In brokerage operations, efficiency is frequently misinterpreted as speed or cost savings. The capacity to maintain performance as complexity rises, more customers, more rules, more products, and more competition, is known as efficiency. As a result, the decision between broker CRM software and basic operational tools becomes more strategic than technical.

Related articles:

- What To Look For In Trading Software 2026?

- Unlock Your Brokerage Potential: Top Forex CRM Solutions Revealed!

Both strategies can assist brokerage operations, but over time, they yield essentially different results. The difference is most noticeable as the company expands rather than at the start.

Operational Design: Accidental Processes vs Intentional Systems

Typically, basic tools develop naturally. Lead tracking is done in a spreadsheet, client status is kept in a separate file, communication is handled via email, and documents are stored in shared folders. No overarching operational logic links the solutions, but each one resolves a local issue. There are processes, but they rely more on habit than structure and are informal.

This creates what can be called “accidental efficiency.” As a result, “accidental efficiency” is produced. Tasks are finished, but only if staff members with experience keep everything together, and volumes are kept under control. Because knowledge is dispersed among various tools and people, efficiency drastically declines when new employees join or responsibilities change.

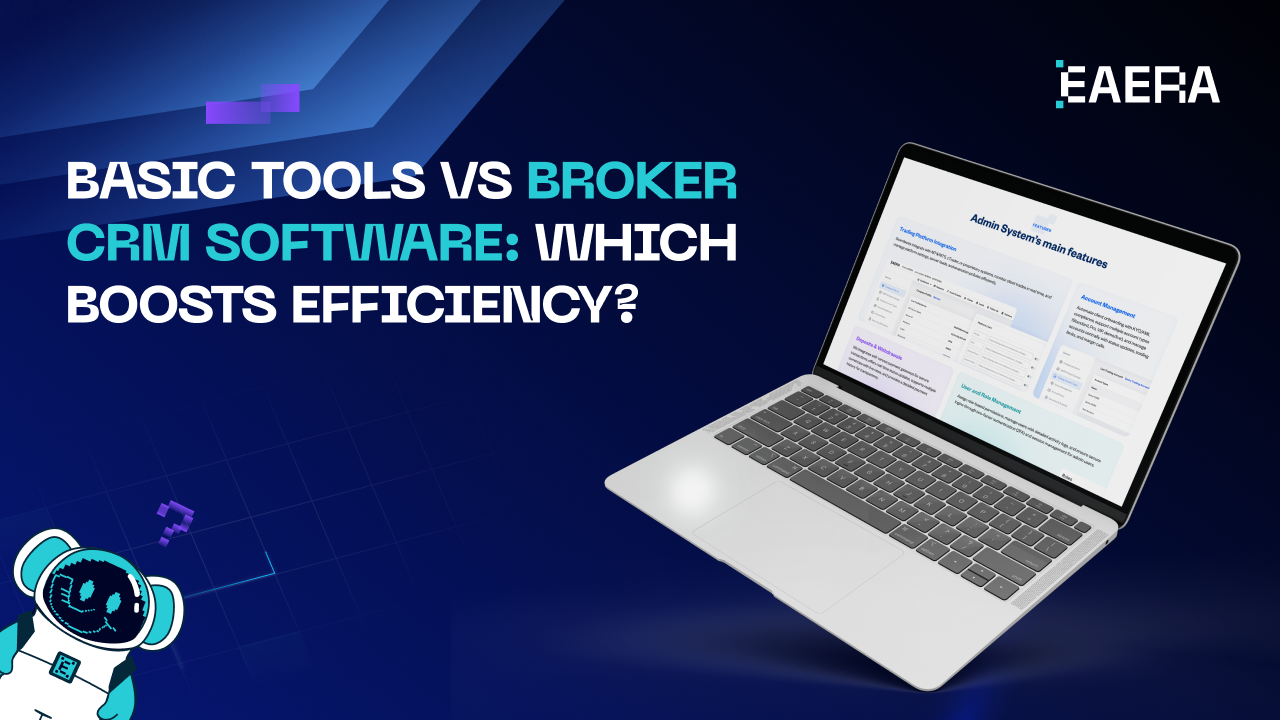

The system design of broker CRM software is deliberate. Lead assignment, onboarding, account management, retention, and reporting are all part of a defined workflow. Departments automatically exchange information because it is structurally connected.

In contrast, broker CRM software enables the system to support people, whereas basic tools require people to maintain the system. As operations develop, this distinction becomes more crucial.

Workflow Control: Manual Discipline vs Process Intelligence

Efficiency with simple tools depends on self-control. Managers must have faith that the information is up to date, support teams must manually update records, and sales teams must remember to follow up. Inconsistency is unavoidable, even with a robust internal culture.

Workflows that rely on humans add unpredictability. Unpredictable client experiences and uneven performance can result from two employees using the same tools, producing very different results. There is efficiency, but it is brittle.

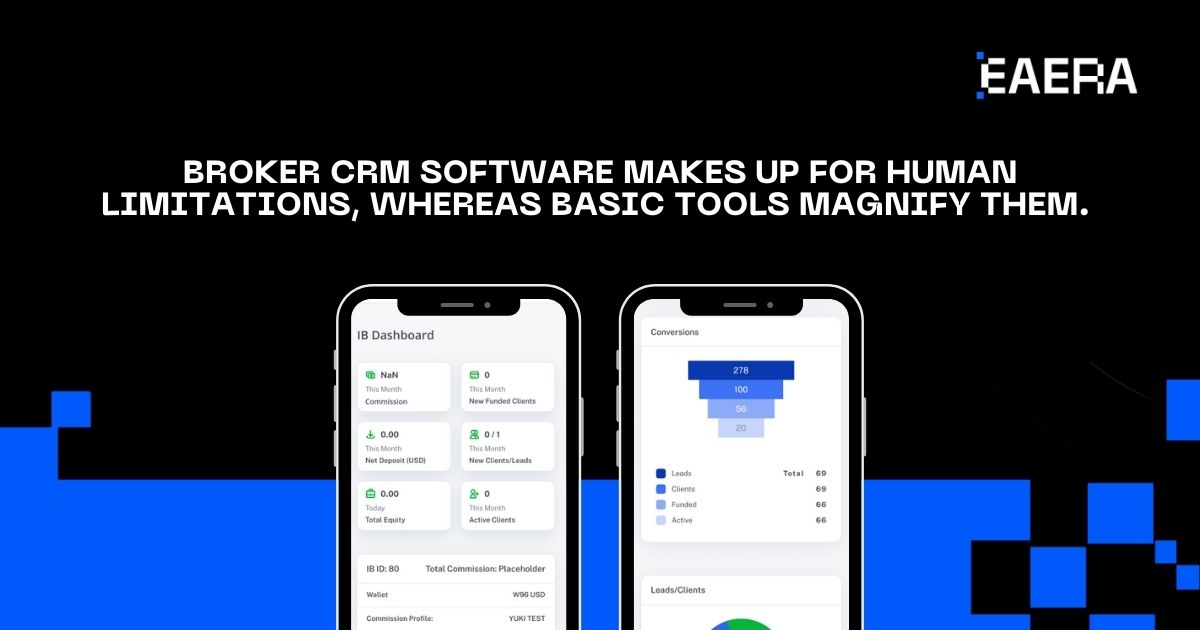

Process intelligence is introduced by broker CRM software. Regardless of individual behavior, automated workflows guarantee that crucial steps take place. Tasks are assigned according to rules; follow-ups are initiated by client’s actions, and alerts reveal problems before they become more serious.

This preserves human judgment rather than eradicating it. Broker CRM software frees teams to concentrate on higher-value tasks like relationship management and strategic problem-solving by eliminating repetitive coordination tasks.

Comparatively speaking, broker CRM software makes up for human limitations, whereas basic tools magnify them.

Data Usage: Information Storage vs Decision Infrastructure

Data is treated as static information by basic tools. The main purpose of client records is for reference, and insights must be manually extracted. Reporting is frequently done after problems or performance gaps have already happened.

Decision-making is therefore often reactive. Instead of influencing results beforehand, managers react to them.

Data is reframed as decision-making infrastructure by broker CRM software. Performance metrics, behavioral tracking, and real-time dashboards are all contextually linked and updated on a regular basis. Early pattern recognition allows for proactive adjustments.

Efficiency quality is directly impacted by this difference. Decisions based on incomplete or delayed data are riskier and take longer to make. Broker CRM software facilitates quicker, more assured decisions that are more in line with operational reality.

Broker CRM software can turn data from a reporting burden into a strategic asset that supports both short-term and long-term decisions, as platforms like EAERA show.

Compliance Integration: Operational Friction vs Built-In Assurance

One important efficiency factor that is frequently overlooked is compliance. Compliance tasks are typically kept apart from core workflows using simple tools. Approvals are tracked externally; documents are manually requested, and audits necessitate a thorough reconstruction of previous actions.

Friction results from this separation. When problems with compliance occur, teams slow down, and efficiency is compromised in order to manage risk in the past.

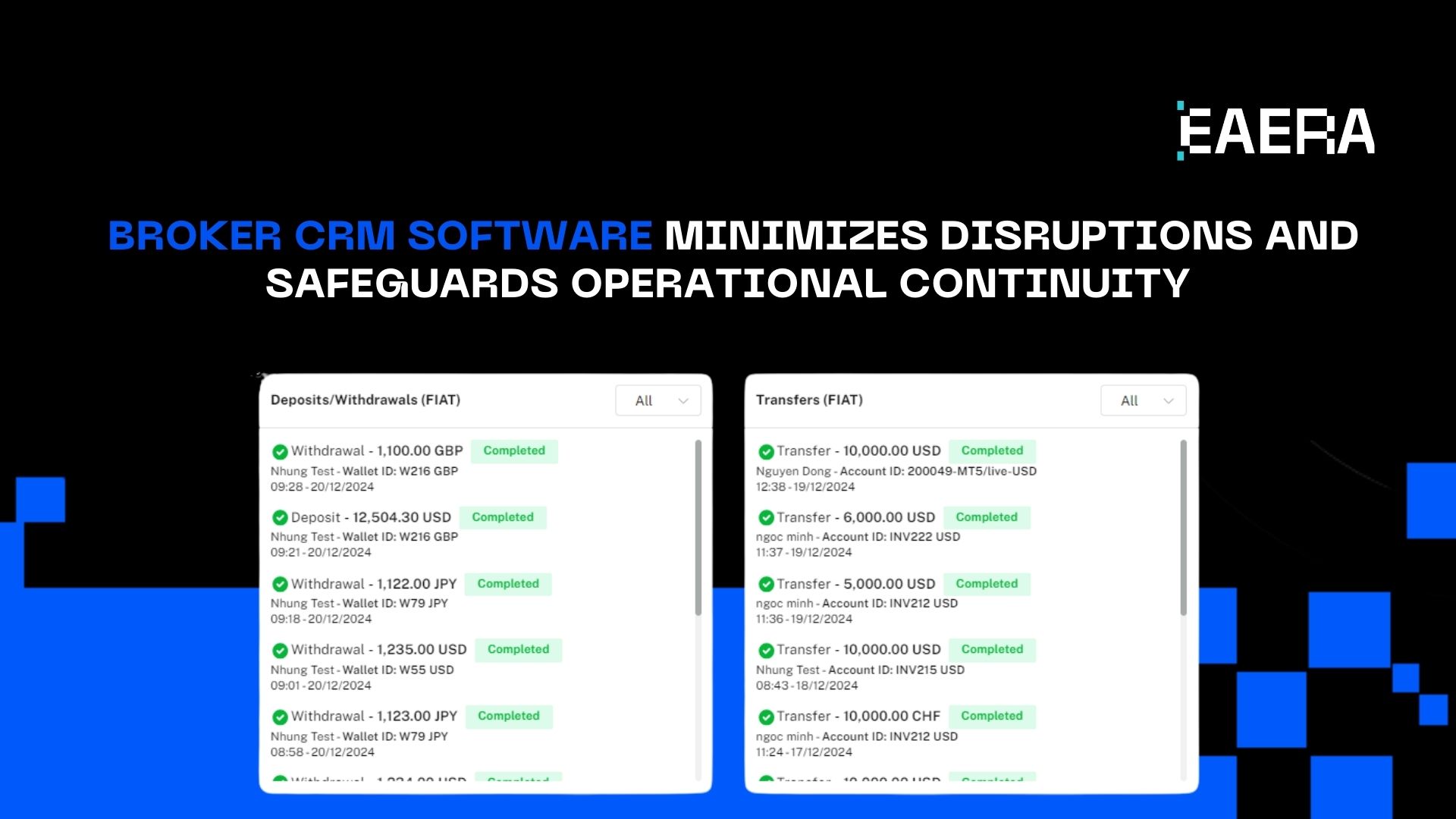

Compliance is directly integrated into operational flows by broker CRM software. The client lifecycle incorporates audit trails, document verification, and KYC checks. Compliance becomes proactive, observable, and traceable.

Here, the efficiency benefit is proactive. Broker CRM software minimizes disruptions and safeguards operational continuity by detecting problems early and standardizing compliance actions – something that simple tools find difficult to consistently accomplish.

Scalability and Organizational Stability

Because they were never intended to handle complexity, basic tools scale poorly. Coordination overhead rises with the number of clients. The increase in costs occurs because teams must offset this problem with more procedures and more manpower.

Efficiency will decline not as a result of poor implementation, but due to inefficiency inherent in the system that hinders expansion.

The broker CRM software is scalable. Processes can handle volume without affecting the process, and levels such as regions, partners, or products can be added without having to redefine processes.

Organizational stability is equally important. Knowledge is maintained in the system and not in the inboxes and files of the staff. The system is less dependent on key personnel. When transitions occur, it is more stable.

Vendors such as EAERA focus on the importance of consistency as one of the key advantages of the broker CRM software solution, especially in the case of brokerages that may wish to grow in the longer term rather than quickly.

Cost Efficiency: Immediate Savings vs Compounding Returns

Briefly, basic tools appear more affordable. Their low upfront costs make them attractive, especially for smaller firms. However, inefficiencies accumulate quietly: duplicated work, manual corrections, delayed onboarding, and missed engagement opportunities.

These hidden costs grow with scale and are rarely visible in simple budget comparisons.

Broker CRM software requires investment, but it consolidates effort across departments. Reduced error rates, faster workflows, improved retention, and better resource allocation create compounding efficiency gains over time.

When viewed holistically, broker CRM software often delivers lower total operational cost, even if initial expenses are higher.

Related articles: 5 Best Practices FX Brokers Must Know for Back Office Software

Experience as a Measure of Efficiency

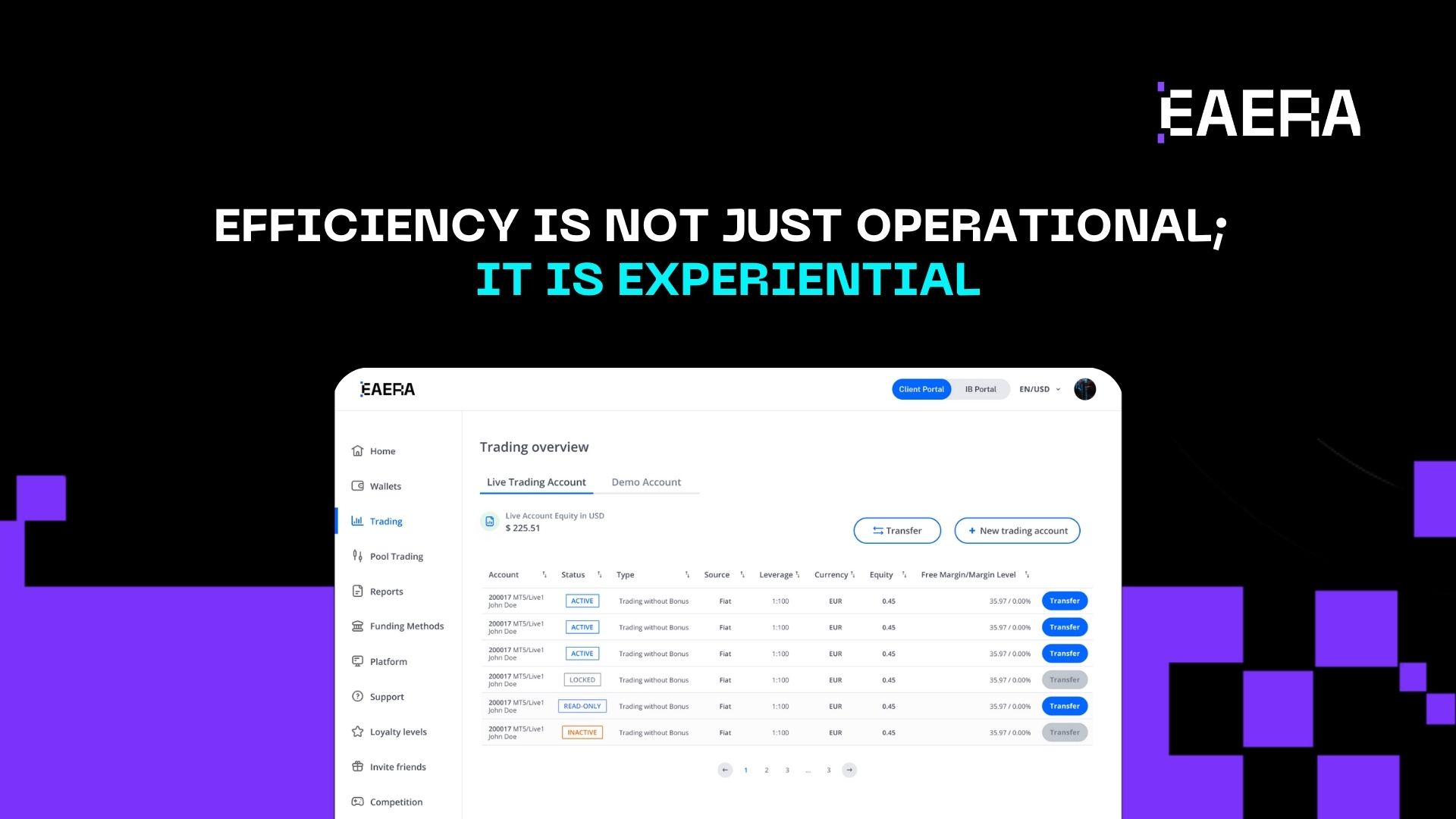

Efficiency is evident in experience, both internal and external. Clients dealing with teams using simple tools usually experience disjointed communication patterns. Teams, on the other hand, experience frustration in regard to unclear ownership, as information is scattered.

In the case of broker CRM systems, interactions are contextual and seamless. Also, a common perspective on each client is shared among various teams. The result is a smooth flow of communication.

In this sense, efficiency is not just operational; it is experiential.

Drawing a comparison between basic tools and broker CRM software helps highlight the differences in efficiency models. Tools can help manage a certain number of tasks or processes but are rendered less effective as the task involves increasing levels of complexity.

For future-oriented broking businesses, the CRM software for brokers is more than just a tool. It is the basis on which the efficiency of growth and competitiveness is determined.