In the fast-evolving forex and trading landscape, selecting the best client management system is now a strategic choice that directly impacts performance, scalability, and customer satisfaction. With dozens of CRM options available, brokers frequently must decide whether to use a generic CRM platform or invest in specialized broker software.

These two might appear similar at first glance. Both support lead management, client communication, and workflow optimization. However, a typical CRM is not designed to handle the complexity of a brokerage’s requirements, which include trading integrations, regulatory compliance, partner programs, client funding, and risk monitoring.

Related articles:

- Top 10 Forex CRM Features Every FX Broker Needs to Succeed

- 5 Best Practices FX Brokers Must Know for Back Office Software

This article helps you determine which solution best suits your brokerage needs by breaking down the differences and comparing values.

What is Broker Software?

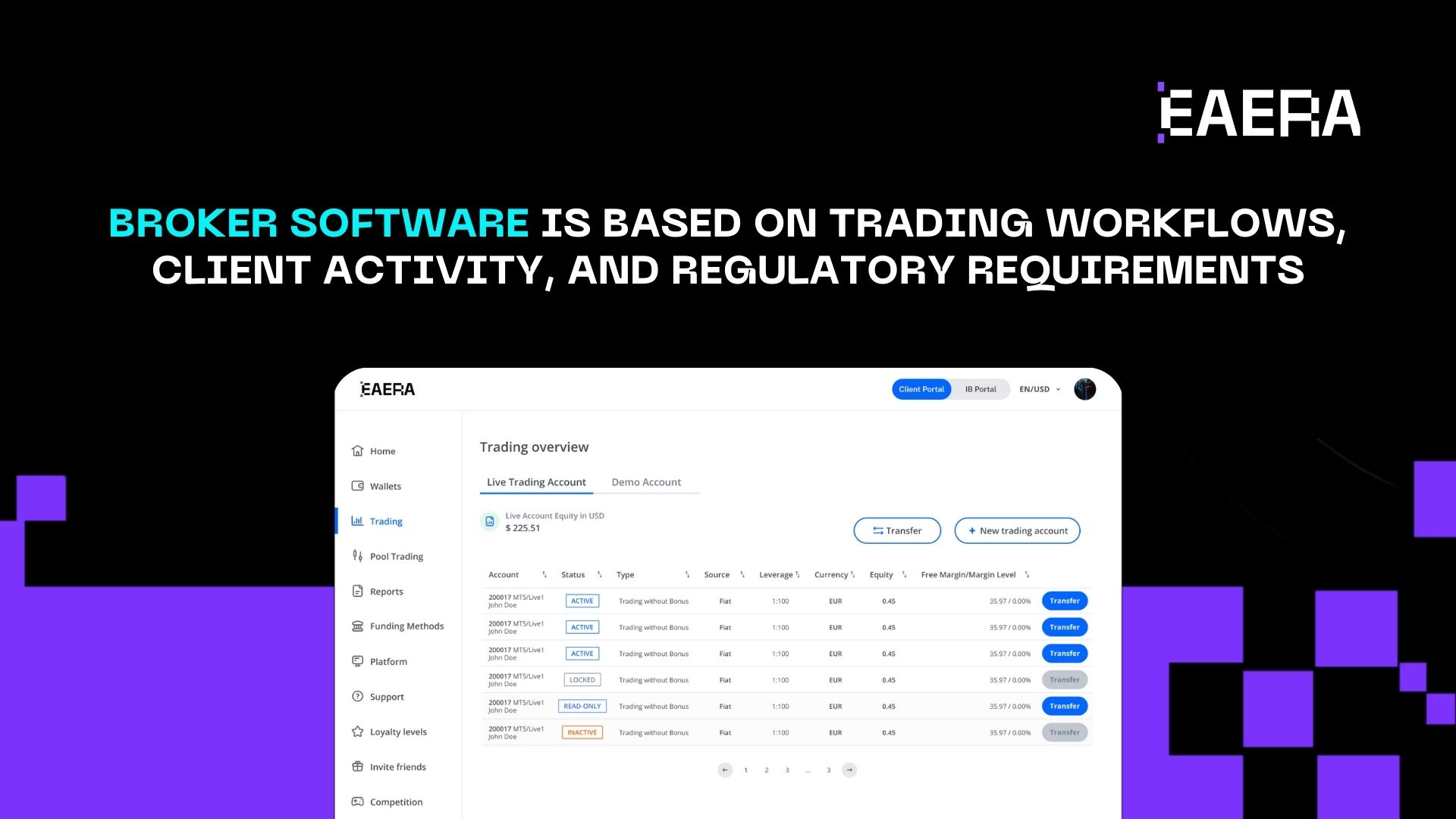

Broker software, also known as a trading CRM or broker CRM, is designed especially for multi-asset trading firms, prop trading firms, and forex brokers. Broker software is based on trading workflows, client activity, and regulatory requirements, in contrast to general CRMs.

Key competencies usually consist of:

Integrations with native trading platforms (MT4/MT5/cTrader)

Trading accounts, balances, equity, and activity can all be automatically synchronized in real time by brokers.

KYC/AML tools and client onboarding

Risk assessments, document uploads, compliance approval, and identity verification.

Portals for traders and clients

Give customers the ability to deposit money, request withdrawals, track trades, and monitor performance.

Affiliate and IB management systems

Comprises partner dashboards, commission tracking, rebates, and multi-tier structures.

Integrations for payments

Smooth funding, withdrawals, and deposits through PSPs and cryptocurrency gateways.

Automation of operations

Trading-based segmentation, auto account creation, lead routing, and status updates.

Specialized broker software serves as the brokerage’s operational foundation and is more than just a CRM.

What is Generic CRM?

Generic CRM such as HubSpot, Salesforce, Monday.com, Pipedrive, and Zoho are designed to support standard sales and marketing procedures in a variety of industries. Although they lack native trading features, they provide remarkable customization and automation.

Typical generic CRM attributes consist of:

- Contact and lead management

- Sales pipelines

- Email marketing automation

- Deal tracking and analytics

- Customer support ticketing

- Integration with marketing tools

- Custom workflows and dashboards

These platforms are effective for conventional B2B or B2C companies, but without substantial custom development, they are just not built for the intricacy of brokerage operations.

Head-to-Head Comparison: Which Delivers More Value?

Below is a detailed comparison of both systems using the key factors brokers care about most.

| Criteria | Broker Software | Generic CRM |

| Trading Functionality |

|

|

| Compliance & Security |

|

|

| Lead & Client Management |

|

|

| IB & Affiliate Management |

|

|

| Cost & Scalability |

|

|

| Ease of Implementation |

|

|

When Brokers Should Choose Broker Software?

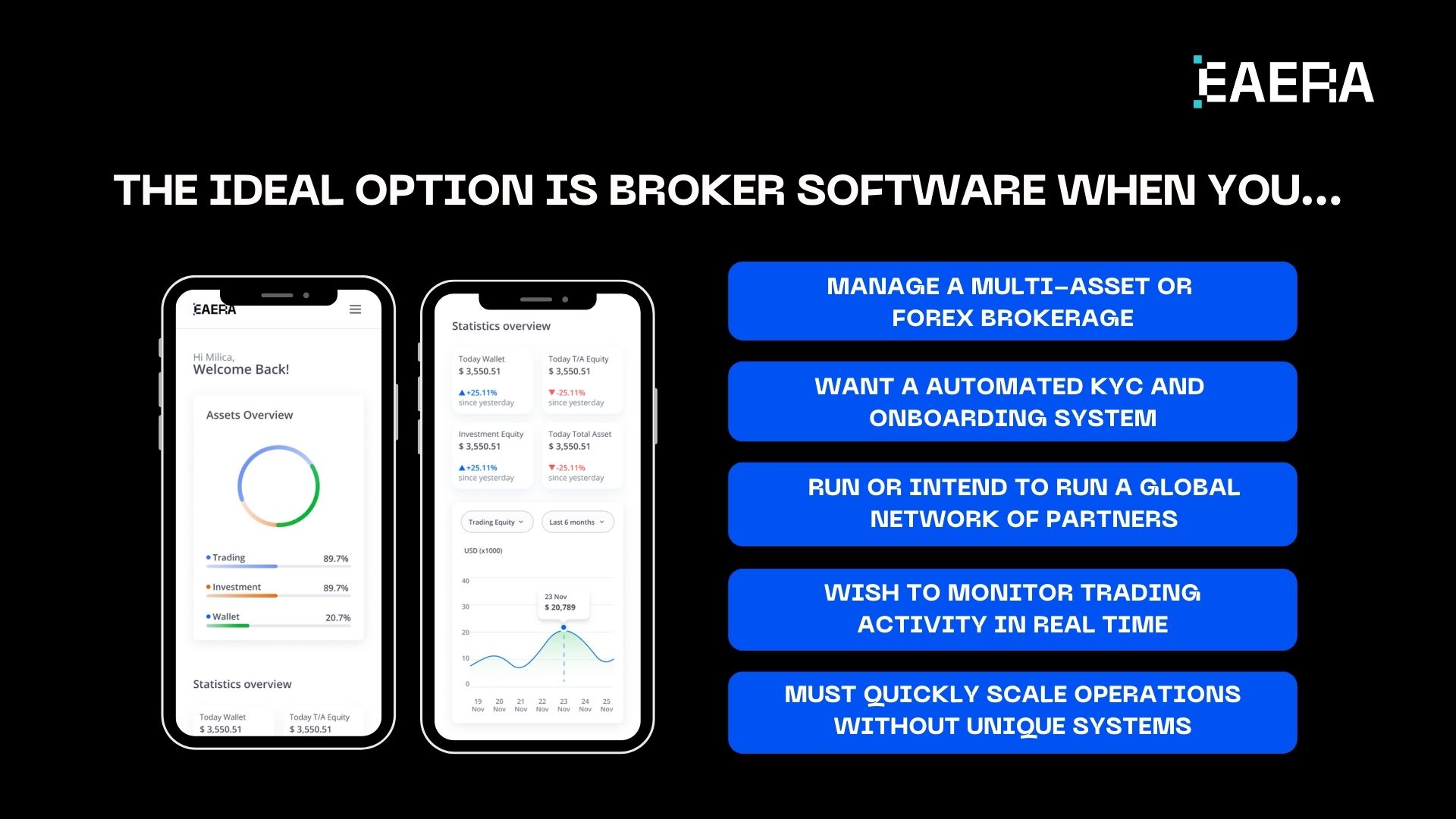

The ideal option is broker software when:

- You manage a multi-asset or forex brokerage that requires trading platform integration.

- You want a KYC and onboarding system that is completely automated.

- You run or intend to run a global network of partners.

- You wish to monitor trading activity in real time in your CRM

- You must quickly scale operations without creating unique systems.

Generic CRMs are just unable to compete in these situations.

When a Generic CRM Might Be Enough?

A general CRM might be appropriate if:

- You are a startup in its early stages with few operations.

- You only need a simple marketing automation system.

- You manually oversee a few traders.

- You would rather build your entire tech stack from scratch.

Generic CRMs are useful for simple tasks, but they soon become inadequate as brokerage expands.

One of the most crucial choices a brokerage can make is selecting the appropriate CRM. Although generic CRMs are powerful for all-purpose tools, they don’t have the native trading, compliance, and IB features needed for effective brokerage operations. Conversely, broker-specific software offers comprehensive support tailored to the particular requirements of the forex and trading sector.