Technology is now the primary differentiator that determines a firm’s success in the fast-paced world of proprietary trading. Prop trading dashboards are more than just reporting tools; they are command centers that enable businesses to track performance, control risk, and inspire traders with transparent data.

Dashboards with interactive leaderboards and real-time risk alerts are becoming indispensable as trading firms grow internationally and depend more on automation. They foster a culture of accountability and healthy competition among traders in addition to safeguarding businesses’ capital.

Related articles:

- Prop Trading Solutions: Key Features and Top Provider

- Prop Firm CRM: What are the must-have features?

What Is a Prop Trading Dashboard?

A prop trading dashboard is a single, easily navigable interface that compiles trading data from several platforms. Key performance indicators (KPIs) like profit and loss (P&L), drawdown, leverage, margin usage, and compliance metrics can all be tracked in real time by traders, risk managers, and administrators.

The dashboard gives traders information about their performance, open positions, and advancement toward profit goals. By keeping an eye on exposure and guaranteeing adherence to company-wide policies, risk managers acquire a macro-level perspective. Administrators and business owners can examine the overall profitability and efficiency of trading in the interim.

The combination of automation, analytics, and accountability distinguishes a prop trading dashboard from conventional trading interfaces. It interprets data in addition to visualizing it, providing insights and alerts that facilitate proactive decision-making throughout the company.

The Role of Risk Alerts in Prop Trading

Risk management is crucial in the high-stakes world of proprietary trading. What sets sustainable businesses apart from transient ones is their capacity to identify, react to, and manage risk exposure in real time. Risk alerts are useful in this situation.

Risk alerts act as the early warning system within a prop trading dashboard. Long before they result in monetary losses or rule infractions, they automatically alert traders and risk managers when crucial thresholds are crossed.

Conventional risk management is based on reactive strategies, which address problems only after they arise. However, proactive and predictive control are necessary in contemporary prop trading environments.

Common alert types consist of:

- Equity or Balance Alerts: Triggered when an account gets close to or exceeds a predetermined loss limit

- Leverage Alerts: Notify traders when their leverage ratios surpass the allowed

- Daily Loss and Drawdown Alerts: Preserve capital by implementing regular risk management procedures.

Common types of alerts

Smart automation is integrated into modern dashboards to detect unusual trading patterns, flag risks instantly, and send alerts via email, dashboard pop-ups, or even Slack and Telegram notifications.

Risk alerts enable businesses to take early action, safeguard profitability, and uphold stringent compliance by converting unprocessed trading data into actionable signals. In addition to protecting capital, this intelligent control system fosters discipline and trust among traders.

Leaderboards: Driving Motivation and Transparency

Leaderboards are meant to motivate performance, whereas risk alerts concentrate on safety. They add a layer of competition and transparency to trading, which inspires people and improves the overall performance of the company.

Top-performing traders are displayed on a leaderboard in a prop trading dashboard according to metrics such as ROI, win rate, consistency, or risk-to-reward ratio. Leaderboards encourage accountability and recognition while gamifying performance by displaying accomplishments.

One characteristic that distinguishes all professional trading environments is transparency. By making performance visible, verifiable, and comparable, a leaderboard makes that idea a reality.

Accountability inevitably arises when traders are able to view their position in real time. Every transaction, action, and outcome leads to a discernible result, promoting self-control and discouraging careless choices.

Leaderboards are an impartial assessment tool for company managers. They can evaluate traders using consistent data points across equity growth, drawdowns, risk ratios, and trade volume rather than depending only on subjective performance reviews.

The benefits go beyond motivation:

- Transparency: Traders promote a culture of fairness by knowing what constitutes “good performance”

- Community Engagement: Open ranking systems promote healthy competition and peer learning.

- Marketing Power: By showcasing their top-performing traders as brand ambassadors, prop trading firms can increase industry credibility.

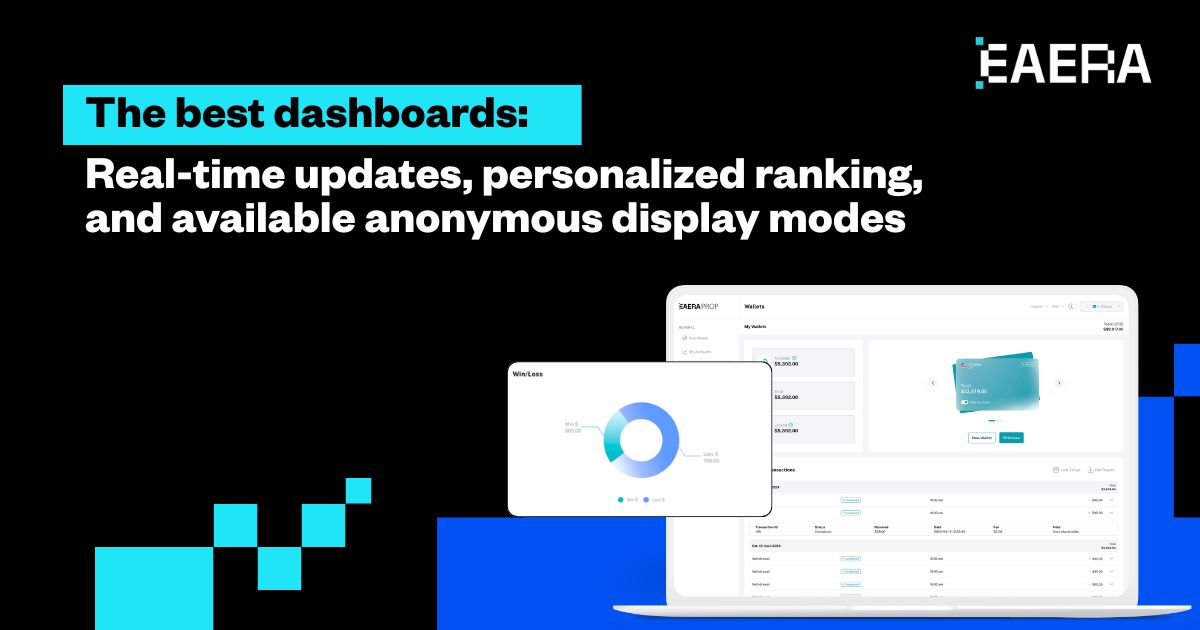

Real-time leaderboard updates, personalized ranking filters, and anonymous display modes for privacy when needed are all features of the best dashboards.

Features of the best dashboards

Integrating Risk Alerts and Leaderboards: The Smart Prop Trading Dashboard

The prop trading dashboard transforms a management tool into a strategic ecosystem when risk alerts and leaderboards are integrated into the same system.

This is how integration adds value:

- Risk alerts enforce compliance and capital protection, which keeps discipline.

- Leaderboards serve to strengthen trader engagement, motivation, and transparency.

When combined, they produce a trading environment that is self-sustaining and based on accountability, trust, and performance data.

A contemporary prop trading dashboard typically includes three core layers:

- Data Engine: Gathers real-time trading data through API integrations, MT5, or cTrader.

- Analytics Layer: Analyzes trend patterns, performance metrics, and risk ratios.

- Alert & Visualization Layer: Shows leaderboards and sends out instant alerts when thresholds are reached.

Businesses can monitor hundreds of traders at once with this structure while still ensuring smooth scalability and compliance.

The dashboard’s capacity to predict risk, adjust to trader behavior, and dynamically display insights will characterize the next phase of proprietary trading as automation and artificial intelligence continue to advance.

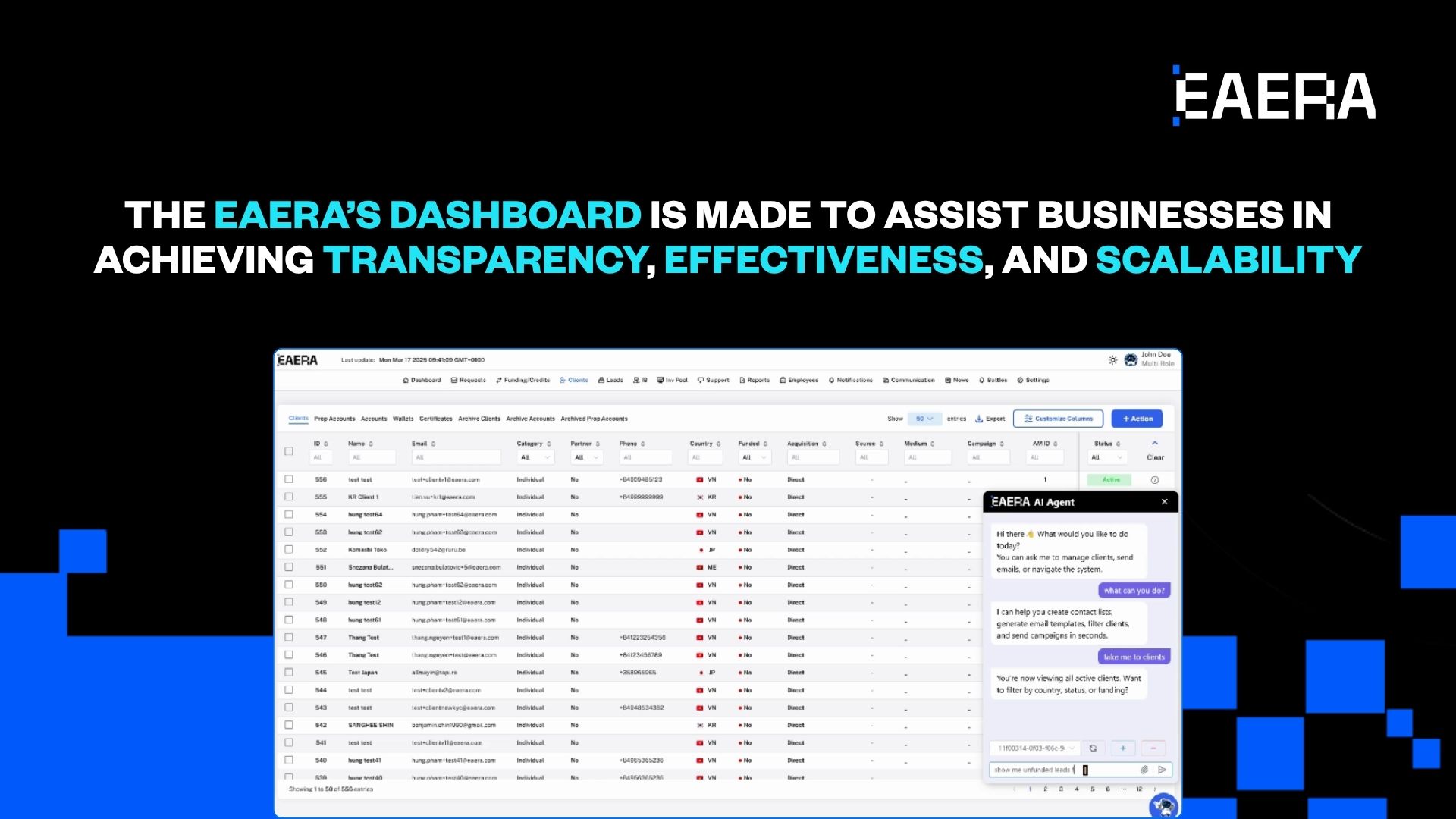

EAERA’s Approach: Building Smarter Prop Trading Ecosystems

At EAERA, precision and innovation coexist. The prop trading dashboard from the company is made to assist businesses in achieving complete transparency, effectiveness, and scalability.

The EAERA’s dashboard aims to achieve transparency, effectiveness, and scalability

EAERA’s system is based on a modular, API-driven architecture that incorporates:

- Customized Risk Parameters: Alerts for drawdown and leverage are made to fit the policies of individual firms.

- AI-Powered Analytics: Automates reporting and finds trading irregularities.

- Real-Time Leaderboards: Show rankings and performance indicators for funded or challenging accounts.

- Cloud-Based Infrastructure: Guarantees speed and dependability at the institutional level.

The EAERA dashboard facilitates decision-making in addition to tracking trading. Businesses can increase trader accountability, manage risk more efficiently, and lessen the manual labor of risk managers by implementing automation.

EAERA gives prop trading firms the digital platform they need to grow with confidence in a market that is becoming more data-driven by combining risk management and motivation.

Smart dashboards that blend transparency and intelligence are the way of the future for proprietary trading.