In the fast-paced world of foreign exchange (FX) markets, the selection of FX trading platform is crucial for high-frequency trading (HFT), which uses ultra-low latency technology and algorithmic strategies to execute thousands or even millions of trades daily. According to industry research, HFT in FX focuses on exploiting minute price differentials, arbitrage opportunities, and fleeting market inefficiencies.

Related articles:

- 5 Best Practices FX Brokers Must Know for Back Office Software

- Choosing the Best CRM for FX Brokers: A Step-by-Step Guide

System architecture, connectivity, risk management, execution speed, and data feed integration are all matter. This article examines the key requirements of an HFT-capable FX platform, outlines core solution components, evaluates common challenges, and offers recommendations for trading firms looking to develop or implement such a platform.

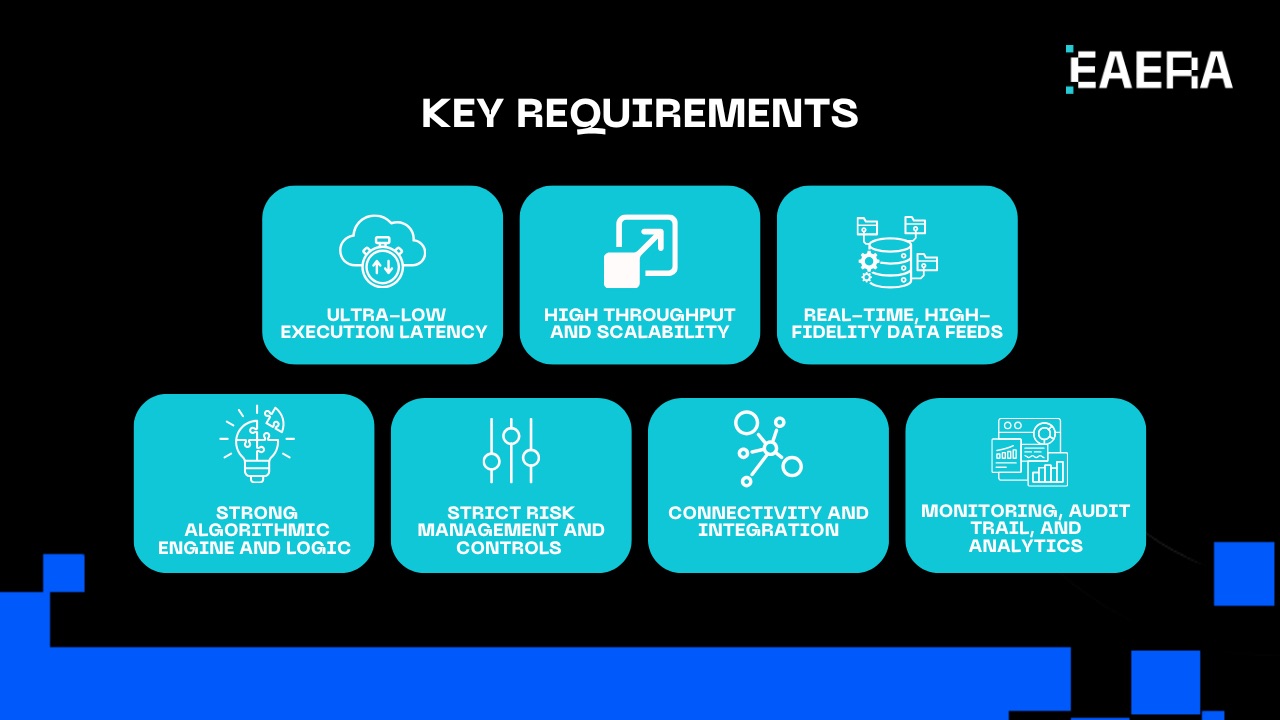

Key requirements for an FX HFT‐capable trading platform

When a firm target a fx trading platform in the FX space, the chosen one must satisfy some essential requirements:

– Ultra-low execution latency

HFT’s worst enemy is latency; winning trades frequently depend on outperforming rivals by a few microseconds. Therefore, flatforms designed for HFT must offer co-located servers, native FIX API connectivity, direct market access (DMA), and minimal internal processing delays. For instance, research indicates that HFT forex traders avoid retail-oriented platforms, prefer co-located servers and direct feeds.

– High throughput and scalability

HFT strategies generate extremely large volumes of orders per second. As a result, requirements for the system design include efficiency in processing and matching orders, book depth maintenance, cancelation and modification handling, and support for enormous tick-by-tick data loads.

– Real-time, high-fidelity data feeds

Obtaining clean, high-resolution market data (tick level, order-book depth, quote updates) and sending it to the algorithmic engine as quickly as possible are important for success. Internal data streaming and data subscriptions from Tier-1 liquidity providers must be supported by the platform.

– Strong algorithmic engine and execution logic

Strategy modules that react in micro/milliseconds, such as scaling, arbitrage, market-making, and latency arbitrage, must be supported by the platform. Algorithmic decision-making, instant order submission, cancellation, and conditional logic are all made possible by a flexible execution layer.

– Strict risk management and real-time controls

Risk can accumulate quickly in HFT. The platform must embed pre-trade and intra-trade risk controls, such as position limits, kill-switches, latency detection, and slippage monitoring, to safeguard capital and infrastructure.

– Connectivity and integration

It is crucial to integrate with essential external elements like order-routing systems, clearing networks, liquidity pools, co-location services, and FIX gateways. A qualified fx trading platform for trading firms must support multiple APIs (FIX, REST, WebSocket) and custom development in language (C++, Java, or Python).

– Monitoring, audit trail, and analytics

The platform must provide real-time monitoring (latency metrics, fill rates, slippage, failed orders), complete audit logs, and post-trade analytics to assess performance and adjust strategies due to the volume and speed of trades.

Chosen fx trading platform must meet some key requirements

Challenges and considerations

Deploying or adopting an FX HFT platform is complex and comes with important considerations.

- Cost and capital requirements: Co-location, low latency connectivity, algorithmic development, and liquidity access fees are all costly components of HFT infrastructure. Retail or smaller traders may find it difficult to compete.

- Broker and market limitations: Despite the widespread use, many retail platforms, such as MT4/MT5, may not offer the latency, throughput, or access that institutional-level HFT requires. Additionally, FX Fund Managers Brokers may also limit HFT strategies or impose higher fees for ultra-fast order flow.

- Latency variation and competitive edge erosion: The competitive advantage gets smaller as more participants use low-latency infrastructure. Maintaining a competitive edge requires continual investments in connectivity, algorithm development, and infrastructure.

Low-latency infrastructure – a competitive factor for participants

- Risk of technological failure and market impact: High-volume, high-speed trading increases operational risk, including system outages, network problems, algorithmic bugs, and black-swan market events. Devastating losses could result from a fx trading platform failure.

- Regulatory scrutiny and market fairness: HFT has been the focus of regulatory scrutiny in relation to order-book manipulation, latency arbitrage, and market fairness. Financial institutions must guarantee ethical execution and compliance.

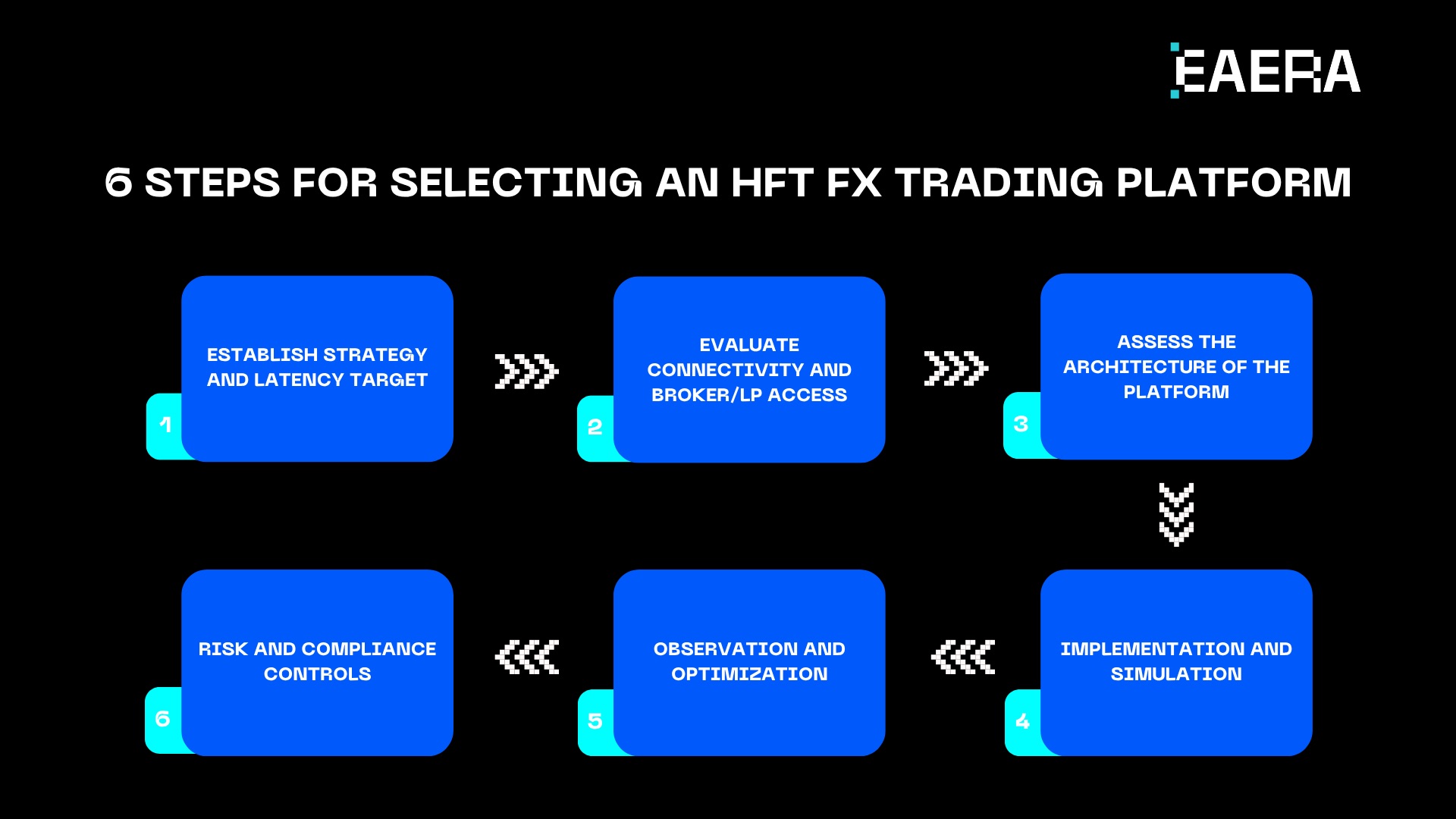

6 steps for selecting an HFT FX trading platform

The following actions are advised for firms or serious traders looking to apply HFT in FX trading platform:

Step 1: Establish strategy and latency target

Define the latency target (microseconds, sub-milliseconds) and the types of strategies you plan to run (market-making, arbitrage, and scaling). These components drive the infrastructure requirements.

Step 2: Evaluate connectivity and broker/LP access

Assure co-location facilities, FIX API, DMA/ECN connectivity, Tier-1 liquidity providers, and an order-routing architecture that minimizes slippage and facilitates high throughput.

Step 3: Assess the architecture of the platform

Compare vendors or in-house builds using following criteria:

- Benchmarks for latency (matching, routing, data-feed)

- Capacity of throughput (orders/second, cancellations/second)

- Rish controls in real time (kill-switches, latency thresholds)

- Open APIs for customizing and deploying strategies.

Step 4: Implementation and simulation

Conduct back-testing and simulation using realistic tick-data and latency models prior to go-live. Simulate trading in a co-located environment and stress-test the system under extreme load and volatility.

Step 5: Observation and optimization

After going live, keep an eye on strategy behaviors, risk exposures, and quality of execution (latency, slippage, and fill rates). Optimize algorithms, route orders more effectively, and remove bottlenecks with analytics.

Step 6: Risk and compliance controls

Establish robust risk controls (kill-switch, dynamic limits, and pre-trade filters), keep audit logs, and ensure that all applicable laws and governance frameworks are followed.

Suggested steps for choosing fx trading platform for your trading firm

EAERA’s Competitive Edge: Innovation Built for High-Frequency Trading

Milliseconds are a decisive aspect for success in the ultra-fast world of high-frequency trading. EAERA combines state-of-the-art speed, intelligent automation, and scalable infrastructure that is essential for traders to stay ahead. EAERA is specifically designed to meet the demands of contemporary trading by providing reliable performance and innovation.

Low Latency Architecture

EAERA’s proprietary trading engine is designed for microsecond-level execution, enabling traders to take advantage of market opportunities as soon as they present themselves. Every order reaches the market with the least amount of delay thanks to co-located data centers, optimized network routing, and direct liquidity access, providing HFT traders with the accuracy and responsiveness they need to compete.

AI-Powered Optimization and Smart Execution

EAERA uses real-time analytics and machine learning to improve risk management and order execution. Even during times of high volatility or market congestion, its AI-driven modules help HFT traders maintain optimal performance by automatically adjusting routing logic.

Adaptive technology and ongoing innovation

Constant innovation is the priority feature of EAERA’s development philosophy. The platform develops in tandem with shifts in trader demands, regulatory requirements, and market structure. EAERA incorporates cutting-edge technologies through active research and development as well as cooperation with partners, guaranteeing that its HFT clients always have access to next-generation trading capabilities.

EAERA is an HFT-optimized ecosystem that helps traders to outperform in the most robust financial markets globally.