is built to handle the complexity of modern forex programs. Brokers can create multi-level IB structures, assigning sub-IBs beneath main IBs to form a dynamic tree-like hierarchy. Each level can have its own commission, allowing rewards to flow seamlessly through multiple layers based on performance and predefined rules.

The Tree List tab offers a visual map of all relationships, making it easy to monitor growth, track referrals, and adjust the network as market needs evolve. This level of flexibility helps brokers attract more partners, motivate sub-IBs, and scale globally without losing transparency or control.

Customizable Commission Profiles for Flexible Incentives

With custom commission profiles, EAERA lets brokers design incentive plans that fit their business strategy. You can define payouts per traded lot, per trading group, or per product category, rewarding IBs exactly according to the value they generate. Whether your brokerage focuses on high-volume traders or long-term clients, this module makes it simple to adjust rewards and launch promotional campaigns. Detailed reporting ensures every commission is accurately calculated and automatically credited, cutting down on disputes and strengthening partner loyalty.

Centralized Dashboard with Full Visibility and Control

From initial referral to final payout, every action is visible in one centralized dashboard. The IB List, Commission Profile, and Tree List tabs provide real-time insight into partner performance, active clients, and commission history. This unified view streamlines daily management and ensures compliance with internal policies and financial regulations. By combining clarity with automation, the EAERA IB System empowers brokers to build transparent, efficient, and profitable IB networks that consistently drive business growth.

As the forex industry grows faster and more competitive, relying on spreadsheets or partially connected tools is no longer an option. An automated forex back-office solution doesn’t just save time—it strengthens compliance, prevents costly payout disputes, and creates a transparent, trustworthy partner ecosystem.

Ready to experience this efficiency yourself?

EAERA’s Back Office System is well-designed to handle every detail—so you can focus on growing your brokerage. Request a personalized demo today at eaera.com and see how EAERA can simplify operations, accelerate partner payouts, and set your business up for long-term success.