Admin System

for Prop Firm

An Admin System for a proprietary trading firm is designed to centralize management, streamline operations, and ensure compliance while providing a real-time overview of firm-wide performance.

Admin System

for Prop Firm

Features

Our Admin System’s best features

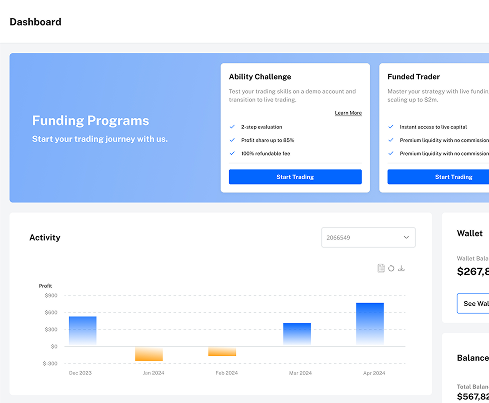

Dashboard Overview

Display real-time metrics like active accounts, evaluation progress, P&L, and payouts, monitor daily loss and firm-wide risk exposure, and offer quick links for compliance checks, payouts, and account creation.

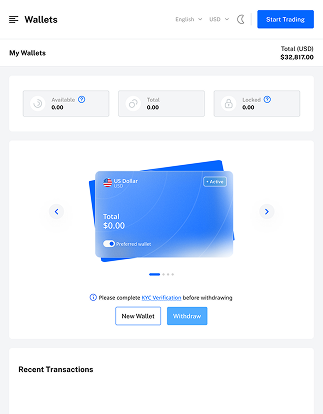

Trader Management

Enable traders to manage multiple evaluation or funded accounts from one dashboard, view account status and progress milestones, monitor real-time leverage, equity, and margin levels, and track compliance with trading rules like drawdown and daily loss limits.

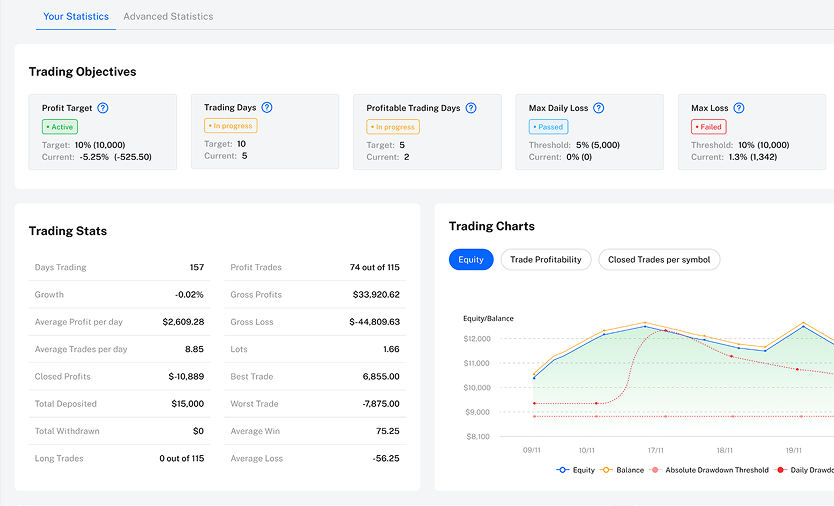

Risk Management

Monitor firm-wide exposure, including open positions and margin levels, set risk alerts for thresholds like drawdowns, integrate with liquidity providers, and enforce trader limits by account type or evaluation phase.

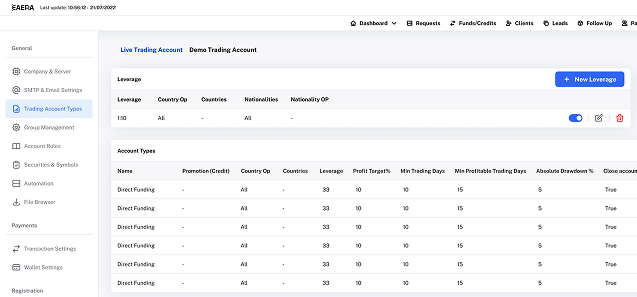

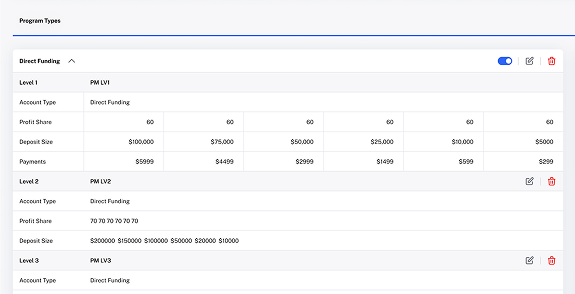

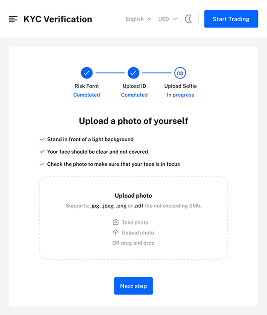

Evaluation Management

Define evaluation rules like profit targets and drawdown limits, track trader progress with automated alerts, promote successful traders to funded accounts, and manage account resets with fee tracking.

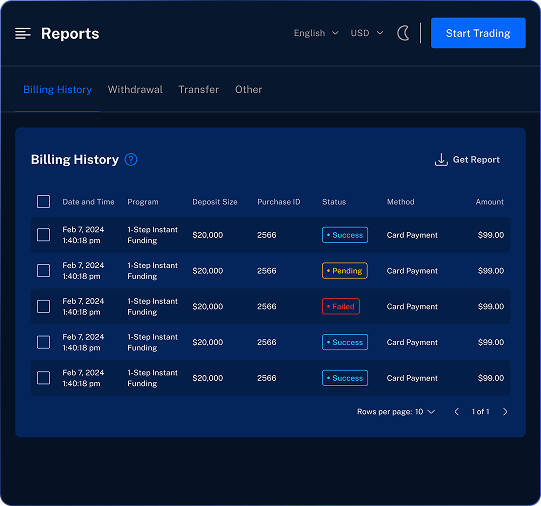

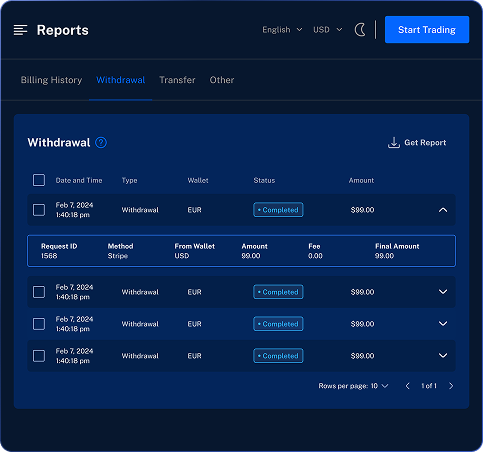

Payout and Financial Management

Manage payout requests with automated profit split calculations, track firm revenue, access detailed payment histories, and monitor deposits, evaluation fees, and reset fees in real time.

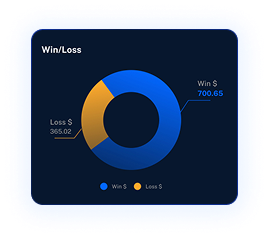

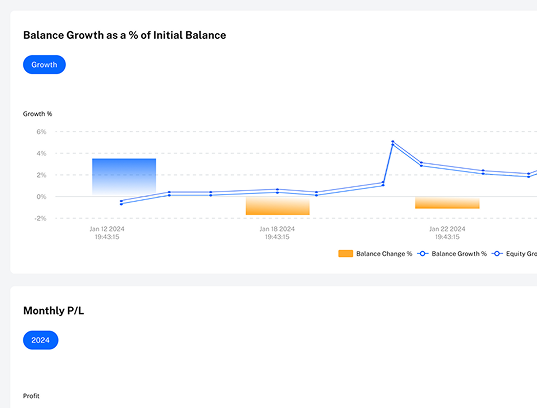

Reporting and Analytics

Generate detailed reports on trader profitability, evaluation success rates, and P&L, track revenue from fees and performance, monitor affiliate contributions, and create customizable dashboards with relevant data for admins.

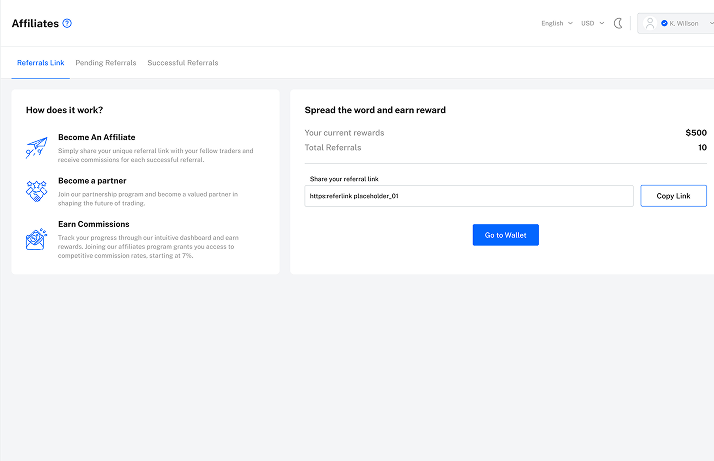

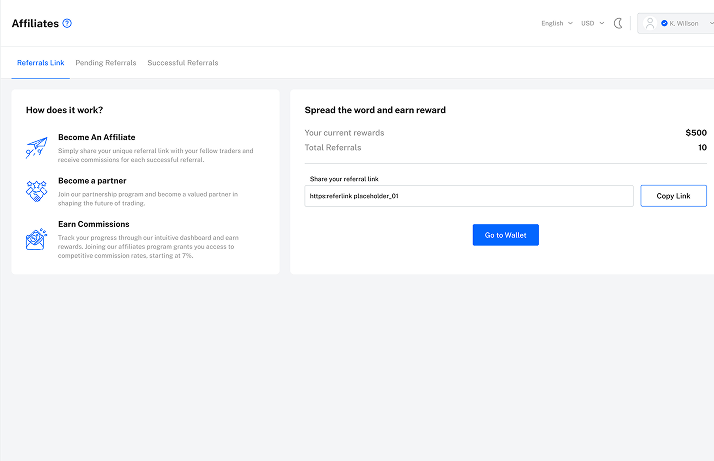

Affiliate and IB Management

Display funded account status, including upgrades or resets, offer one-click payment options for evaluation resets, and notify traders when they qualify for higher funding levels based on performance.

Scalability and Customization

Enable white-label customization to match firm branding, ensure scalable infrastructure for growing trader bases and activity, and adapt workflows to meet specific operational needs or regional regulations.

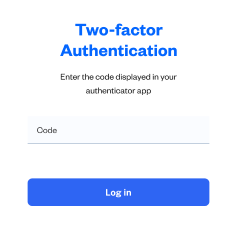

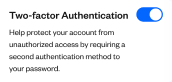

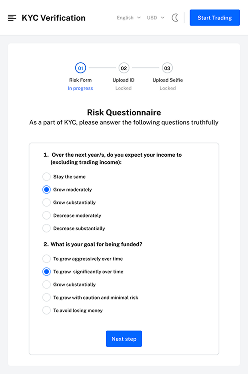

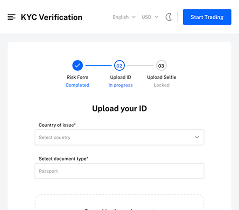

Multi-Tier Access and Permissions

Assign tasks to compliance officers, support staff, or managers, automate notifications for rule violations and milestones, and optimize processes by automating KYC checks, evaluation reviews, and payout approvals.

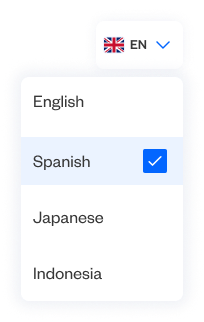

Multi-Language and Multi-Currency Support

Offer admin features in multiple languages for global operations and support multi-currency transactions and payouts with real-time conversion rates.

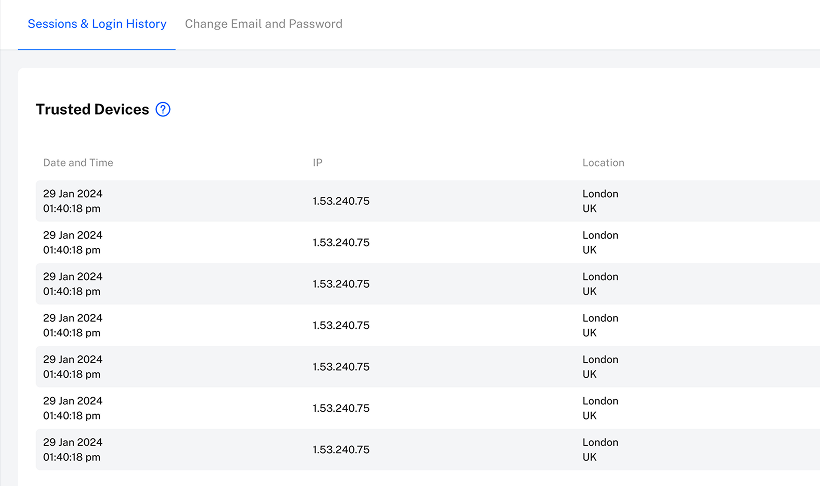

Fraud Detection and Prevention

Detect unusual trading patterns, multiple account usage, or potential fraud with suspicious activity alerts, enable manual trade reviews for flagged accounts, and notify admins of rule breaches or fraud in real time.

Integration Capabilities

Sync real-time trading data with MT4, MT5, or proprietary platforms, integrate payment gateways like Stripe and PayPal for automated processing, connect third-party tools via APIs, and enhance decision-making with risk management and analytics integrations.

Trader Communication

Send bulk updates or notifications to specific trader groups, enable in-app messaging for personalized communication, and manage trader support tickets with real-time resolution tracking.

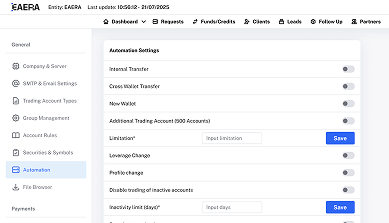

Workflow Automation

Automate workflows for account approvals and verifications, create custom rules for exceptions like high-risk transactions, and optimize back-office operations to reduce manual workload and improve accuracy.

Trader Communication

Send bulk updates or notifications to specific trader groups, enable in-app messaging for personalized communication, and manage trader support tickets with real-time resolution tracking.