The foreign exchange market is a dynamic and fiercely competitive landscape where success hinges on more than just competitive spreads and robust trading platforms. FX brokers must cultivate and nurture long-term client relationships to thrive. This requires a great deal of time spent on nurturing clients, optimizing processes, and monitoring the competition, among other activities. In contrast to available user relationship management solutions, a Forex CRM system is specifically designed for Forex institutions, offering tailored capabilities that include client management, trading integration, compliance assistance, and marketing automation.

This blog will explore what a Forex CRM system is and delve into the key benefits it offers brokerages. Whether you’re a seasoned brokerage or new in the market, understanding how a Forex broker CRM can transform your operations is crucial for sustained success.

Related articles:

- The Future of CRM in Forex Brokerage: Trends and Technologies

- Unlock the Secrets to Superior Customer Servicing in Brokerage

1. Understanding the importance for Forex Brokers

The Forex market operates 24/7, demanding unwavering attention to client needs and a proactive approach to risk management. Brokerage firms face a multitude of challenges, including:

1.1. Acquiring and Retaining High-Value Clients

In a saturated market, attracting and retaining profitable traders requires a sophisticated understanding of client behavior and preferences. Forex CRMs provide the tools to analyze and act on client data, ensuring brokers meet traders’ expectations.

1.2. Meeting Regulatory Compliance

Adherence to stringent financial regulations is paramount. A broker CRM software can help ensure compliance with KYC/AML requirements and maintain accurate records, thus reducing the risk of regulatory penalties.

1.3. Optimizing Operational Efficiency

Manual processes can be time-consuming and error-prone. Automating tasks like client onboarding, communication, and data analysis frees up valuable resources for strategic initiatives, allowing brokers to focus on growth.

1.4. Gaining a Unique Selling Point

Differentiating from competitors requires a deep understanding of client needs and the ability to deliver personalized experiences. Forex CRMs enable brokers to craft tailored strategies that resonate with their target audience.

2. The Transformative Power of a Forex CRM

A comprehensive forex broker CRM serves as the central hub for all client-related activities. Key functionalities include:

2.1. 360-Degree Client View

A centralized repository of client data, including demographics, trading history, preferences, and communication logs, provides a holistic view of each client. This enables brokers to deliver personalized and timely services.

2.2. Automated Marketing and Sales

Personalized email campaigns, targeted promotions, and automated follow-ups nurture leads and convert them into loyal clients. Forex CRMs facilitate these processes seamlessly, enhancing marketing efficiency.

2.3. Streamlined Onboarding and Support

Automated workflows facilitate seamless client onboarding, while integrated ticketing systems ensure efficient and timely customer support. This improves client satisfaction and retention rates.

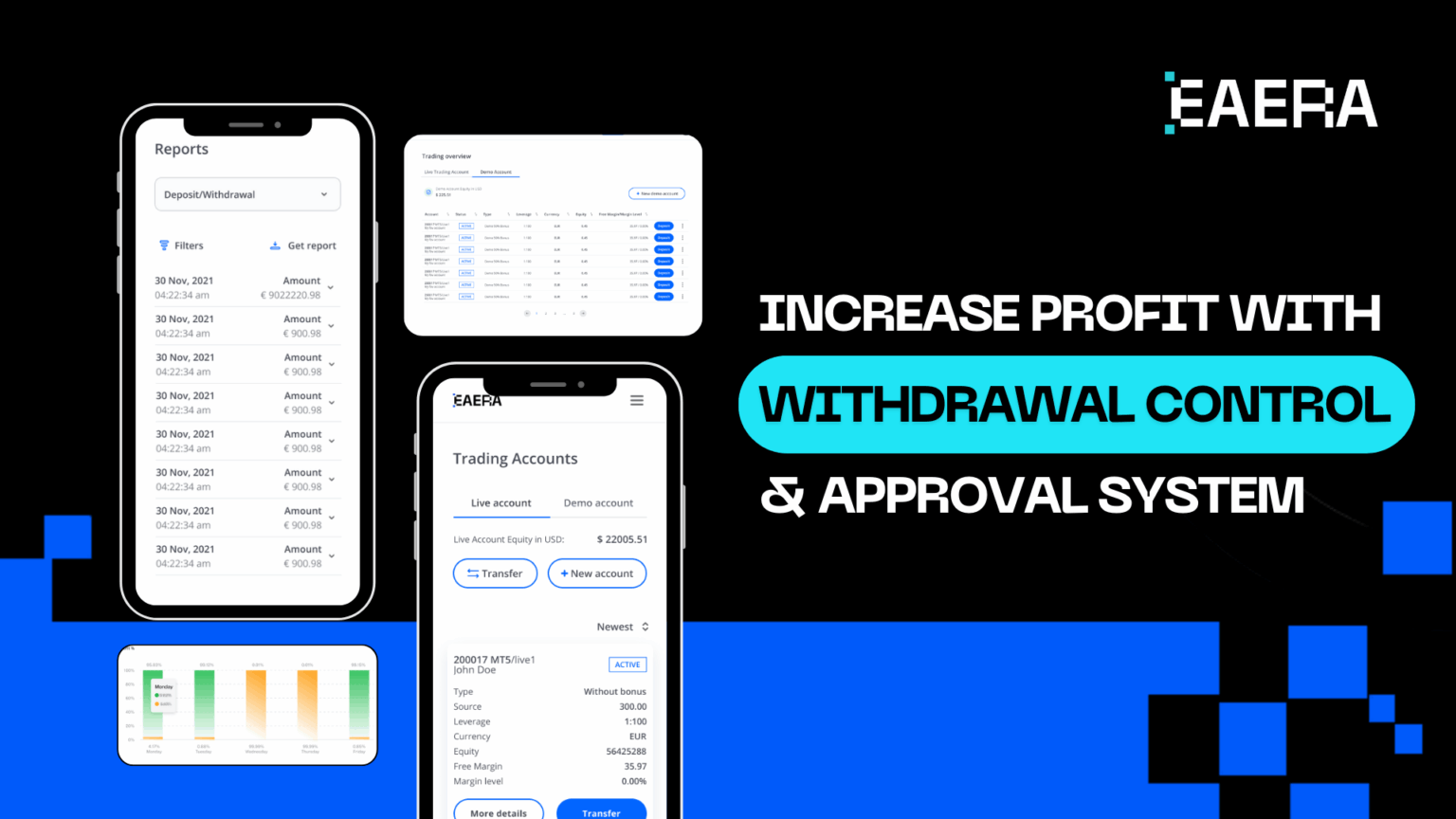

2.4. Enhanced Risk Management

Real-time monitoring of client activity and automated alerts help mitigate potential risks. Forex CRMs ensure that brokers adhere to compliance standards and proactively address issues before they escalate.

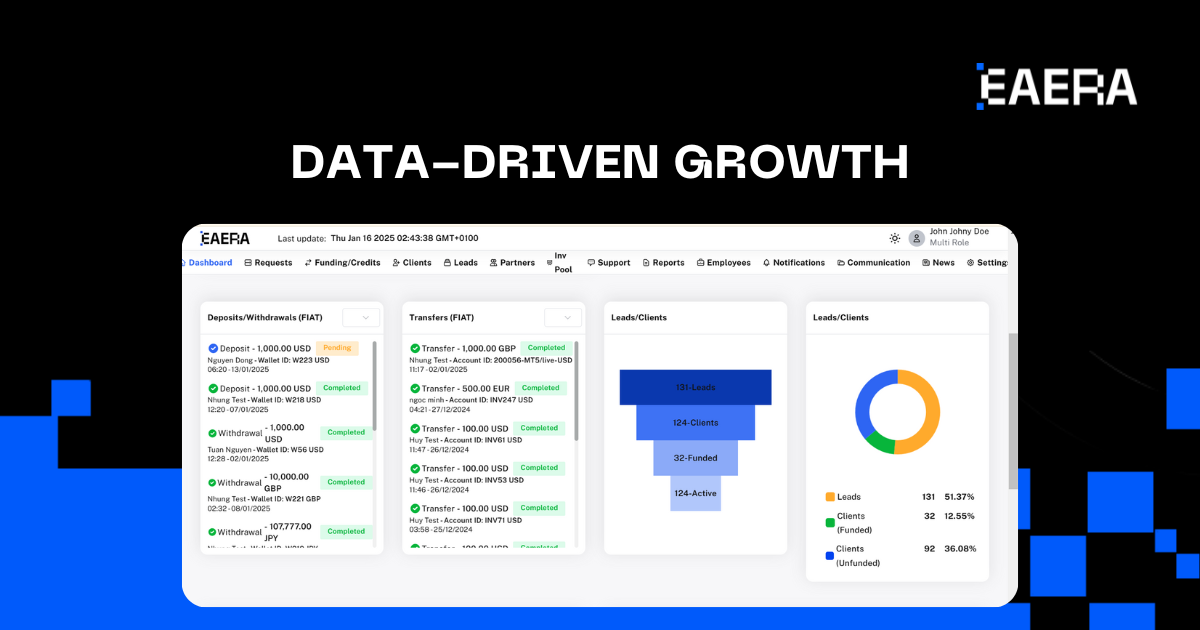

2.5. Data-Driven Decision Making

Comprehensive reporting and analytics provide valuable insights into client behavior, market trends, and the effectiveness of marketing campaigns. Brokers can leverage this data to refine their strategies and achieve better outcomes.

3. Key Benefits for Forex Brokerages

Implementing a robust forex CRM yields significant advantages:

3.1. Improved Client Relationships

Personalized communication, proactive support, and tailored offerings foster strong client relationships and enhance loyalty. A forex CRM helps brokers stay attuned to client needs.

3.2. Increased Operational Efficiency

Automation of repetitive tasks frees up valuable time for sales and support teams to focus on high-value activities, boosting overall productivity.

3.3. Data-Driven Growth

Actionable insights from client data enable brokers to make informed decisions about product development, marketing strategies, and risk management. This data-driven approach ensures continuous improvement.

3.4. Enhanced Compliance

Streamlined processes and automated record-keeping ensure compliance with regulatory requirements, minimizing the risk of fines and maintaining the brokerage’s reputation.

3.5. Differentiation

By delivering superior client experiences and providing personalized service, brokers can gain a significant competitive edge in the market.

4. Choosing the Right Forex CRM Solution

Selecting the optimal forex broker CRM requires careful consideration:

4.1. Integration Capabilities

Seamless integration with existing trading platforms, payment gateways, and other essential systems is crucial. This ensures a cohesive ecosystem that supports all brokerage functions.

4.2. User-Friendliness

The interface should be intuitive and easy to navigate for all users, from sales and marketing teams to customer support representatives. A user-friendly design minimizes training time and enhances efficiency.

4.3. Cost-Effectiveness

The total cost of ownership, including licensing fees, implementation costs, and ongoing maintenance, should be carefully evaluated to ensure the solution aligns with the brokerage’s budget.

5. Maximizing the Value of Your Forex CRM

To fully unlock and maximize the extensive benefits offered by a Forex broker CRM, it is crucial to implement the platform strategically:

5.1. Ensure Data Quality

Maintain accurate and up-to-date client data to ensure the effectiveness of all CRM functionalities. Regular data audits can help achieve this.

5.2. Provide Comprehensive Training

Equip all users with the necessary knowledge and skills to effectively utilize the CRM system. Training sessions and ongoing support are critical to user adoption.

5.3. Continuously Optimize

Regularly review and refine CRM processes based on data analysis and user feedback to maximize ROI. Continuous improvement ensures the CRM evolves with the brokerage’s needs.

5.4. Align with Business Goals

Ensure that CRM strategies are aligned with the overall business objectives and key performance indicators (KPIs) of the brokerage. This alignment guarantees that the CRM contributes to achieving organizational goals.

6. Why EAERA is the Forex CRM You’ve Been Searching For

In today’s highly competitive Forex market, having a robust CRM is a necessity. EAERA stands out as a leading CRM platform, offering comprehensive solutions to support Forex brokers across multiple aspects of their operations. By leveraging the right tools and strategies, brokers can efficiently manage market complexities, enhance client relationships, and pave the way for sustained growth.

- Streamlined Client Management: Simplifies onboarding, lead tracking, and client engagement for enhanced efficiency.

- Advanced Automation: Reduces manual effort, saving time and resources through automated processes.

- Centralized Data: Consolidates client information, improving transparency and accessibility for better decision-making.

- Industry-Specific Features: Offers tailored solutions like integrated payment systems, compliance support, and real-time analytics.

- Enhanced Trust: Fosters transparency and reliability, building stronger client relationships.

Boost your brokerage with EAERA. Increase client satisfaction, streamline operations, and drive revenue. Start your trial now! https://eaera.com/contact-us/