One of the FX industry’s most valuable and delicate assets is client trust. The trustworthiness of the day-to-day experience is a major factor in traders’ decisions about whether to stay, trade more, or recommend a broker. In this situation, the FX trading platform serves as the main interface for the development, testing, and reinforcement of trust rather than merely being an execution tool.

Related articles:

- Forex CRM: How to Choose the Best Provider for Your Brokerage

- Smart Prop Trading Tactics for Cleaner Risk Management

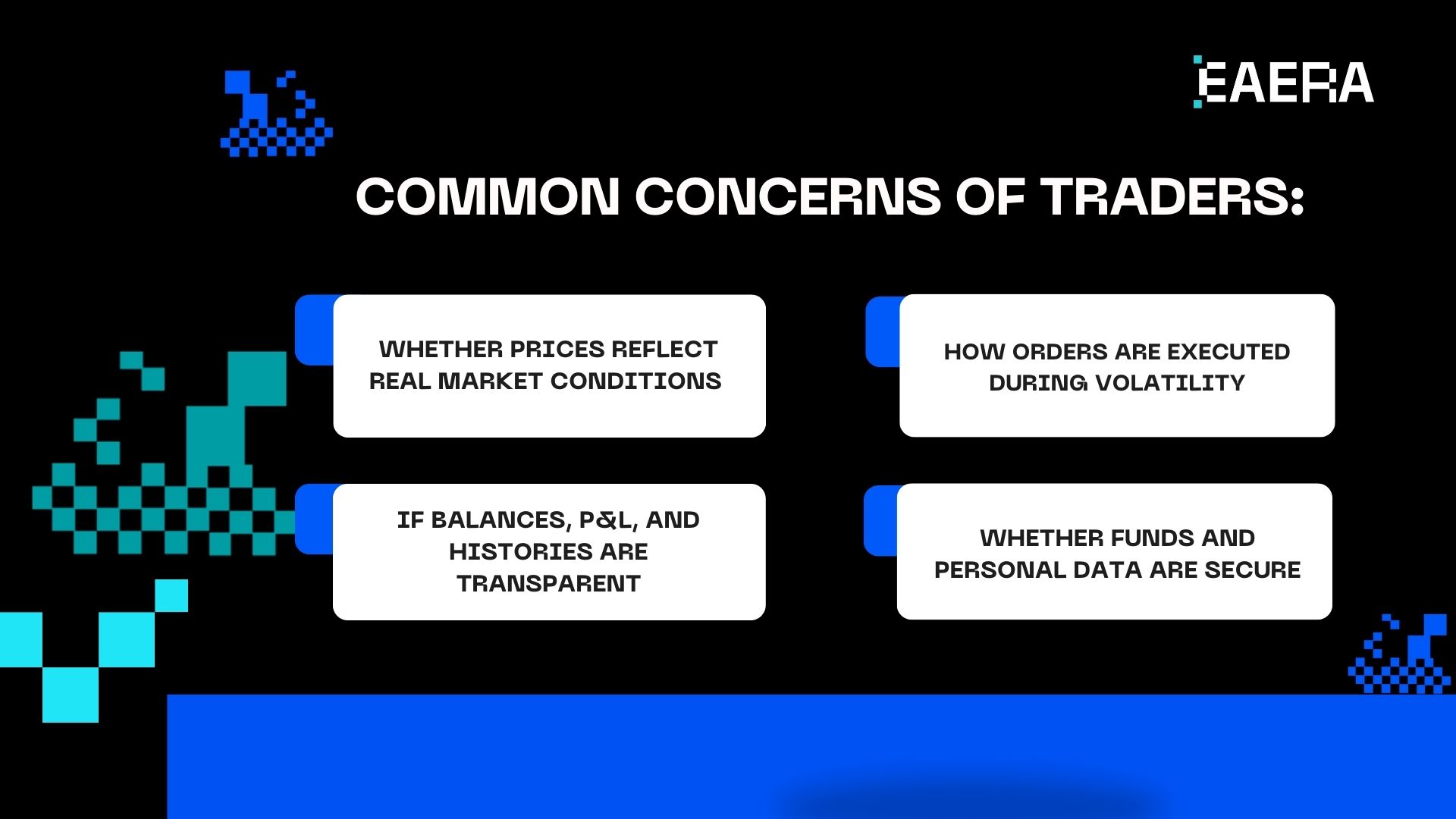

Why Trust Is a Core Issue for FX Traders?

FX traders operate in fast-moving markets where outcomes depend on speed, accuracy, and fairness. Confidence can be swiftly damaged by any uncertainty, such as delayed orders, ambiguous pricing, or inexplicable mistakes.

Common concerns traders evaluate before trusting a broker include:

- Whether prices reflect real market conditions

- How orders are executed during volatility

- If balances, P&L, and histories are transparent

- Whether funds and personal data are secure

The FX trading platform becomes the most obvious measure of a broker’s credibility because traders engage with the system on a regular basis. What traders see on the screen is far more important than marketing and promises.

Platform Stability and Performance as Trust Signals

One of the best indicators of trust that a broker can give is stability. Traders are immediately alarmed by frequent outages, lag, or execution delays.

A trustworthy FX trading platform fosters trust by:

- Consistent uptime, even during the busiest times of the day

- Low-latency execution that matches trader expectations

- Predictable performance during news events and volatility

When a platform freezes or behaves inconsistently, traders often assume manipulation or technical incompetence—even if neither is true. Stable performance eventually turns into a silent guarantee that the broker conducts business in a professional manner.

On the other hand, traders are compelled by unstable systems to decrease the size of their positions, trade less frequently, or quit completely. Long-term trust is built on performance reliability, which is not a “nice to have.”

Transparency Features That Build Trader Confidence

Uncertainty is the enemy of trust, and transparency lessens it. Traders must be able to clearly see the results of their actions.

Key transparency features of a strong FX trading platform include:

- Real-time pricing and spreads, without unexplained gaps

- Clear order status (pending, filled, rejected)

- Detailed execution reports showing price, time, and volume

- Complete trade history accessible at any time

Confidence increases, and disputes decline when traders are able to confirm what is transpired and why. Even when execution is fair, a lack of transparency—such as concealed execution logic or incomplete histories—raises suspicions.

A transparent FX trading platform confirms that the broker has nothing to conceal and gives traders the ability to make well-informed decisions.

Security and Fund Protection Through Platform Design

When traders worry about the security of their money or data, trust quickly crumbles. Therefore, security should not be an afterthought but rather a fundamental design requirement.

A well-architected FX trading platform supports trust through:

- Strong authentication and access controls

- Encrypted data transmission and storage

- Clear wallet and balance tracking

- Accurate transaction logs for deposits and withdrawals

Platform design influences perceived security in addition to technical safeguards. Traders are reassured that their funds are managed responsibly through timely notifications, transparent transaction statuses, and clear confirmations.

Weak security practices—or even unclear security communication—can damage credibility irreversibly. Traders expect modern protection standards as a baseline for trust.

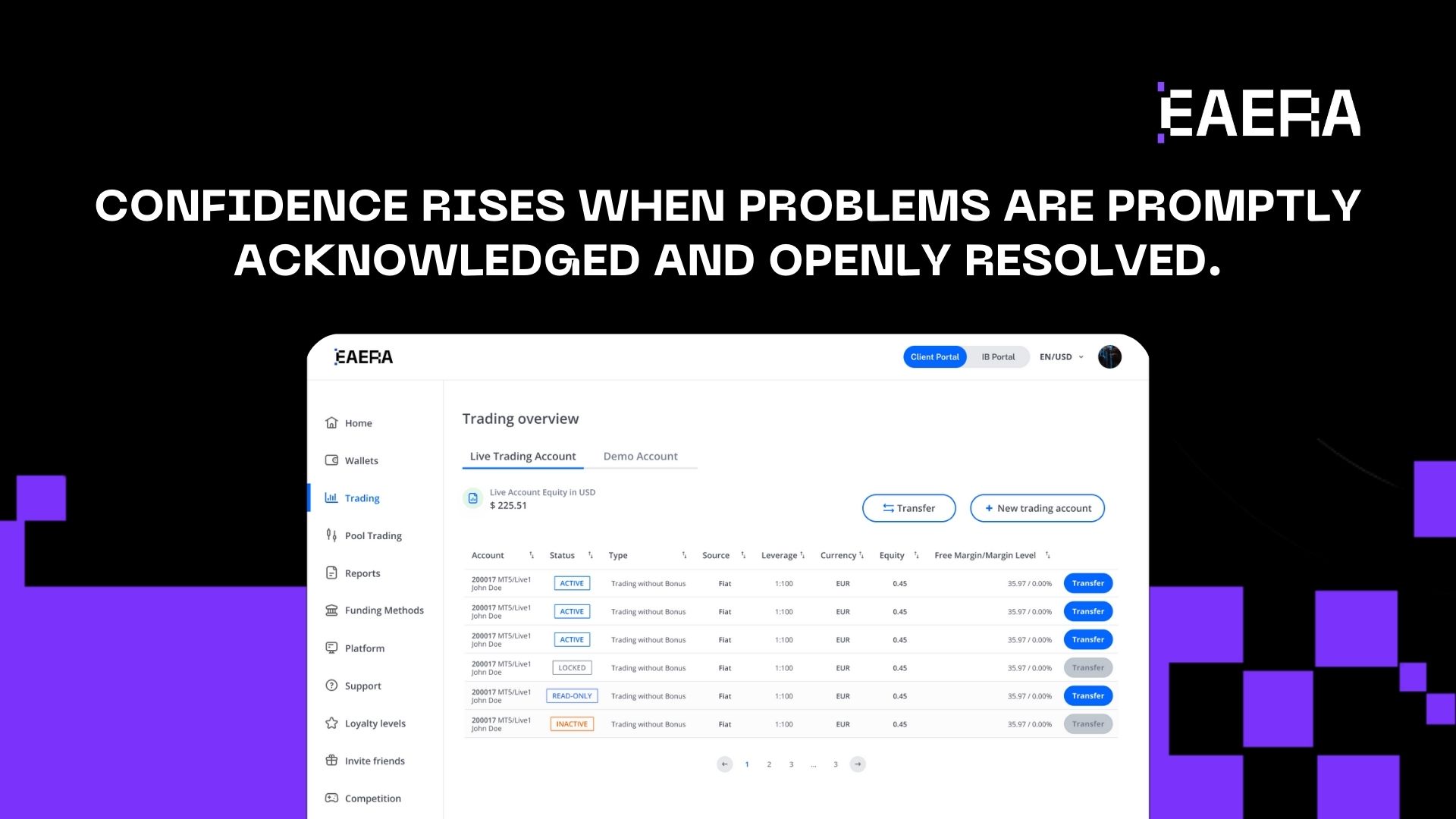

User Experience and Support as Trust Multipliers

Poor user experience can undermine trust even in cases where security and execution are sound. Confusing interfaces, unclear error messages, or slow support responses create frustration and doubt.

An effective FX trading platform enhances trust by offering:

- Intuitive navigation that reduces user error

- Clear feedback when actions fail or are restricted

- Fast issue resolution through integrated support channels

In addition to success stories, traders evaluate trustworthiness based on how issues are resolved. Confidence rises rather than falls when problems are promptly acknowledged and openly resolved.

Platforms created with a user-centric mindset, like those in line with EAERA’s approach to responsiveness and clarity, understand that trust develops from regular interactions rather than just moments of peak performance.

Compliance Readiness and Long-Term Credibility

Trust is structural as well as emotional. The question of whether a broker complies with established operational and regulatory standards is becoming more important to traders.

A robust FX trading platform supports credibility by:

- Maintaining consistent audit trails

- Enforcing rule-based account controls

- Supporting accurate reporting and record retention

- Enabling compliance without disrupting the trading experience

Compliance readiness assures traders that the broker is long-lasting and lessens operational surprises. Platforms that scale cleanly as regulatory expectations evolve demonstrate professionalism and stability.

Compliance-first solutions, like the platform architecture of EAERA, assist brokers in matching operational discipline with trader expectations, gradually building trust.

How the Right FX Trading Platform Sustains Trust Over Time?

One interaction is not enough to establish trust. It builds through consistent, recurring experiences. The proper FX trading platform maintains trust by consistently providing dependability.

Long-term trust indicators include:

- Consistent execution quality across market conditions

- Transparent histories that remain accessible over time

- Stable feature behavior as the platform scales

- Predictable handling of edge cases and exceptions

Traders have higher expectations as they gain more experience. Advanced users are frequently the first to leave platforms that are unable to change without interruption. A scalable FX trading platform, on the other hand, easily adjusts, strengthening rather than eroding trust.

Ultimately, platform selection dictates whether trust grows—or diminishes—during the trader’s relationship.

How Transparency and Control Reduce Emotional Trading Risk?

Beyond technical performance, giving traders a sense of control over their choices is a frequently disregarded way an FX trading platform fosters trust. One of the primary causes of traders losing faith in a broker is emotional uncertainty rather than actual market volatility.

Key design elements that support emotional trust include:

- Clear margin and risk indicators updated in real time

- Transparent stop-out and liquidation logic

- Immediate feedback on order rejections or partial fills

- Consistent calculation of equity, balance, and free margin

The FX trading platform reassures traders that outcomes are determined by rules rather than covert interventions by making these mechanics transparent. This clarity is particularly crucial during times of high volatility, when trust is most brittle and emotions run high.

Trust in FX trading is established by systems, not slogans. An effective FX trading platform enhances trust by integrating stability, transparency, security, and usability into a seamless experience. FX brokers who invest in trust-building platforms safeguard retention, reputation, and future growth in a growing competitive environment.