The Forex market continues to evolve, shaped by global economic shifts, technological advancements, and changing trader behavior. As we approach 2025, understanding FX market trends becomes crucial for traders, brokers, and stakeholders.

Related articles:

This article provides a comprehensive overview of the key trends and predictions for the Forex market in 2025, with actionable insights for businesses and traders alike.

Additionally, we’ll explore how adopting advanced tools like Forex CRM software can help businesses stay agile and competitive in this dynamic environment.

1. Key FX Market Trends for 2025

1.1 Increased Volatility Amid Global Events

- Geopolitical tensions and diverging monetary policies are expected to heighten currency volatility.

- Brokers using Forex CRM platforms can better track client risk levels and communicate real-time alerts, improving transparency and risk management.

1.2 Rise of Emerging Market Currencies

- Countries like India, Brazil, and South Africa are expected to draw more Forex activity due to strong economic reforms.

- Brokers with Forex CRM tools tailored for these markets can segment leads effectively and launch targeted campaigns.

Institutions increasingly favor emerging market currencies for growth and diversification.

1.3 Greater Role of Technology in Forex Trading

- AI and blockchain will continue to transform Forex trading

- Brokers using Forex CRM software will gain a competitive edge by automating onboarding, analyzing trader behavior, and increasing client engagement.

1.4 Regulatory Developments

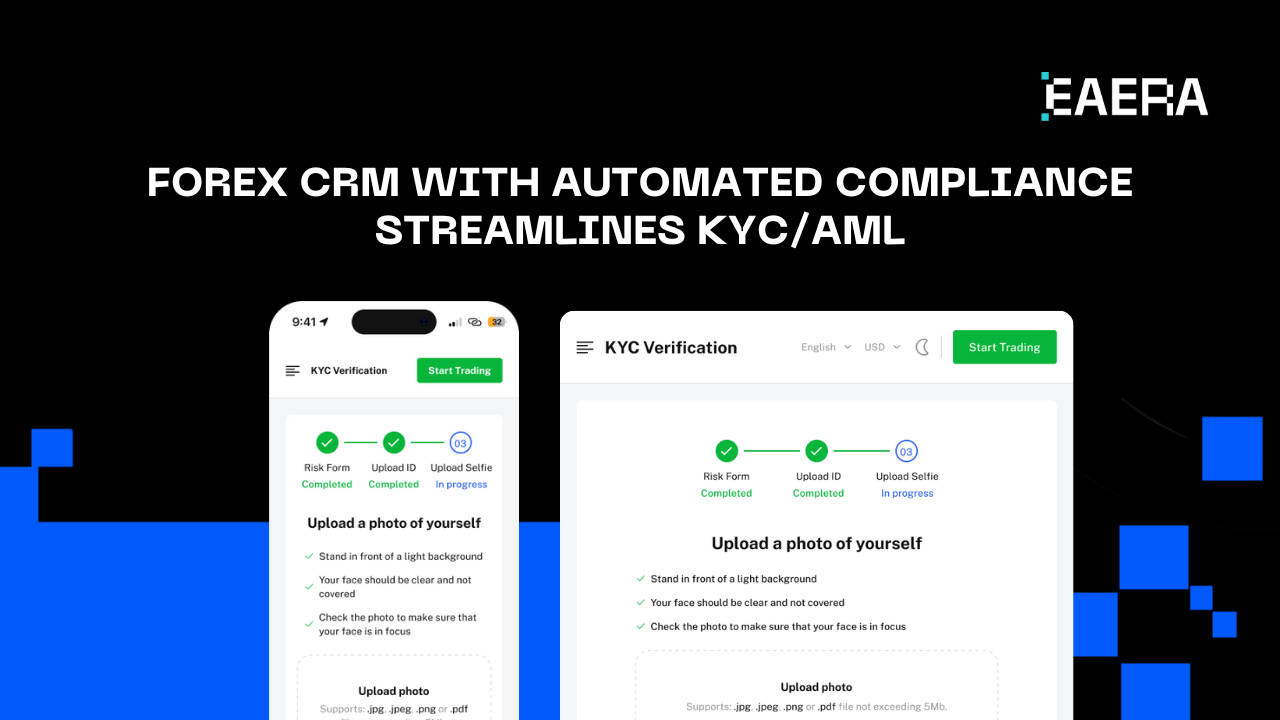

- Stricter global regulations will require automation and transparency.

- Business Forex CRM solutions with built-in compliance features will streamline KYC, AML, and reporting for brokers operating in multi-jurisdictional setups.

2. Predictions for the Forex Market in 2025

2.1 Forex CRM Trading Volume Growth

The Forex market’s daily trading volume is projected to exceed $8 trillion by 2025, driven by:

- Increased accessibility through mobile trading platforms

- Greater participation from retail investors, especially in emerging economies

- Growing adoption of Forex CRM software by brokers to support seamless client management and onboarding processes

2.2 Popularization of Multi-Asset Trading

Traders are increasingly demanding multi-asset platforms that allow simultaneous trading of Forex, stocks, cryptocurrencies, and commodities.

Brokers offering such platforms with built-in FX market trend analysis tools and integrated Forex CRM capabilities will gain a significant edge in client acquisition.

2.3 Emphasis on ESG and Sustainable Investing

ESG factors are set to impact currency valuations as investors increasingly consider sustainability metrics.

Economies leading in green energy transitions, such as the EU, will likely see their currencies gain favor among traders.

Forex CRM analytics can help brokers identify sustainability-focused investors and align their offerings accordingly.

2.4 DeFi’s Impact and the Role of Blockchain-Enabled Forex CRM

The integration of DeFi in Forex trading will open opportunities for decentralized liquidity pools, reducing reliance on traditional banking systems.

Forex CRM systems equipped with blockchain features will support innovation, secure transactions, and efficient client tracking for brokers entering the DeFi space.

3. Technology and Automation in the Forex Market: The Power of Forex CRM

3.1 The Role of Forex CRM Software

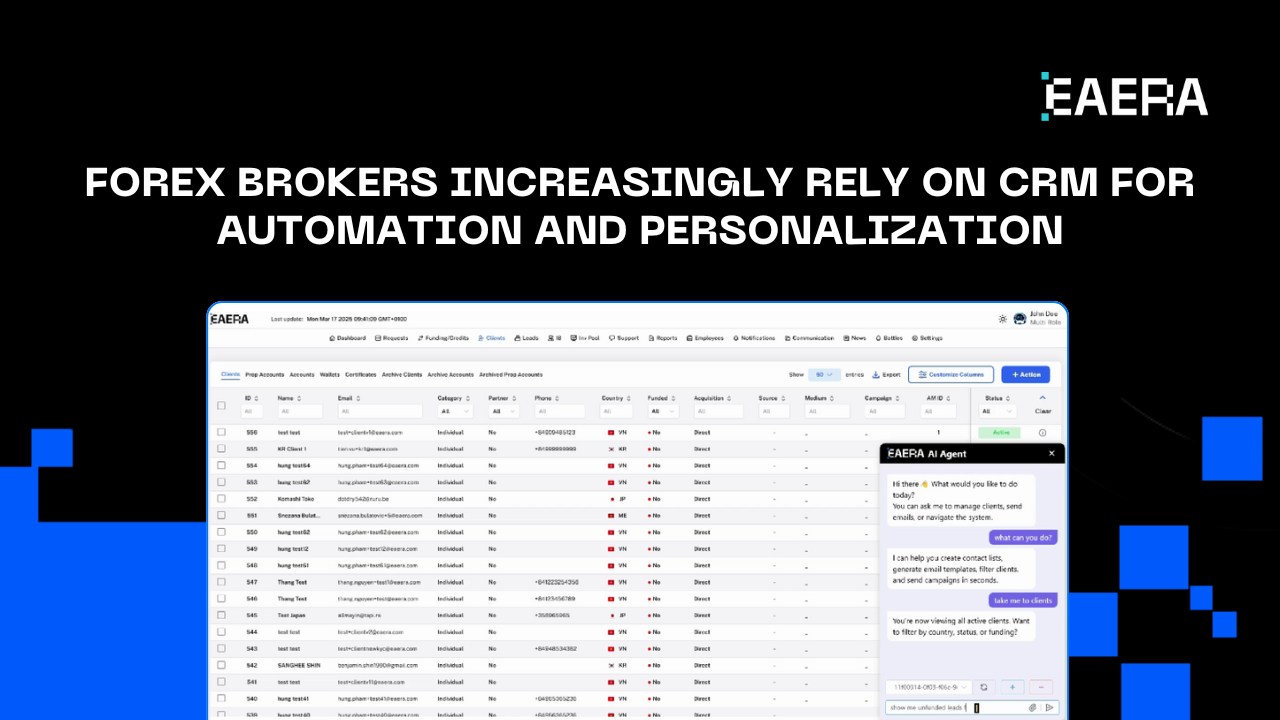

- Brokers will increasingly depend on Forex CRM solutions to streamline operations and improve service delivery.

- These systems automate workflows such as lead management, onboarding, and ongoing communication.

- By leveraging Forex CRM software, brokers can access predictive analytics for smarter segmentation and client targeting.

- Personalized data insights from a robust Forex CRM help enhance customer retention and satisfaction.

Forex brokers will increasingly rely on CRM for automation, segmentation, and personalized experiences

3.2 AI-Driven Trading Tools

- AI-powered tools will continue to evolve, analyzing historical and real-time data for precise trading decisions.

- Brokers that integrate AI within their Forex CRM will enable traders to automate strategies and minimize errors efficiently.

3.3 Blockchain and Smart Contracts

- Blockchain technology will drive faster, more transparent settlements in Forex trading.

- Smart contracts can help automate profit-sharing and other Forex trading agreements.

- Brokers using blockchain-enabled Forex CRM software will be better positioned to manage compliance and operational risks seamlessly.

4. Adapting to the Changing FX Market

4.1 Key Strategies for Brokers in 2025

To remain competitive in 2025, brokers must embrace innovation and strategic expansion.

- Invest in Forex CRM Technology: Adopting AI-powered tools and Forex CRM solutions will be essential for automating workflows, improving operational efficiency, and enhancing client experiences.

- Expand Market Reach: Leveraging data from your Forex CRM can help identify and target high-growth regions such as Southeast Asia and Africa with precision.

- Enhance Customer Experience: Personalization is key. Using insights from your Forex CRM software, brokers can deliver more relevant communication, tailored support, and smarter segmentation.

4.2 Best Practices for Traders

Modern traders must also adapt to the evolving FX landscape:

- Stay informed on market trends using platforms enhanced by Forex CRM tools that provide real-time insights and alerts.

- Diversify across asset classes to manage risk.

- Utilize strategy-enhancing features such as automated alerts, risk calculators, and trading dashboards integrated with CRM-powered platforms.

5. Top Challenges for the Forex Market in 2025

5.1 Cybersecurity Risks

- As brokers increasingly rely on digital platforms and cloud-based tools, the risk of cyberattacks grows.

- Protecting sensitive trader data will require multi-layered defenses and integration with secure Forex CRM systems.

- A well-implemented Forex CRM can help monitor user activity and flag potential security issues before they escalate.

5.2 Navigating Regulatory Complexity

- Regulatory compliance across jurisdictions continues to challenge brokers, especially with tightening rules on leverage and transparency.

- Business Forex CRM solutions with automated compliance tracking can reduce the burden by streamlining KYC, AML, and reporting processes.

- Advanced Forex CRM software also ensures brokers can maintain accurate records, perform due diligence, and meet audits efficiently.

Forex CRM with automated compliance streamlines KYC/AML, easing broker burden.”

5.3 Differentiating in a Crowded Market

With more brokers entering the industry, delivering unique value is essential.

Offering platforms integrated with Forex CRM tools gives brokers a competitive edge by combining trading, analytics, and customer engagement features into a unified system.

5.4 Addressing Changing Trader Preferences

New generations of traders expect fast, intuitive, mobile-friendly platforms. Forex CRM systems that support real-time data access, customizable interfaces, and personalized dashboards will be crucial to meeting these evolving expectations.

6. How EAERA’s Forex CRM Solutions Empower Brokers in 2025

As the Forex market evolves, brokers need smarter tools to stay competitive. EAERA delivers industry-leading Forex CRM solutions designed to streamline operations, enhance compliance, and support growth in 2025’s dynamic FX landscape.

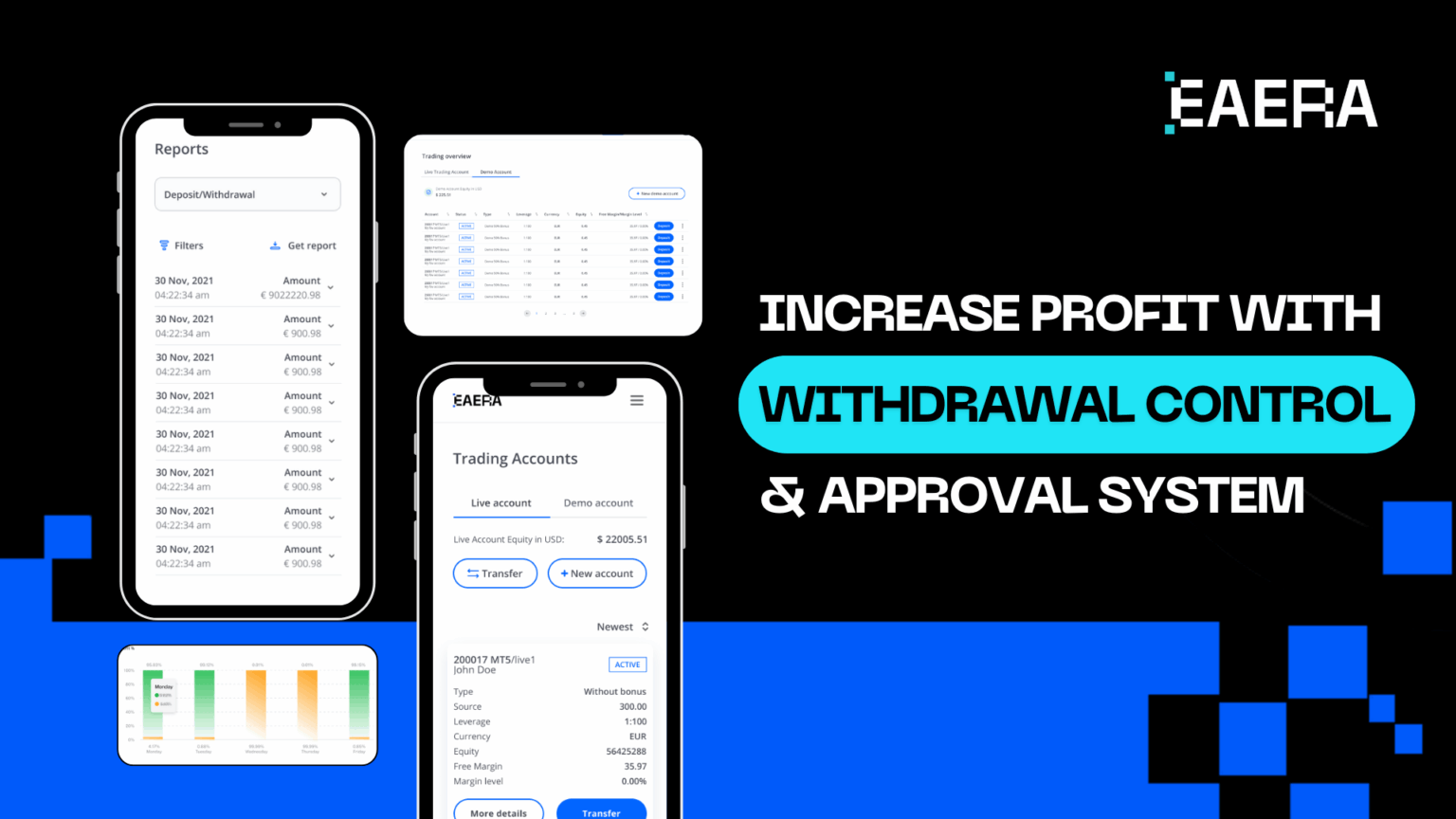

EAERA’s Forex CRM platform enables brokers to manage leads, clients, and campaigns in one centralized system. It simplifies onboarding, improves communication, and delivers insights through advanced data analytics.

EAERA specializes in helping brokers thrive in the modern FX environment with our powerful Forex CRM software. Our platform includes:

- Seamless integration with trading platforms to provide a unified experience.

- Advanced analytics for customer segmentation, trader behavior analysis, and actionable insights.

- Built-in compliance features for streamlined regulatory adherence and risk management.

With EAERA, you can confidently navigate the challenges of the FX market trends and unlock new growth opportunities. Contact us today to explore how we can empower your Forex business for success in 2025.

The year 2025 will be transformative for the Forex industry, shaped by rapid technological innovation, shifting trader expectations, and tighter regulatory frameworks. Brokers and traders who embrace modern tools—especially advanced Forex CRM software—will gain a critical edge in efficiency, compliance, and client engagement. Stay ahead of the curve by making Forex CRM a core part of your business strategy today.