CRM System

for Prop Firm

A CRM system tailored for a proprietary trading firm is crucial for managing trader relationships, streamlining onboarding, and improving operational efficiency.

CRM System

for Prop Firm

Features

Our CRM System’s best features

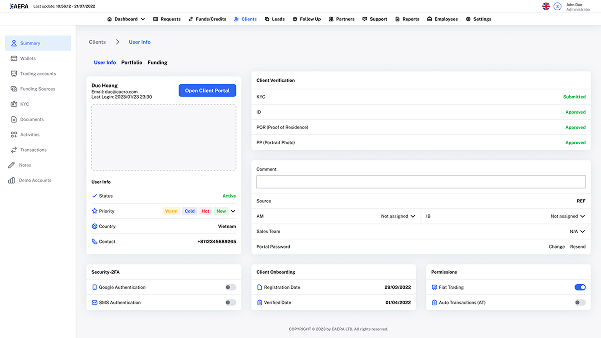

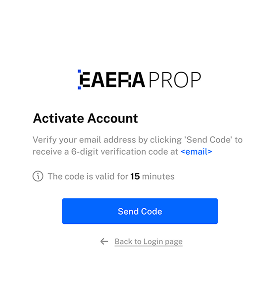

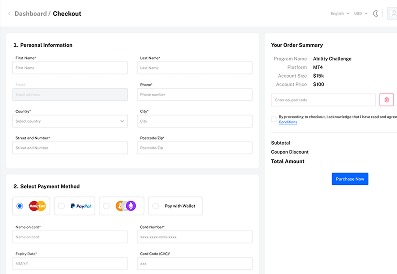

Trader Onboarding and KYC/AML Compliance

Simplify trader registration with automated onboarding, secure KYC document uploads, AML compliance checks, and progress tracking, while using custom questionnaires to gather detailed trader profiles.

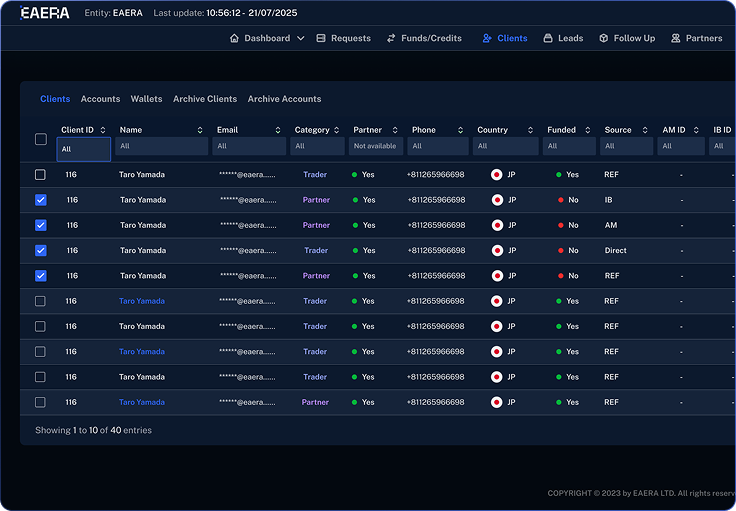

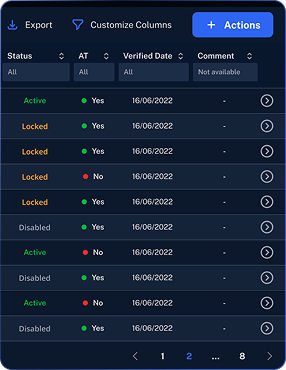

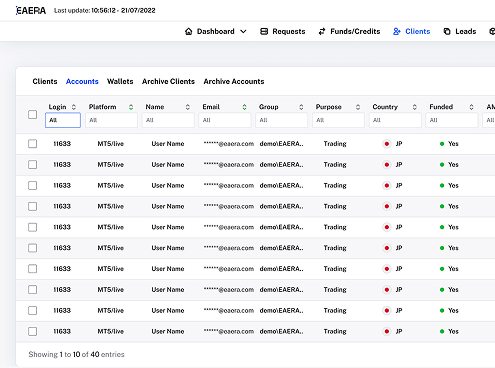

Trader Management

Access centralized trader profiles with contact details, performance metrics, and trading history, manage statuses by phase or activity, track trading behavior and rule violations, and segment traders for targeted communication based on performance or funding status.

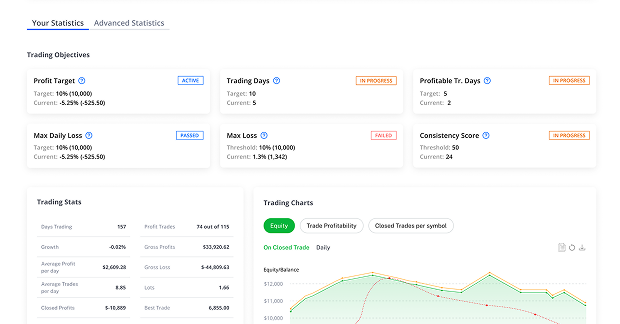

Performance Analytics

Display trading KPIs like P&L, win rate, and drawdown, provide risk analysis insights on behaviors and rule compliance, and track retention metrics, churn rates, and engagement levels.

Progress Tracking for Evaluations

Track evaluation progress with milestones like profit targets and trading days, monitor rule compliance, and provide real-time updates on account status and performance.

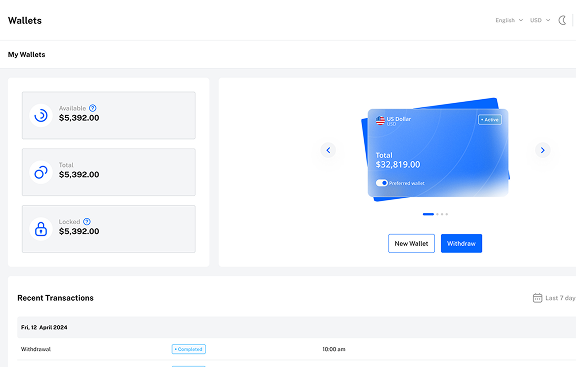

Payout Management

Enable traders to submit payout requests with integrated payment options, view payout history for completed and pending requests, and display profit split details with percentages and calculations.

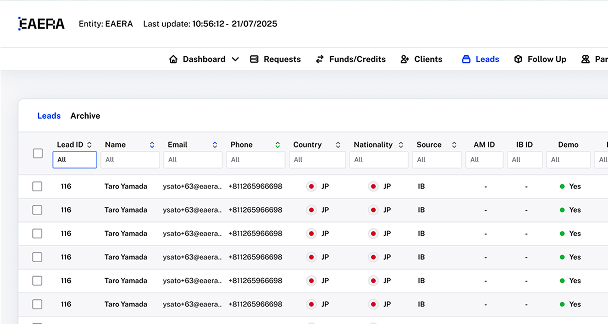

Lead Management

Automatically capture leads from forms or campaigns, qualify them with scoring based on attributes, and visualize their progress through acquisition, onboarding, and funding stages.

Workflow Automation

Automate workflows for account approvals and verifications, create custom rules for exceptions like high-risk transactions, and optimize back-office operations to reduce manual workload and improve accuracy.

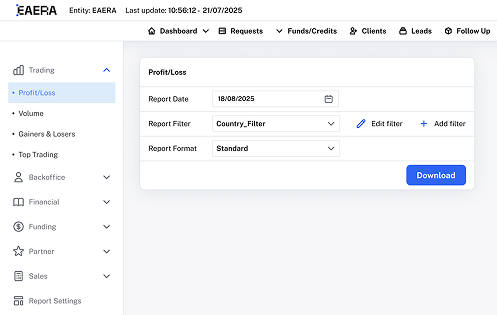

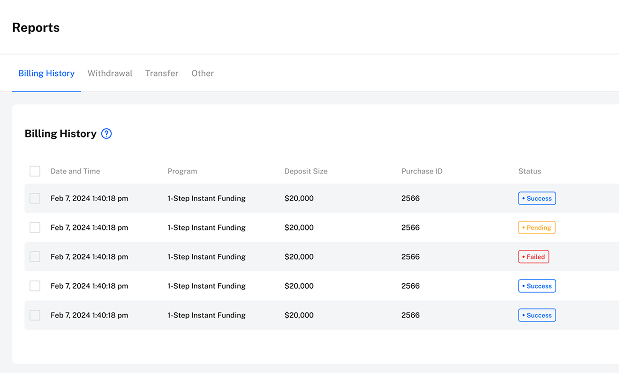

Reporting and Insights

Provide administrators with performance dashboards for trader insights and financial metrics, generate customizable reports by trader or account type, and analyze revenue from evaluations, funded performance, and affiliates.

Compliance Monitoring

Automatically flag rule violations like daily loss limits or drawdowns, maintain audit trails of trader activities for compliance, and generate regulatory reports to meet jurisdictional requirements.