MT5 trading platforms have long been cornerstones for online trading. Amongst many brokers and traders, it became the ‘go-to’ default almost out of habit. However, as we move deeper into 2026, the trading industry is looking very different from where it was when MT5 first ruled the roost.

Tighter regulations, increased trade expectations, and the emergence of new trading models that challenge conventional platform assumptions have all contributed to a significant shift in market dynamics.

Related articles:

- Key Broker Back Office Software Risks to Avoid

- Why Working with a Best Forex CRM Agency Helps in 2026?

The question today is not whether MT5 is well-known – it clearly is. The real question is whether MT5 trading platform as the top choice still makes sense in this market, driven by prop trading, automation, and business models that have become increasingly more complex.

The article is an attempt to look at MT5 practically and in a forward direction, assessing its relevance in 2026 based on how trading actually works today.

What “Top Choice” Means for a Trading Platform in 2026?

Calling any solution the “top choice” in 2026 requires more than just checking off a feature list. A modern trading platform must function like core infrastructure, not a trading terminal.

This entails supporting the operational, analytical, and compliance layers that surround trading execution.

A top-tier platform in 2026 shall be one that:

- Handles high volume trades reliably

- Supports automation and algorithmic strategies at scale

- Adaptable to different business models

- Smooth integration with CRM, KYC, and payment systems

- Remains affordable and sustainable over the long term

It is against these real-world expectations, rather than some presumed historical reputation, that the MT5 trading platform must be assessed.

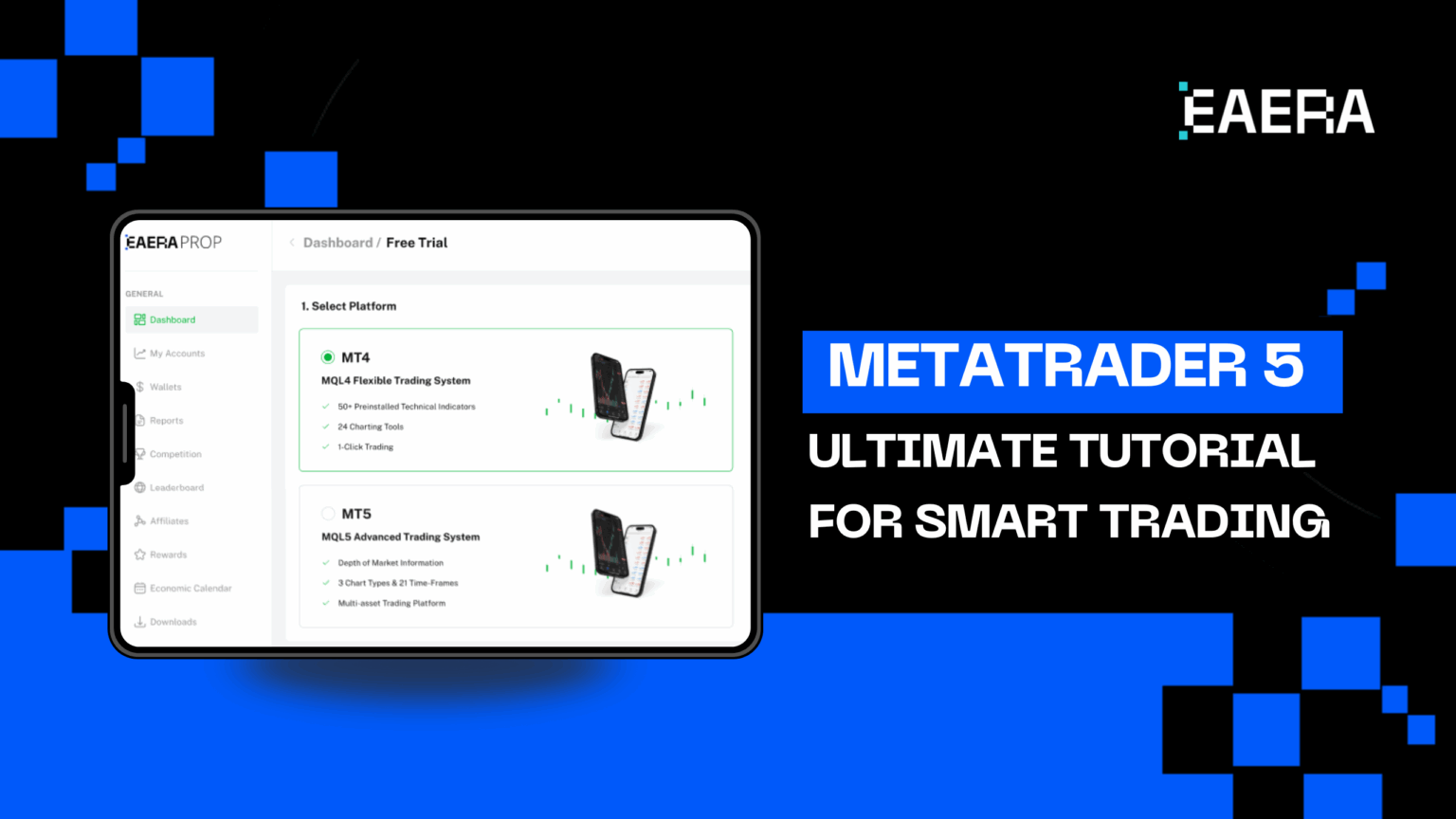

Where the MT5 Trading Platform Still Performs Strongly?

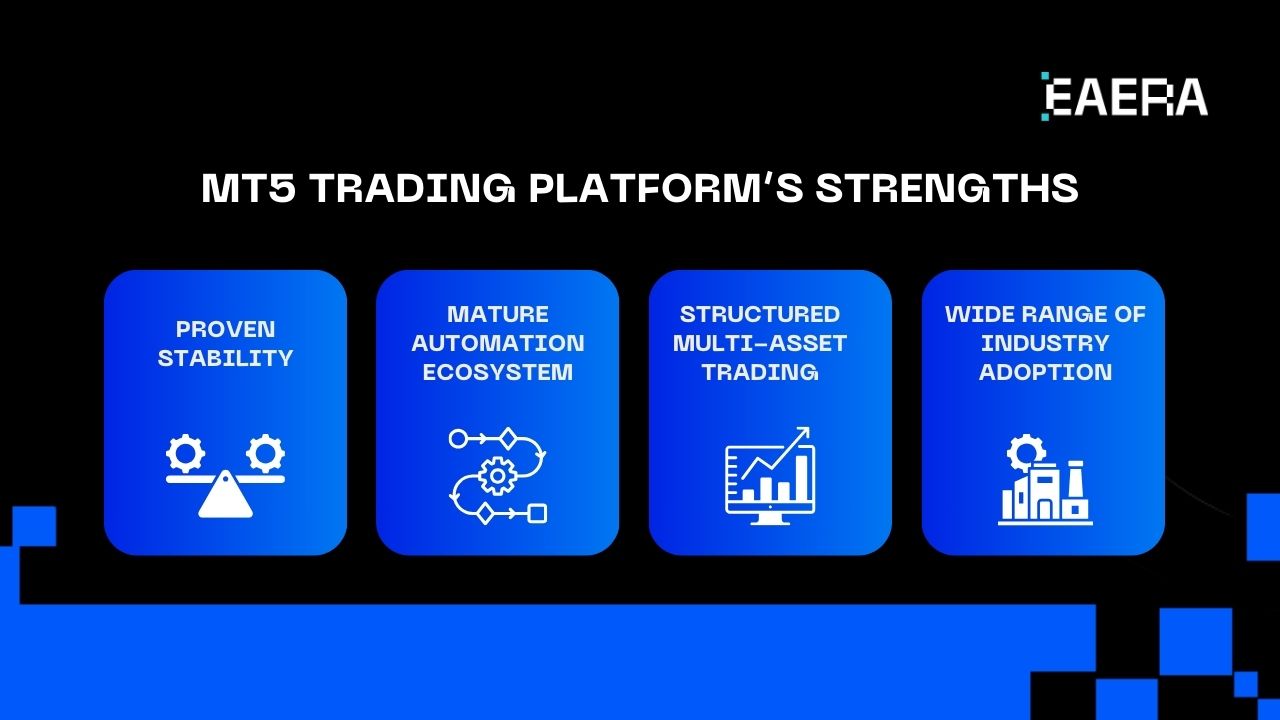

Despite the increased competition, the MT5 trading platform continues to do extremely well in a number of significant areas.

Firstly, it provides proven stability. MT5 has operated without a hitch globally through volatile markets, high-impact news events, and long sessions of heavy trading activity. For brokers who value reliability above everything else, this track record still means something.

Second, MT5 hosts a mature automation ecosystem. The MQL5 environment natively supports a wide range of automated strategies, indicators, and expert advisors. Many trading businesses rely on this ecosystem to reduce development time along with operational risk.

Furthermore, the global availability of competent MQL5 developers reduces dependency risks and increases the predictability of long-term platform maintenance.

Third, the MT5 trading platform provides multi-asset trading in a structured way: Forex, CFDs, indices, commodities, and other instruments can be managed within one environment, which still is appealing for the traditional retail brokers.

Finally, there is a wide range of industry adoption of MT5. In simple terms, it means that liquidity providers, regulators, and service vendors already understand how MT5-based setups work; hence, onboarding and compliance are simpler.

The Limitations of MT5 in a Changing Market

In 2026, the MT5 trading platform exhibits obvious limitations even though it is still dependable.

Flexibility is a significant obstacle. MT5 is designed to be a closed-core system. Deeper control over business logic, such as sophisticated risk rules or payout structures, is restricted even though surface customization is feasible.

This is particularly evident in prop trading models, where businesses need specific performance metrics, dynamic drawdown rules, and evaluation phases. Although these features are rarely native or seamless, they can be added to MT5.

Another issue is integration. Additional middleware is frequently needed to connect the MT5 trading platform to contemporary fintech stacks, which raises system complexity and long-term maintenance costs.

As trading businesses evolve, MT5’s structure can feel more like a constraint than a foundation.

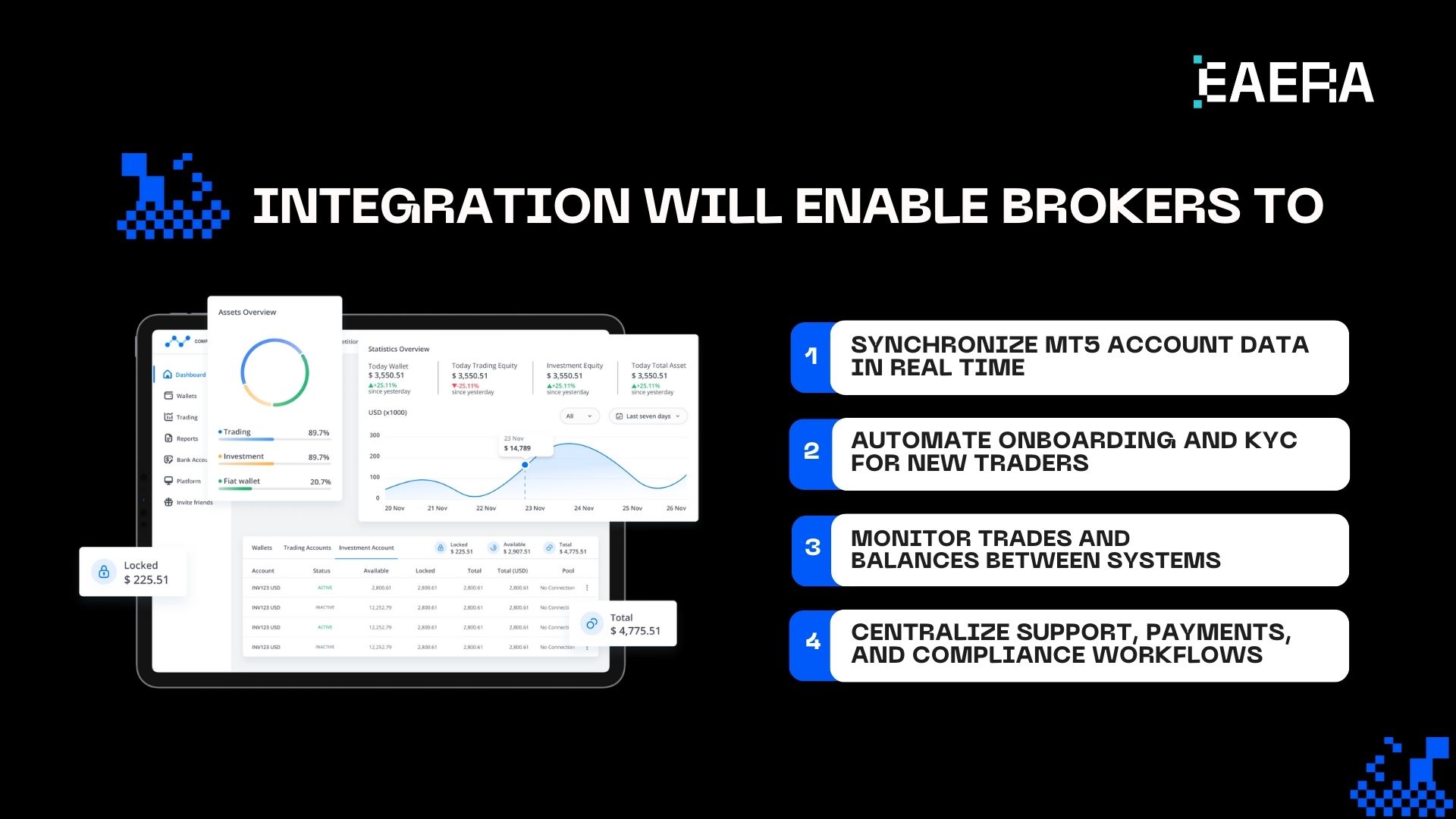

Integrating MT5 with Broader Infrastructure

It is here, however, that platforms such as EAERA must step in and fill this need. Offering a cloud-based CRM and operations engine which integrates with trading platforms such as MT5, business automation and analysis become possible.

By compensating for MT5’s shortcomings in the business and operational layers, this strategy enables companies to maintain its execution strengths.

The solution set offered by EAERA (CRM systems, back-office solutions, and client portals) is designed to bring together trading information, client relationship management, and operating analytics data all within one location. Such integration will enable brokers to:

- Synchronize MT5 account data in real time

- Automate onboarding and KYC for new traders

- Monitor trades and balances between systems

- Centralize support, payments, and compliance workflows

Rather than using MT5 in a vacuum, visionary companies integrate it with robust solutions such as EAERA to create a fully integrated trading house.

When MT5 Is the Right Choice—and When It Isn’t?

The MT5 trading platform does remain pertinent in given circumstances.

It is a good option when you:

- Run a conventional retail brokerage

- Requires rapid deployment with less customization development

- Depend heavily on automated trading methods

- Prefer existing regulatory and liquidity regimes

However, MT5 becomes less suitable if:

- Your business revolves around prop trading or assessments

- You need extreme customization for the trading rules

- You seek to create a web-focused or mobile-focused trading interface

- You want complete control over the roadmap for your platform

Often, the current approach is for companies to view the MT5 trading platform as part of a system, as opposed to the complete solution offered by MT4.

Is MT5 Trading Platform Still the Top Choice in 2026?

Thus, is the MT5 trading platform the best option in the year 2026? The answer to this question depends on what you are developing.

Undoubtedly, for the stability-oriented broker, the MT5 remains an option they can rely on. Its execution, automation support, and widespread acceptance have not waned.

When a business model involves innovation or customization or prop trading, the use of MT5 could hinder long-term growth. At that point, it is not the fall-back option; it has to be a strategy.

The MT5 trading platform has changed from a universal system to a situational system.

The MT5 trading platform continues to provide strong execution and widespread adoption in 2026. The context of value has evolved; trading operations now require more than just execution. They need business automation, transparent data flows, and end-to-end integration.

MT5 is transformed from a trading interface into a scalable, contemporary backbone that facilitates long-term growth when paired with enterprise-ready solutions like EAERA‘s platform.

Prioritize integration and adaptability over legacy popularity when assessing trading infrastructure today. A platform stack that facilitates both current trading and future innovation will be the best in 2026.