Automation, cross-border participation, and the increasing impact of technology are driving the proprietary trading industry’s rapid evolution. Infrastructure that is scalable, transparent, and adaptable is now essential as prop trading companies grow internationally.

EAERA comes into play here. EAERA Prop offers a customized, all-in-one ecosystem that blends automation, analytics, and scalability in order to address the operational and regulatory demands of multinational prop firms. It gives trading firms the ability to effectively and smoothly manage traders, risks, and performance internationally.

EAERA Prop establishes the new benchmark for prop trading management in a borderless market where traders can participate from any time zone: intelligent, modular, and globally-ready.

The Borderless Prop Trading Landscape

Prop trading is no longer a regional industry. By simultaneously hiring traders from Asia, Europe, and the Americas, the new generation of businesses operates without regard to geographical boundaries.

Among the key challenges faced by borderless prop firms are:

- Regulatory diversity: Handling reporting, AML, and KYC requirements that vary by jurisdiction.

- Time zone management: Real-time coordination of international trade.

- Scalability: The ability to accommodate hundreds or thousands of traders without experiencing any lag in performance.

- Data consolidation: Ensuring operations involving multiple assets and platforms are accurate and transparent.

Prop firms need a technology partner who can offer infrastructure designed for a global scale and who is knowledgeable about the trading and compliance landscape to succeed in this dynamic ecosystem.

EAERA provides fintech solutions designed for international expansion in order to meet these demands. No matter where their traders operate, businesses can easily grow, adjust to local laws, and maintain complete transparency thanks to its adaptable, modular architecture.

EAERA Prop: A Tailored Solution for Every Prop Firm

EAERA Prop is a customizable ecosystem designed to meet the particular requirements of proprietary trading, not just a management system. Each feature is made to be flexible enough to fit a company’s growth goals, operating models, and regulatory environment.

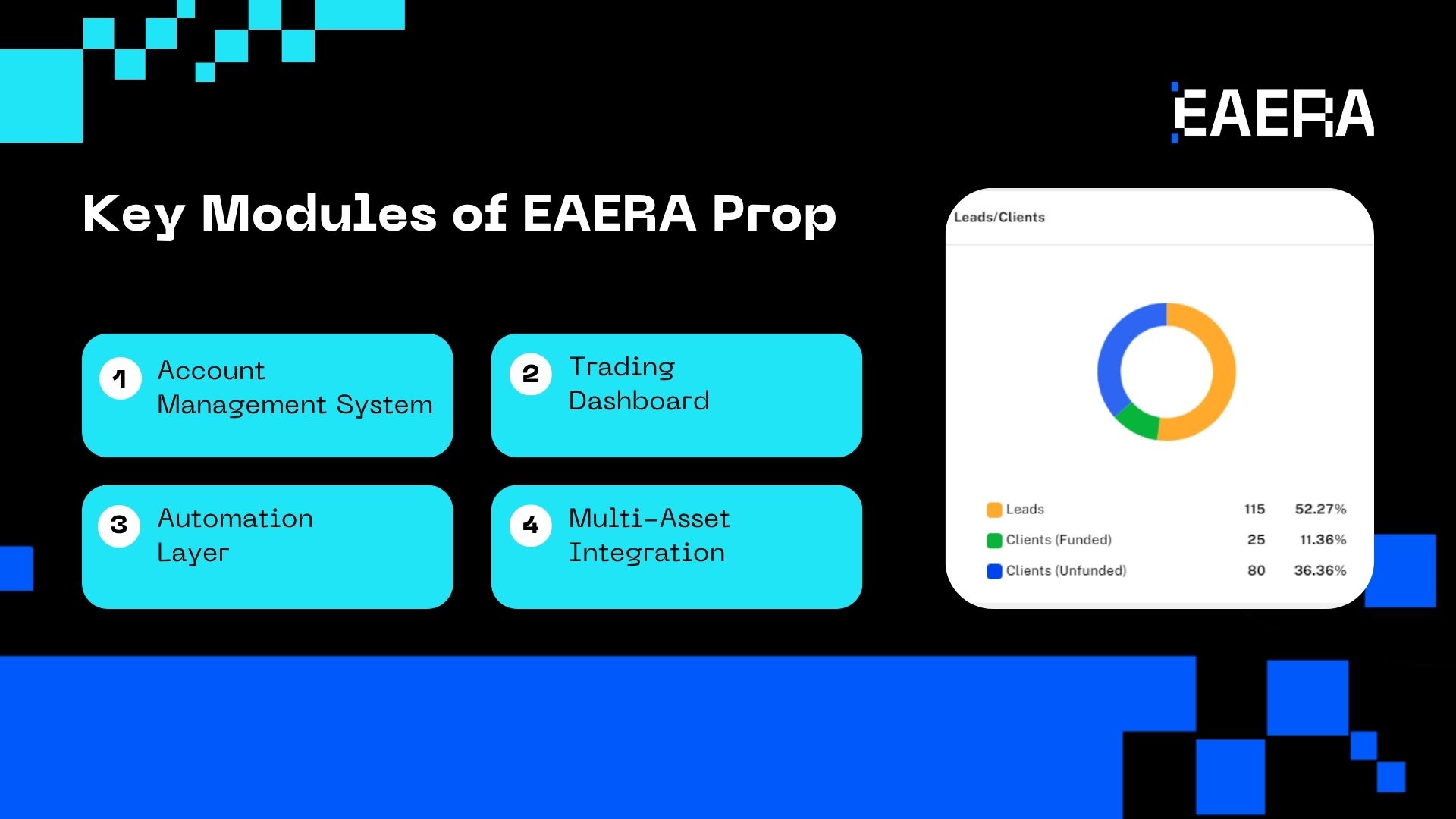

Key Modules of EAERA Prop:

- Account Management System

- Automates trader evaluation, funding phases, and performance monitoring.

- Supports challenge and funded accounts with modifiable rules and limits.

- Trading Dashboard

- Displays real-time metrics: risk exposure, leverage, drawdown, and profit and loss.

- Provides traders, risk managers, and administrators with multi-level visibility.

- Automation Layer

- Manages routine tasks like account approvals, balance resets, and profit sharing.

- Integrates risk alerts to promptly inform managers instantly when thresholds are crossed.

- Multi-Asset Integration

- Use open APIs to connect to trading platforms such as MT5, cTrader, and others.

- Offers traders complete diversification by supporting cryptocurrencies, commodities, indices, and forex.

EAERA Prop transforms operational complexity into a strategic advantage by fusing automation, analytics, and compliance. Depending on a company’s growth stage and global reach, each module can be scaled, modified, or expanded.

Core Strengths of EAERA Prop Technology

1. Global Scalability

EAERA Prop’s cloud-native architecture guarantees reliable performance worldwide. Regardless of a company’s location—Tokyo, London, or São Paulo—its traders have access to the same fast-paced, stable environment.

- Multi-language and multi-time-zone support.

- Integrated global payment gateways and account management.

- Enterprise-level uptime for global operations.

Scalability is about sustainability, not just performance. Businesses can onboard hundreds of traders thanks to EAERA without experiencing additional operational stress.

2. Smart Risk Management

Risk discipline is the foundation of any prop firm. EAERA Prop enhances this through intelligent risk alerts and automated protection mechanisms.

- Limits for drawdown, leverage, and daily loss can be changed.

- Identifying unusual trading patterns in real time.

- Automated notifications sent by email, dashboard, or Telegram/Slack.

EAERA Prop protects firm capital and trader confidence by enabling risk managers to take proactive rather than reactive measures by transforming raw trading data into actionable insights.

3. Transparent Leaderboards & Performance Analytics

Accountability depends on transparency. EAERA Prop introduces real-time leaderboards that rank traders according to risk-to-reward ratio, ROI, and consistency.

Leaderboards gamify the trading experience, rewarding excellence while promoting fair competition. They also provide:

Leaderboards encourage fair competition and reward excellence. Additionally, they offer:

- Clear understanding of what constitutes excellent performance.

- Community involvement, encouraging traders to work together.

- Opportunities for marketing: top traders can serve as brand representatives.

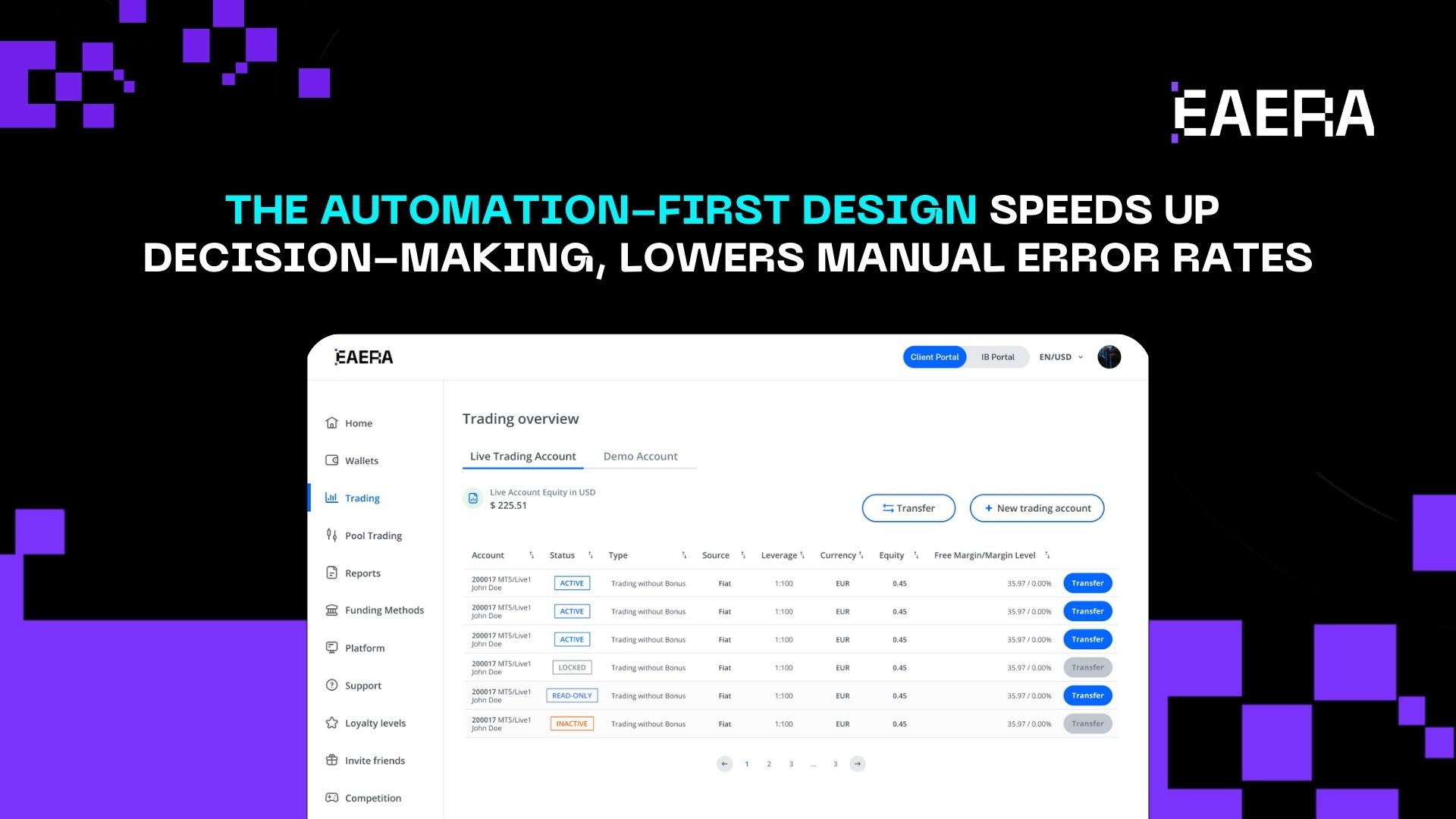

4. Automation and Compliance by Design

Automation workflows and compliance logic are integrated from the ground up in EAERA Prop’s architecture.

- Regionally compliant automatic KYC/AML verification.

- Smart workflows for account funding, tracking evaluation results, and validating payouts.

- Audit trails are integrated for complete operational transparency.

This automation-first design speeds up decision-making, lowers manual error rates, and guarantees that all businesses scale while maintaining regulatory integrity.

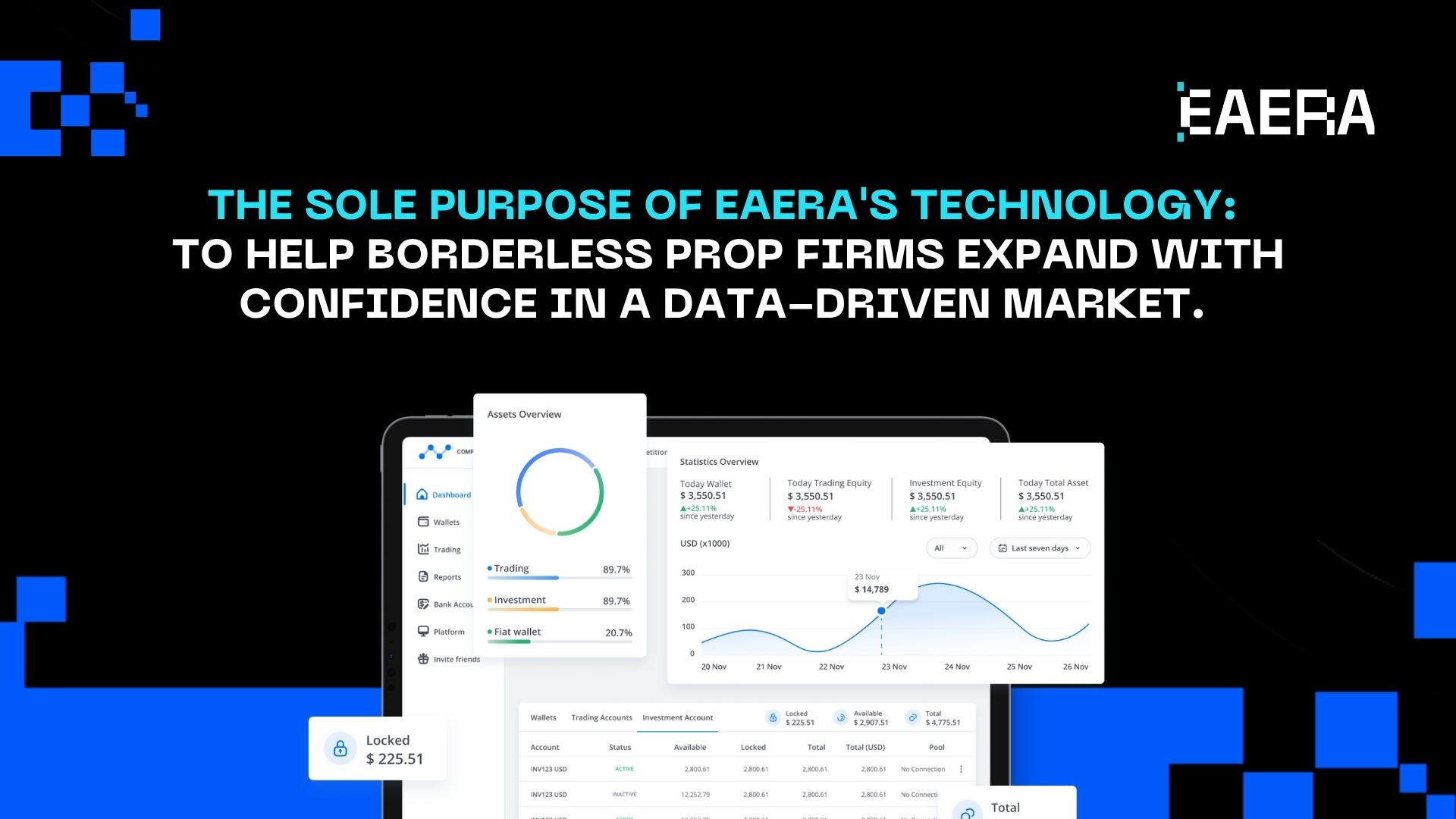

How EAERA Empowers Borderless Prop Firms

EAERA’s technology is built around one goal — helping borderless prop firms grow confidently in a data-driven, global market.

The sole purpose of EAERA’s technology is to help borderless prop firms expand with confidence in a data-driven, global market.

Key advantages include:

- Speed: Rapid deployment and integration with existing systems.

- Transparency: Visibility of data in real time across all trading layers.

- Trust: Trader confidence is guaranteed by institutional-grade dependability.

- Growth: A scalable structure that fits any market or firm size.

Without compromising performance or compliance, many prop trading companies that use EAERA’s technology report lower operational costs and quicker regional expansion.

EAERA Prop allows businesses to concentrate more on growth strategy and less on manual management by integrating traders, managers, and data into a single ecosystem.

Related article: Prop Firm CRM: What are the must-have features?

The Future of Prop Trading: Data, AI, and Customization

Prop trading’s next development will center on predictive analytics, customized dashboards, and adaptive automation as automation and artificial intelligence transform the financial sector.

EAERA Prop is already preparing for this future by creating insights driven by AI that:

- Identify trader behavior patterns.

- Forecast potential risk exposure.

- Recommend adjustments for improved strategy performance.

EAERA’s open API ecosystem makes it possible to integrate third-party fintech tools, liquidity providers, and compliance systems with ease, resulting in an intelligent, networked trading infrastructure that is prepared for international growth.

Prop trading will be transparent, data-driven, and borderless in the future, and EAERA is developing the technology to enable this.

Technology defines a competitive advantage in today’s globalized trading environment. EAERA Prop distinguishes itself by providing prop firms with the freedom to function without limitations, with automation, transparency, and scalability at its core.