One of the biggest changes to the brokerage sector in decades is currently taking place. Brokers are under pressure to update their infrastructure as financial markets grow faster, more digital, and more globally integrated. In this context, EAERA has become a key player in the development of next-generation broker tools, changing the way brokerages function, grow, and contend.

Related articles:

- Key Broker Back Office Software Risks to Avoid

- Why Working with a Best Forex CRM Agency Helps in 2026?

Conventional brokerage systems are no longer appropriate because they are frequently disjointed, manual, and reactive. Today’s brokers have to oversee thousands of traders in various regions, guarantee real-time risk visibility, adhere to stringent compliance regulations, and provide flawless user experiences.

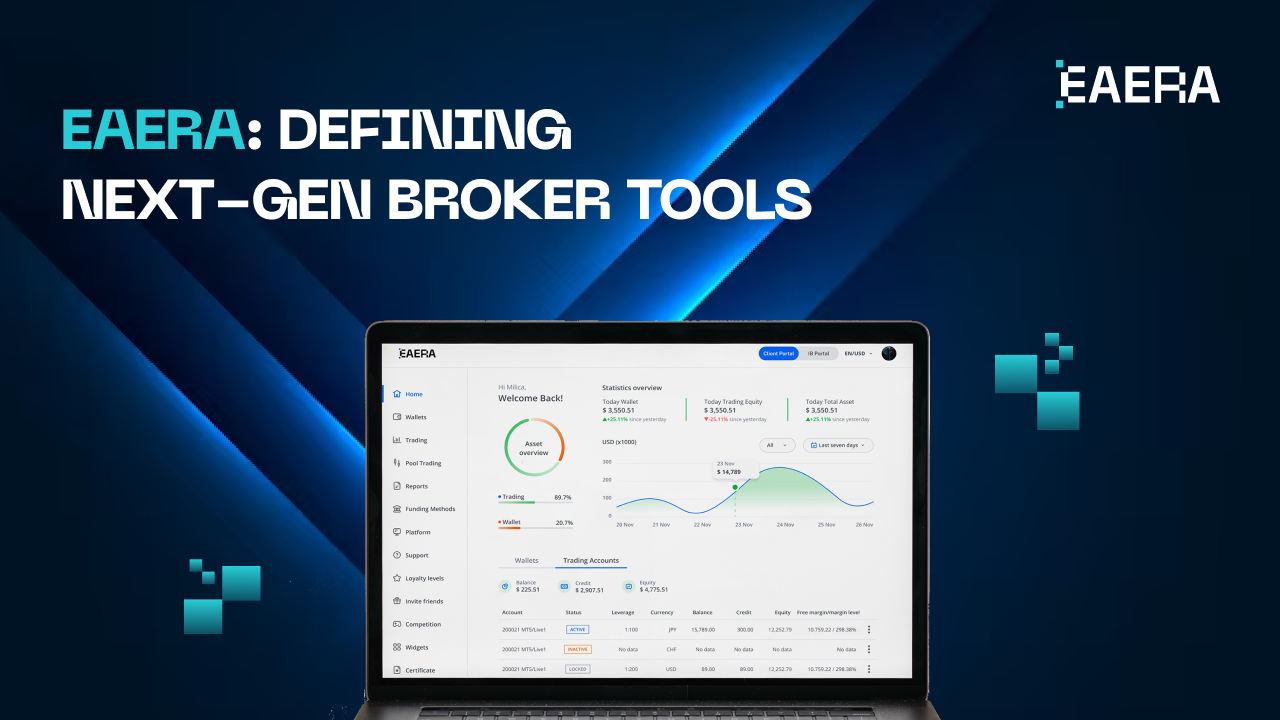

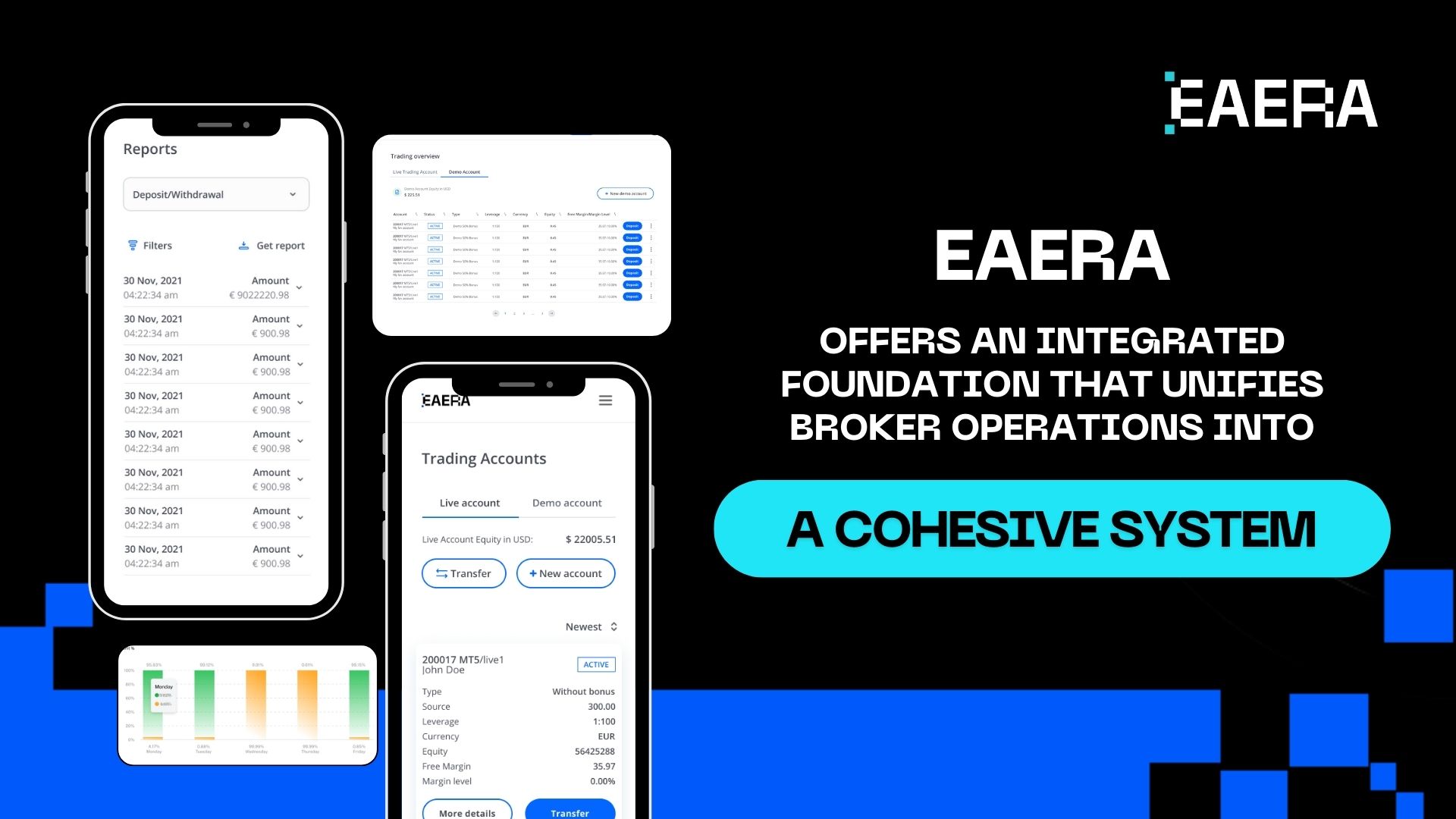

By offering a cohesive, intelligent technology ecosystem created especially for contemporary financial institutions, EAERA tackles these issues. EAERA defines next-generation broker tools, including its architectural philosophy, primary solutions, and long-term goals.

The Evolution of Brokerage Technology and EAERA’s Role

Brokerage operations have grown well beyond simple trade execution over the last ten years. Multi-asset trading, instant onboarding, automated compliance, partner management, and advanced analytics – often across multiple jurisdictions – are all requirements for modern brokers.

Many businesses continue to use disparate tools that have been pieced together over time: one system for trading platforms, another for CRM, and distinct tools for reporting, payments, and KYC. This fragmentation raises operational risk, slows down decision-making, and produces blind spots.

EAERA was built to address this structural issue. EAERA offers an integrated foundation that unifies broker operations into a single, cohesive system instead of introducing yet another tool. Its strategy mirrors a more general change in the sector: broker tools are now strategic infrastructure rather than utilities.

What EAERA Represents: Vision and Market Position?

Fundamentally, EAERA is an automated, data-driven, and scalable brokerage technology vision. Instead of concentrating on quick fixes, the company delivers infrastructure that promotes long-term growth.

Three guiding principles influence EAERA’s market positioning. Broker tools must first be operationally comprehensive, encompassing risk, trading, onboarding, compliance, and reporting within a single environment. Second, systems need to be adaptable enough to accommodate a variety of business models, including institutional players, prop firms, and retail FX brokers.

This philosophy is reflected across EAERA’s product ecosystem, which emphasizes modular design, real-time data synchronization, and deep integration with trading and fintech platforms.

The Architecture Behind Next-Gen Broker Tools

Next-generation broker tools are defined by their architecture rather than just their feature sets. Because EAERA is built on an API-driven, cloud-native foundation, brokerages can grow without having to rebuild their systems.

EAERA centralizes operational data – client profiles, trading activity, payments, and compliance records – into a single system in place of separate databases. By ensuring that all departments use the same real-time data, this architecture removes inconsistencies between operations, risk, and sales.

At the infrastructure level, security and compliance are integrated. Audit trails, encrypted data flows, and role-based access are essential elements rather than extras. This enables brokers to maintain speed and flexibility while operating with confidence in regulated environments.

EAERA helps brokers transition from reactive operations to proactive, insight-driven management by prioritizing architecture.

EAERA’s Core Solutions for Modern Brokers

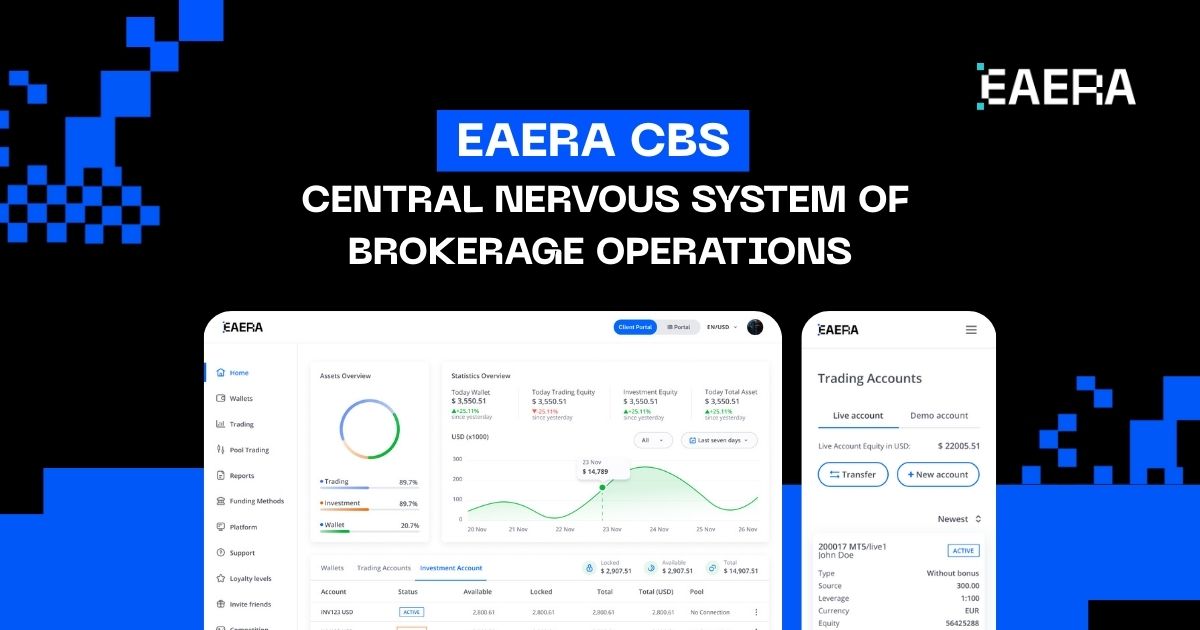

EAERA CBS: The Operational Backbone

The central nervous system of brokerage operations is the EAERA Core Brokerage System (CBS). It unifies trading platforms, client accounts, reporting, and compliance processes into a single operational center.

Brokers have a single view of accounts, balances, exposure, and performance instead of having to switch between tools. Maintaining operational control at scale, controlling risk, and reacting to market volatility all depend on this degree of visibility.

EAERA CBS replaces outdated back-office configurations with a system built for automation, speed, and transparency.

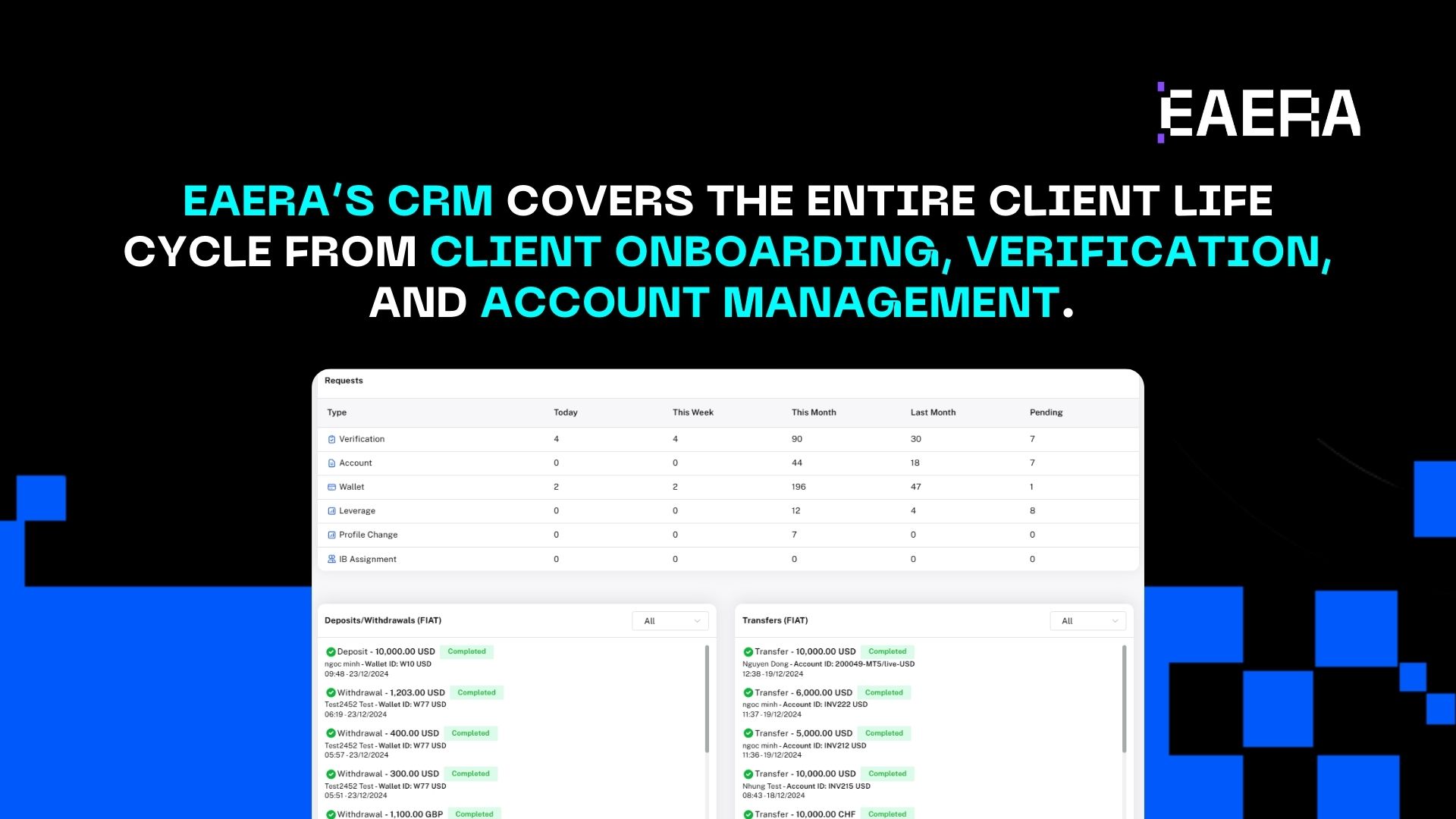

CRM and Back-Office Automation

The CRM offered by EAERA is much more than a contact management solution. The solution covers the entire client life cycle from client onboarding, verification, and account management.

Where manual tasks occupy staff members, such as checking documents and approving accounts, as well as calculating commissions, all this happens automatically. The system, therefore, eradicates mistakes, saves time, and leaves staff to carry out high-level tasks.

For brokers, this automation essentially means lower costs of operation as well as enhanced customer satisfaction.

Prop Trading, PAMM, and Institutional Tools

Brokers require systems that facilitate intricate evaluation rules, capital allocation, and performance transparency as prop trading and managed account models expand.

EAERA offers tools made especially for these models, allowing businesses to automatically enforce risk rules, monitor trader performance, and manage funded accounts. The broker’s service offerings are expanded by PAMM and MAM capabilities, which further support asset management and institutional use cases.

These tools allow brokers to diversify revenue streams without increasing operational complexity.

Social and Copy Trading Integrations

Trader engagement has become a competitive differentiator. Thanks to integrations with the most demanded social trading solutions, EAERA opens a copy trading opportunity to brokers, which can remain in full control over their business operations.

Performance data, relationships, and risk metrics are all harmonized through the EAERA environment, providing the much-needed transparency required for traders and the much-needed oversight by brokers, thus attempting to minimize the operational risks associated with these social models of trading.

AI-Driven Analytics and Automation

Artificial intelligence plays an increasingly important role in the EAERA ecosystem. AI-powered analytics help brokers identify patterns in trader behavior, segment clients more effectively, and anticipate operational risks.

Intelligent rule-driven automation makes workflows adapt dynamically. Whether it is the flagging of unusual trading behavior or optimizing onboarding flows, AI amplifies efficiency and decision-making.

Ecosystem Integrations and Strategic Partnerships

EAERA’s impact extends beyond its own platform through a growing ecosystem of integrations. By connecting with trading platforms, payment providers, KYC services, and analytics tools, EAERA reduces the need for custom development.

These integrations allow brokers to deploy new services quickly while maintaining data consistency and operational control. Instead of managing dozens of vendor relationships, brokers operate within a unified ecosystem orchestrated by EAERA.

This ecosystem approach is central to defining what next-gen broker tools should look like: connected, extensible, and cohesive.

Business Impact: What Brokers Gain from EAERA

EAERA’s true worth is determined by its results rather than its features. Brokers who use EAERA benefit from quicker onboarding, more precise reporting, and improved operational visibility.

When manual workflows are eliminated, operational efficiency increases. Instead of being reactive, risk management becomes proactive. The centralization and real-time updating of data speeds up decision-making.

The ability to scale is perhaps the most significant benefit of EAERA. Brokers don’t need to increase staffing or complexity in order to grow from hundreds to thousands of clients. In a market with fierce competition and worldwide growth prospects, this scalability is crucial.

The Future of Brokerage Technology with EAERA

Looking to the future, more change is on the horizon in broker tool functions. Greater automation and increased predictability using AI are coming, along with ever-more complex regulatory demands.

EAERA is poised to help bring about this evolution by continually advancing its capabilities while maintaining this unified architectural vision. The future version of the broker platform will increasingly resemble an intelligent operating system, and EAERA is in this regard on the right track.