Trading strategy alone is rarely the cause of growth failure in the forex industry. When lead volume rises, client management becomes disjointed, and compliance requirements begin to impede execution; it usually breaks down at the operational level. Business forex CRM solutions are no longer optional support tools in this situation. They are now essential components that determine whether a foreign exchange company can grow sustainably or fail due to its own complexity.

Related articles:

- Broker CRM Software for Smarter Lead Tracking

- Basic Tools vs Broker CRM Software: Which Boosts Efficiency?

This article outlines the importance of business forex CRM solutions for expansion, how they handle forex-specific issues, and how they differ significantly from general CRM systems.

Growth Challenges Unique to Forex Businesses

The majority of traditional CRMs were never intended to handle the conditions that forex companies operate in. Instead of easing these difficulties, growth makes them worse.

Key pressures include:

- High volume of leads from various sources of acquisition (IBs, affiliates, ads, referrals)

- Quick decision cycles where conversion is directly impacted by response time

- Strict regulatory and audit requirements

- Intricate client structures with numerous accounts, platforms, and geographical locations

Data frequently becomes dispersed across spreadsheets, trading platforms, sales tools, and compliance systems when growth picks up speed. Onboarding is slowed by compliance checks; managers rely on incomplete reports, and sales teams lose visibility.

Business forex CRM solutions are essential in this situation. They connect leads, clients, trading activity, and compliance into a single system of record, specifically designed to manage the operational realities of forex. Without this base, growth becomes brittle very quickly.

What Defines Business Forex CRM Solutions (Beyond Basic CRM)?

CRMs are not all equal. While generic CRM systems concentrate on contacts and transactions, forex companies need far more sophisticated logic.

The ability of business forex CRM solutions to support the entire forex lifecycle, which includes:

- Lead and qualification capture

- Onboarding and verification of clients

- Creating and linking trading account

- Continuous observation, preservation, and reactivation

Typical core functional layers consist of:

- Lead management: monitoring source, behavior, and readiness

- Client lifecycle tracking: from prospect to funded trader

- Automation of compliance: KYC, AML, audit trails

- Trading data visibility: account status, activity, and performance metrics

Business forex CRM solutions comprehend multi-account structures, IB hierarchies, and the regulatory checkpoints needed both before and after onboarding, in contrast to generic CRMs. They are able to support growth without increasing operational friction because of this specialization.

How Business Forex CRM Solutions Directly Enable Scalable Growth?

The ability of business forex CRM solutions to separate growth from manual labor is their most significant contribution. Businesses scale systems rather than headcounts to handle complexity.

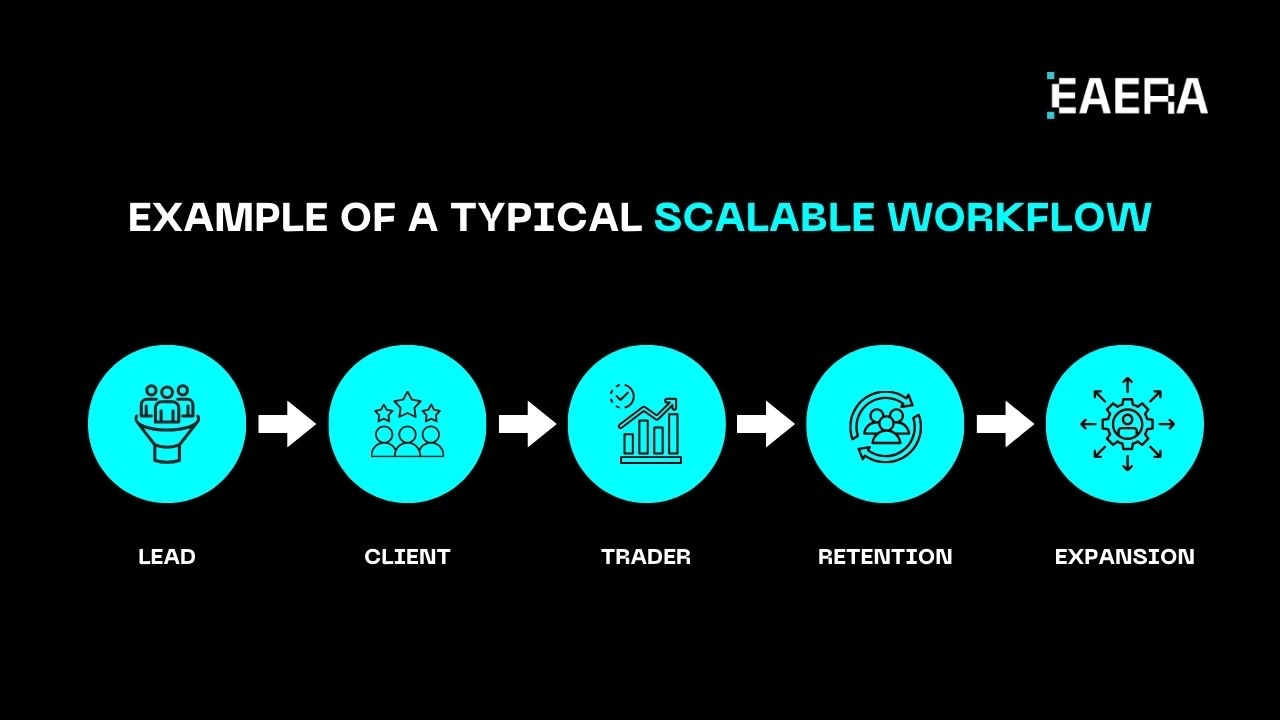

This is an example of a typical scalable workflow:

Lead → Client → Trader → Retention → Expansion

The CRM enforces automation and consistency at every stage:

- Leads are automatically routed and scored

- Workflows for onboarding guarantee that no compliance steps are overlooked

- Client profiles are directly connected to trading accounts

- Behavioral data drives retention and upsell initiatives

Clear growth benefits are provided by this structure:

- Quicker conversion from lead to client

- Increased productivity in sales per agent

- Decreased team-to-team operational handoffs

- Reliable onboarding capacity as volume rises

Every new client adds a disproportionate amount of work in the absence of business forex CRM solutions. Growth becomes systematic rather than reactive with them.

Over time, this approach can refine internal alignment as well. This is because the sales, operations, and compliance teams will be using the same dataset. This automatically means there will be fewer bottlenecks when growth initiatives are being undertaken.

Data, Compliance, and Risk Control as Growth Foundations

Many times, compliance is seen as a barrier to expansion. One of the quickest ways to completely stop growth is through poor compliance.

By centralizing the following, business forex CRM solutions transform compliance from a bottleneck into an integrated process:

- Client identity data

- Verification status

- Communication history

- Transaction and account records

This results in:

- Clear audit trails

- Regular application of rules

- Decreased risk of manual error

Platforms with compliance-first architecture, like those created by EAERA, show how organized workflows can promote both operational speed and regulatory confidence. Onboarding becomes more dependable and quicker rather than slower when compliance checks are integrated into the CRM process.

This balance between speed and control is crucial for expanding forex businesses. Without it, it becomes more dangerous to expand into new markets or increase volume.

Operational Intelligence and Smarter Decision-Making

Decisions about growth are only as good as the data supporting them. The operational intelligence that business forex CRM solutions offer is one of their most underappreciated advantages.

Modern systems offer instantaneous insight into:

- Conversion funnels for leads

- Client funding practices

- Sales team performance

- Retention and churn signals

As a result, management can:

- Allocate marketing budgets more wisely

- Determine which acquisition channels are performing poorly

- Use objective data to mentor sales teams

- Estimate operational capacity and revenue

Decision-makers obtain insights beyond surface-level metrics when CRM data is linked to trading activity. Systems such as those developed by EAERA serve as examples of how centralized data and analytics enable quicker, more intelligent decision-making throughout financial operations.

This intelligence is a necessity for growth in a competitive forex environment, not an extravagance.

Choosing Business Forex CRM Solutions for Long-Term Growth

Picking the appropriate business forex CRM solutions for long-term considerations. Rating systems based on feature lists alone are insufficient.

Key evaluation criteria include:

- Forex-specific architecture (not adapted generic CRM)

- Scalability across regions, brands, and volumes

- Integration with trading platforms and payment systems

- Strong security and compliance infrastructure

- Vendor experience in actual forex markets

Critical questions to ask:

- Does the CRM simplify our complexity as we grow?

- Can it adapt to changes in the regulation or marketplace?

- Is it conductive to our operating model, or do we have to manually integrate?

Business forex CRM systems that are short-term convenient choices can turn out to be long-term limitations. Those designed for growth help businesses grow without the need for relaunching and resetting the operation.

The growth of the forex industry is not constrained by opportunity but by structure. A business forex CRM system enables the forex business to grow their number of leads, customers, and trades without compromising control.

By integrating sales, compliance, and trading data, such systems revolutionize growth from an uncertain expansion into a systematic, repeatable process. For any forex business looking to not only compete in the digital world but also grow. Integrating the right business forex CRM solutions into their business model is no longer an exercise in efficiency, but an exercise in survival.