By 2026, automation, speed, volatility, and regulatory pressure will characterize trading environments. Data volumes have increased, markets are moving more quickly, and execution tolerance is at an all-time low. Because of this, choosing the appropriate trading software is now a strategic decision that directly impacts performance, risk, and scalability rather than just a technical one.

Related articles:

- How a Trading Platform Supports Fast, Reliable Execution?

- Is MT5 Trading Platform Still the Top Choice in 2026?

What to look for in trading software in 2026 is described in this article. It focuses on the fundamental characteristics that determine whether a system can function dependably under actual market conditions rather than comparing feature lists.

Execution Quality Comes First

The cornerstone of every trading operation is execution quality. Poor execution results in slippage, inconsistent fills, and hidden losses regardless of the strength of the strategy.

Three fundamental characteristics define execution quality in 2026:

- Speed with accuracy – Quick execution is only beneficial if orders are handled correctly.

- Consistency under stress – When there is volatility, execution behavior should stay consistent.

- End-to-end reliability – The procedure needs to be steady from order submission to confirmation

Effective trading software views execution as a system result rather than a feature. Instead of being separate processes, it guarantees that validation, routing, and confirmation are all a part of a single, cohesive workflow.

Buyers should consider the behavior of execution during peak load when assessing trading software, rather than just average conditions. Operational risk is introduced by a platform that functions well in calm markets but deteriorates under pressure.

Architecture That Scales with Market Reality

Interface design is not as important as architecture. Poor system architecture permanently restricts performance, but dashboards and workflows can be enhanced over time.

It is anticipated that contemporary trading software will manage:

- Real-time data streams

- High-frequency order events

- Sudden spikes in volume

- Continuous system availability

By 2026, event-driven processing will usually be the foundation of scalable systems instead of sequential or batch-based logic. This eliminates the need to wait for planned procedures and enables the platform to respond instantly to market and order events.

Key architectural signals to look for include:

- Clear separation between execution, risk, and reporting layers

- Capacity to expand horizontally without rewriting essential logic

- Stable performance during market shocks

Instead of needing ongoing workarounds or human intervention, a well-architected trading software platform expands to meet market demands.

Fault tolerance is another essential component of scalable architecture. System failures are a matter of when, rather than if in actual trading environments. Instead of failing entirely, high-quality trading software is made to deteriorate gradually. This implies that the system as a whole continues to function with little interruption when one component encounters a problem.

Fault-tolerant design improves execution reliability by isolating failures, preserving order integrity, and ensuring recovery without data loss. In 2026, platforms that cannot demonstrate resilience under partial failure represent a significant operational risk, especially for firms trading across multiple markets or time zones.

Risk Management Built into the Core

Risk management is often misunderstood as a constraint on execution speed. Integrated risk control is an execution enabler.

In 2026, effective trading software embeds risk logic directly into execution workflows. This includes:

- Pre-trade validation

- Exposure and limit enforcement

- Consistent rule application across all orders

When risk systems are external or manual, they introduce latency and inconsistency. Orders may pass through under certain conditions and fail under others, creating unpredictable outcomes.

Integrated risk management improves execution by:

- Preventing invalid orders before they reach the market

- Reducing post-trade corrections

- Increasing trust in system behavior

Enterprise platforms such as those developed by EAERA illustrate how financial core systems can integrate execution and risk logic into a single operational flow, supporting both speed and control without compromise.

Automation That Improves Control, Not Just Speed

In today’s trading environment, automation is inevitable. Automation without governance, however, may pose a systemic risk.

The appropriate trading software in 2026 automates procedures rather than choices. Typical candidates for automation include:

- Order validation

- Routing logic

- Post-trade updates and reporting

Governance must continue to be explicit. Monitoring, exception handling, and execution rules should all be precisely defined and uniformly enforced.

Well-governed automation provides:

- Lower latency by eliminating human bottlenecks

- Higher consistency across large order volumes

- Easier auditing and troubleshooting

On the other hand, poorly managed automation increases errors on a large scale. Instead of assuming that automation on its own is advantageous, buyers should consider how trading software strikes a balance between automation and control.

Data, Transparency, and Decision Support

Data quality and execution quality will be inextricably linked by 2026. Traders and operators cannot evaluate performance or effectively manage risk without precise, real-time visibility.

Robust trading software offers transparency in the following areas:

- Execution status

- Account balances and exposure

- Order history and audit trails

Better decision-making, quicker problem identification, and more trustworthy performance analysis are all made possible by this transparency. Additionally, it makes internal reporting and compliance easier.

Contemporary platforms increasingly use analytics to turn unprocessed data into insight. This comprises operational indicators, behavioral patterns, and execution metrics.

Modern trading software needs to facilitate decision accountability in addition to visibility. For internal review and regulatory confidence, clear data lineage, which demonstrates how an execution decision was made, which rules were applied, and which data points were used, has grown in significance.

Organizations have more control over performance analysis, incident investigation, and continuous improvement when execution outcomes can be linked to defined logic and structured data. Transparency is now a fundamental prerequisite for trading system trust in 2026.

Fintech platforms that concentrate on financial core systems and data analytics, such as EAERA, show how structured data models and real-time processing can facilitate quicker, better-informed decisions throughout trading operations.

Long-Term Product Mindset and Vendor Reliability

In 2026, selecting trading software will involve more than just resolving current issues. It involves choosing a system that will continue to be useful as markets, laws, and technological advancements change.

Included in a long-term product mindset are:

- A precise and practical roadmap

- Proof of ongoing progress

- Experience working in actual trading environments

Important queries that consumers ought to ask are:

- Does this trading software have long-term scalability built in?

- Can it adapt to regulatory and market changes?

- As volume increases, does it lessen operational complexity?

Platforms designed only as temporary fixes frequently find it difficult to change over time. System built with longevity in mind offers lower operational risk and a higher return on investment.

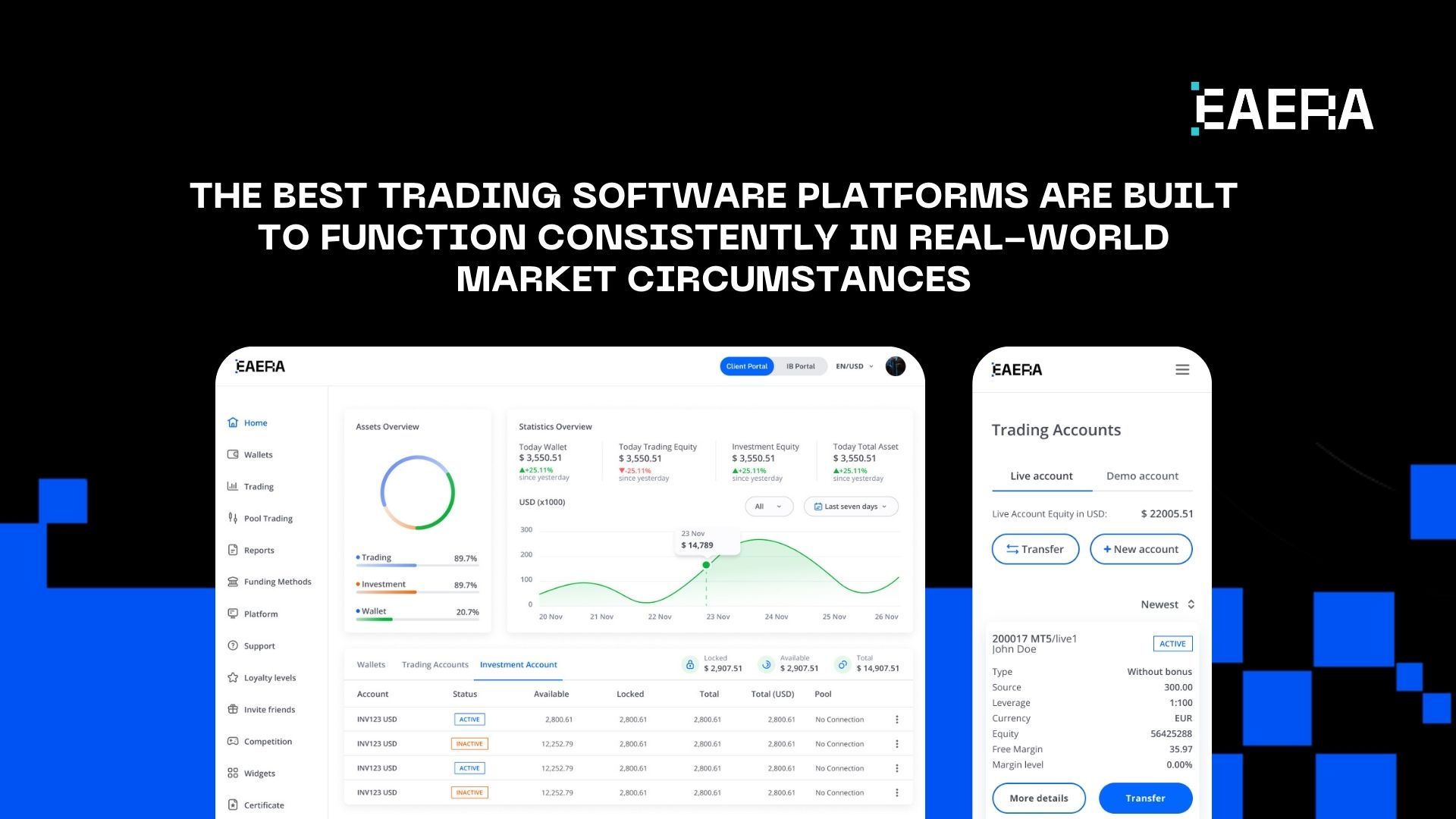

In 2026, features and interface design are not the only considerations when choosing trading software. It has to do with long-term dependability, integrated risk control, architectural strength, and execution quality.

The best trading software platforms are those that are built to function consistently in real-world market circumstances, including volatility, high volume, and steady expansion. Organizations can select platforms that facilitate scalable, sustainable trading operations in the future by concentrating on system behavior rather than surface functionality.