MetaTrader 5 (MT5) is one of the most popular multi-asset trading platforms, which offers a solid foundation for contemporary brokerages. However, MT5 plugins, which are specialized add-ons that enhance the platform’s functionality, are where its full potential is revealed.

In today’s competitive trading environment, brokers face pressure to manage risk, report, and deliver transparent operations. The increase in algorithmic and high-frequency trading leads to major losses occurring because of a few seconds of delay. By automating repetitive tasks like margin control, risk monitoring, and regulatory reporting, these plugins lessen the amount of manual labor required and increase accuracy.

Related articles:

The challenge: Manual risks and reporting process

In the past, spreadsheets and manual monitoring were key components of brokerage operations’ risk exposure and reporting management processes. Risk managers manually tracked client positions, exposure by instrument, and liquidity, which is a laborious and prone to error process.

This manual reporting procedure presents various difficulties. Every trade needs to be documented, balanced, and condensed into reports that adhere to strict international laws like ASIC, ESMA, or MiFID II. Delays and errors from human input become inevitable, posing risks to operations and reputation of brokers.

Furthermore, the complexity of managing multiple data streams rises as brokers expand their offerings to include multi-asset services, ranging from commodities and indices to forex and CFDs. Manual systems are no longer viable due to the requirement for consistent reporting and real-time oversight. To reduce human error and optimize workflows, MT5 plugins come into play with clever and comprehensive solutions.

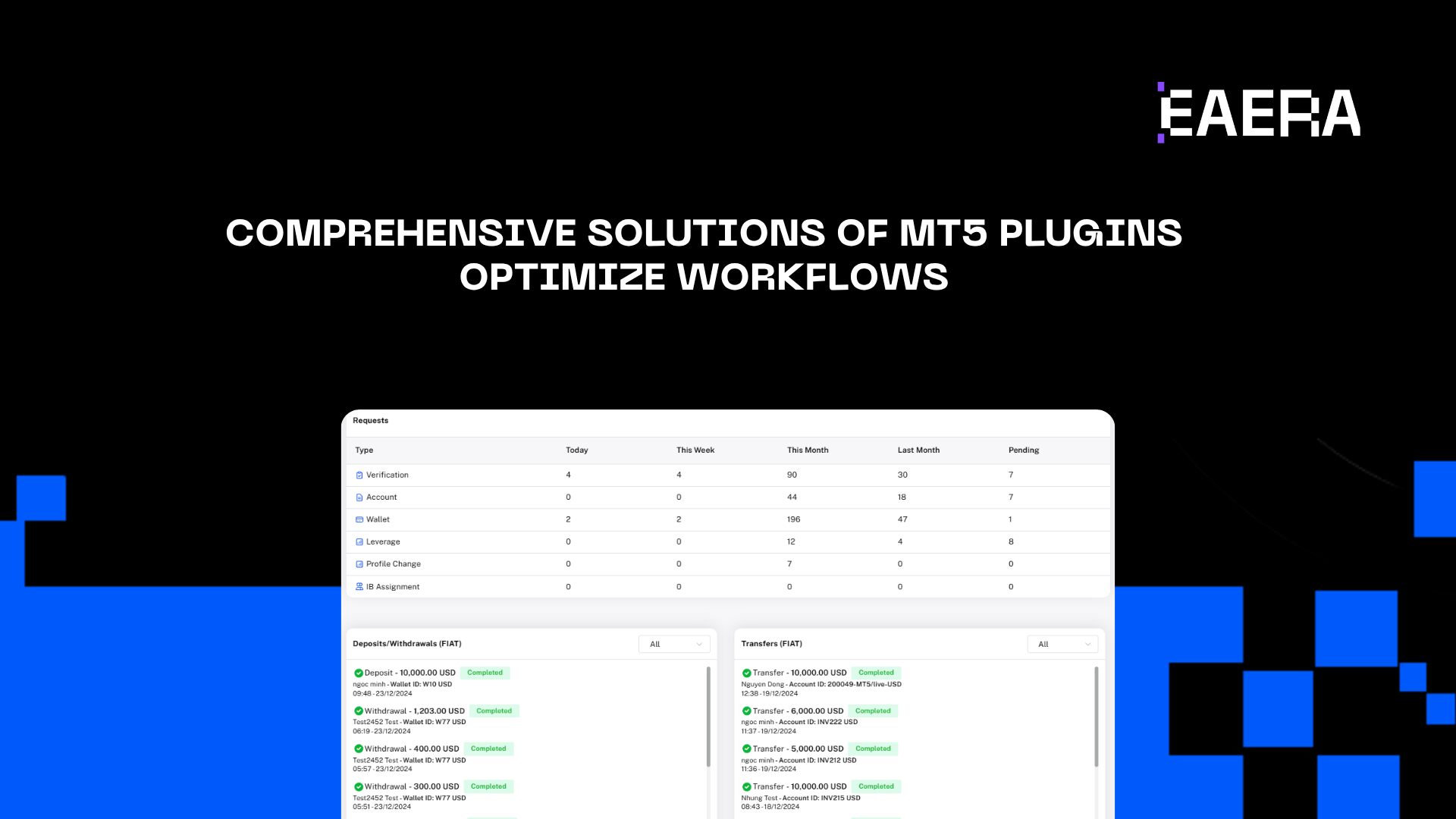

Comprehensive solutions of MT5 plugins optimize workflows

Why use MT5 plugins?

MT5 plugins are specialized software modules that are made to improve the capabilities of the MT5 platform. Brokers can customize their systems to meet operational requirements by integrating seamlessly with the MT5 core environment.

The benefits of using MT5 plugins are scalability, accuracy, and automation. Brokers can center control through an ecosystem of MT5-compatible plugins that can handle complex operations in a matter of seconds, rather than manually handling data across multiples tools.

Automating risk management

Risk management is the backbone of any brokerage business. Brokers are required to evaluate ratios, maintain liquidity coverage, and monitor exposure across thousands of client accounts. In addition to being ineffective, doing this by hand is dangerous in erratic markets.

MT5 risk management plugins automate these crucial procedures by:

- Tracking exposure in real time: Keeping an eye on client positions, open trades, and total risk for each instrument or account group.

- Dynamic margin management: Automatically adjusting margin requirements in response to open exposure and market conditions.

- Auto-hedging and stop-out logic: Executing hedge trades to offset exposure or closing risky positions when margin levels are crossed.

- Automated alerts: Sending out instant notifications when trading limits are reached or anomalous behavior is detected.

For example, to maintain balanced exposure without requiring human intervention, a liquidity bridge plugin can automatically hedge client orders with providers. Another example is a risk monitor dashboard plugin, which enables the risk team to react quickly to market volatility by visualizing all open positions and P&L in real time.

The advantages are obvious: better capital efficiency, fewer human errors, and quicker decision-making. Automated risk control safeguards trader confidence and regulatory compliance in addition to protecting the broker’s balance sheet.

The advantages are obvious

Automating compliance and reporting

Reporting and compliance are one of the areas of brokerage operations that require the greatest resource of brokerage operations. Firms must gather, reconcile, and archive thousands of transaction records daily, all of which must be formatted in accordance with regional or global standards.

MT5 reporting plugins solve this problem by automatically collect information straight from the trading server. They can produce reports on:

- Quality of execution and trade history.

- Deposits and withdrawals from client accounts.

- Statements of profit and loss by symbol, group, or region.

- Regulatory submissions in the format required by MiFID II, ESMA, FCA, or ASIC.

Numerous sophisticated plugins combine with data warehouses or business intelligence (BI) tools to create automated processes that generate, verify, and export reports to internal stakeholders or regulators.

Brokers can guarantee the following by automating compliance:

- Accuracy: Remove human errors in data processing.

- Timeliness: Easily meet stringent submission deadlines.

- Transparency: Keep thorough audit records for every transaction.

- Integration: Establish a smooth connection with CRM, ERP, and external reporting systems.

Ultimately, automated reporting turns compliance from an expensive manual task into a strategic advantage, allowing human teams to concentrate on analysis instead of administration.

Beyond automation: strategic approach for future brokers with MT5 plugins

Automation promotes strategic growth in addition to efficiency. In the upcoming decade, brokerage firms that integrate data-driven decision-making with automation will prosper.

By implementing MT5 plugins, brokers can use real-time data analytics to improve pricing strategies, customer segmentation, and operational performance. For instance:

- Risk plugins information about the most erratic products or customer segments

- Reporting tools show patterns in the use of client activity and liquidity.

- Automated alerts help management teams identify early indicators of operational stress.

Automation also makes scalability possible. Without adding more employees or manual procedures, a broker that operates in one area can readily expand to new markets. The infrastructure is still lean, consistent, and cross-jurisdictional.

In the long-term, adopting MT5 automation is a strategic move toward creating a data-driven sustainable brokerage model that can quickly adjust to market or regulatory changes.

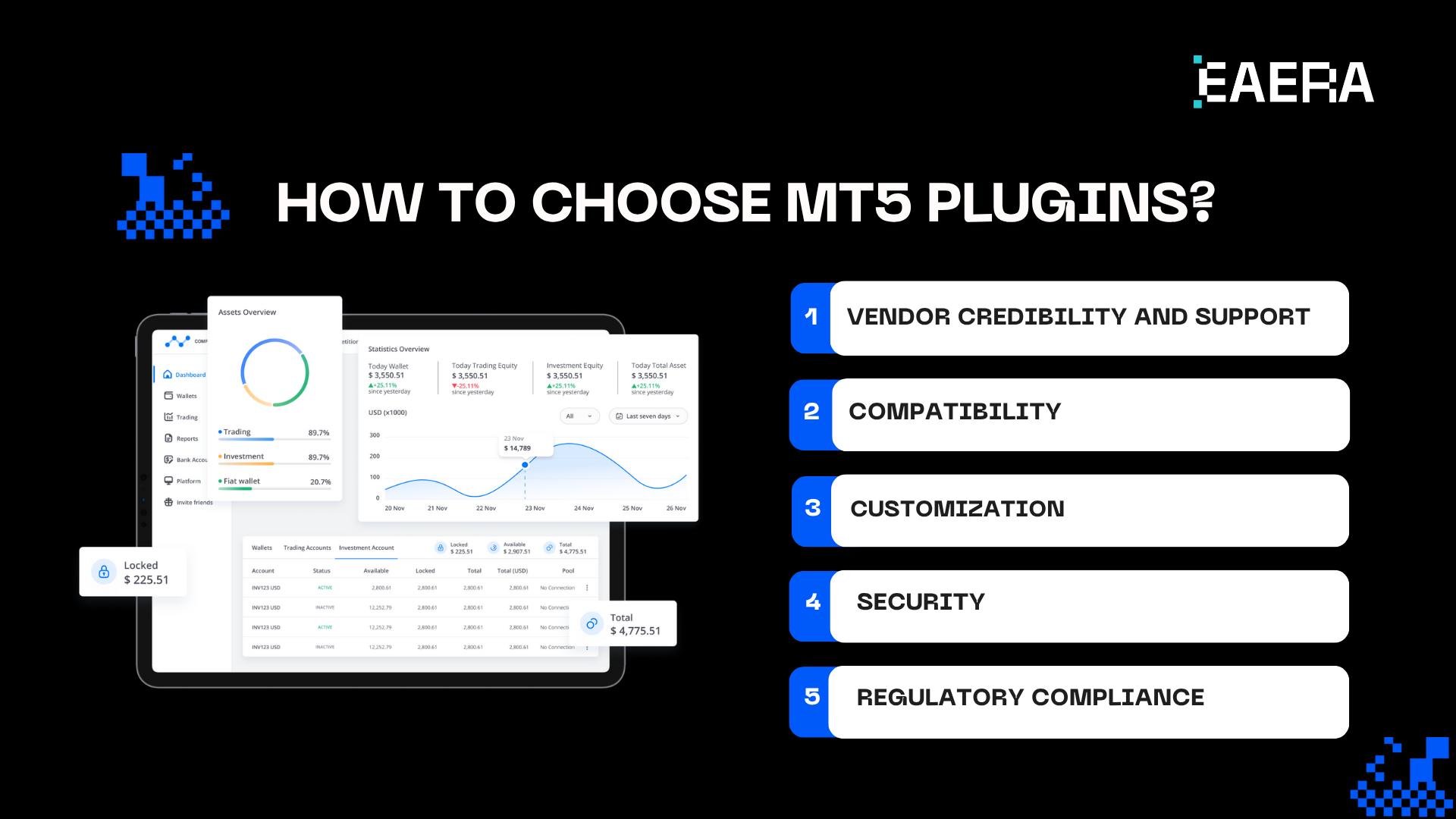

How to choose the right MT5 plugins?

Selecting the right MT5 plugins is a crucial decision that directly affects performance, security, and compliance. Brokers should evaluate potential solutions based on the following criteria:

The choice of MT5 plugins is important because it directly impacts performance, security, and compliance. Brokers should assess potential solutions following these criteria:

- Vendor credibility and support: Select developers with proven success and consistent product updates.

- Compatibility: Guarantee smooth interaction with your CRM, liquidity bridge, and MT5 configuration.

- Customization: Seek out plugins that enable adaptable setup to fit your company’s models.

- Security: Verify access controls, data handling guidelines, and encryption standards.

- Regulatory compliance: The plugin should align with the risk and reporting requirements of your target markets.

Select MT5 plugins following suggested criteria

It’s wise to start with modular implementation, adding plugins gradually as the company expands. Brokers can maximize investment with this strategy, which also ensures seamless adoption and minimal disruption.

MT5 plugins represent the next evolution in brokerage automation, which gives businesses a real-time performance view, improve accuracy, and lessen operational burden. MT5 automation is a strategic shift that prepares brokers for the future of international trading, not merely a technological advancement.