The proprietary trading sector is about to enter a pivotal stage. By 2026, smart prop firms will no longer be specialized businesses supporting a select group of traders. These multinational companies prioritize digital technology and are onboarding thousands of participants from various time zones, asset classes, and geographical areas.

The definition of success has been drastically altered by this rapid growth. These days, operational speed, risk management, transparency, and scalability are just as important as actual trading performance.

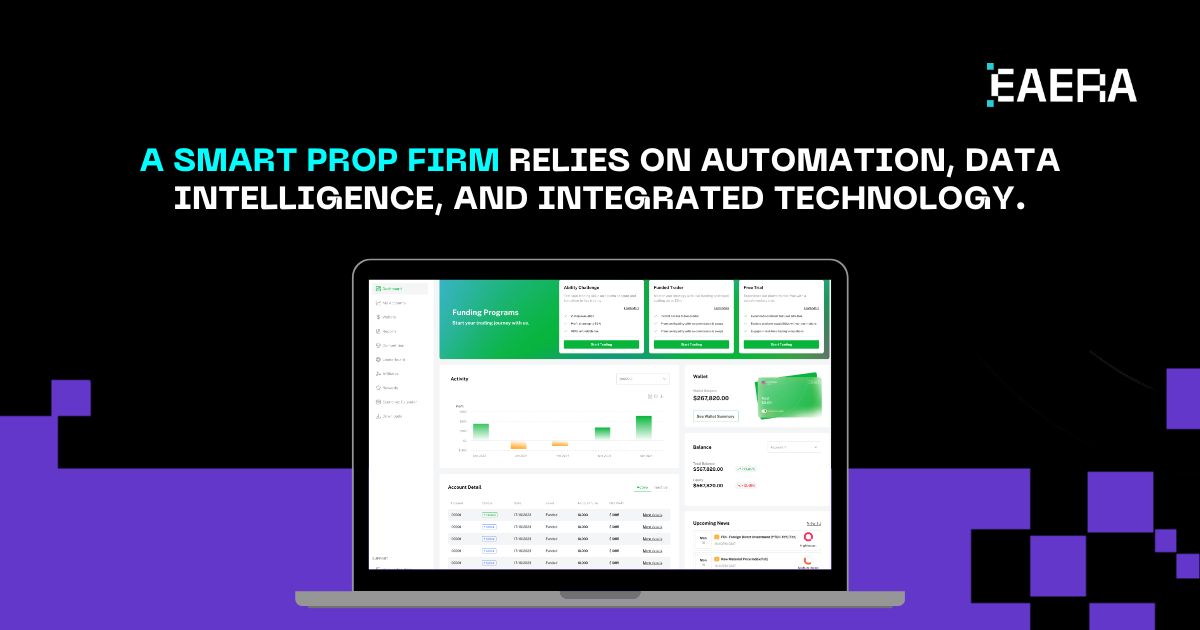

The idea of a smart prop company has become the new industry standard in this setting. A smart prop firm does more than just finance traders. This company uses automated workflows, intelligent systems, and real-time decision-making.

Related articles:

- Smart Prop Firm Solutions: AI, Risk, and Real-Time Funding

- Real-Time Risk Monitoring in Prop Firm Forex with CRM Dashboards

Technology is now the fundamental infrastructure that establishes whether a prop firm can develop sustainably in 2026 and beyond.

What Is a Smart Prop Firm?

A smart prop firm is a proprietary trading business that relies less on human oversight and more on automation, data intelligence, and integrated technology. A smart prop firm uses a centralized system to manage the entire trader’s lifecycle in real time, in contrast to traditional prop firms that rely on spreadsheets, manual reviews, and disjointed platforms.

Evaluation, funding, risk enforcement, compliance, performance analytics, and payouts are all handled by a single operating environment. The ability of the company to handle complexity without raising operational friction is what distinguishes it, not the quantity of traders funded.

In the smart prop firm, the rules are enforced automatically, the data is synched across all platforms, and the decisions made are driven by real-time insight rather than delayed reports. This enables firms to expand worldwide while still providing consistency, control, and integrity. By 2026, this is no longer a choice but is rapidly setting the standard for major players in prop trading.

Why Traditional Prop Firms Struggle to Compete in 2026?

Many prop companies continue to use antiquated processes that were created for much smaller operations. Reactive risk monitoring, delayed funding approvals, and manual evaluation reviews may be effective for dozens of traders, but they become ineffective when businesses try to scale into hundreds or thousands.

One of the most detrimental flaws is the absence of real-time visibility. Decision-making becomes sluggish and inconsistent when trader activity, risk exposure, and performance data are dispersed across several tools. Rather than preventing losses, risk teams respond to them after they happen. Delays, ambiguous regulations, and a lack of transparency cause traders to lose faith.

A smart prop firm, on the other hand, is designed to be proactive. Instead of responding after issues arise, it uses analytics and automation to anticipate problems. In 2026, traditional prop firms will find it more difficult to retain traders, manage risk, and sustain profitability due to this structural difference.

Core Pillars That Define a Smart Prop Firm in 2026

Intelligent Trader Evaluation and Funding Automation

Every smart prop firm starts with an automated evaluation engine. Rather than monitoring traders to see how much progress they make, the software looks at them against set criteria such as profit levels, drawdowns, and trading days.

As the traders proceed through the various levels of challenge, verification, and funding, the transitions occur automatically as soon as the required criteria are achieved. This means that accounts are created, money is transferred, and levels are assigned without human involvement.

More importantly, it removes delays. In the smart prop firm, eligible traders are funded instantly. This ensures that the process is smoother, and more conversions are seen from evaluation accounts to funded accounts.

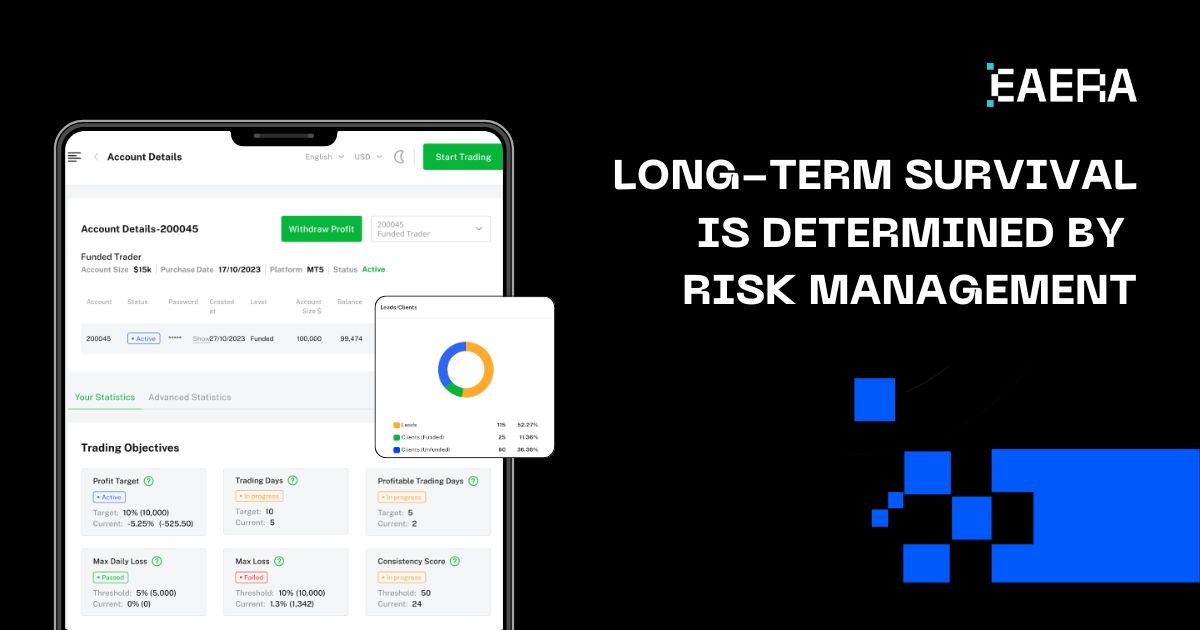

Real-Time Risk Management as a Control System

A smart prop firm’s long-term survival is determined by risk management. Risk is continuously monitored in a smart prop company rather than reviewed on a regular basis. Drawdowns, leverage usage, exposure limits, and P&L fluctuations are all monitored by real-time engines for every account.

Based on predetermined logic, the system instantly reacts to rule violations by sending out alerts, closing positions, or suspending accounts. This eliminates human inconsistency and emotional bias from risk judgments.

Beyond individual traders, firm-wide exposure is visible at all times. Management can identify correlated risks, asset concentration, or abnormal behavior patterns before they escalate. This proactive control framework is one of the strongest differentiators of a smart prop firm in 2026.

Centralized Data and Performance Intelligence

One of the main obstacles to scaling is data fragmentation. By consolidating data from trading platforms into a single analytics layer, a smart prop company resolves this issue.

This enables management to assess performance in ways other than just profitability. Behavioral patterns, disciplined metrics, consistency, and risk-adjusted returns become apparent. Firms can find excellent traders with long-term potential rather than responding to isolated rule infractions.

For decision-makers, this unified intelligence enables faster and more confident strategy adjustments. Expansion plans, modifications to rules, and capital allocation are based on live insights rather than past presumptions.

Built-In Compliance and Audit Readiness

There is also a growing regulatory requirement globally, and this is true even in the case of proprietary trading models. It is essential to note that a smart prop firm considers compliance as an integral process.

KYC and AML verification is fully automated, thus making the whole process of signing up more convenient. Every operation by the system is recorded, thus delivering an entire audit trail, which is useful in internal investigations and external inquiries. There is also no reporting burden.

This compliance-oriented approach not only mitigates risk, but it also increases credibility. By the year 2026, being ready for regulations is a competitive advantage for any smart prop firm aiming for global outreach.

Seamless Trader Experience and Transparency

Clarity and speed are the foundations of trader trust. Real-time dashboards displaying performance metrics, rule compliance, progress milestones, and payout status are provided to traders by a smart prop firm.

This transparency lessens uncertainty and encourages reliance. Traders know exactly where they stand and what they need to do to move forward. Long-term engagement is strengthened, and disputes are eliminated when violations or limits are communicated clearly.

In an increasingly competitive market, a smart prop firm enhances brand reputation and retention by making transparency a feature rather than a risk.

Automated Payouts and Scalable Profit Sharing

Payout delays are among the major causes of dissatisfaction among traders. A smart prop firm removes this pain point by providing auto-calculated profit payouts.

Profit splits are made in accordance with predefined rules, and all requests are automatically validated. Also, integrations with payment platforms make the processing of payouts faster. Every single payout operation is recorded.

Just as in other aspects, this reliability promotes confidence and loyalty. For 2026, payment efficiency is more than just an operation; it is one of the factors that make a smart prop office stand out.

In 2026, intelligent prop trading firms will be defined by the intelligence of their execution, rather than the number of traders they fund. Where a wise investment firm of 2026 is different is in its demand for intelligence.