In 2026, the global brokerage market is expanding more quickly, under more regulation, and with more sophisticated technology than in the past. Broker back office software is now the operational foundation that determines whether a brokerage can grow, maintain compliance, and continue to be profitable, going far beyond administrative support.

Yet many brokers still underestimate the risks embedded in this layer of their infrastructure. The wrong system does not simply slow operations – it creates compounding failures across compliance, risk control, client experience, and revenue generation.

Related articles:

- 5 Best Practices FX Brokers Must Know for Back Office Software

- Why Working with a Best Forex CRM Agency Helps in 2026?

This article examines the most critical broker back-office software risks to avoid, explaining why they matter and how forward-looking firms are addressing them.

Why Broker Back Office Software Has Become Mission-Critical?

Contemporary back office applications for brokers carry out many more important functions than simple report generation or account administration. These applications currently address an overall trading relationship life-cycle span, starting from account registration to trading operation execution.

As brokerage companies continue to expand geographically and by asset type, the back office becomes the single point of truth for the entire operation. Problems with the back office will impact all departments in the company. The risk department depends on it for portfolio visibility, the compliance function depends on it for the readiness of the books for an audit, the sales force depends on it for portfolio behavior analysis, and the executive suite depends on it for strategic analysis.

As a result of this crucial role, risks in broker back-office software are usually interlinked. They cascade.

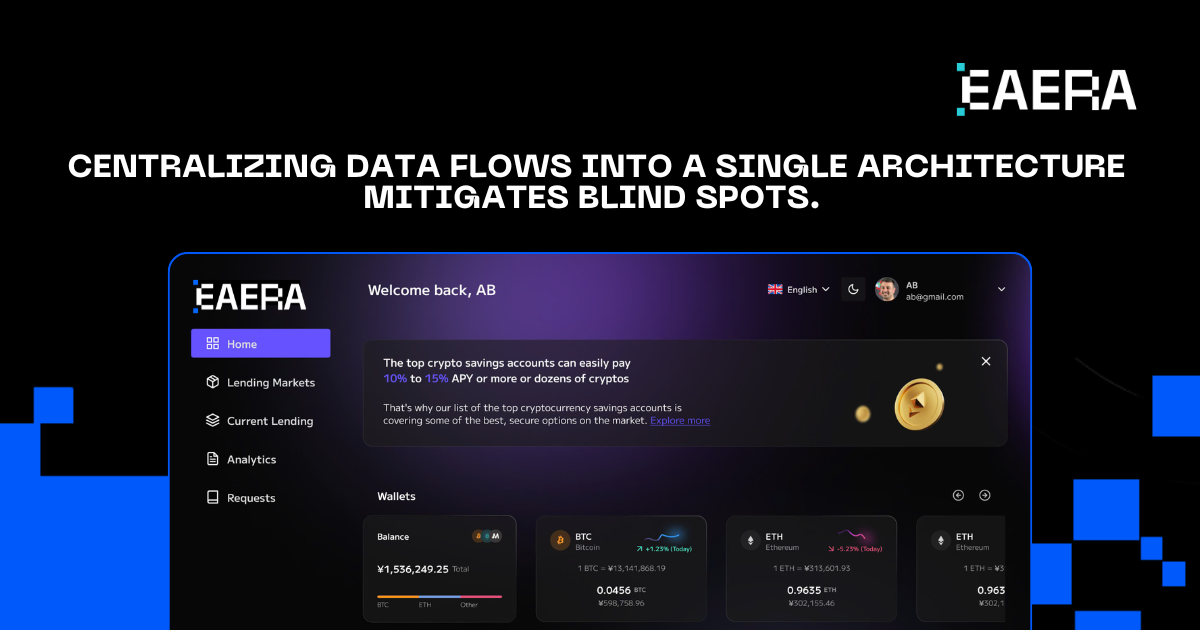

Risk #1: Fragmented Architecture That Creates Operational Blind Spots

Running a back office made up of disparate systems is one of the most frequent risks brokers encounter. For CRM, payments, KYC, reporting, and trading platform data, many businesses still use disconnected tools that are only tangentially connected by manual procedures or constrained APIs.

Blind spots result from this fragmentation. Teams are compelled to manually reconcile numbers, exposure data is delayed, and client information becomes inconsistent across systems. While finance teams work on different datasets, risk managers might only be partially exposed. These discrepancies eventually erode confidence in internal reporting and impede decision-making.

Centralizing data flows into a single architecture where all departments operate from the same real-time information; effective broker back office software mitigates this risk.

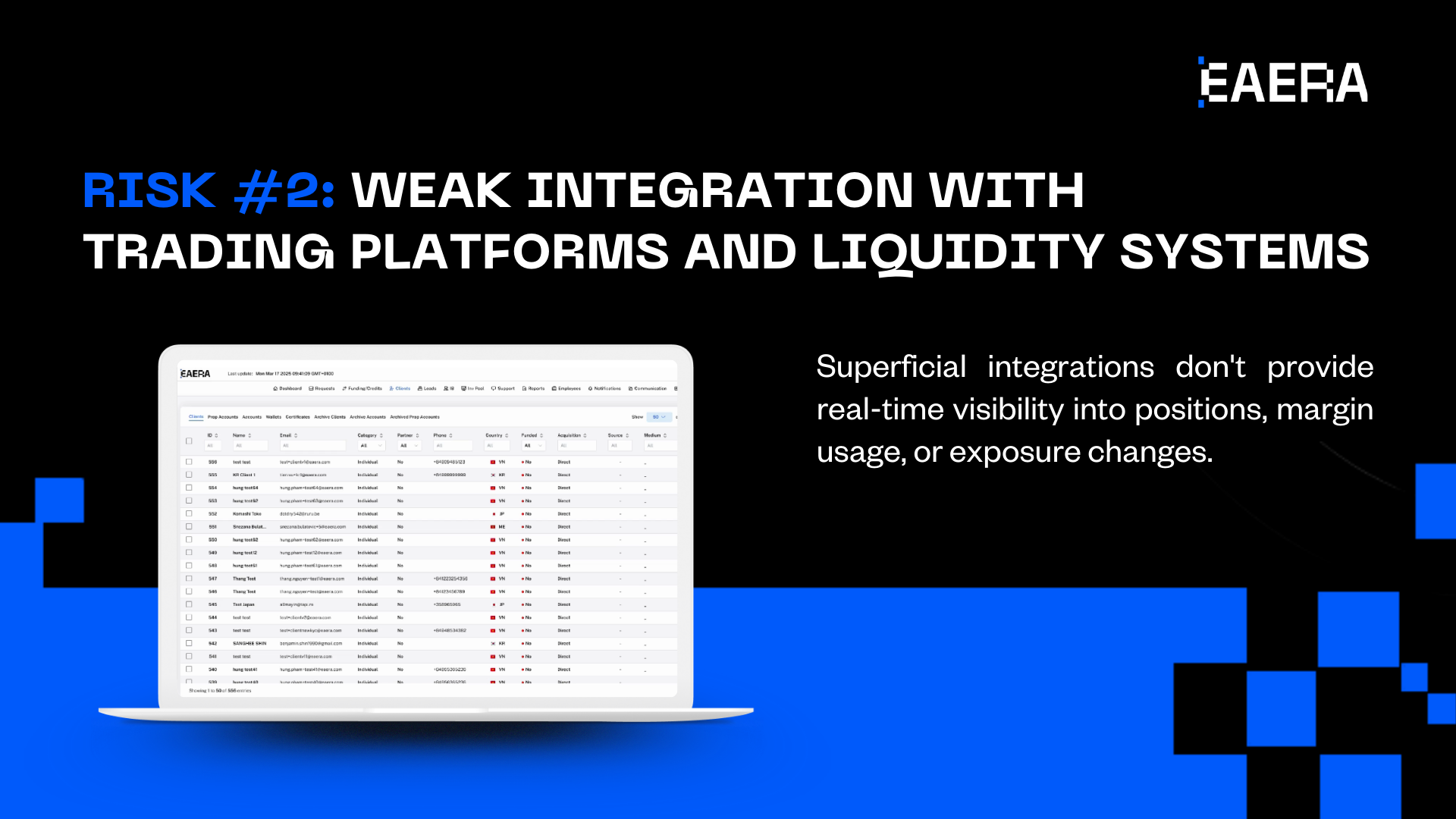

Risk #2: Weak Integration with Trading Platforms and Liquidity Systems

When back-office systems don’t fully integrate with trading platforms, another serious risk arises. Although they might occasionally sync balances, superficial integrations don’t provide real-time visibility into positions, margin usage, or exposure changes.

Delayed data becomes dangerous in erratic markets. Trade disputes become more difficult to settle; risk teams may respond to exposure spikes too late, and margin calls may be miscalculated. Operational confidence gradually declines, particularly as trading volumes rise.

Sturdy broker back-office software ensures that operational decisions are based on real-time data rather than snapshots by providing constant, real-time synchronization with trading platforms and liquidity systems.

Risk #3: Manual or Semi-Automated Compliance Workflows

For 2026, there are regulatory obligations that require accuracy, transparency, and traceability. In contrast, many brokers have been using manual processing for compliance, particularly with KYC, AML screening, and other reporting obligations.

It takes time to do this, and it frustrates clients. More importantly, it also allows divergence to occur. Sometimes, two similar cases are also disposed differently; trails and deadlines can be missed.

Modern broker back office systems integrate compliance functionalities directly into business operations. Automated KYC screening, rule-based AML monitoring, and audit trails produced by systems eliminate human error margins while ensuring fairness across regions.

Risk #4: Limited Scalability That Turns Growth into a Liability

Growth ought to be a benefit, but for many brokerages, it turns into a test that their systems can’t withstand. When onboarding speeds up or new markets are added, back office software that works well with a few thousand clients might have trouble.

Slower account creation, delayed reporting, and system instability during peak trading hours are signs of poor scalability. To make up for these problems, businesses must hire more employees, which raises expenses and lowers profit margins.

Software for scalable broker back offices is designed with expansion in mind. Brokers can grow without reconstructing their operational core thanks to cloud-native architecture, elastic data processing, and customizable workflows.

Risk #5: Poor Data Security and Access Control

The broker’s back office systems contain some of the most confidential information within an organization; this includes, but is not limited to, personal information of the clients, trading activities, and internal business controls. Inadequate security design and implementation at this organizational tier poses a great risk to the broker’s loss of funds, fines, and loss of reputation.

Some common security issues may include the lack of role-based access control, the absence of a detailed audit trail, and poor encryption practices. Such issues pose a significant problem concerning the tracking of events and the prevention of misuse.

Secure broker back office software also has strict permission structures, keeps all major actions recorded, and uses encryption on both transmission and rest. Security then becomes a seamless operation for them.

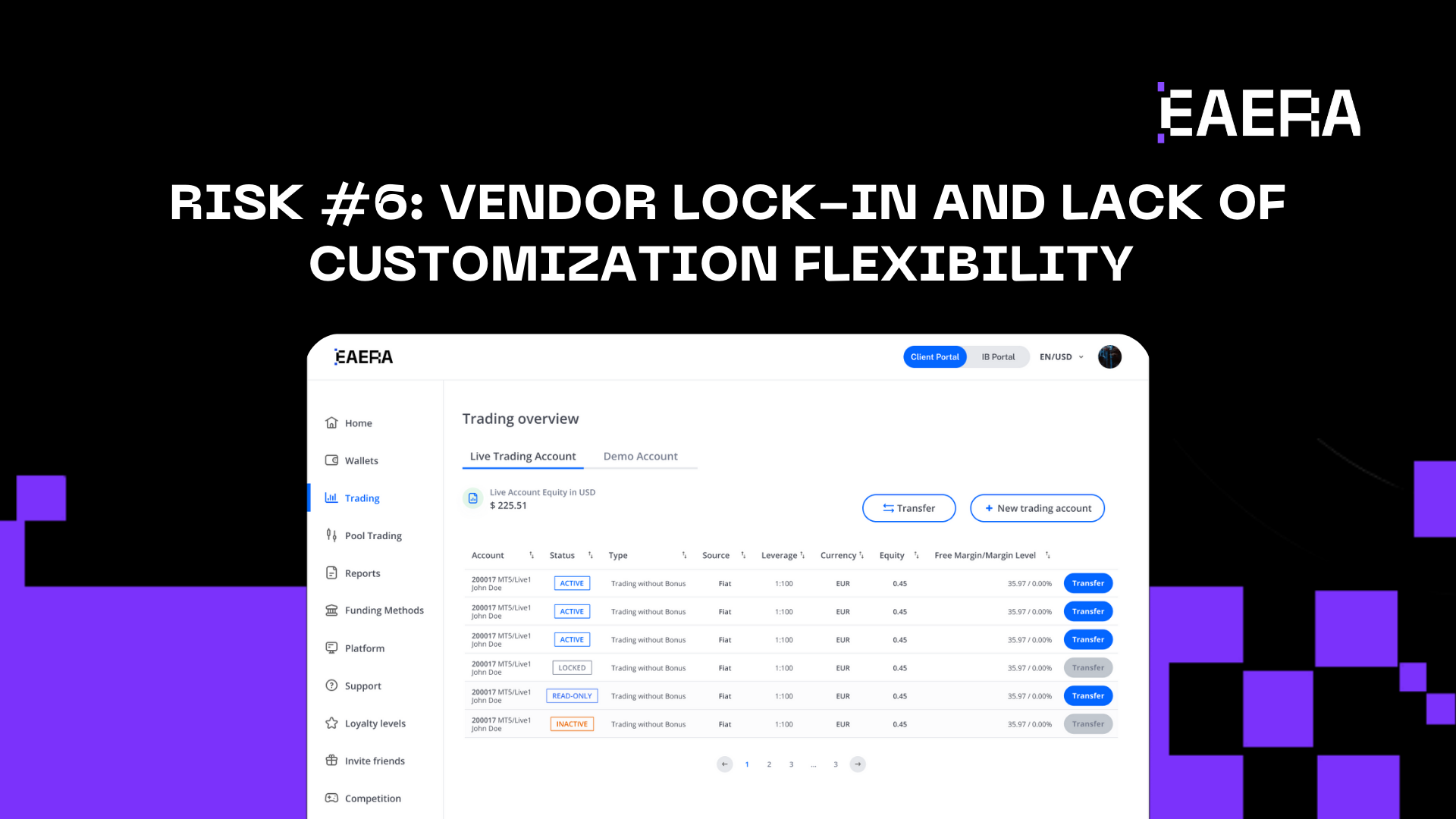

Risk #6: Vendor Lock-In and Lack of Customization Flexibility

Many brokers find out too late that their back office system cannot grow with their company. Rigid platforms can restrict workflow modifications, limit customization, or necessitate costly development for even minor changes.

A strategic risk arises from this lack of adaptability. Brokers might not be able to quickly implement new products, modify IB models, or adhere to local laws. Sometimes businesses are compelled to make expensive system migrations to reclaim control.

By providing modular design, open APIs, and configurable logic, flexible broker back office software prevents vendor lock-in. Because of this, brokers can quickly adjust to shifting markets and business models.

How to Evaluate Broker Back Office Software to Avoid These Risks?

A change in evaluation mindset is necessary to avoid these risks. Back office software should be evaluated by brokers based on operational resilience rather than feature lists. The most crucial issues center on automation capability, architecture, integration depth, and scalability in practical settings.

Strong broker back office software shows how data moves between departments, how compliance is automatically enforced, and how growth scenarios are managed without degrading performance. Instead of prioritizing immediate convenience, it promotes long-term operational stability.