One of the most popular trading platforms worldwide, MetaTrader 5 (MT5) is renowned for its adaptability, sophisticated charting, and support for algorithmic trading. However, as trading operations expand, performance issues frequently arise – not from trading strategies themselves, but rather from how operations are managed.

Small delays that accumulate over time can be caused by manual workflows, repeated confirmations, and disconnected tools. Execution consistency, operational effectiveness, and eventually trading results are all impacted by these delays. For this reason, infrastructure optimization is starting to take precedence over strategy optimization in many professional trading environments.

This layer of the issue is addressed by a plugin for MT5. It improves the platform’s functionality rather than taking the place of trading logic, assisting traders and organizations in automating procedures and reducing internal friction.

Related articles:

- Is MT5 Trading Platform Still the Top Choice in 2026?

- Why Working with a Best Forex CRM Agency Helps in 2026?

In structured trading ecosystems – especially those supported by platforms like EAERA – automation and speed are treated as operational foundations rather than optional enhancements.

What Is a Plugin for MT5? A Practical Explanation

A plugin for MT5 is a software extension designed to enhance the platform’s behavior without altering its core engine. Unlike Expert Advisors (EAs), which are focused on trading strategies and signals, plugins typically operate at a lower, more operational level.

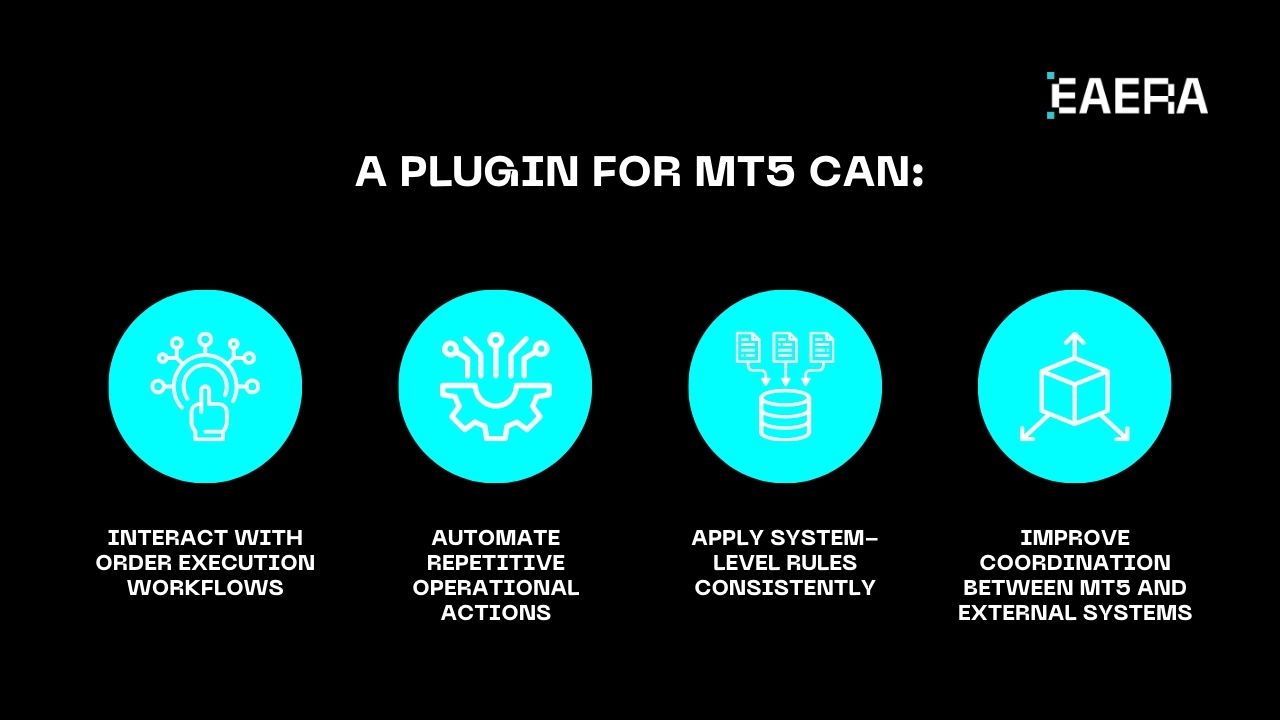

In practical terms, a plugin for MT5 can:

- Interact with order execution workflows

- Automate repetitive operational actions

- Apply system-level rules consistently

- Improve coordination between MT5 and external systems

Understanding the difference between scripts, EAs, and plugins is critical. Scripts perform one-off tasks. EAs automate trading decisions. Plugins, however, are responsible for how MT5 behaves as part of a larger operational system. This is why plugins are often used to improve automation and speed rather than to chase trading performance directly.

Where MT5 Operations Commonly Slow Down?

Most speed issues in MT5 environments are not caused by platform technology, but by human-dependent processes layered on top of it. Common bottlenecks include manual trade validation, repeated account checks, delayed synchronization between systems, and fragmented workflows across tools.

These inefficiencies often go unnoticed on a small scale. However, as trading volume increases, they become structural problems. Adding more EAs or indicators does not solve these issues and may even increase system complexity.

A plugin for MT5 targets these bottlenecks directly. By automating actions that would otherwise require manual input, plugins reduce execution friction and create more predictable operational flows.

How a Plugin for MT5 Enables Meaningful Automation?

Automation through a plugin for MT5 is not about removing control—it is about enforcing consistency. Plugins are commonly used to automate operational rules such as risk checks, trade validation, account state updates, and data synchronization.

Because plugins operate closer to the execution layer, they reduce the number of steps between a decision and its execution. Fewer steps mean fewer delays and fewer opportunities for error. This is particularly important in professional environments where consistency matters more than individual trade outcomes.

Automation also improves transparency. When rules are enforced at the system level, behavior becomes easier to audit and analyze. This aligns well with compliance-focused and performance-driven trading operations.

Speed Optimization: What Plugins Improve—and What They Do Not

In trading, speed is frequently misinterpreted. A plugin for MT5 does not ensure better trade entries or accelerate market movement. Rather, it increases internal speed by eliminating needless delays in the actual trading process.

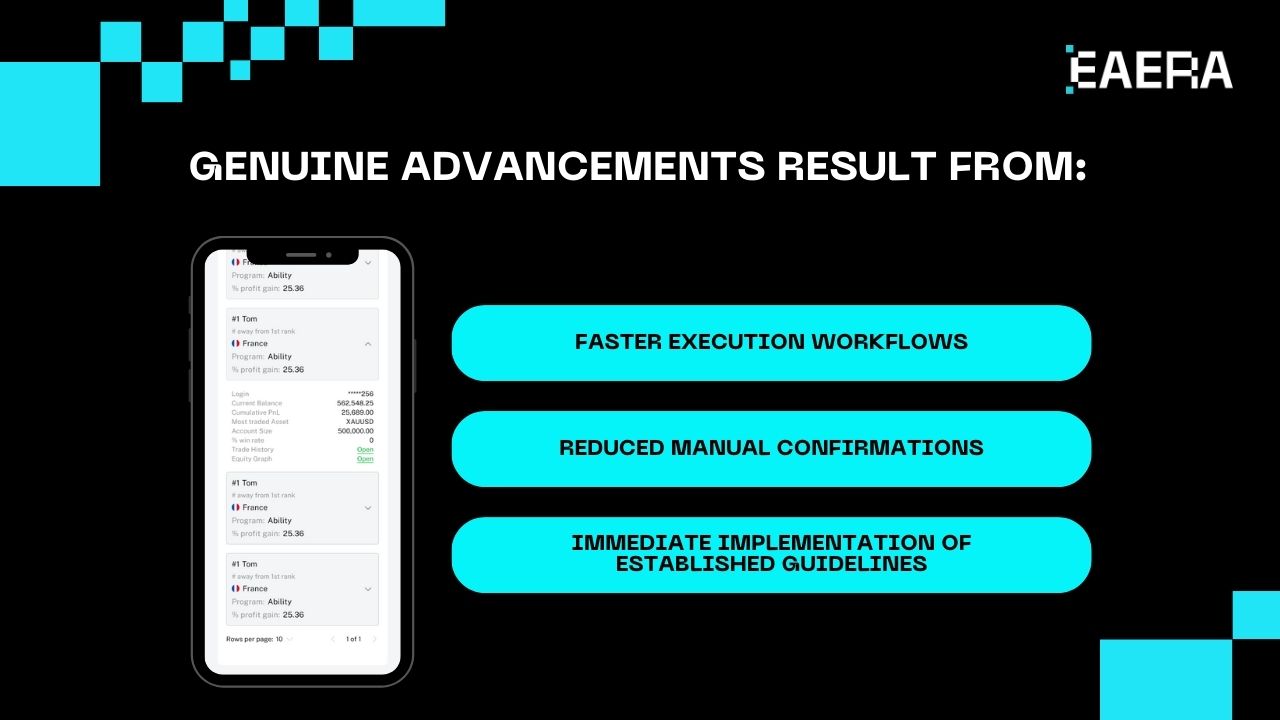

Genuine advancements usually result from:

- Faster execution workflows

- Reduced manual confirmations

- Immediate implementation of established guidelines

Knowing the boundaries is equally crucial. External factors like low network latency or limited liquidity cannot be overcome by plugins. Unrealistic expectations are avoided, and system trust is increased by clearly defining these boundaries.

When utilized properly, a plugin for MT5 increases operational speed in quantifiable, repeatable, and sustainable ways.

Real-World Use Cases for a Plugin for MT5

Real-world operational scenarios are where the value of a plugin for MT5 is most evident. Plugins are used by prop trading companies to uniformly enforce trading rules across thousands of accounts. Plugins are used by multi-account managers to minimize operational overhead and synchronize actions.

Plugins are used by brokers and platform operators to keep things stable and under control as trading volumes increase. Plugins help link execution with account management, reporting, and risk oversight in ecosystems where MT5 is a part of a larger infrastructure, like those created or supported by EAERA.

The advantages might be minimal for individual traders. However, for businesses, plugins frequently serve as the cornerstone of a scalable trading system.

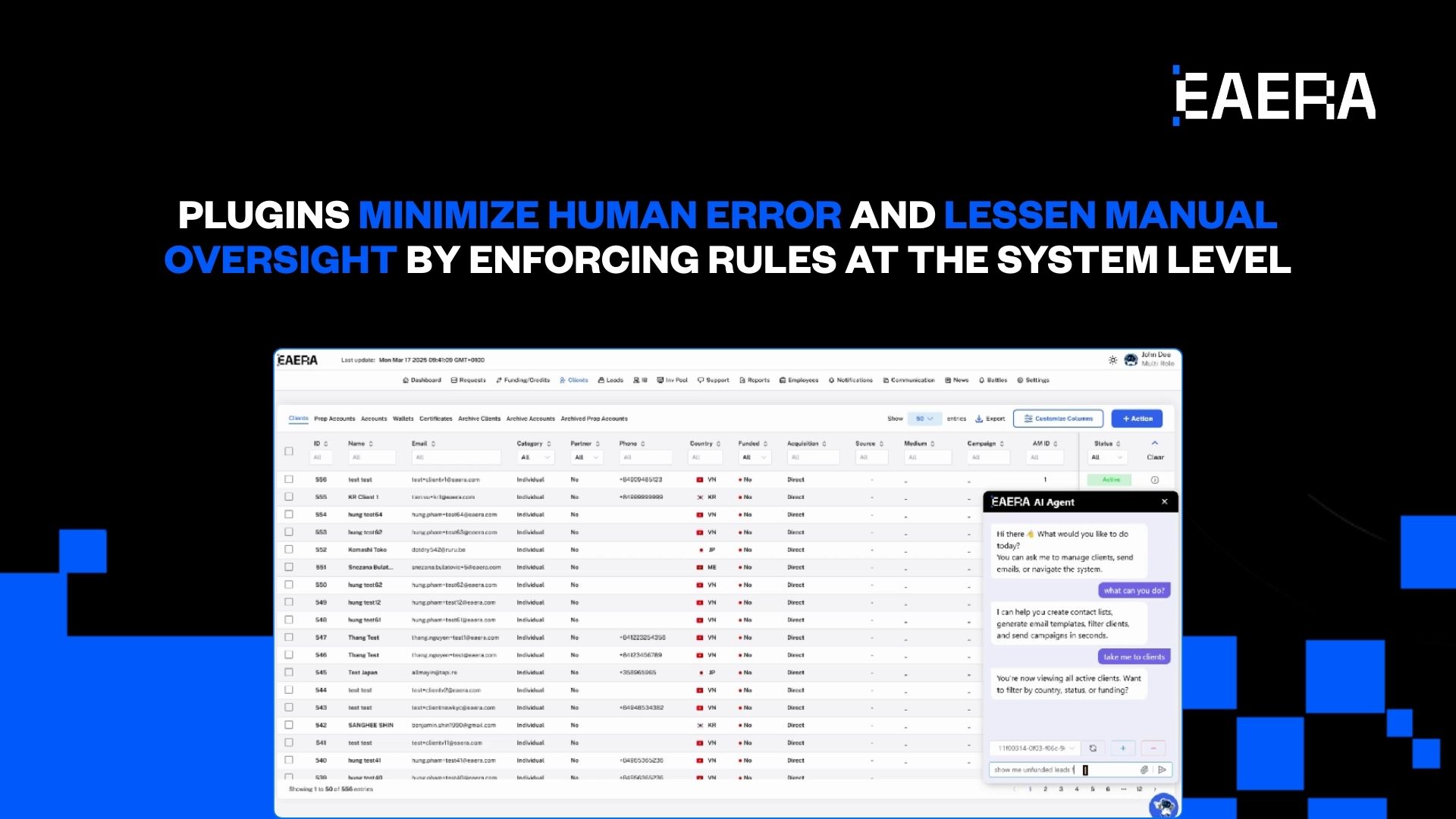

Operational Governance and Control

A plugin for MT5 is essential to governance in addition to speed and automation. Plugins minimize human error and lessen the need for manual oversight by enforcing rules at the system level.

This is particularly crucial in settings where several users, accounts, or tactics are used concurrently. Fairness, consistency, and operational clarity are guaranteed by centralized rule enforcement—qualities that are challenging to uphold through manual procedures alone.

Additionally, reporting and analysis are made simpler by governance-driven automation, which facilitates comprehension of how and why particular results occur.

Key Considerations Before Adopting a Plugin for MT5

Not all plugins for MT5 are useful. Careful consideration must be given to compatibility, security, and stability. Plugins with poor design can add latency, raise system risk, or make maintenance more difficult.

Update cycles and long-term support are additional factors to take into account. Automation changes as the trading platform does; it is not a one-time setup. Crucially, increased automation does not always translate into improved outcomes. Every plugin should have a specific, quantifiable function in the trading process.

Effective automation differs from needless complexity due to careful implementation.

Plugin for MT5 vs Other Automation Methods

A plugin for MT5 is more concerned with execution and operations than trading logic, in contrast to EAs. Although external automation tools can provide flexibility, they frequently result in extra integration points and possible delays.

Plugins are usually selected when control, dependability, and execution of proximity are important considerations. Because of this, they are particularly well suited for automation at the infrastructure level as opposed to developing experimental strategies.

Organizations can select the best automation strategy for their unique requirements by being aware of these differences.

The Future of MT5 Automation

Deeper integration and centralized control are key components of MT5 automation’s future. Automation becomes more about sustainability and less about convenience as trading operations grow.

Plugins will increasingly act as layers of coordination, connecting risk management, governance, and analytics with execution. According to this model, a plugin for MT5 is a structural part of an established trading infrastructure rather than a shortcut.

Automation will enhance human judgment rather than replace it, resulting in systems that are quicker, more reliable, and simpler to scale over time.