The forex trading landscape continues to expand, creating new opportunities for startup forex brokers. But launching a brokerage in today’s fast-paced, regulated environment requires more than a license and funding—it requires the right technology. From the forex broker software to the forex CRM and scalable forex broker software for brokerage firms, startups must build a stack that enables scalability, automation, and compliance from day one.

Related article:

1. Understanding Startup Broker Needs

Startup forex brokers typically operate under tight budgets and high-pressure timelines. They need forex broker software that is cost-efficient, cloud-based, and scalable—solutions that support fast deployment while ensuring strong client experience and regulatory compliance. The right combination of CRM and forex broker software forms the operational core, enabling startups to launch quickly and compete with established industry players.

2. Essential Forex Broker Software Stack

2.1 Forex Trading Platform

A reliable trading terminal is non-negotiable when choosing the right forex broker software. Most startups opt for MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader due to their features, market reach, and seamless integrations. MT4 remains popular for its simplicity and large user base, while MT5 offers multi-asset capabilities. cTrader is gaining traction as part of modern forex broker software suites thanks to its clean interface and advanced analytics.

When selecting a forex broker software, it’s important to consider mobile compatibility, API support, and trader usability. The ability to customize the interface and support multi-asset trading helps newer brokers compete with more established players.

2.2 Forex Broker Software

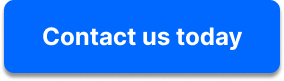

The CRM manages everything from onboarding to client retention. A good forex broker software should automate KYC/AML checks, support affiliate tracking, and centralize communication. The best forex broker software combined with CRM solutions for business also offer role-based dashboards, lead scoring, and campaign automation. A startup broker in Eastern Europe improved conversions by 42% within six months using such tools.

By integrating the forex broker software with other systems, such as marketing platforms and client portals, brokers can provide a seamless and data-rich experience for both clients and staff.

2.3 Risk & Back-Office Tools

Back-office tools help startups manage operations with fewer resources. Key features include margin alerts, automated payouts, compliance reporting, and trade monitoring. Having these tools integrated with your CRM and forex trading platform provides end-to-end operational visibility and simplifies management.

3. Key Features to Look for in a Forex Broker Software

When evaluating a forex broker software for brokerage firms, startups should prioritize the following features:

- Scalability: Can the platform handle increased trade volumes and clients as the business grows?

- Automation: Does it reduce manual tasks such as client onboarding, reporting, and support?

- Security: Does it meet modern encryption standards and offer access controls?

- Modular Integration: Can the forex broker software connect seamlessly with payment processors, liquidity providers, and marketing tools?

- Customizability: Does the solution allow for branded interfaces and client segmentation?

These capabilities are essential to ensure both short-term efficiency and long-term business expansion.

4. Integrated Systems and Ecosystem Connectivity

For startup forex brokers, disconnected systems create inefficiencies and risk. An integrated ecosystem powered by reliable forex broker software reduces manual tasks, prevents errors, and keeps data consistent across operations.

Effective forex broker software acts as a central hub, connecting with trading platforms, CRMs, payment gateways, KYC/AML tools, and marketing systems. For example, when integrated properly, sales teams get instant lead updates, compliance receives real-time document alerts, and traders receive automated welcome emails—all without manual effort.

This level of automation is only possible with well-connected forex broker software, giving startups the agility to grow and comply at scale. With the right forex broker software, your entire brokerage ecosystem becomes smarter, faster, and more efficient.

5. Scalability and Security Considerations

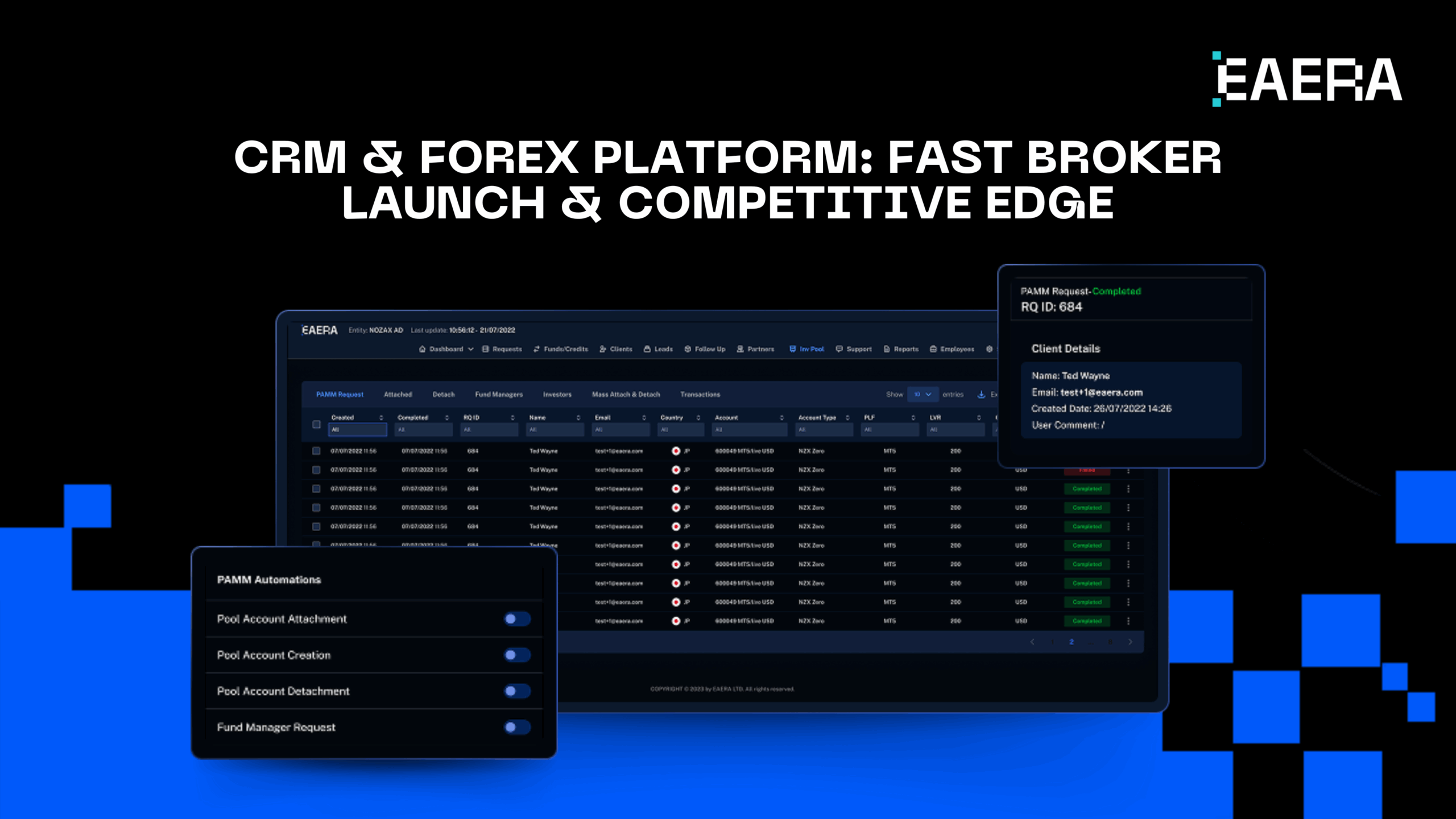

Scalability goes beyond handling more clients—it’s about adapting to new markets, evolving needs, and increasing regulatory demands. Forex broker software must support high user concurrency, real-time data syncing, flexible user roles, and a dynamic system architecture. Startups should choose forex broker software built on cloud-native infrastructure, enabling them to scale resources instantly without adding hardware or reconfiguring systems. The right forex broker software ensures long-term growth without sacrificing performance or compliance.

Security is a top concern for any modern forex broker software. Vendors that offer automatic updates, security patches, and 24/7 monitoring help reduce risk for growing brokers. Additionally, having built-in disaster recovery, backup, and system redundancy ensures business continuity in the face of technical failures or cyber threats.

6. White-Label Solutions for Speed-to-Market

Time-to-market can define a startup’s success or failure in the forex space. White-label brokerage solutions like a forex broker software have become a go-to approach for entrepreneurs who want to launch quickly without building proprietary technology. These turnkey packages typically include branded trading terminals, a fully functional forex broker software, client portals, KYC integrations, and payment systems.

Startups benefit from the ability to test and validate their business models rapidly, often going live within 4–6 weeks. With minimal technical resources required, white-label forex broker software reduces upfront development costs and simplifies operations. This allows brokers to focus on client acquisition and business growth rather than technical development.

High-quality forex broker software packages come bundled with tools like CRM systems, compliance modules, and trading analytics, making them a comprehensive solution. The integration of CRM with forex broker software also supports better customer management and retention strategies.

Choosing the right white-label provider ensures you receive ongoing updates, localization support, and scalable infrastructure. As your business grows, your forex broker software should grow with it—keeping your brokerage agile and competitive in a dynamic market.

7. How to Choose the Best Forex Solution Partners in 2025

In a fast-changing market, the right technology partner is as important as the forex broker software itself. Here’s how to evaluate a vendor:

- Track Record: Look for companies with proven success working with startups.

- Support Quality: 24/7 multilingual support and onboarding assistance are essential.

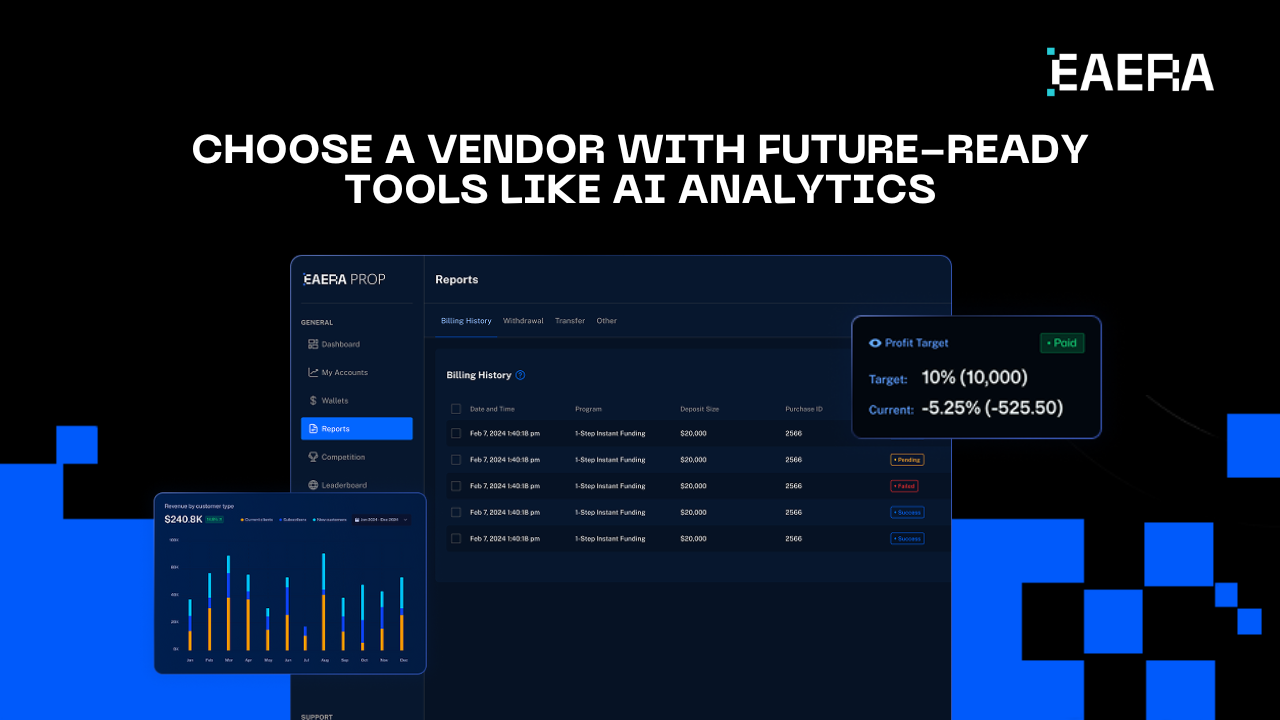

- Product Roadmap: Choose a vendor with future-facing features like AI-driven analytics or blockchain-ready modules.

- Integration Capabilities: Ask about APIs, plug-in availability, and partner ecosystems.

- Transparency & SLAs: Make sure service level agreements cover uptime, updates, and issue resolution.

These criteria ensure your forex broker software has a long-term technology partner that supports innovation and global growth.

8. Case Study: Building a Successful Tech Stack

A 2023-launched startup in Southeast Asia used cTrader with a modern forex broker software to create a lean, agile system. The software automated document collection, segmented traders, and tracked affiliate traffic. Integrated analytics helped the firm improve client retention by 30% and expand across three markets without increasing tech headcount.

Their choice to use an integrated forex trading platform and robust forex broker software for brokerage firms allowed them to streamline processes and outperform competitors within their first year.

Conclusion: How EAERA Empowers Startup Forex Brokers

EAERA delivers turnkey forex broker software for brokerage firms, tailored to help startups succeed. Our platform integrates a powerful forex broker software, top-tier forex broker software support, risk management, onboarding automation, and compliance tools in one scalable solution.

Whether you’re launching your first forex broker software brand or looking to modernize outdated infrastructure, EAERA provides the best forex broker softwares for business—equipping you with tools to operate smoothly, engage clients, and grow fast. Contact us today to see how EAERA can power your brokerage’s future.