Advanced technology, automation, and real-time data are essential for a smart prop firm to function effectively, grow sustainably, and maintain its competitiveness. Businesses can no longer handle onboarding, trader performance, and risk exposure using manual procedures or disjointed systems as the prop trading landscape changes. Rather, the future belongs to companies that use real-time risk management dashboards to improve protection and centralize operations through a robust CRM.

Related articles:

- Prop Firm CRM: What are the must-have features?

- Challenges & Benefits of Launching a Prop Firm in 2025

Why Smart Prop Firms Need Better Tools

In recent years, prop trading has undergone a significant transformation. Businesses have been forced to upgrade their infrastructure due to the growth of funded programs, difficulties, and worldwide hiring. Traders anticipate openness, quick onboarding, and unambiguous regulations. Accurate KYC/AML compliance is required by regulators. Meanwhile, there is intense competition; businesses that automate succeed while those that don’t fall behind.

A smart prop firm is designed to:

- simplify operations through centralized systems

- enforce consistent guidelines across all accounts

- Safeguard capital with real-time risk monitoring

- make data-driven decisions at scale

Two potent toolsets become essential in this situation:

(1) CRM & Back Office Systems

(2) Risk Management & Exposure Dashboards

When combined, they form the digital foundation of a secure, scalable, and effective prop trading model.

CRM & Back Office: The Operational Core

The core of a smart prop company is a contemporary CRM and back-office system. It provides administrators with a real-time view of firm performance and links all phases of the trader journey, from account upgrades to onboarding.

Centralized Onboarding & Compliance

Conventional onboarding is slow and ineffective because it uses spreadsheets, emails, and manual identity checks. This entire process is changed by a centralized CRM by:

- Automating KYC and AML verifications

- Collecting and storing trader documents securely

- Validating data for compliance audits

- Providing a smooth experience for applicants

Administrators ensure that all onboarding rules are consistent and auditable by working from a single platform rather than switching between tools.

Automated Account Management for Funded & Evaluation Traders

Prop firms manage several trader categories:

- Evaluation/challenge participants

- Funded traders

- Scaling accounts

- Accounts eligible for resets or upgrades

Manually monitoring these statuses is nearly impossible at scale.

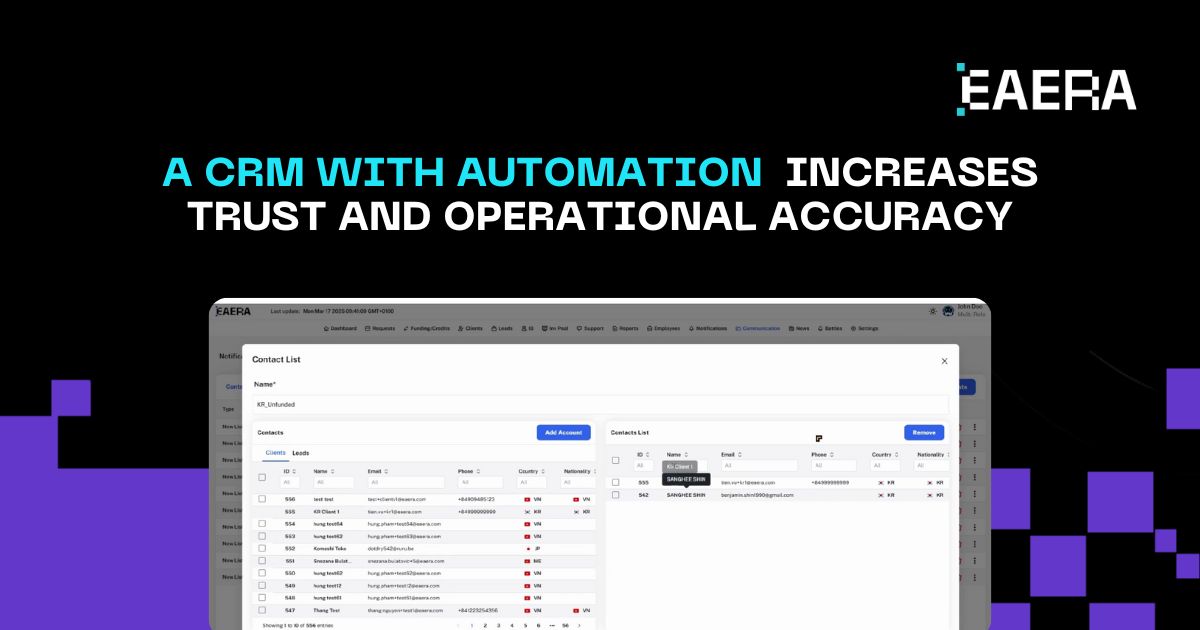

A CRM with automation ensures that:

- Account statuses update instantly

- Funded accounts are activated without human intervention

- Payouts, scaling milestones, and resets follow predefined rules

- Trader progress is tracked in real time

This increases trust and operational accuracy, two essential elements of a smart prop firm.

A CRM with automation increases trust and operational accuracy

Detailed Reporting Dashboards for Administrators

Data, not conjecture, is necessary for wise decision-making. Back-office reporting dashboards provide administrators with information like:

- Challenge pass/fail rates

- Number of active funded traders

- Payout history

- Trading performance metrics

- Operational costs and revenue projections

These insights assist business owners in anticipating risks, identifying inefficiencies, and managing growth. Dashboards are used by a smart prop company to direct future strategy in addition to analyzing the past.

Risk Management Tools: Protecting the Firm in Real Time

Prop firms must strike a balance between firm-wide safety and trader freedom. Real-time risk management systems – a smart prop firm’s most important defense – maintain this equilibrium.

Trader Risk Monitoring with Real-Time Alerts

Smart prop firms enforce strict rules on:

- Daily drawdown

- Overall drawdown

- Lot size limits

- Maximum position exposure

- News trading restrictions (if applicable)

These regulations are continuously monitored by a risk management engine. The system doesn’t wait when a trader exceeds a limit; it can automatically close positions to stop losses and send out instant alerts.

Fairness is ensured by automation. The company protects capital without human intervention, and each trader is treated equally.

Firm-Wide Exposure Controls

Smart prop firms require an overview of exposure across all traders, even though individual rules are important. This involves monitoring:

- Ttotal long vs. short exposure

- Correlated instruments (e.g., all traders long gold at once)

- Concentration risk

- Market shocks affecting multiple accounts simultaneously

Real-time exposure dashboards allow managers to:

- Spot risky patterns instantly

- Adjust internal hedging

- Apply temporary limits during high-volatility events

- Maintain liquidity even during market turbulence

For businesses that run around the clock and have traders in different time zones, this degree of supervision is essential.

Dynamic Hedging & Liquidity Aggregation

Hedging is a common strategy used by prop firms to offset trader positions and reduce possible losses. Support for smart risk dashboards:

- Automated or semi-automated hedging

- Routing orders to the best liquidity providers

- Aggregating liquidity across multiple LPs

- Ensuring tighter spreads and more reliable execution

By using dynamic hedging, the firm actively manages risk rather than merely responding to it.

What Smart Prop Firms Should Look For in Their Tools?

One of the most crucial strategic choices for a smart prop firm is selecting the appropriate tech stack. The essential characteristics of a genuinely intelligent prop trading system are listed below.

Unified Data Ecosystem

The risk engine, trading platforms, back-office systems, and CRM must all be completely integrated. Fragmented tools cause blind spots and slow reactions.

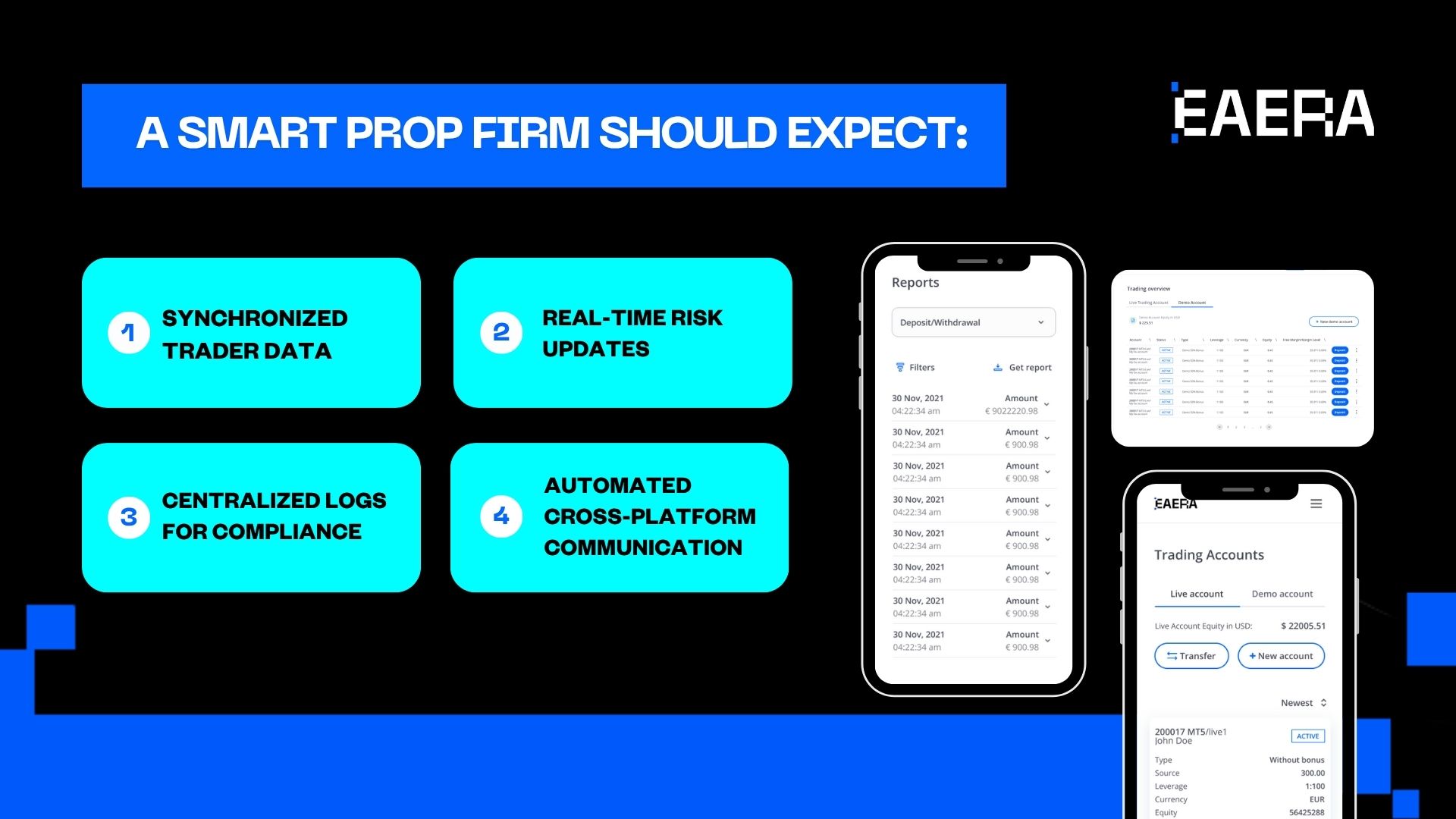

A smart prop firm should expect:

- Synchronized trader data

- Real-time risk updates

- Centralized logs for compliance

- Automated cross-platform communication

CRM must all be integrated

High-Level Automation

Eliminating as many manual tasks as possible is necessary for scaling. Among the crucial automations are:

- Onboarding and verification

- Account creation and scaling

- Payout scheduling

- Rule enforcement and closures

- Reporting and analytics

Even as the number of traders increases, automation lowers errors, removes bottlenecks, and maintains low operating costs.

Advanced Analytics & Reporting

Data is a key component of smart prop companies. Among the crucial analytics are:

- Trader performance trends

- Challenge conversion rates

- Risk distribution charts

- Hedging efficiency metrics

- Profitability forecasts

Real-Time Sync with Trading Platforms

Delays – even a few seconds – can cause massive inconsistencies. Tools must sync instantly with:

- MT4 / MT5

- cTrader

- DXtrade

- Other proprietary platforms

Live synchronization ensures risk rules are correct, dashboards stay accurate, and trades are always monitored.

Scalable Infrastructure

Smart prop firms grow fast. The tech stack must support:

- Thousands of traders

- Global traffic

- High-frequency updates

- Multi-region operations

Cloud-based, modular systems offer the flexibility needed to scale without downtime.

Smart prop firms succeed because they combine automation, centralized CRM systems, and real-time risk dashboards. These tools give contemporary proprietary trading a safe, scalable, and data-driven base that enables businesses to expand with confidence while safeguarding their capital.