The importance of branding in Fintech

July 6, 2021

Forex Sales Team – How to choose and train the right people?

September 2, 2021An effective risk management solution is one of the essential ingredients in the success of a forex brokerage business. Companies and organizations use risk management systems to track claims and risk information, analyze and report on data, monitor and control the overall cost of risk supervision.

Assuming you’re a brokerage reading this, you’re probably aware of the many risks associated with this unpredictable market. Exchange rates, margin or leverage, political influences, interest rate changes, credit risks, currency depreciation, fraud, operational risks, or toxic client strategies, can all harm your company’s overall performance.

You’ve realized that your organization requires a risk management system. Great! But how do you know which system is suitable for you? You must select a system that is appropriate for your company and simplifies rather than complicates your workflow.

Types of risk

Due to the speed of changes and innovation, new risks are constantly emerging.

Cross-border transactions are typically conducted at a high transactional speed, which is a valuable Fintech tool. Still, it will also require you to adapt to greater risk assessments to meet such fast changes. The following are some of the risks that must be effectively managed:

- Fraud risk

- Merchant risk

- Regulatory risk

- Anti-money laundering and countering terrorist financing

- Consumer risks

- Cybersecurity and data privacy

- Credit risk and operational risk

- Outsourcing risk

The implementation of a solid risk management system promotes financial stability. Internal risk management controls, in particular, provide four critical functions:

- Protection against the market, credit, liquidity, operational, and legal risks;

- Protection of the financial industry from systemic risks;

- Customers’ protection from significant non-market losses (e.g., firm failure, misappropriation, fraud, etc.);

- Reputational risk protection for the company and its franchisees.

Risk management and controls that are safe and effective support both securities firm and industry stability, instilling confidence in the investing public and counterparties. Firms with sound risk management internal control systems have economic and commercial incentives to do so. A company is subject to danger if it lacks such measures.

Risk Assessment of Customers

Prior to establishing a relationship with a customer, a broker should analyze the risks of doing business with the former. These risks should be monitored on a frequent basis throughout the relationship. The following areas should be considered by a broker in general:

- the customer’s type (e.g., institutional or retail) and the associated level of expertise and complexity;

- the customer’s creditworthiness, as determined by the broker/established intermediary’s credit rules and processes;

- the customer’s legal authorization (including apparent authority) to carry out its intended trading activities, as well as the capacity of the personnel responsible for the trading.

Customers’ financial situations should be monitored and appropriate decisions made by people and business units inside the broker/intermediary who are not directly compensated based on the volume or profitability of trading done by customers.

Brokers should create and enforce rules and processes for collecting customer margin promptly (unless proper credit arrangements are in place) and liquidating customer accounts (or taking other appropriate action) when necessary.

Policies for account opening and trading via omnibus and introduced accounts should be created and implemented by brokers, understanding the potential brokers’ exposure from such accounts.

Brokers/intermediaries should establish risk management procedures for trading by affiliates carried on their books. Such procedures should include, among others, position limits for affiliates’ trading activities based on their financial status.

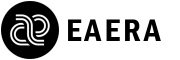

Our solution: EAERA Risk

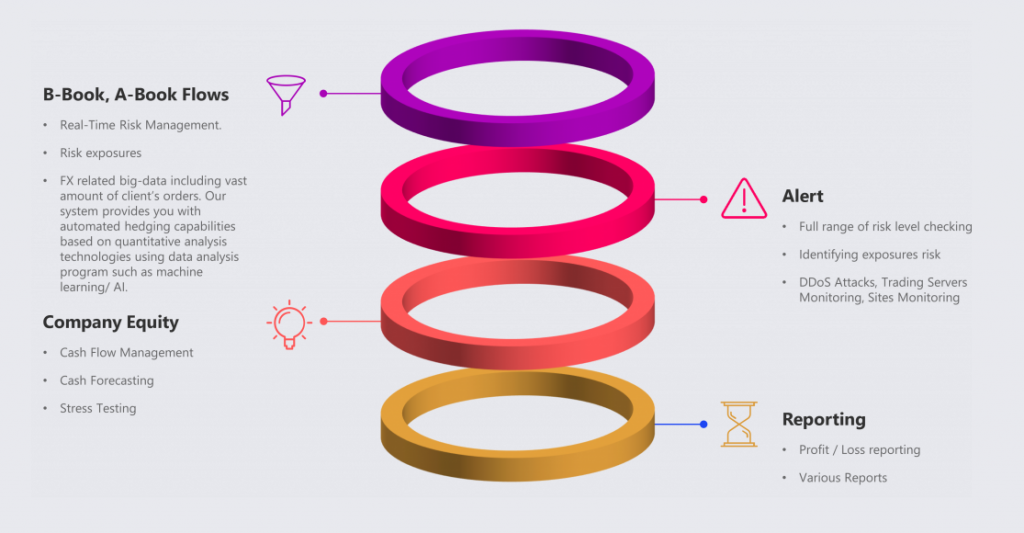

Risk management is the process of identifying, assessing and controlling threats to an organization’s capital and earnings. This process can be very challenging. But, with EAERA Risk, it will be much easier for your company to do so.

Our Risk Management platform provides data in real-time through a state-of-the-art streaming technology that enables the broker to pivot their view of risk through a full range of dimensions such as client, symbol, or book. It drills down to identify the key sources of risk and then automatically takes actions to mitigate that risk.

With EAERA Risk you get:

Real-time risk management

Instant overview of all of your client and proprietary positions and their associated risk aggregated across all of your trading servers.

Reporting

EAERA Risk collects trading data from all connected providers and generates advanced execution reports. Receive detailed statistics for liquidity providers and answer client execution complaints accurately.

Alerts and automated actions

Visual and audio alerts are triggered when there is a trade exception, position exception, or a connection issue. In addition, email warnings are sent to end users if there is a connection issue.

Contact us and find out more about EAERA Risk and how it can help you support your operations and boost your company’s performance.