Managing multiple trading accounts efficiently is crucial for Forex brokers and fund managers. That’s where Multi Account Manager (MAM) software integrated with MetaTrader 5 becomes a game-changer. Designed to simplify account operations and enhance trade execution, MAM software on MetaTrader 5 offers powerful tools for real-time management, allocation, and scalability. In this article, we’ll explore how MAM solutions can transform your trading operations and improve client satisfaction.

1. Introduction to Multi Account Manager (MAM) Software

Multi Account Manager (MAM) software is essential for Forex brokers looking to manage multiple client portfolios from a single platform. It streamlines trading operations and integrates directly with MetaTrader 5, enhancing account control and execution speed.

Unlike PAMM systems, MAM allows flexible trade allocations, letting brokers distribute trades proportionally or non-proportionally. This makes it ideal for brokers using MetaTrader 5 to serve a variety of client strategies and risk profiles.

MetaTrader 5 users benefit from real-time trade execution, reporting, and risk management through MAM software. For those exploring MetaTrader 5 how to trade efficiently at scale, MAM provides the structure and tools needed.

MAM remains a core solution in brokerage systems, especially for firms leveraging MetaTrader 5 to grow client trust and operational performance.

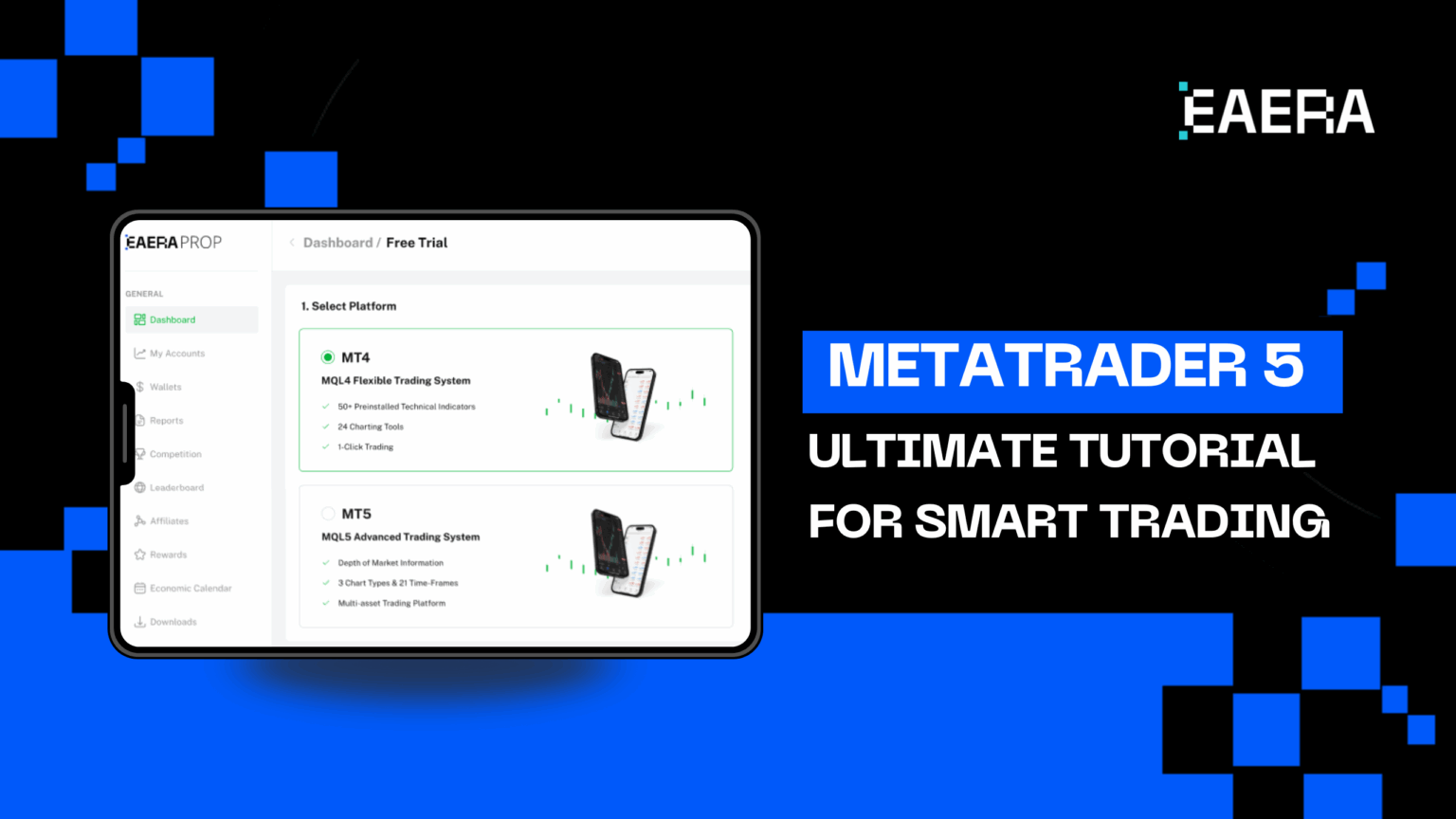

2. What Is MetaTrader 5 (MT5)?

MetaTrader 5 is a multi-asset trading platform widely used by Forex brokers and traders for its advanced features, speed, and flexibility. As the successor to MT4, MetaTrader 5 supports more order types, timeframes, and built-in technical indicators.

The platform allows brokers to manage trades across various asset classes with powerful charting tools and real-time analytics. Its compatibility with MAM software makes it ideal for managing multiple accounts.

Brokers using MetaTrader 5 gain access to robust automation, custom trading strategies, and seamless integration with third-party tools—making MetaTrader 5 a top choice for professional trading.

Learn More: Plugin for MT5

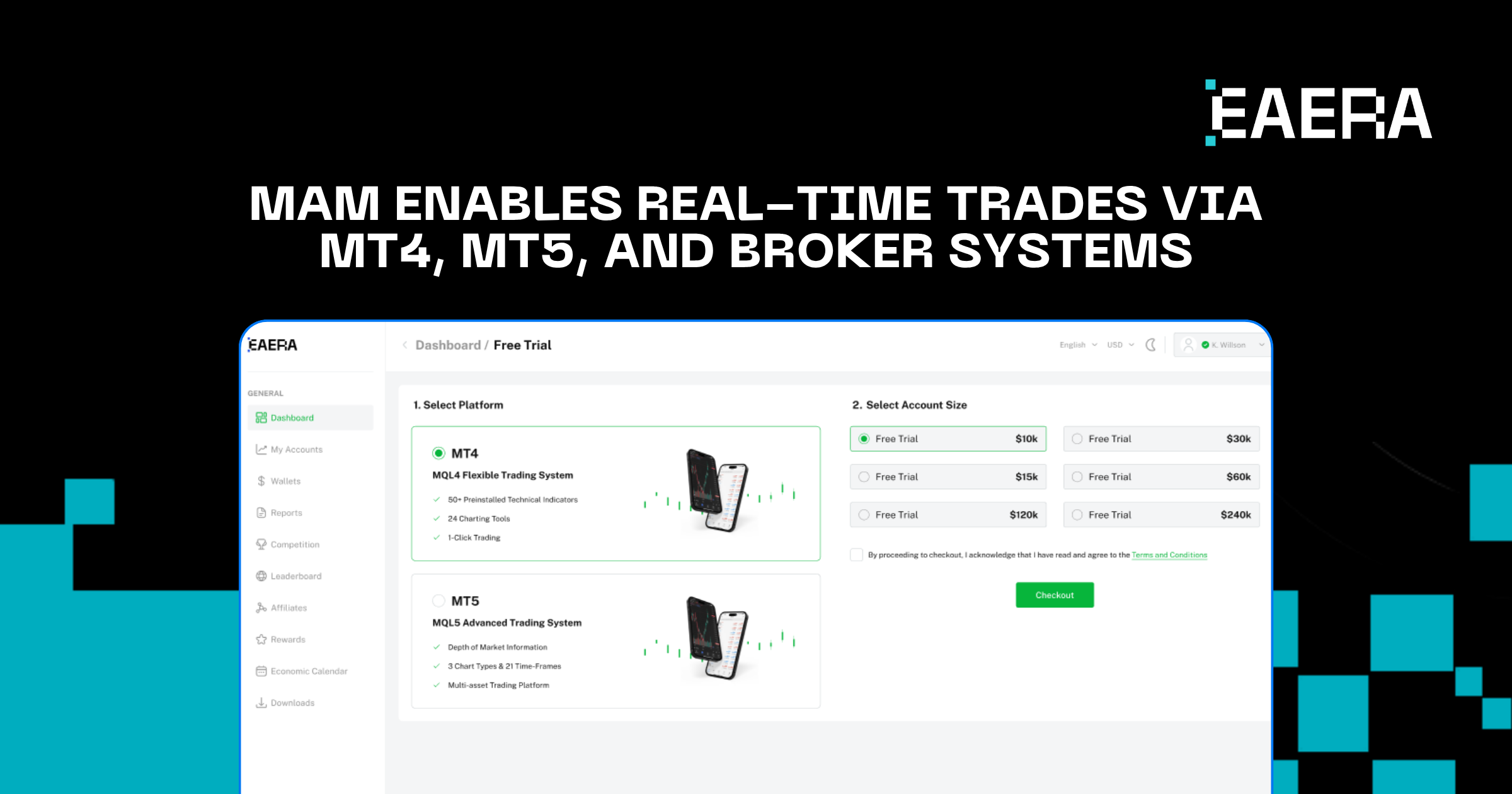

3. MetaTrader 5 How to Trade Using MAM

Trading with MAM software on MetaTrader 5 allows brokers to control multiple accounts through a single master account. Once connected, a money manager can place trades that are automatically mirrored across client accounts based on predefined allocation rules.

To understand MetaTrader 5 how to trade with MAM, users must configure trade sizes, risk settings, and allocation types within the MAM interface. These settings integrate directly into the MetaTrader 5 environment.

Using MetaTrader 5, brokers can monitor trade performance in real time, adjust strategies on the fly, and ensure precise execution. MAM software enhances MetaTrader 5 by enabling scalable account management without sacrificing individual client control.

4. Key Features of MAM Software for MT5

MAM software offers powerful capabilities that enhance account management for brokers using MetaTrader 5. Key features include:

- Trade Allocation Flexibility: Allocate trades by lot size, percentage, or equity—ideal for managing diverse clients on MetaTrader 5

- Real–Time Monitoring: Track trades, risk, and performance across all accounts directly within the MetaTrader 5 interface

- Platform Integration: Seamless integration with MetaTrader 5, MT4, and other major platforms ensures operational continuity

- Automated Trade Execution: Mirror trades from the master account instantly across all client accounts in MetaTrader 5

- Risk Management Tools: Set stop-loss, margin limits, and exposure thresholds to protect client capital

- Client Reporting: Generate detailed performance, commission, and activity reports for full transparency

- Multi-Level IB Support: Manage introducing brokers and affiliate structures efficiently

These features make MAM software indispensable for brokers leveraging MetaTrader 5.

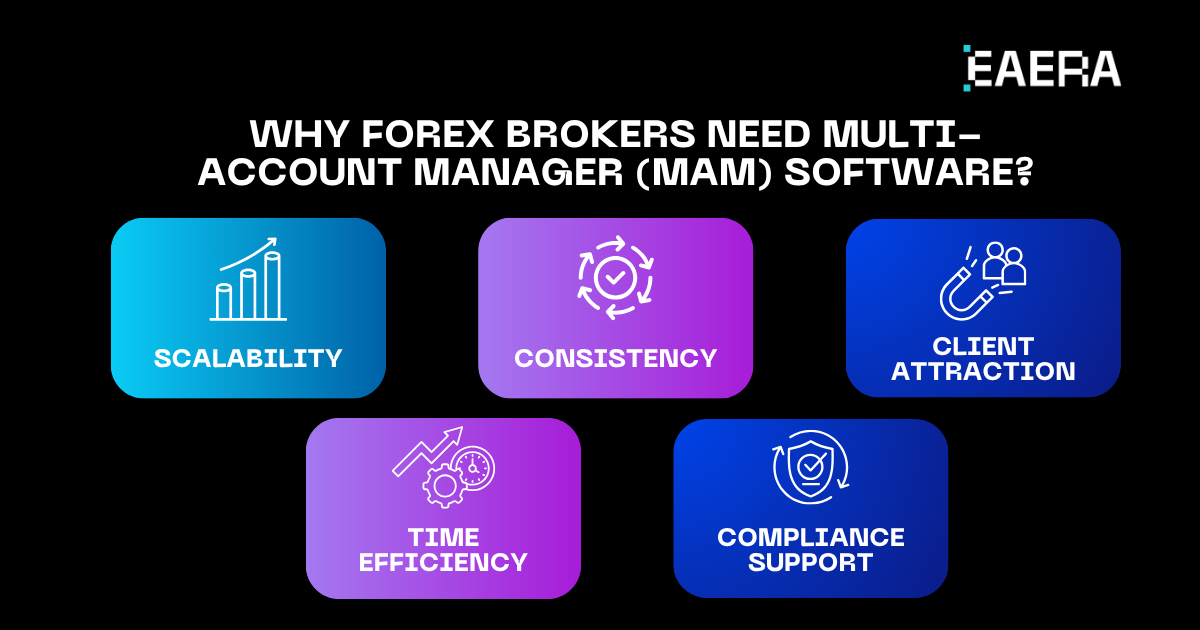

5. Why Forex Brokers and Fund Managers Need MAM Software

Managing multiple accounts in a fast-paced market requires tools that scale with demand. MAM software integrated with MetaTrader 5 helps brokers and fund managers meet this need efficiently. Here’s why it’s essential:

- Scalability: Handle unlimited client accounts via MetaTrader 5 without losing performance

- Consistency: Mirror trades across accounts to ensure uniform strategies on MetaTrader 5

- Client Growth: MAM features attract investors looking for managed solutions on MetaTrader 5

- Time Efficiency: Automate trade execution and focus more on strategy than manual input

- Compliance Support: Built-in tools support regulatory standards while operating on MetaTrader 5

For those exploring MetaTrader 5 how to trade at scale, MAM software is a vital part of staying competitive and compliant.

6. Benefits of Using MAM Software with MetaTrader 5

MAM software integrated with MetaTrader 5 offers significant advantages for brokers managing multiple accounts. Key benefits include:

- Enhanced Efficiency: Automate trade allocation and account management within MetaTrader 5, saving time and resources.

- Improved Client Satisfaction: Ensure transparency and consistent execution, building long-term relationships.

- Revenue Growth: Attract clients seeking professional trading through MetaTrader 5 how to trade solutions.

- Risk Mitigation: Use built-in risk tools to protect client capital.

- Scalable Operations: Grow operations without overhauling your infrastructure.

- Customizable Solutions: Tailor MAM settings for individual trading strategies on MetaTrader 5.

EAERA’s CRM empowers brokers to maximize these benefits through secure, cloud-based integration.

7. Common Challenges and How to Overcome Them

Despite its advantages, MAM software for MetaTrader 5 presents a few challenges that brokers must manage:

- Technical Setup: Integrating MAM with MetaTrader 5 may require advanced IT support.

- Compliance: Ensuring regulatory alignment, including KYC/AML, across MetaTrader 5 systems.

- Cost: Upfront investment in quality MAM solutions can be significant.

- Risk Settings: Misconfigured trade allocations may lead to client losses.

- Client Understanding: Educating clients about MAM’s structure and value is essential.

To address these challenges, brokers should partner with a trusted brokerage CRM provider like EAERA, which offers comprehensive support, seamless integration, and robust security features.

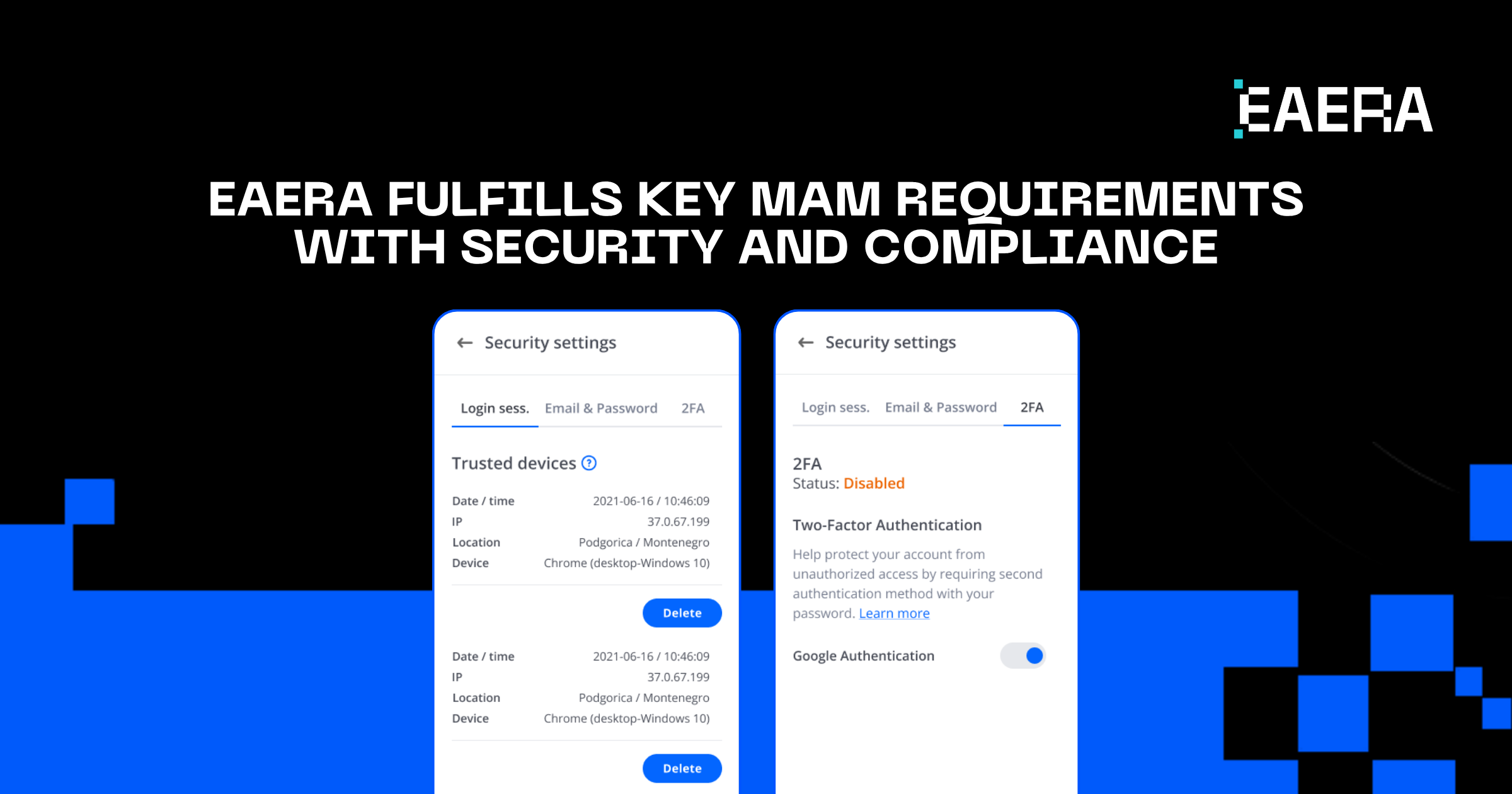

8. How to Choose the Best MAM Software for MT5

Selecting the right MAM software for MetaTrader 5 is crucial for brokers aiming to scale operations and deliver high-quality service. Consider these factors:

- Integration Capabilities: Ensure compatibility with MetaTrader 5, payment systems, and CRM platforms. EAERA integrates smoothly with MT4, MetaTrader 5, and Vertex.

- Customization: Choose software that adapts to your trading models and workflows. EAERA’s MAM modules are tailored for broker-specific needs on MetaTrader 5.

- Security and Compliance: Look for encryption, two-factor authentication, and KYC/AML tools. EAERA protects MetaTrader 5 operations with top-tier security.

- Scalability: MAM should support growing account volumes within MetaTrader 5.

- User-Friendly Interface: Simplifies MetaTrader 5 how to trade processes and reduces onboarding friction.

- Support and Training: Opt for providers like EAERA that offer 24/7 support.

- Cost-Effectiveness: Ensure value through flexible, scalable pricing.

EAERA’s software for brokers combines full MetaTrader 5 integration with powerful MAM and CRM features.

9. The Future of MAM Software in Forex Trading

The future of MAM software, especially for MetaTrader 5 users, is driven by innovation and evolving trader expectations. Key trends include:

- AI and Automation: Smarter trade allocation and predictive risk tools for MetaTrader 5.

- Cloud-Based Solutions: Like EAERA’s CRM, offering flexibility and scale.

- Mobile Accessibility: Supporting traders who use MetaTrader 5 how to trade on mobile.

- Regulatory Integration: Built-in tools for KYC/AML and jurisdiction-specific rules.

- Social Trading Integration: MAM platforms on MetaTrader 5 will integrate these features for broader appeal.

- Blockchain for Transparency: Enhancing trade integrity and auditability.

As MetaTrader 5 adoption rises, MAM software will be essential for brokers to scale, comply, and compete. EAERA continues to lead this evolution with forward-thinking solutions.

Choosing the right MAM software is essential for brokers aiming to stay competitive in today’s fast-paced Forex market. With powerful features, automation, and seamless integration with platforms like MetaTrader 5, MAM solutions enable efficient account management and improved client service. As technology evolves, brokers who invest in advanced tools like EAERA’s CRM and MAM systems will be well-positioned for long-term success.