In the fast-paced world of proprietary trading, having the right tools to manage traders, monitor performance, and ensure compliance is crucial. A powerful prop firm CRM (Customer Relationship Management system) is no longer optional—it’s essential for scaling efficiently and maintaining control. The right prop firm CRM streamlines onboarding, automates payouts, centralizes trading data, and supports real-time decision-making. In this article, we’ll explore the must-have features every prop trading CRM should offer to help firms stay competitive, agile, and profitable.

1. Seamless Trader Onboarding and Account Management

For any proprietary trading firm, efficient trader onboarding is critical to maintaining momentum and capturing opportunities. A prop firm CRM should facilitate automated KYC/AML checks, real-time document verification, and instant approvals—ensuring traders get started without unnecessary delays.

One UK-based forex prop firm dramatically improved its onboarding process by adopting a prop firm CRM with built-in compliance automation. As a result, account approval times dropped from 48 hours to just 6, greatly enhancing trader satisfaction. By integrating the prop firm CRM with prop trading platforms, the firm streamlined the entire journey from sign-up to live trading—reducing manual workloads and improving overall operational efficiency.

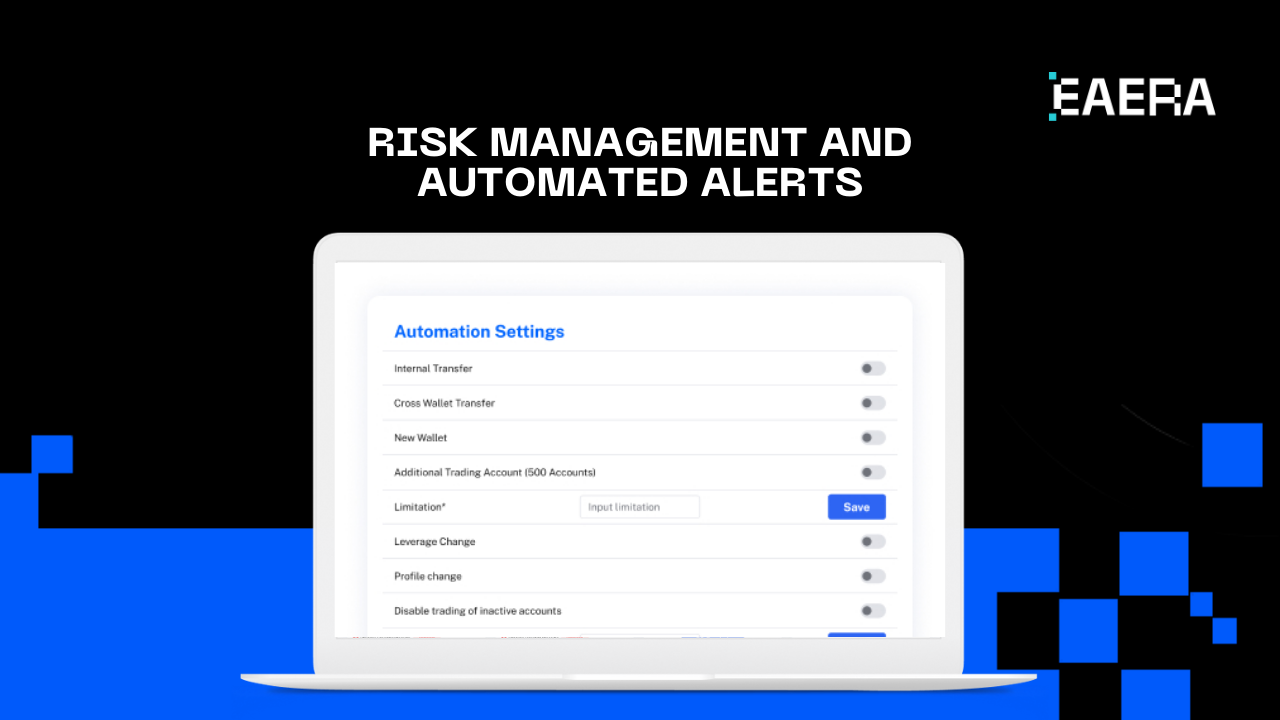

2. Risk Management and Automated Alerts

Risk management is a foundational component of any successful proprietary trading business. A prop firm CRM must include robust, real-time risk monitoring tools that track leverage, drawdowns, trade limits, and more. Automated alerts within the CRM enable risk managers to respond immediately when traders breach predefined thresholds—helping to prevent avoidable losses.

One U.S.-based firm reduced capital losses by 35% after implementing a prop firm CRM equipped with intelligent risk alert systems. The platform automatically flagged risky behavior, allowing swift intervention before accounts were compromised. With a reliable prop firm CRM, firms can enforce consistent risk parameters, protect capital, and give traders clear, enforceable boundaries to operate safely.

3. Performance Tracking and Analytics

To stay competitive, prop trading firms need deep visibility into trader performance. A prop firm CRM should offer detailed analytics on win/loss ratios, profitability, trading frequency, and strategy effectiveness—all from a unified dashboard. With centralized performance tracking, firms can make informed decisions about scaling traders, allocating capital, and providing targeted support.

One top forex prop firm boosted trader profitability by 20% after integrating AI-powered analytics into its prop firm CRM. The system identified key performance patterns, enabling personalized coaching and timely adjustments. A fully equipped prop firm CRM doesn’t just track results—it empowers firms to discover high-performing traders and build long-term success based on actionable data.

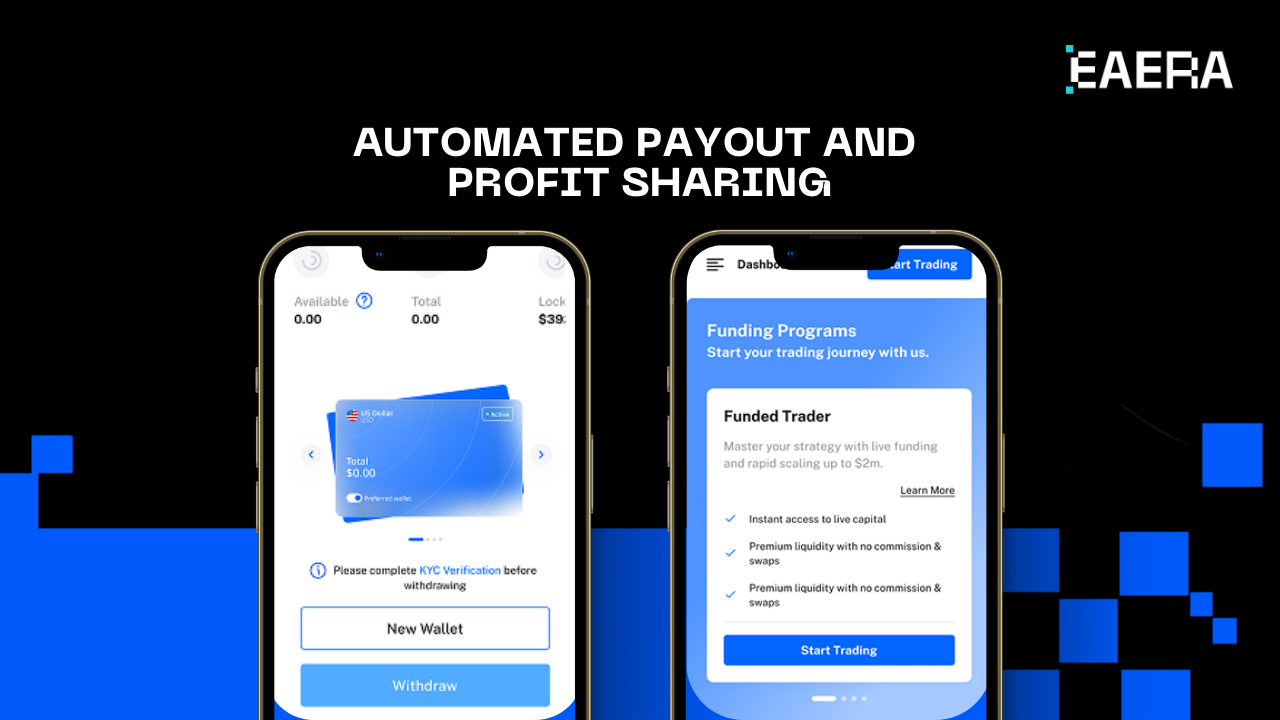

4. Automated Payout and Profit Sharing

Timely and accurate profit distribution is essential for building trader trust and loyalty. A prop firm CRM should automate payout calculations and disbursements based on predefined rules, eliminating manual errors and reducing the potential for disputes. Transparent and automated profit sharing ensures that traders are compensated fairly and on time.

A Singapore-based prop trading firm cut payout-related disputes by 50% after adopting a prop firm CRM with real-time dashboards showing individual profit shares and withdrawal statuses. Traders appreciated the transparency, which led to higher engagement and retention. With an advanced prop firm CRM, firms can streamline financial operations, reduce administrative burdens, and focus more on growth and trader development.

5. Multi-Platform and Multi-Account Integration

Prop firms often work with multiple prop trading software platforms, including MetaTrader 4, MetaTrader 5, and cTrader. A strong prop firm CRM should integrate seamlessly with these platforms, ensuring smooth data flow between trading accounts and back-office operations. The ability to manage multiple trader accounts within a single system is essential for firms looking to scale efficiently.

A Dubai-based prop trading company improved execution efficiency by 30% after integrating its prop firm CRM with multiple trading platforms. Previously, traders submitted reports manually, causing delays and errors. The new prop firm CRM enabled automated trade data syncing, streamlined reporting, and faster access to accurate analytics. For firms aiming to scale, a multi-platform-compatible prop firm CRM is essential to maintaining control and performance across all trading environments.

6. Customizable Prop Firm CRM Dashboard

Every proprietary trading firm has unique workflows, which means flexibility is key. A prop firm CRM should offer a customizable dashboard that adapts to different trading models, reporting structures, and organizational needs. From setting user permissions to configuring data views, customization ensures that each team—whether compliance, risk, or trading—has access to the most relevant information.

A European firm improved trader satisfaction by 25% after deploying a prop firm CRM with role-based dashboards. Traders, risk managers, and admins each accessed tailored interfaces, eliminating information overload and boosting efficiency. With a fully customizable prop firm CRM, firms can align their technology with business goals and streamline collaboration across departments.

7. Trader Evaluation and Challenge Systems

Many prop firms use evaluation programs to assess traders before allocating funding. A well-designed prop firm CRM should include features that automate challenge tracking, rule enforcement, and progress updates. This eliminates manual monitoring and ensures consistency in evaluation criteria.

An Australian firm increased trader retention by 40% after implementing a prop firm CRM that automated its evaluation and challenge programs. The CRM provided real-time updates and automatically verified when traders met funding criteria. By streamlining this process, the prop firm CRM not only saved time but also created a transparent and motivating path from evaluation to funding.

8. AI-Powered Trading Insights and Automation

Artificial intelligence is transforming the way proprietary trading firms operate. A modern prop firm CRM should leverage AI to analyze trader behavior, flag high-risk strategies, and automate compliance tasks. These insights empower firms to make smarter decisions around capital allocation, risk exposure, and trader development.

A London-based forex prop firm forex used AI-driven prop firm CRM analytics to adjust risk exposure dynamically. By identifying patterns in trader performance, they optimized funding allocations, resulting in a 22% increase in firm-wide profitability. An AI-enabled prop firm CRM not only drives smarter analytics but also ensures firms stay ahead of market shifts. For firms aiming to scale intelligently, an AI-powered prop firm CRM offers a critical competitive edge.

9. Security and Compliance Management

Given the high volume of financial transactions and personal data handled by prop trading firms, security is a top priority. A prop firm CRM must include data encryption, multi-factor authentication, and compliance tracking to prevent fraud and unauthorized access.

A Hong Kong-based trading software provider reduced unauthorized account breaches by 60% after integrating advanced security protocols into its prop firm CRM. Compliance tools within the CRM also helped the firm stay aligned with evolving international regulations. By choosing a secure prop firm CRM, firms can mitigate fraud risks, protect client data, and ensure full regulatory compliance—without slowing down operations.

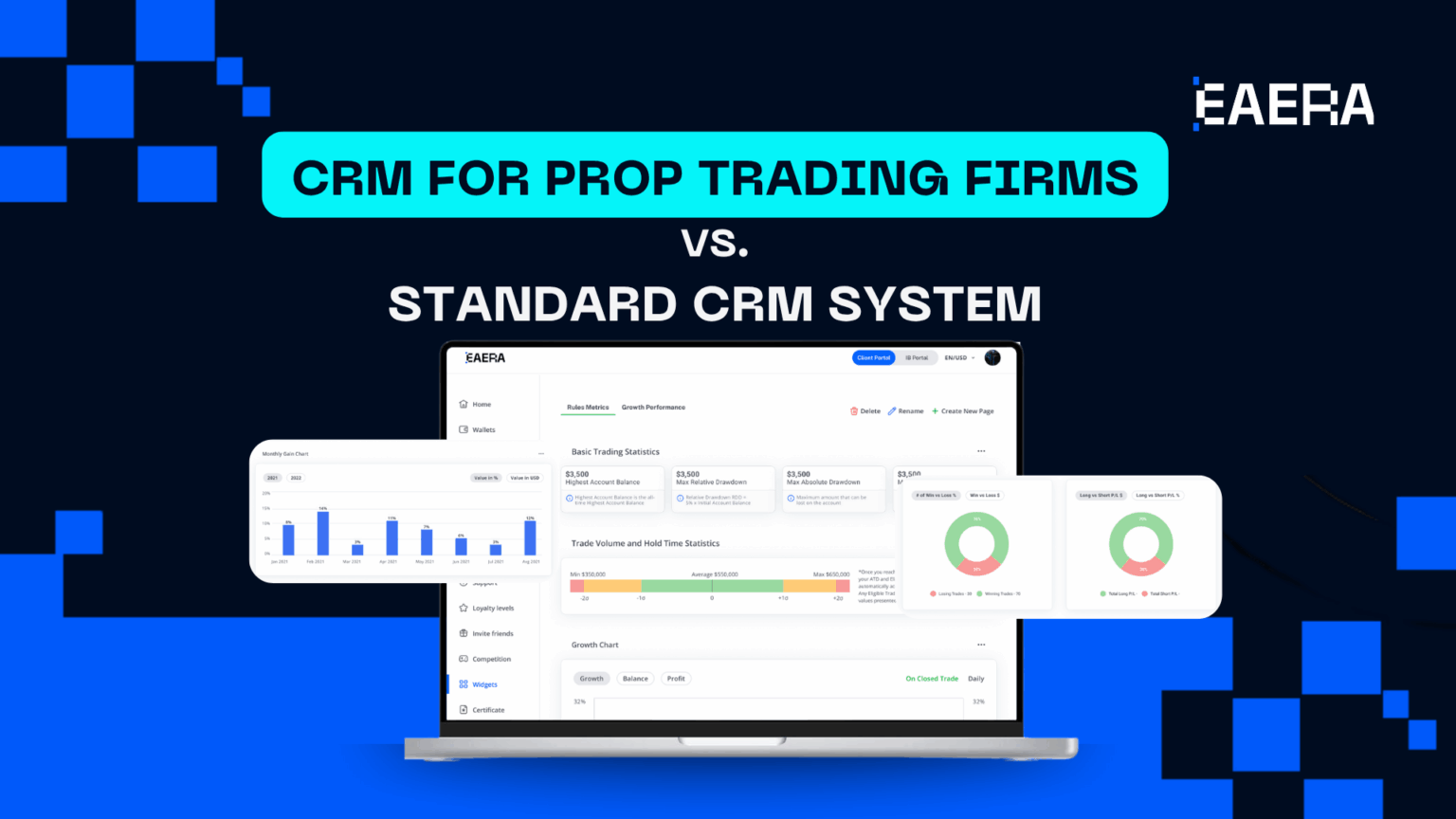

Why EAERA Offers the Best Prop Firm CRM Solution?

Choosing the right prop firm CRM is a game-changer for any prop trading company. EAERA provides a state-of-the-art prop firm CRM system designed specifically for prop firms, offering seamless integration with multiple trading platforms, AI-powered risk management, automated trader evaluations, and real-time analytics. With EAERA’s customizable prop trading dashboard, firms can scale efficiently while maintaining compliance and optimizing risk management.

EAERA’s advanced prop firm CRM is built for modern prop trading firms looking to streamline operations and maximize trader performance. Contact us today to discover how our technology can transform your firm’s success.