In today’s fast-evolving digital economy, crypto lending has emerged as a powerful way to earn passive income by putting idle digital assets to work. As more traders and brokerages explore this opportunity, having the right tools is essential. EAERA offers a cutting-edge CRM solution that simplifies and enhances the crypto lending process. With EAERA, users can efficiently manage assets, reduce risk, and unlock new revenue streams—all from a single, integrated platform built for the future of finance.

Related articles:

What is Crypto Lending & How It Generates Passive Income?

Crypto lending allows clients to deposit digital assets like Bitcoin (BTC) or Ethereum (ETH) into a platform that lends them to vetted borrowers—individuals, traders, or institutions—who repay with interest in crypto. It’s a passive income strategy that retains asset ownership.

At EAERA, we’ve streamlined this process for forex brokers using our advanced Forex broker CRM. Clients can securely deposit assets, while our software handles lending logistics, interest tracking, and compliance.

This integration bridges crypto and forex markets, enhancing portfolios without relying on third-party platforms.

Why EAERA CRM’s Crypto Lending Feature Matters for Brokers?

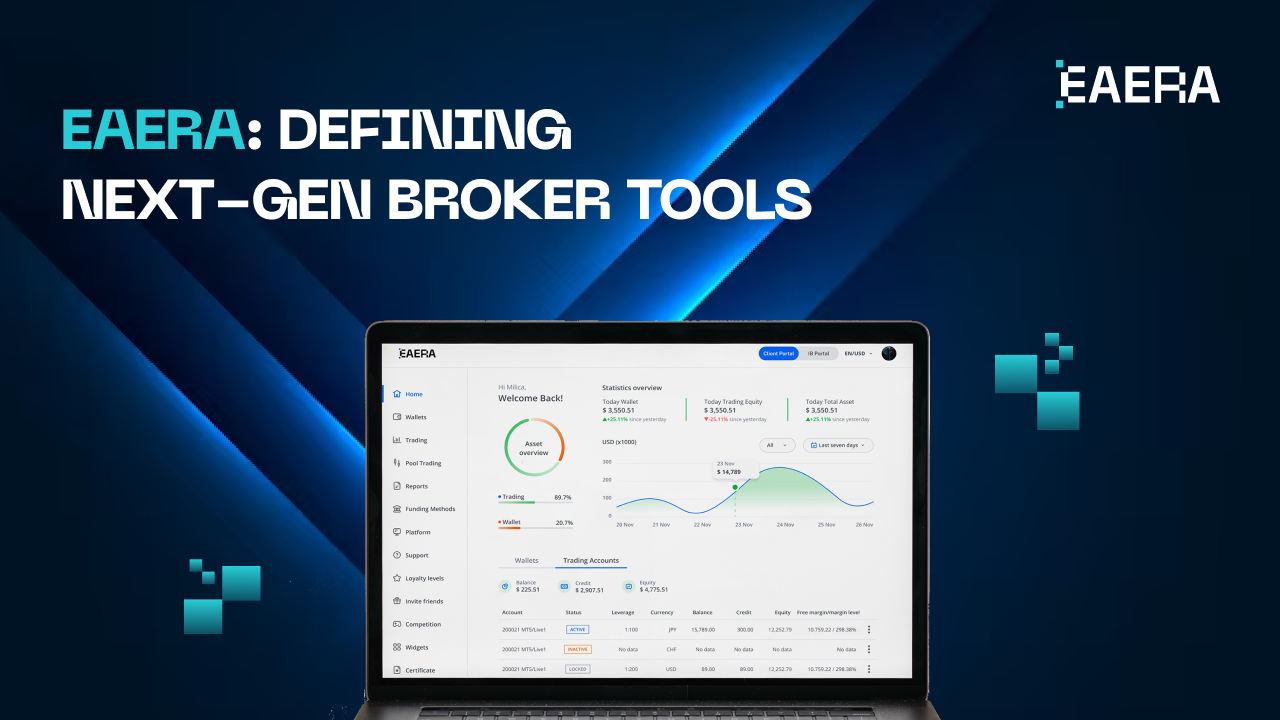

EAERA CRM, is a brokerage software solution for forex brokers, offering client management, risk analytics, and back-office automation. Our 2025 crypto lending feature takes this further, embedding a passive income stream into your operations. We’re not here to replace lending platforms—our goal is to enhance your ability to serve clients holistically with brokerage systems.

Why it’s a game-changer:

- Unified Operations: Manage forex trading and crypto lending within one brokerage CRM, streamlining your workflow and reducing complexity.

- Revenue Growth: Earn 1-2% commissions on client lending interest, seamlessly integrated into software for brokers, boosting profitability effortlessly.

- Client Appeal: Attract crypto-savvy investors and retain forex clients with diversified offerings through Forex broker CRM.

- Compliance Assurance: Our AML/KYC tools in brokerage systems ensure lending aligns with global standards, critical for your peace of mind.

- Scalability: Handle growing client bases and crypto volumes with ease, leveraging our scalable brokerage software.

This feature harnesses our forex expertise to create a synergy between trading and crypto income, giving your brokerage a distinct competitive advantage.

Step-by-Step: How to Use EAERA CRM for Crypto Lending

We’ve designed EAERA CRM to make crypto lending straightforward and efficient. Here’s how you and your clients can leverage it:

1. Setup and Integration:

- Activate the crypto lending module in EAERA CRM, connecting to our vetted lending partners or internal pools via brokerage systems.

- Customize settings—interest distribution, terms, and compliance protocols—using our back-office tools in software for brokers.

2. Client Onboarding:

- Clients register through our secure portal, completing KYC verification within brokerage CRM, a forex standard we uphold.

- Deposit crypto (e.g., BTC, USDT) into a wallet managed by Forex broker CRM, fully integrated into your platform.

3. Select Lending Options:

- Offer flexible terms or fixed terms via brokerage software.

- Provide real-time rates with transparent fees displayed in brokerage systems.

4. Lending Process:

- EAERA CRM facilitates lending, ensuring assets are over-collateralized through software for brokers.

- Interest accrues and is credited weekly or monthly, tailored to your preferences.

5. Monitoring and Withdrawals:

- Clients track earnings, collateral status, and loan health via our dashboard in Forex broker CRM.

- Withdraw or reinvest funds, with you managing analytics through brokerage CRM.

Our forex-grade interface and compliance focus simplify crypto lending, enhancing efficiency and client trust.

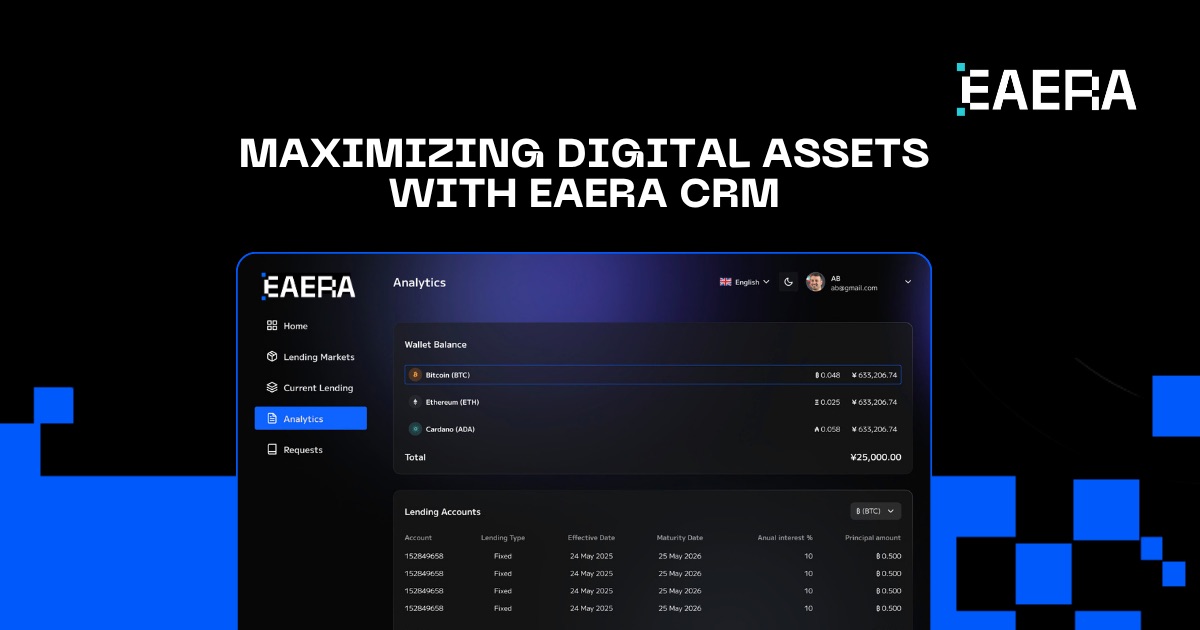

Maximize Passive Income from Digital Assets with EAERA CRM

EAERA CRM empowers you to optimize client returns with strategic tools:

- Diversify Portfolios: Lend volatile assets (BTC, ETH) for growth potential and stablecoins (USDT, USDC) for stability, guided by brokerage systems.

- Compound Earnings: Reinvest interest tracked seamlessly via software for brokers.

- Leverage Analytics: Use our real-time data in brokerage CRM to adjust lending options as market rates shift, maximizing yields.

- Provide Expert Guidance: Offer tailored advice through Forex broker CRM, strengthening client success and loyalty.

These capabilities transform crypto lending into a powerful asset management tool, supported by our comprehensive brokerage software.

Risk Management in Crypto Lending & EAERA’s Strategies

Crypto lending involves risks, but EAERA CRM’s robust design minimizes them:

- Market Volatility: Price drops can impact collateral value. Our brokerage systems monitor LTV ratios, alerting you to act if risks escalate.

- Counterparty Risk: We partner with audited, reputable platforms, reducing exposure through brokerage CRM.

- Borrower Default: High collateral (150%+ LTV) ensures coverage, enforced by software for brokers.

- Regulatory Uncertainty: Our AML/KYC compliance in Forex broker CRM aligns with global standards, featuring automated checks and reporting.

These safeguards, rooted in our forex risk management expertise, make EAERA CRM a secure and reliable solution for crypto lending.

The Future of Forex & Crypto with EAERA CRM

As crypto and forex markets converge in 2025, EAERA CRM keeps you ahead of the curve. Our software for brokers meets the rising demand for passive income, appealing to digital-savvy investors. By adopting this feature, you redefine your brokerage as a comprehensive financial hub, leveraging brokerage software to stay competitive.

With EAERA CRM, you enhance client experiences by offering transparency and control within Forex broker CRM. Clients diversify portfolios without leaving your platform, while you upsell lending to forex clients using brokerage CRM, deepening relationships and boosting retention. This integration streamlines operations and fosters trust, all powered by brokerage systems.

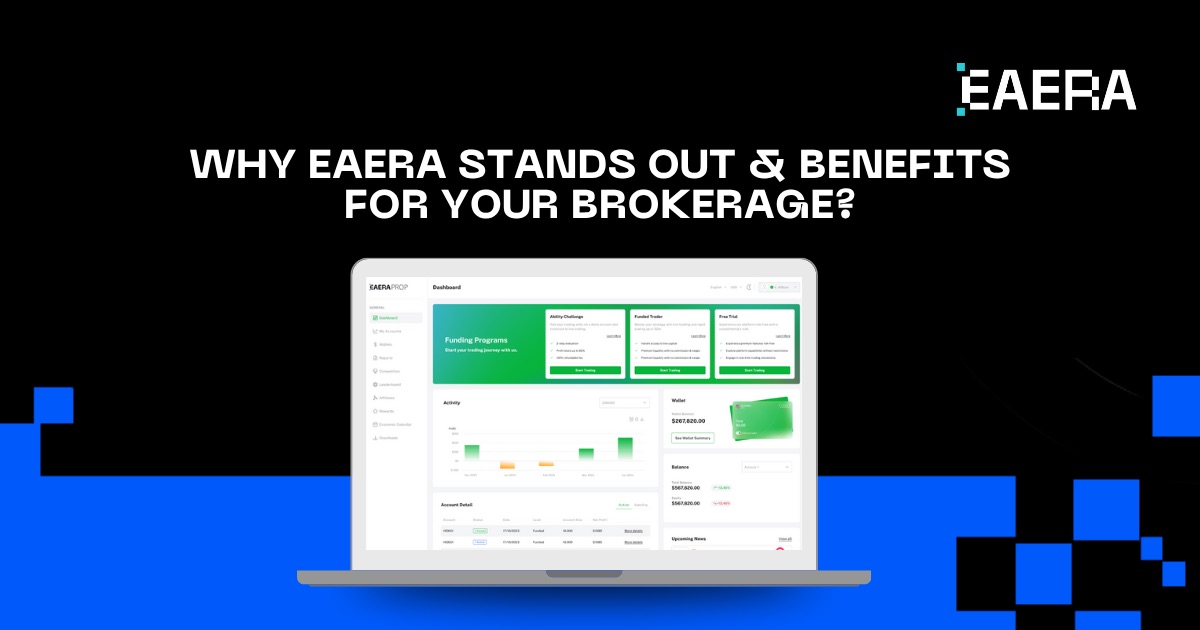

Why EAERA Stands Out: Key Benefits for Brokerages

At EAERA, we’re committed to empowering forex brokers with cutting-edge solutions. EAERA CRM, part of our EAERA CBS suite, isn’t just a tool – it’s your strategic partner. Our brokerage systems streamline complex processes, while our brokerage CRM drives client engagement. The crypto lending feature reflects our dedication to innovation, offering a secure, scalable, and profitable solution tailored to your needs.

Beyond revenue and client appeal, EAERA CRM enhances operational efficiency. Our Forex broker CRM provides actionable insights, enabling you to identify high-value clients and tailor offerings. The crypto lending feature also positions you as a thought leader, attracting partnerships and expanding your market presence—all supported by brokerage software.

EAERA CRM’s crypto lending feature transforms your brokerage into a dual-market leader, helping clients earn passive income and maximize digital assets while enhancing your profitability. Integrated into our brokerage software, brokerage systems, and Forex broker CRM, it simplifies operations, ensures compliance, and drives client satisfaction. As part of EAERA CBS—the operating system for financial institutions is your key to thriving in 2025. Explore our demo, survey your clients’ crypto interests, and train your team with our resources. Partner with us today to unlock your brokerage’s full potential.