In the fast-paced world of prop firm forex, managing risk in real time is no longer optional, it is essential. With trades moving in milliseconds and exposure fluctuating with every tick, proprietary trading firms need robust tools to maintain control.

That’s where CRM dashboards come in, offering real-time oversight, accountability, and actionable insights. This article explores why real-time risk monitoring is critical in the prop firm forex landscape and how CRM dashboards can give firms a competitive edge.

Related articles:

1. Why does a prop firm forex need to monitor real-time risk?

1.1 What is considered real-time risk?

In prop firm forex, real-time risk refers to the immediate exposure a firm faces during active trading sessions. This includes:

- Unrealized profit and loss (P&L)

- Open position sizes

- Margin usage

- Drawdown thresholds

- Leverage ratios

Each metric changes dynamically as trades execute. If left unchecked, small missteps can snowball into significant losses.

1.2 Why to monitor it?

Monitoring real-time risk in prop firm forex is vital for several reasons:

- Capital Protection: Early detection prevents catastrophic losses

- Trader Accountability: Tracks if traders stay within risk limits

- Compliance: Ensures regulatory adherence in real-time

- Operational Efficiency: Supports timely decisions without manual data pulls

Without active monitoring, prop firm forex operations become reactive rather than proactive—a dangerous approach in volatile markets.

2. How can CRM dashboards help with risk monitoring?

2.1 CRM dashboards: an indeed tool for forex players

Customer Relationship Management (CRM) tools have evolved far beyond client databases. In prop firm forex, modern CRMs integrate risk monitoring, compliance, trading activity, and performance analytics into a single platform.

For a prop firm forex, CRM dashboards offer:

- Real-time trading data updates

- Integrated analytics from multiple data sources

- Alert systems for risk limit breaches

- Historical data comparisons for strategy reviews

These features make CRM dashboards indispensable for managing daily operations in a prop firm forex environment.

2.2 How to use CRM dashboards to monitor real-time risk?

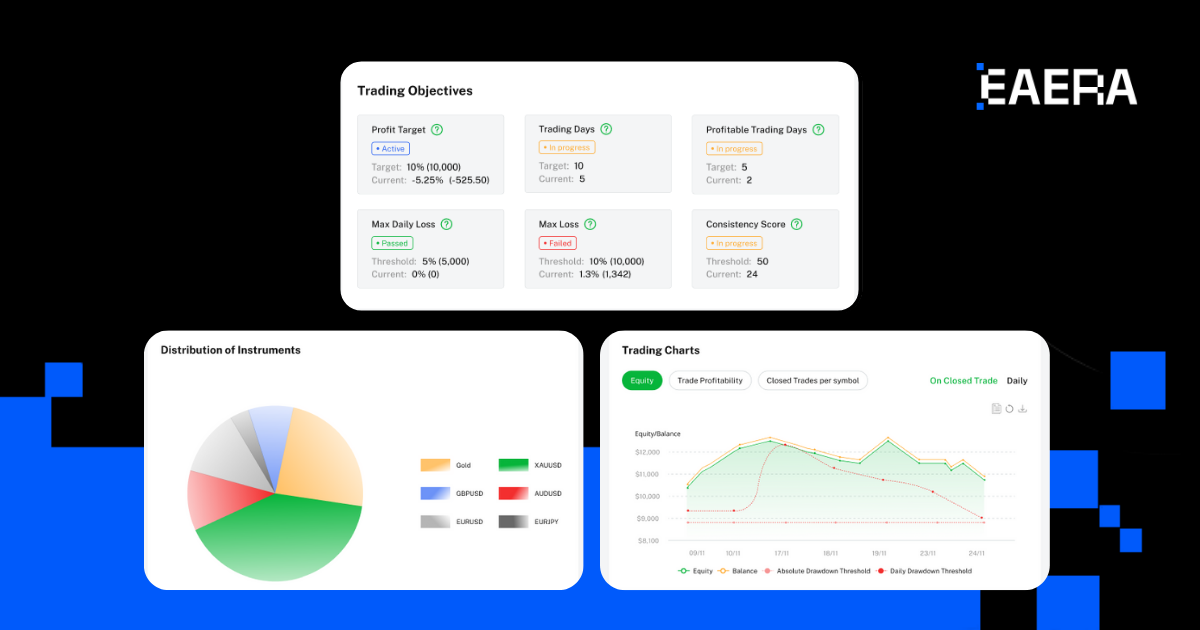

CRM dashboards are powerful tools for managing real-time risk in a prop firm forex environment. They give risk managers immediate insight into trading activity, performance trends, and rule violations which are essential for daily operations.

In prop firm forex, CRM dashboards do more than display data. They help firms react quickly to changing risk conditions and enforce controls automatically. Key functionalities include:

- Live Position Tracking: View open trades across all accounts, including size, direction, entry, and floating P&L. This helps prop firm forex teams detect high-risk exposure instantly.

- Risk Alerts: Get instant alerts when traders exceed limits like drawdown, leverage, or volume. Alerts reduce response time and help prevent larger losses in prop firm forex accounts.

- Trader Segmentation: Organize traders by level, strategy, or funding stage. This enables customized monitoring across all tiers in a prop firm forex structure.

- KPI Monitoring: Track metrics like equity, margin, win rate, and risk-reward ratios in real time. These indicators help assess both individual trader and firm-wide risk.

- Integrated Reporting: Generate reports from live and historical data with one click. In prop firm forex, this simplifies compliance and investor communication

- Rule Enforcement Tools: Automatically restrict trading if limits are breached. This protects capital in a fast-moving prop firm forex environment.

CRM dashboards turn real-time data into smart decisions. For any prop firm forex looking to scale safely while keeping risk in check, these dashboards are an essential part of the tech stack.

3. What to consider when choosing a CRM tool for your prop firm forex?

When selecting a CRM for your prop firm forex, not all tools are built alike. Here are key considerations:

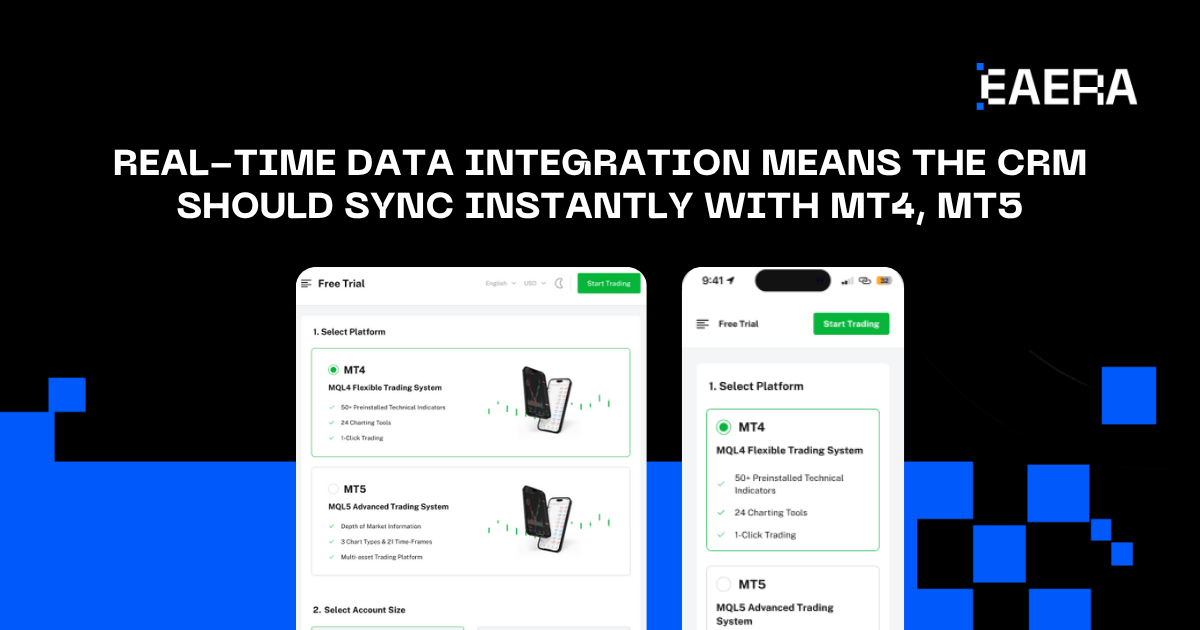

3.1 Real-Time Data Integration

Your CRM must connect seamlessly with trading platforms like MT4, MT5, or cTrader.

- Pull live position data instantly

- Sync account updates with zero delay

- Support real-time P&L and drawdown tracking: A prop firm forex needs data that’s accurate to the second—not minutes behind

3.2 Customizable Dashboards

Every prop firm forex has unique KPIs and workflows. Choose a CRM that lets you:

- Build tailored views for admins and risk officers

- Configure alerts based on your trading rules

- Create branded client portals with your firm’s identity

3.3 Scalability

As your prop firm forex grows, your CRM should grow with you. Look for:

- Multi-account support

- Cloud-based infrastructure

- Fast user onboarding tools

3.4 Security & Compliance

A reliable CRM protects sensitive data and helps your prop firm forex meet regulatory needs.

Ensure your CRM includes:

- Role-based access controls

- Encrypted data storage

- GDPR and KYC/AML compliance tools

3.5 Third-Party Integrations

A strong CRM ecosystem enhances your prop firm forex operations. It should easily connect with:

- Broker APIs

- Payment gateways

- Trader evaluation tools

Choosing the right CRM ensures your prop firm forex stays agile, compliant, and in control of real-time risk.

4. EAERA: Your prop firm forex solution for real-time risk monitoring

EAERA is designed specifically for prop firm forex, combining CRM excellence with cutting-edge risk monitoring tools. Our platform was built with proprietary firms in mind, ensuring every feature supports your real-world needs.

Key Benefits of EAERA for prop firm forex management:

- Real-Time Trading Data: Instant updates from MT4/MT5 accounts, essential for monitoring live risk in prop firm forex environments

- Dynamic Risk Alerts: Customize drawdown, leverage, and volume limits per trader

- Advanced User Permissions: Maintain strict control over who sees and does what

- Custom Dashboards: Design your interface to highlight what matters most

- Trader Performance Analytics: Evaluate every strategy, every day

Whether you’re running a remote trader model or a firm-wide desk, EAERA delivers complete visibility into all risk layers.

Why EAERA Stands Out:

- Built for prop firm forex—not repurposed from generic CRMs

- Supported by a team with deep FX and risk tech expertise

- Trusted by growing and established prop firms worldwide

Real-time risk monitoring is no longer a luxury—it’s a necessity in today’s prop firm forex landscape. The ability to track, interpret, and act on live trading data ensures your firm protects capital, maintains performance, and scales safely.

CRM dashboards are the ultimate command center for modern firms, allowing managers to monitor risk, compliance, and trader behavior from a single screen. But not just any CRM will do.

EAERA offers a purpose-built solution tailored for prop firm forex, giving you control, clarity, and confidence every step of the way. Ready to monitor smarter? Contact EAERA today and take your risk strategy to the next level.